This comprehensive guide explains how Employer of Record (EOR) services facilitate international hiring in Nicaragua. Learn about local labor laws, compliance requirements, and the benefits of using EOR services for your business expansion. Key topics include employment contracts, benefits management, payroll processing, and risk mitigation strategies. Whether EOR is your final goal or a step on the way to company formation in Nicaragua, we have you covered.

Key Takeaways On EOR In Nicaragua

| Is it legal to hire through an EOR in Nicaragua? | Yes, hiring in Nicaragua through a PEO or EOR is legal. It ensures compliance with labor laws, handles payroll and taxes, and simplifies employment without needing a local entity. |

| What are the benefits of hiring through an EOR in Nicaragua? | Hiring through an PEO or EOR in Nicaragua offers quick market entry without a local entity, ensures compliance with complex labor laws, manages payroll and taxes, reduces legal risks, and allows you to focus on core business operations effortlessly. |

| Steps to hire through an EOR in Nicaragua | Assess the Need to Hire in Nicaragua Source Local Talent Choose a PEO Approve the Offer Letter Onboard the Employee via the PEO |

| Why employ Nicaraguan workers? | Employing workers through an EOR in Nicaragua streamlines market entry by managing HR, payroll, and legal compliance, allowing you to hire local talent quickly and focus on business growth without establishing a local entity. |

What are Employer of Record (EOR) Services in Nicaragua?

According to Nicaragua’s Labor Code (Law No. 185 of 1996, last amended 2022), businesses must comply with specific employment regulations when hiring in the country . In today’s global market, companies looking to hire international talent face complex regulatory requirements and administrative challenges. Employer of Record (EOR) services offer a structured solution to these challenges.

Nicaragua presents unique opportunities and challenges for employers. The country’s employment conditions, benefits requirements, and compliance standards require careful attention to detail. This guide provides comprehensive information about using EOR services to establish and maintain a compliant workforce in Nicaragua.

Employer of Record (EOR) services manage employees for their clients. They assume full legal responsibility for these employees. EORs handle all legal, tax, and compliance tasks. They act as the official employer for the workforce.

One key benefit of EORs is that they do not need clients to have a local entity in the country of employment. This feature simplifies hiring in foreign countries. EORs take care of onboarding, payroll, compensation, benefits, tax filing, and employment termination.

Key Benefits of EOR Services:

- Legal and tax management

- Compliance assurance

- Onboarding and payroll handling

- Efficient foreign team management

- Cost and risk reduction

The Employment Landscape in Nicaragua

Nicaragua has specific labor standards that both employers and employees must follow. The work week is limited to 48 hours or eight hours per day. This rule ensures compliance with labor laws. Employers must provide written employment contracts before the employee begins work. Employees receive 15 days of paid leave every six months. This leave usually needs to be taken in one continuous period. An Employer of Record (EOR) can help businesses in Nicaragua. EOR services simplify hiring. They handle tasks like employment contracts and tax obligations.

Key Employment Laws

Nicaragua has set rules for working hours. Standard work is capped at 48 hours per week. Night shifts are limited to 42 hours. Mixed shifts must not exceed 45 hours weekly. Employers must give a Christmas bonus equal to one month’s salary. EORs know local labor laws well. They ensure businesses comply with tax obligations. EORs also handle immigration compliance. This includes visas and work permits for international employees.

Employment Contracts

In Nicaragua, employment contracts must be written. The contract should include details about pay, benefits, and termination. Contracts can be determinate (fixed) or indeterminate (open-ended). Indeterminate contracts allow either party to end the agreement. Employees get severance pay upon termination. Determinate contracts have specific end dates. Breaking a determinate contract entitles the employee to pay for the full term. If extended twice, the contract becomes indeterminate, which a court may review.

Typical Work Regulations

Nicaragua allows hiring on fixed-term contracts for permanent tasks. These can be extended twice; they then become indefinite. The labor code limits work to 48 hours a week. There are specific limits for night and mixed shifts. Overtime pay is double the usual rate. Employees can work up to nine overtime hours weekly. Workers earn 15 days of vacation for every six months of work. Employers handle statutory benefits and observe minimum wage laws.

Employee Benefits in Nicaragua

Nicaragua offers a comprehensive range of benefits to employees through its social security system and labor laws. These benefits comply with local regulations and help maintain a competitive employment environment. Understanding these benefits is crucial for both employers and employees.

| Benefit Type | Requirement | Details |

|---|---|---|

| Annual Leave | 15 days per 6 months | Must be taken continuously unless agreed otherwise |

| Public Holidays | 9 days per year | Full pay for national holidays |

| Christmas Bonus | 1 month salary | Paid in December (13th month) |

| Maternity Leave | 12 weeks total | 4 weeks before and 8 weeks after birth |

| Social Security | Mandatory enrollment | Covers health insurance and pension |

Social Security Contributions

| Contribution Type | Employer Rate | Employee Rate | Total |

|---|---|---|---|

| Social Security | 18.5% | 6.35% | 24.85% |

Additional Benefits and Coverage

The Nicaraguan social security system (INSS) provides comprehensive coverage for employees. Healthcare benefits combine public and private services, with the government covering routine medical visits. Many employers enhance this coverage with private medical insurance plans. The system operates through direct hospital programs, differing from U.S. healthcare models.

For work-related injuries, employees receive full coverage including wage replacement starting three days after the incident. During qualified medical leave, the Social Security Institute provides 60% of the worker’s average earnings based on their last eight weeks of work.

Pension Benefits

The pension system requires:

- Retirement age: 60 years

- Contribution period: 750 weeks minimum

- Minimum pension: Equal to legal minimum wage

- Special provisions: Modified requirements for miners, teachers, and those enrolling after age 45

- Continued contributions: Required for working pensioners

Leave Policies

Nicaragua’s leave policies ensure adequate rest and work-life balance:

- Annual leave must typically be taken as one continuous period

- Alternative leave arrangements require employer consent

- Sick leave coverage extends up to one year through social security

- Initial three sick days are unpaid unless employer policy differs

- Maternity benefits include partial salary coverage through social security

Understanding and implementing these benefits correctly helps maintain compliance while supporting employee welfare. EOR services can manage these benefits effectively, ensuring proper administration and regulatory compliance.

Role and Advantages of Professional Employer Organizations (PEOs)

Professional Employer Organizations (PEOs) help companies manage HR tasks in foreign countries. PEOs handle payroll, benefits, and compliance with employment laws. They act as an employer of record (EOR), taking on legal duties to pay wages and withhold taxes. By using PEO services, companies avoid the costs of setting up a legal entity abroad. This lets businesses focus on growth and strategic goals. PEOs also reduce overhead costs and speed up employee onboarding, boosting efficiency.

Benefits of Using PEOs in Nicaragua

Using a PEO in Nicaragua helps companies hire and onboard staff quickly. It eliminates the need to form a local entity, saving time and money. PEOs manage local payroll and tax compliance, ensuring adherence to labor laws. This minimizes risks of legal penalties. PEOs also allow businesses to focus on core goals, not administrative tasks. They offer scalability for managing small to large teams, maintaining consistent fees for budget planning. Partnering with a PEO in Nicaragua provides local expertise, lowering hiring and management risks.

- Reduces time and costs for market entry

- Ensures tax and legal compliance

- Streamlines HR processes

- Offers scalable workforce management

- Provides local expertise and resources

Step-by-Step EOR Setup Process

- Initial Assessment

Understanding your business needs is crucial before engaging an EOR service. Consider your hiring timeline, budget constraints, and specific requirements for your Nicaragua operations. - EOR Selection

Choose an EOR provider based on their experience in Nicaragua, service quality, and cost structure. Consider their track record with similar companies and their understanding of local regulations. - Documentation Preparation

Gather essential company and employee documents:- Company registration documents

- Tax identification numbers

- Employee qualifications and identification

- Position descriptions and salary details

- Contract Development

Work with your EOR to create compliant employment contracts that include:- Clear job descriptions and responsibilities

- Compensation terms in córdobas

- Working hours and leave policies

- Benefits package details

- Employee Onboarding

The EOR will manage the complete onboarding process:- Official document verification

- Social security registration

- Bank account setup

- Benefits enrollment

- Initial orientation

- Ongoing Management

Your EOR partner will handle:- Monthly payroll processing

- Tax withholding and reporting

- Benefits administration

- Compliance monitoring

- Employee relations

EOR vs. PEO in Nicaragua – What’s the Difference?

When expanding into Nicaragua, businesses often choose between an Employer of Record (EOR) or a Professional Employer Organization (PEO) to hire and manage employees.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. EOR services are legal in Nicaragua and allow businesses to hire staff and manage payroll without establishing a local office.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

Note that EOR and PEO are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Nicaragua. Biz Latin Hub offers both EOR and PEO solutions, helping businesses navigate Nicaragua’s specific regulations (including the 48-hour workweek, mandatory 15 days of paid leave every six months, and social security requirements), establish entities, and ensure full HR compliance. Whether you need a fast market entry or a stable long-term presence, we can guide you through the process.

Legal Frameworks Governing Employment in Nicaragua

The legal framework in Nicaragua requires all employers to comply with specific labor laws. Establishing a written employment contract in Spanish is mandatory under the Nicaraguan Labour Code. This contract must outline job titles, duties, remuneration, and various other terms. Compensation must be stated in Nicaraguan córdobas instead of foreign currency. Nicaragua’s standard workweek is set at 48 hours, with a daily limit of eight hours. Employees are entitled to 15 days of paid leave every six months. Employers must also provide a 30-day probation period for new employees.

Labor Code Overview

In Nicaragua, drafting an employment contract in Spanish is crucial, as per the Nicaraguan Labour Code. This document should include the job title, duties, pay, workplace, work hours, contract duration, notice periods, and payment intervals. Employees are entitled to a weekly 24-hour rest period. They also receive 15 days of paid leave every six months. The probation period for new hires cannot exceed 30 days. Employers must respect minimum wage laws and statutory benefits when creating contracts.

Compliance Requirements

Employers of Record (EORs) play a crucial role in ensuring compliance with Nicaraguan labor laws. They maintain up-to-date knowledge of local regulations, which helps businesses navigate legal requirements. Using EOR services eliminates the need to set up a legal entity or manage extensive HR systems in foreign countries. Engaging an EOR ensures adherence to local employment laws, reducing risks associated with payroll errors and oversight.

Employers in Nicaragua must follow tax and social security laws. Employers contribute 18.5% to social security, while employees contribute 6.35%. The country employs a progressive income tax structure. Adhering to these regulations is crucial for businesses operating in Nicaragua.

Practical Aspects of Hiring in Nicaragua

Hiring in Nicaragua can be efficient using Employer of Record (EOR) services. These services help companies hire staff and manage payroll without setting up a local office. This approach supports fast market entry. With EOR, you can onboard employees within days. This method is quicker than traditional hiring. EOR and Professional Employer Organizations (PEO) ensure compliance with local labor laws. They manage contracts, benefits, and payroll efficiently. Employees hired through EOR work on your business tasks. Meanwhile, EOR handles compliance and HR duties. This lets you focus on core business goals. EOR services are scalable. You can start with one employee and grow your team. Costs remain predictable.

Working Hours and Overtime Regulations

The workweek in Nicaragua is 48 hours, usually eight hours a day, six days a week. Overtime is capped at three extra hours a day. Total daily hours, including overtime, must not exceed nine. Overtime pay is double the regular hourly rate. Employees receive 15 days of paid leave every six months.

Recruitment and Hiring Negotiations

A written employment contract is a legal must in Nicaragua. Contracts should outline pay, benefits, and termination terms. They must be in Spanish. Fixed-term and indefinite contracts are both allowed, offering flexibility. State compensation in Nicaraguan córdobas, not foreign currencies, in offer letters. Verbal contracts are only for certain short-term or agricultural roles. Remember the 48-hour workweek limit when discussing time-related aspects.

Onboarding Processes

Onboarding in Nicaragua follows specific legal requirements. A written contract must detail job title, duties, pay, and hours. It needs to be in Spanish. Clarify contract duration and notice periods for termination. Follow local rules about minimum wage and statutory benefits. New employees should learn about public holidays and vacation leave. They are entitled to 15 days of paid leave every six months. Effective onboarding includes educating new hires about their rights and company policies. This supports smooth integration into the company.

Simplifying Payroll Processing Through EOR Services

Using an Employer of Record (EOR) service in Nicaragua streamlines payroll processing. An EOR makes the transition from contractor to employee simple. This process eases the workload for new hires and businesses.

Employers in Nicaragua must have an employment contract. EOR services help create agreements that meet the Nicaraguan Labour Code. These contracts include job title, remuneration, and payment intervals. This attention to detail minimizes administrative work.

EOR providers ensure compliance with local laws. They help with minimum wage regulations, statutory employee benefits, and legal working hours. This support leads to accurate payroll processing.

Benefits of EOR Services in Nicaragua:

- **Legal Compliance**:

- Adheres to the Nicaraguan Labour Code.

- Contracts prepared in Spanish.

- **Efficient Payroll**:

- Accurate payment intervals.

- Adherence to wage laws.

- **Reduced Administration**:

- Simplifies employment agreement preparation.

- Handles mandatory employee benefits.

Mitigating Risks of Non-Compliance

Partnering with a Professional Employer Organization (PEO) or an Employer of Record (EOR) can significantly reduce compliance risks in Nicaragua. These partners help foreign employers manage local employment laws, avoiding unintentional violations.

Benefits of PEOs and EORs:

- Compliance Assurance: Ensure adherence to local labor regulations.

- Tax and Payroll Management: Handle tax filing and payroll tasks, reducing errors during tax season.

- Focus on Growth: Allow businesses to concentrate on growth without facing administrative hurdles.

- Legal Risk Mitigation: Minimize the risk of hefty fines and penalties.

A PEO or EOR supervises your company’s compliance with financial and employment obligations, which is crucial for international expansion. This partnership helps businesses mitigate legal and compliance risks effectively, ensuring smooth operations in foreign markets.

Key Points:

- Avoid heavy fines and legal penalties.

- Protect against non-compliance risks.

- Focus on core business objectives.

Choosing the right PEO or EOR partner ensures companies can expand internationally while maintaining compliance and optimizing their business operations. These partners help navigate local complexities, promoting seamless growth and adherence to laws.

Enhancing Employee Engagement with EOR Services

An Employer of Record (EOR) can enhance employee engagement for businesses in Nicaragua. EOR services streamline the onboarding process, enabling quick and efficient hiring. This allows companies to access local expertise, which aids in understanding market nuances and cultural differences.

EORs manage the entire employee lifecycle, offering comprehensive support for all employee needs. This includes handling administrative functions such as payroll, tax filing, and employee benefits. By taking on these tasks, EORs allow businesses to focus on their core objectives and engage more effectively with their workforce.

Additionally, EORs enable companies to recruit skilled professionals from untapped markets. This approach removes the risks linked to setting up a local entity. Businesses can access new talent pools while ensuring compliance with local employment laws.

FAQs for an EOR in Nicaragua

Based on our extensive experience these are the common questions and doubts of our clients:

You can hire an employee by incorporating your own legal entity in Nicaragua to hire employees. Alternatively, you can hire through an Employer of Record (EOR), which is a third party organization that allows you to hire employees in Nicaragua. With an EOR you do not need a local legal entity to hire local employees.

A standard employment contract must be written in Spanish (and can also be in English) and contain the following information:

– ID number and taxpayer code

– City and date.

– Start date of the employment relationship.

– Relationship rules between superior and subordinate.

– The location where the service will be provided.

– Remuneration and bonifications/commissions.

– Method payment frequency.

– Duration of the contract.

– Social work.

– Penalties for non-compliance for both employer and employee.

– Main tasks.

– Probation Period.

– Cases of termination of contract

The mandatory employment benefits in Nicaragua are the following:

– Working tools necessary to carry out the work.

– Payment of social security contributions (health, pension, and labor risks).

– Social benefits (service premium, severance pay, and interest on severance pay).

– Paid time off (vacation and weekend off) always depends on the kind of work you have.

– Disabilities (common or labor origin).

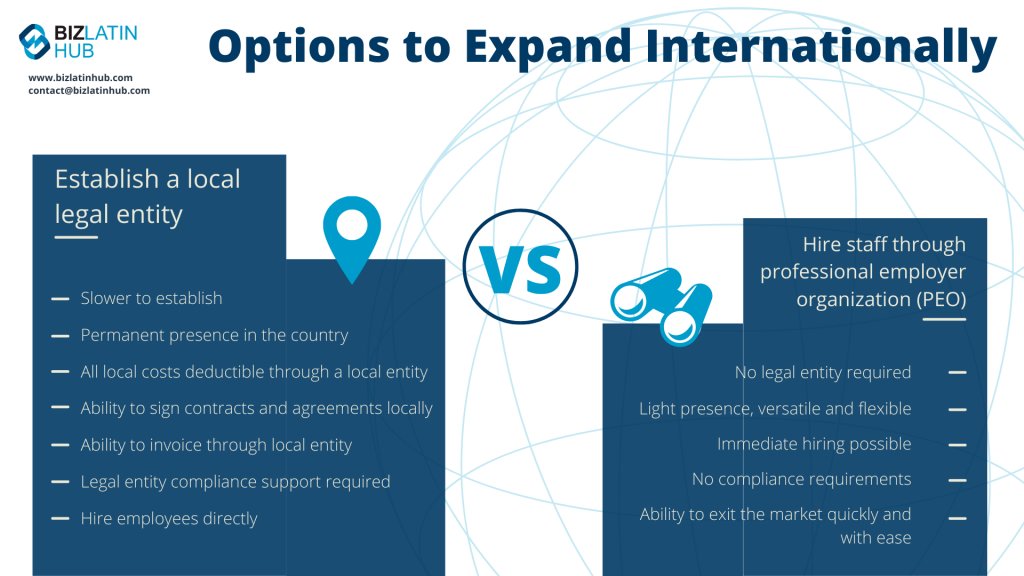

The best decision depends on the needs of your company. Forming a legal entity has the following characteristics:

Slower to establish.

Permanent presence in the country.

All costs deductible through a local entity.

Ability to sign contracts and agreements locally.

Ability to invoice through local entity.

Legal entity compliance support required.

Hire employees directly.

A PEO works with your company as a co-employer, while a EOR is the legal employer of your employees. An EOR can provide more services than a PEO.

How Biz Latin Hub Can Support Your Business in Nicaragua

Biz Latin Hub serves as your trusted Employer of Record partner in Nicaragua. Since 2014, we have helped businesses establish and manage their workforce in Nicaragua and across Latin America. Our local team in Nicaragua combines international standards with deep local expertise to ensure your business operations comply with all regulations while maintaining efficiency.

Our comprehensive EOR services in Nicaragua include:

- Full payroll administration and compliance with local tax regulations

- Employment contract management in accordance with Nicaraguan labor law

- Complete benefits administration including social security and insurance

- Work permit and visa processing for international employees

- Ongoing HR support and employee relations management

As a client-focused organization, we provide:

- Dedicated account managers who understand your business needs

- Bilingual support in English and Spanish

- Regular compliance updates and reporting

- Fast employee onboarding within 5-7 business days

- Competitive pricing with transparent fee structures

With our established presence across Latin America and our dedicated Nicaragua team, we offer seamless support for companies expanding into the region. Our track record of successful partnerships with international businesses demonstrates our capability to handle all aspects of employment and compliance in Nicaragua.

Contact us today to discuss how our EOR solutions can support your business growth in Nicaragua.