If you are interested in starting a business in Costa Rica, or are already active in this highly-developed Central American economy, complying with local employment law will be crucial to your business running smoothly and maintaining your company’s good standing with local authorities. Below, an overview of the employment law in Costa Rica is offered, including statutory working hours, commonly used types of contracts, information related to terminations and severance, leave and other absences, and the tax contributions that employers must manage.

Key Takeaways

| What are the working hours mandated by employment law in Costa Rica? | Employment law in Costa Rica sets a maximum work schedule of 8 hours per day and 48 hours per week, not including overtime. |

| What is the minimum wage in Costa Rica? | The current minimum wage as of January 2025 varies widely depending on sector from CRC$367,108 to CRC$784,139 (aprox USD$725-$1,550). |

| Types of Employment Contracts in Costa Rica | There are two basic types of contract: Regular employment and temporary employment. |

| What percentage of an employee’s salary is contributed to social security in Costa Rica? | Total contributions from the employer are around 26% of the gross salary of an employee. |

What are the Working Hours Based on the Employment law in Costa Rica?

The maximum working week in Costa Rica is 48 hours long, which is based on a daytime worker working six shifts of eight hours. Daytime workers are those whose hours fall between 05:00 and 19:00 on a given day. For nighttime workers, whose hours run between 19:00 and 05:00 the following day, a shift should be no longer than six hours long.

- Mixed shift workers: What is the ordinary mixed workday? It is the one in which a part of the work is done between five in the morning and seven at night and another part between seven at night and five in the morning; for example, the worker starts at two in the afternoon and leave at ten at night.

Certain employees – including the likes of management, legal representatives, and employees who are working without direct supervision – can work longer than the eight-hour daytime maximum, however they should not work longer than 12 hours per day.

Note that, there are generally between eight and nine public holidays that fall on weekdays, as well as three holidays for government employees observed in Costa Rica each year.

2 Types of Labor contracts under Employment Law in Costa Rica

There are two main types of labor contracts used under employment law in Costa Rica. If you’re considering expanding your business to Costa Rica, it’s essential to understand the importance of complying with the country’s employment laws and the distinctions between various types of contracts. Costa Rica’s Ministry of Labor and Social Security oversees these employment regulations, which are similar in many ways to other countries in the region, but with distinct particularities.

- Regular employment agreement: A regular employment agreement is the standard type of contract under employment law in Costa Rica. Such a contract has an indefinite duration and only ends when the employer and employee mutually agree, or when one of the parties has the right to end the agreement unilaterally. Examples of such circumstances include an employee resigning from their role, or an employer terminating the contract of an employee found guilty of misconduct.

- Temporary employment agreement: The alternative to a regular employment agreement is a temporary employment agreement, which is established for a limited period of time and only under circumstances that require such an agreement. That includes the likes of seasonal work or replacement of an employee on an extended absence – such as maternity leave. A temporary employment agreement cannot last longer than one year, and should it be extended beyond that period, it is automatically recognized as a regular agreement under employment law in Costa Rica.

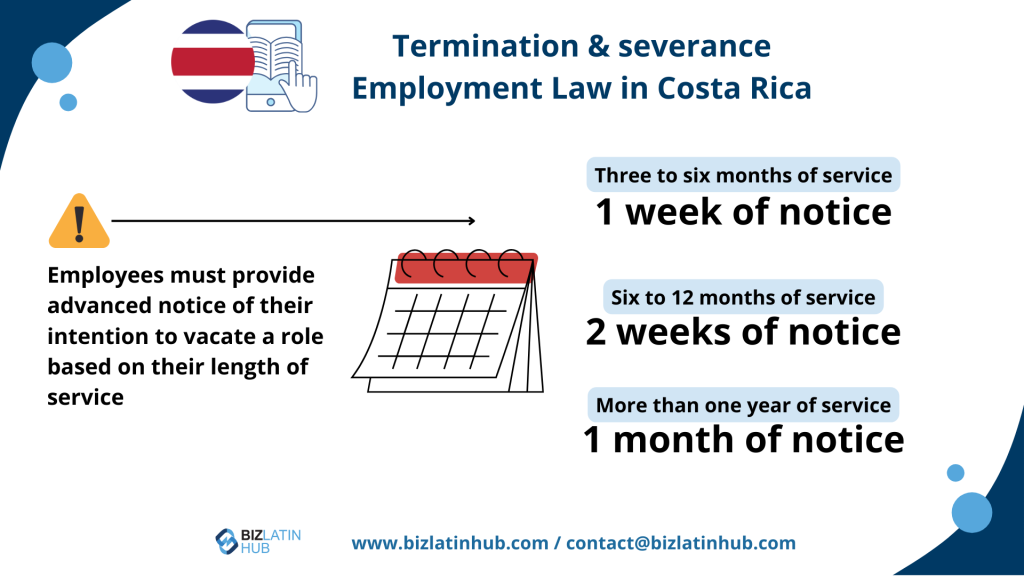

Termination & severance

Under employment law in Costa Rica, employees must provide advanced notice of their intention to vacate a role based on their length of service. That notice period is established as follows:

- Three to six months of service: one week of notice

- Six to 12 months of service: two weeks of notice

- More than one year of service: one month of notice

Should the employer wish to terminate an employee’s contract unilaterally and without just cause, the employee will be entitled to:

- Any outstanding salary

- Compensation for unused vacations

- A proportion of their annual bonus (thirteenth salary) based on how much of the year they have worked

- A severance payment of around 20 days pay per year of service

Note that termination without compensation can only happen if an employee is be found guilty of misconduct, as laid out in Article 81 of the Costa Rican Labor Code and protected by the employment law in Costa Rica.

What are the vacations, leave, & other absences under Costa Rican employment law?

Under employment law in Costa Rica, an employee is entitled to two weeks of paid leave after the completion of 50 consecutive weeks of service – meaning that, unlike in many jurisdictions, the statutory vacation allowance is included within the first year of service.

1. Maternity and paternity leave: Employment law in Costa Rica provides new mothers with four months of maternity leave, beginning one month before a doctor-confirmed due date. However, this can be extended under the recommendations of a registered medical professional. During maternity leave, 50% of the employee’s salary is covered by Costa Rica’s social security fund. There is no statutory paternity leave under Costa Rican law.

2. Sick leave: The length of a period of sick leave is determined by Costa Rica’s social security fund, based on the employee’s condition. That fund will cover 50% of the employees salary during their first three days of absence, with the employer obliged to cover the rest. From the fourth day of absence onwards, the social security fund will cover 60% of the employee’s salary, with the employer under no legal obligation to cover the shortfall.

3. Bereavement: Under employment law in Costa Rica, there is no stipulation with regard to bereavement leave, which must be negotiated and agreed upon between the employee and employer.

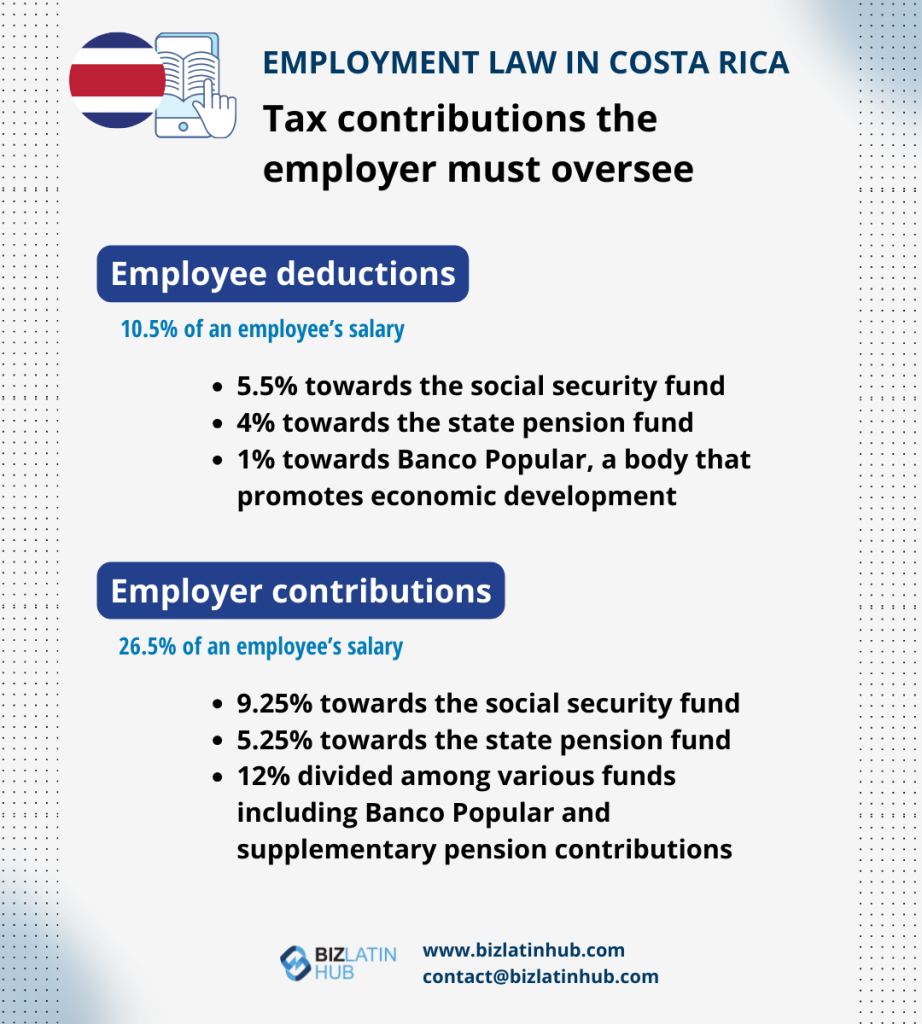

What are the Tax Obligations Employment law in Costa Rica?

Under Costa Rican employment law, the employer must oversee the following deductions from employee salaries, as well as make the following contributions based on those salaries:

- Employee deductions: In total, the employer is responsible for deducting 10.5% of an employee’s salary, made up of:

- 5.5% towards the social security fund

- 4% towards the state pension fund

- 1% towards Banco Popular, a body that promotes economic development

- Employer contributions: Employer contributions total the equivalent of 26.5% of an employee’s salary, made up of:

- 9.25% towards the social security fund

- 5.25% towards the state pension fund

- 12% divided among various funds including Banco Popular and supplementary pension contributions

A quality representative or PEO firm can ensure your company is complying with Costa Rica labor laws.

FAQs about employment law in Costa Rica

In our experience, these are the common questions we receive from clients.

1. What are the labor laws in Costa Rica?

In Costa Rica, employment arrangements can take the form of either fixed-term or indefinite contracts, complemented by a nationally defined minimum wage. Workers enjoy the entitlement to paid annual leave, and comprehensive legislation ensures maternity leave with full compensation. Additionally, the country has established regulations governing social security, safeguarding the well-being of employees, and upholding the right to unionize as a fundamental aspect of its labor framework.

2. What are the working conditions in Costa Rica?

Working conditions in Costa Rica are classified into day shifts and night shifts. During a normal work week, employees are allowed to work a maximum of 8 hours per day and 48 hours per week for day shifts, and 6 hours per day and 36 hours per week for night shifts.

3. How many hours are in a standard work day in Costa Rica?

The legal workweek in Costa Rica consists of 48 hours, which are divided into six 8-hour days. Employees in Costa Rica are entitled to one day of rest per week, usually on Sundays. Overtime is defined as any work that exceeds 48 hours per week or 8 hours per day. In such cases, employers are required to pay overtime wages at a rate of 1.5 times the employee’s regular hourly wage.

4. What is the minimum salary in Costa Rica?

The minimum monthly wage for workers in Costa Rica varies depending on the occupation and level of education. For unskilled occupations, the minimum salary is 367,108 CRC (USD$725). For specialized occupations, it is 476,866 CRC (USD$940). For individuals with a university bachelor’s degree, the minimum salary is 653,427 CRC (USD$1,290), and for university graduates, it is 784,139 CRC (USD$1,550). These figures have been established by the Ministry of Labor.

5. How is overtime paid in Costa Rica?

Overtime in Costa Rica is paid at 1.5 times the employee’s regular hourly wage. It is considered any work that exceeds 48 hours a week or 8 hours a day. The legal workweek in Costa Rica consists of 48 hours, spread across six 8-hour days. Employees are also entitled to one day of rest per week, usually on Sundays.

6. What are the laws regarding employment termination in Costa Rica?

In Costa Rica, employment termination can occur without just cause as long as the employee is provided with severance pay according to their employment agreement. It is important to include the yearly bonus known as the aguinaldo in the severance package. Additionally, there are specific notice periods that must be followed based on the employee’s length of service with the company.

7. What are the requirements for terminating an employee in Costa Rica?

In Costa Rica, employers are required to have a valid reason to terminate an employee. If there is no valid reason, the employer can still terminate the employee but must provide severance pay. The valid reason must be based on one of the grounds listed in Article 81 of the Labor Code. The termination must be well supported, and the burden of proof lies with the employer to show that the termination was justified. The notice period for termination is determined by the employee’s length of service:

- For employees with three to six months of service, one week of notice is required.

- For employees with six to 12 months of service, two weeks of notice is required.

In addition to the notice period, the employer is also responsible for paying preaviso (notice pay) and cesantia (severance pay).

8. What happens when an employee quits in Costa Rica?

Employees in Costa Rica are entitled to severance pay if they quit with just cause or are terminated without cause. The employer must pay an additional month’s pay for each year, or a fraction over six months, up to a maximum of eight months’ pay. The employee is also entitled to compensation for unused vacation and personal days, any remaining salary, and a portion of their aguinaldo, or thirteenth-month bonus.

If an employee quits without giving proper notice, they forfeit their rights to the aguinaldo. The employer cannot deduct the compensation from the employee’s benefits if the employee resigns without notice. Additionally, the employer is obligated to grant workers’ requests for a certificate or letter of termination of the work contract.

Biz Latin Hub can help you to understand employment law in Costa Rica

Biz Latin hub provides integrated market entry and back office support to investors and corporations throughout Latin America and the Caribbean, helping them to bridge the cultural and linguistic gaps they encounter.

Our portfolio includes accounting & taxation, company formation, due diligence, legal services, and hiring & PEO, among others.

With offices in 17 major cities around the region, we are ideally placed to support multi-jurisdiction market entries and cross-border operations,

Contact us today to find out more about how we can support you doing business in Guatemala.

Or learn more about our team and expert authors.