Recently, Ecuador’s National Assembly approved a series of reforms to improve the process of starting a business in Ecuador as a way to stimulate local and foreign investment in the country and reactivate the economy after the Covid-19 pandemic.

Ecuador’s economy is the eighth largest in Latin America, with a gross domestic product (GDP) of $107.44 million (USD) in 2019. While services are key to the economy, the South American country also has abundant petroleum reserves, with oil drilling accounting for 40 percent of the country’s export income and one-fourth of public budget revenues in recent years.

The Ecuadorian government also recently announced significant efforts to stimulate commerce and investment. So if you are considering business formation in Ecuador, read on to learn about the five considerations you’ll want to keep in mind to support your endeavor.

Table of Contents

Ecuador’s business-friendly approach

The government of Ecuador has taken numerous measures to strengthen the private sector and promote economic growth, bolstered by a $10.2 billion (USD) funding agreement struck in 2018 with the International Monetary Fund (IMF) intended to correct fiscal imbalances and improve the efficiency of public finances.

Within this package of reforms, several benefits emerged for foreign companies that set up a business in Ecuador, including:

- Simplification of the processes to establish a company in Ecuador

- Digitization of the processes to establish a business in the country

- Improved connectivity between business registers

- Reduction of procedures and tax requirements to form a company

5 Key considerations to start a business in Ecuador

Anyone thinking about starting a business in Ecuador should take the following considerations into account:

1. Choose the right company type: You must determine what type of company will fit your business needs before settling in the country. Note that in Ecuador there are several types of companies such as a joint-stock company (Sociedad Anónima), a limited liability company (Sociedad de Responsabilidad Limitada), and a simplified stock company (Sociedad Anónima Simplificada).

2. Appoint a reliable legal representative: You must appoint a legal representative in Ecuador, who will be in charge of representing the company and signing legal documents in labor and civil matters. Please note that this person must reside in Ecuador.

3. Register before tax authorities: All companies in Ecuador must register with the Internal Revenue Service (SRI) and pay taxes on a monthly or semi-annual basis. Therefore, you must engage with a local trusted advisor when starting a business in Ecuador to ensure full compliance with tax authorities.

4. Comply with labor regulations: It is vital to understand the monthly and annual obligations that an employer must meet with its employees. These obligations include the payment of social security per employee, the payment of bonuses in the middle, and at the end of the year, vacations, pregnancy leave, disability, and severance payments.

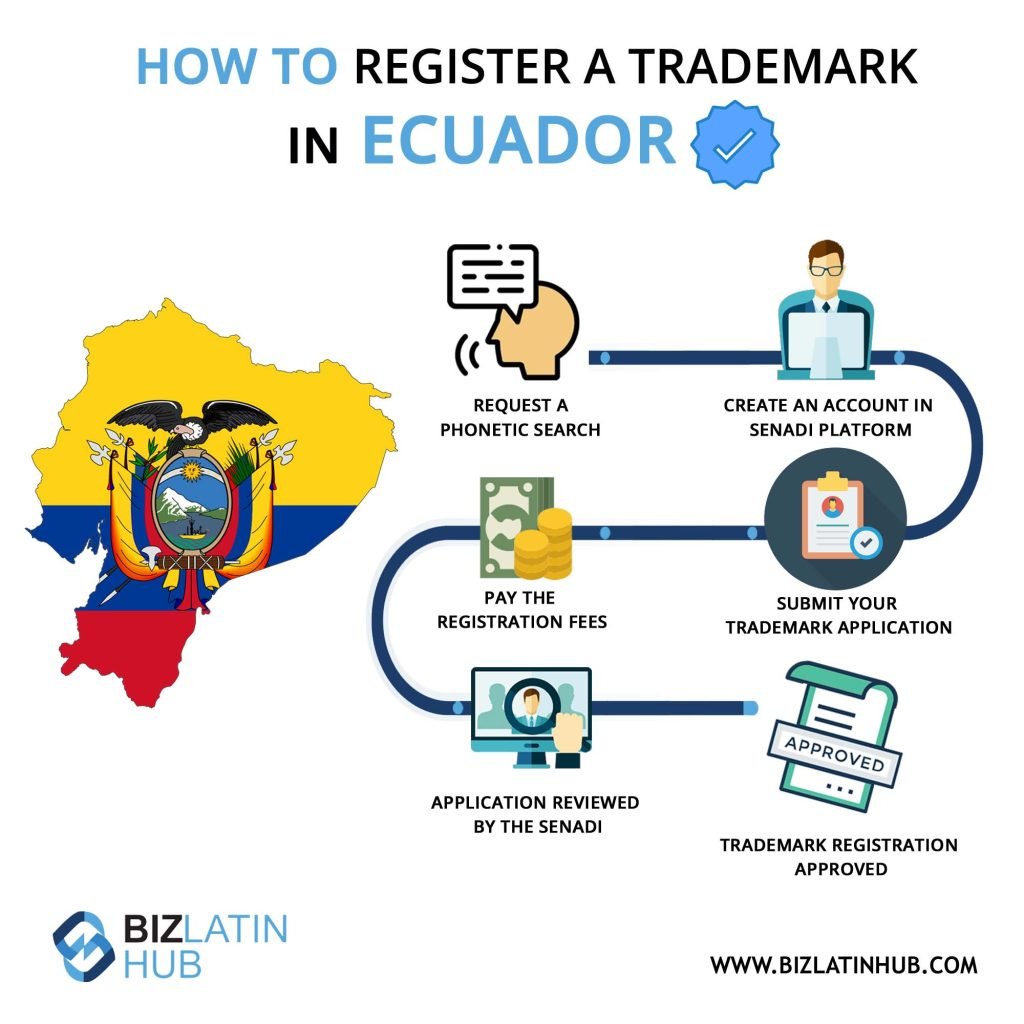

5. Protect your intellectual property: Your company name and logo must be protected to avoid the risk of your competition emulating them. Therefore, it is always advisable to know what the options are to protect them.

Launch your business in Ecuador with help from Biz Latin Hub

If you are interested in starting a business in Ecuador seek professional support to avoid problems or delays in the process and ensure that all legal and corporate tax corporate requirements are met.

At Biz Latin Hub, our team of multilingual legal and tax specialists has extensive experience supporting foreign investors with company formation, recruitment, and many other professional services in Ecuador. With our full suite of market entry and back-office services, we are your single point contact to ensure the success of your business expansion in Latin America and the Caribbean. Reach out to us now or personalized assistance.

Learn more about our team and expert authors, and check out our short video below on how to form a company in Ecuador.