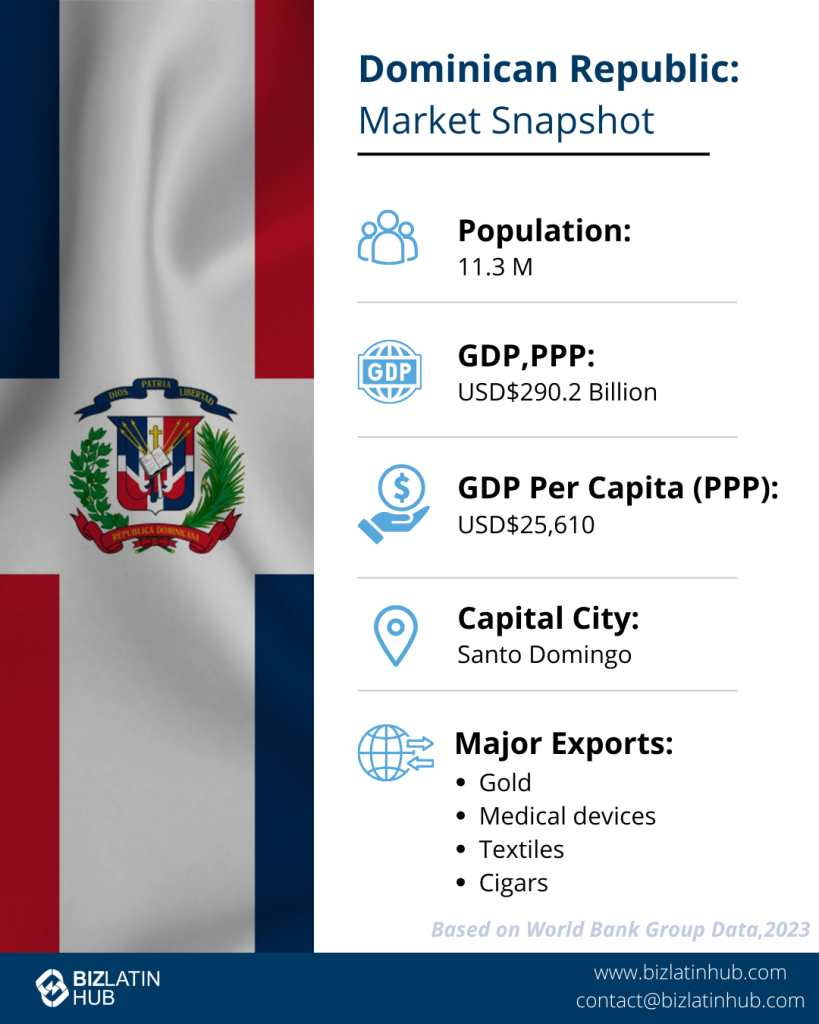

For anyone interested in company formation in the Dominican Republic, or who is already doing business in this Caribbean nation, understanding employment law in the Dominican Republic will be crucial to maintaining your company’s good standing and maximizing your potential for success.

Below, an overview of employment law in the Dominican Republic is provided, including information on normal working hours, types of contracts most commonly used by foreign investors, details regarding terminations and severance, information on leave allowances, and guidance on taxes related to salaries that employers must oversee.

Key Takeaways

| What are the working hours mandated by employment law in the Dominican Republic? | The Dominican Republic has a maximum work schedule of 8 hours per day and 44 hours per week, not including overtime. |

| What is the minimum wage in the Dominican Republic? | In the Free Trade Zones (FTZs), the minimum wage is 8,310 Dominican pesos per month. Outside the FTZs, the minimum wage ranges from 7,843 to 12,873 pesos per month, depending on the company’s size. |

| Types of Employment Contracts in the Dominican Republic | Fixed-term. Indefinite-term. Project-specific. |

| What percentage of an employee’s salary is contributed to social security in the Dominican Republic? | Employer contributions total a minimum of 15.34% of the gross salary being paid. |

Common contracts under employment law in the Dominican Republic

There are three types of contract allowed under employment law in the Dominican Republic that are most commonly used by foreign investors:

- Indefinite period employment contracts are the most common type of contract and only end based on a mutual agreement between the employer and employee, or under circumstances when one of the parties has the right to act unilaterally.

Examples include the employee resigning from their role, or an instance of employee misconduct that warrants dismissal as set out by the contract. - Fixed-term employment contracts last for a period specified within the contract and can only be sued when the nature of the service warrants it, or when it is in the best interests of the employee. Examples include when a worker is needed to cover maternity or other extended periods of leave

- Contracts for specific tasks or projects are given for the completion of particular outcome-based duties, and must state markers and thresholds in order to unequivocally establish when the task or project is complete and the contract completed.

Employment law in the Dominican Republic: working hours

Under employment law in the Dominican Republic, a standard working week is 44 hours long, with a normal shift lasting eight hours. Any employee who works for more than six consecutive hours must take a mandatory meal break lasting one hour, while all full-time employees are entitled to a weekly rest period of at least 36 consecutive hours.

Certain positions, such as management and supervisory roles, are exempted from these provisions.

Note that there are usually between nine and 11 national holidays that fall on weekdays each calendar year.

Vacations, leave, and other absences under Dominican law

After one year of continuous full-time employment, employees are entitled to 14 days of paid time off (PTO) per year, which is extended to 18 days after five years of service.

Under employment law in the Dominican Republic, vacations must last for a period of at least one full working week, and allowances cannot be exchanged for additional remuneration.

Maternity and paternity leave

A total of 12 weeks of paid maternity leave is granted to new mothers, beginning six weeks before the expected date of the birth. Dominican employment law also provides for two days of paid paternity leave for new fathers, to be granted following the birth.

Sick leave

Under employment law in the Dominican Republic, employees are not entitled to paid sick leave and, as such, it is at the employer’s discretion to remunerate time missed due to illness.

Bereavement leave

Bereavement leave totalling three days is granted in the event of the loss of a parent, child, partner, or other dependant.

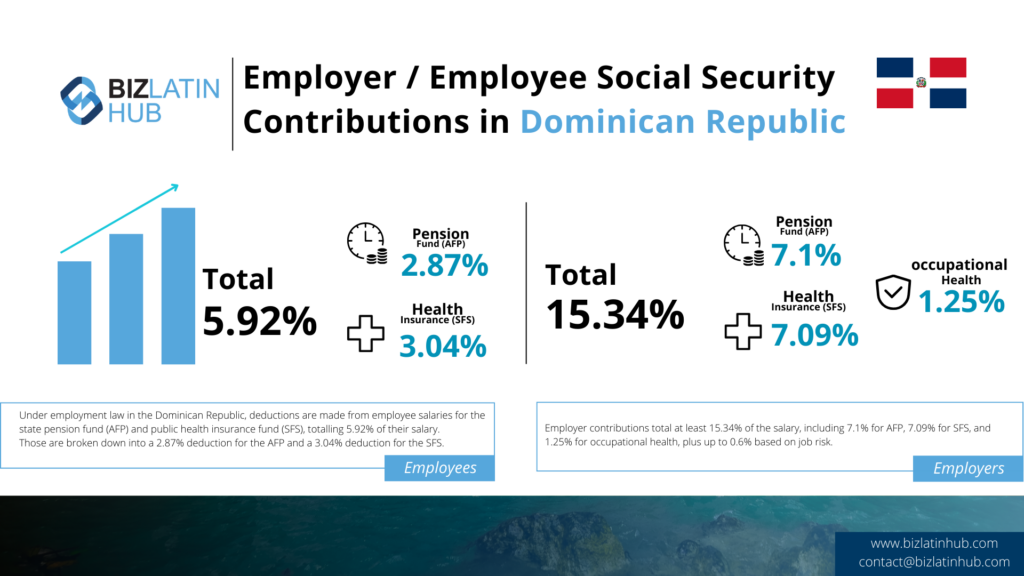

Employment law in the Dominican Republic: contributions

Employee deductions:

Under employment law in the Dominican Republic, deductions are made from employee salaries for the state pension fund (AFP) and public health insurance fund (SFS), totalling 5.92% of their salary.

Those are broken down into a 2.87% deduction for the AFP and a 3.04% deduction for the SFS.

Employer contributions

Employer contributions to the AFP and SFS, as well as for occupational health insurance, total a minimum of 15.34% of the value of the salary being paid.

Those are broken down into a 7.1% contribution to the AFP, a 7.09% contribution to the SFS, and a 1.25% contribution for occupational health, with up to an additional 0.6% based on the level of risk involved in the job.

Profit sharing

Employers are legally obliged to share 10% of net annual profits with their employees, and the payment must be made within a period of between 90 and 120 days following the end of the fiscal year, which in the Dominican Republic closes on December 31. That means that profit shares will generally be paid during the month of April.

For workers who have provided less than five years of service to the company, their profit share cannot exceed the equivalent of 45 days of salary, while for those who have provided more than five years of service, it should not exceed the equivalent of 60 days of salary.

Note that the following types of companies are exempted from sharing profits:

- Companies working in agriculture, forestry, and mining that have been in operation for less than three years

- Agricultural companies whose capital does not exceed one million Dominican pesos (approximately USD$18,000 as of November 2021)

- Companies based in free trade zones

Termination and severance

An employee is obliged to provide notice of their resignation based on the length of time they have worked with the company. A similar period of notice must be provided by an employer in the event of terminating a contract without just cause. That period is established as follows:

- Zero notice when the employee has served for less than three months with the company

- Seven days of notice when the employee has served for between three and six months with the company

- 14 day of notice when the employee has served for between six and 12 months with the company

- 28 days of notice when the employee has served for more than 12 months with the company

Upon termination of the contract, regardless of the cause, the employer is obliged to pay the following to an employee:

- The proportion of the annual bonus accrued based on how much of the calendar year they have worked

- Full compensation for unused vacation allowance that has been accrued

- Payment of profit share entitlement based on the proportion of the fiscal year the employee has worked

On top of that, when an employee is terminated without just cause, they will be entitled to economic assistance based on the length of their service with the company, established as follows:

- For less than three months of service, no assistance is due

- For between three and six months of service, six days of salary must be provided

- For between six and 12 months of service, 13 days of salary must be provided

- For between one and five years of service, 21 days of salary per year served must be provided

- For more than five years of service, 23 days of salary per year served must be provided

FAQs about employment law in the Dominican Republic

In our experience, these are the common questions we receive from our clients and potential clients.

Work for more than 44 hours a week in the Dominican Republic is considered overtime and must be paid with a 35% premium over regular hours. If an employee works more than 68 hours a week, they are entitled to be paid at a 100% premium. However, it is important to note that overtime pay does not apply to managers. Additionally, according to labor laws in the Dominican Republic, at least 80% of a company’s workforce must be Dominican.

Working conditions in the Dominican Republic ensure that employees are provided with fair treatment and protection in the workplace. Some key aspects of working conditions include working hours, minimum wage, occupational safety and health, and the right to join trade unions. The labor laws in the Dominican Republic aim to create a safe and healthy work environment for employees and promote their well-being.

The standard workweek in the Dominican Republic is 44 hours per week or 8 hours per day. However, part-time employees are not allowed to work more than 29 hours in a single week.

The minimum salary in the Dominican Republic varies depending on the location and sector. In the Free Trade Zones (FTZs), the minimum wage is 8,310 Dominican pesos per month. Outside the FTZs, the minimum wage ranges from 7,843 to 12,873 pesos per month, depending on the company’s size.

For the public sector, the minimum wage is 5,884 pesos per month. Farm workers earn a minimum wage of 234 pesos per day, based on a 10-hour workday. In June 2023, there will be a 28.5% increase in the minimum wage for medium-sized companies, raising it from 10,650 pesos to 13,685 pesos.

Overtime in the Dominican Republic is paid for any work done beyond 44 hours in a week. It is required to be compensated with a 35% premium on top of the regular hourly rate. If an employee works more than 68 hours in a week, they are entitled to a 100% premium on their overtime hours. However, it is important to note that managers are exempt from receiving overtime pay.

Termination of employment in the Dominican Republic requires evidence of misconduct by the employee and notice must be given to the Department of Labor within 48 hours. Jobs can be terminated by either party without cause, but advance notice must be given depending on the length of employment. Severance must be paid within 10 days of termination, with a penalty for any delays. Employers can dismiss employees for specific causes listed in the Labor Code, such as lack of integrity or criminal conviction.

Requirements for terminating an employee in the Dominican Republic include:

– Notice period: The length of the notice period depends on the employee’s length of employment, ranging from zero notice for less than three months to 14 days of notice for six to 12 months.

– Cause: The employer must have evidence that the employee committed one or more of the listed grounds for termination.

– Department of Labor: The employer is required to give notice of the termination and the grounds for it to the Department of Labor within 48 hours.

– Dismissal with cause: The employer must exercise the right to dismiss with cause within 15 days of learning about the fault committed by the employee.

– Resignation: An employee also has the option to resign from their job for cause.

– Communication: The intention to terminate the contract must be communicated to the affected party and to the Ministry of Labor.

When an employee quits in the Dominican Republic, they are entitled to receive severance pay. The amount of severance pay depends on the length of employment. For employees who resign with cause or are dismissed without cause, the severance pay includes advance notice, strict severance, a portion of the year’s Christmas salary, unused vacation time, and a yearly bonus. The specific amount of severance pay is as follows:

– For employees who have worked for 3 to 6 months, they will receive 6 days’ salary.

– For employees who have worked for 6 to 12 months, they will receive 13 days’ salary.

– For employees who have worked for 1 to 5 years, they will receive 21 days’ salary.

Biz Latin Hub can assist you with employment law in the Dominican Republic

At Biz Latin Hub, our team of bilingual professional support experts is available to help you get to grips with and properly adhere to employment law in the Dominican Republic.

Our comprehensive portfolio of corporate solutions includes company formation, accounting & taxation, corporate legal services, visa processing, and hiring & PEO, and we provide tailored packages of integrated back-office services to suit every need.

We have teams in place in 16 markets around Latin America and the Caribbean and trusted partners that extend our coverage to almost every corner of the region, and we specialize in multi-jurisdiction market entries.

Contact us today to find out more about how we can assist you entering the market and doing business in the Dominican Republic.

Or learn more about our team and expert authors.

Download Biz Latin Hub’s snapshot of employment law in the Dominican Republic here: