For business executives considering doing business in El Salvador, one route available is to purchase an existing company or develop a commercial partnership with a local organization. However, either option demands an audit to be carried out on that local entity to make sure you are going into the venture with all of the insight you need. Because by conducting due diligence in El Salvador, you will develop a forensic understanding of the state of that entity’s finances, structure, and regulatory compliance, allowing you to avoid legal inconveniences and enter the Central American market with confidence.

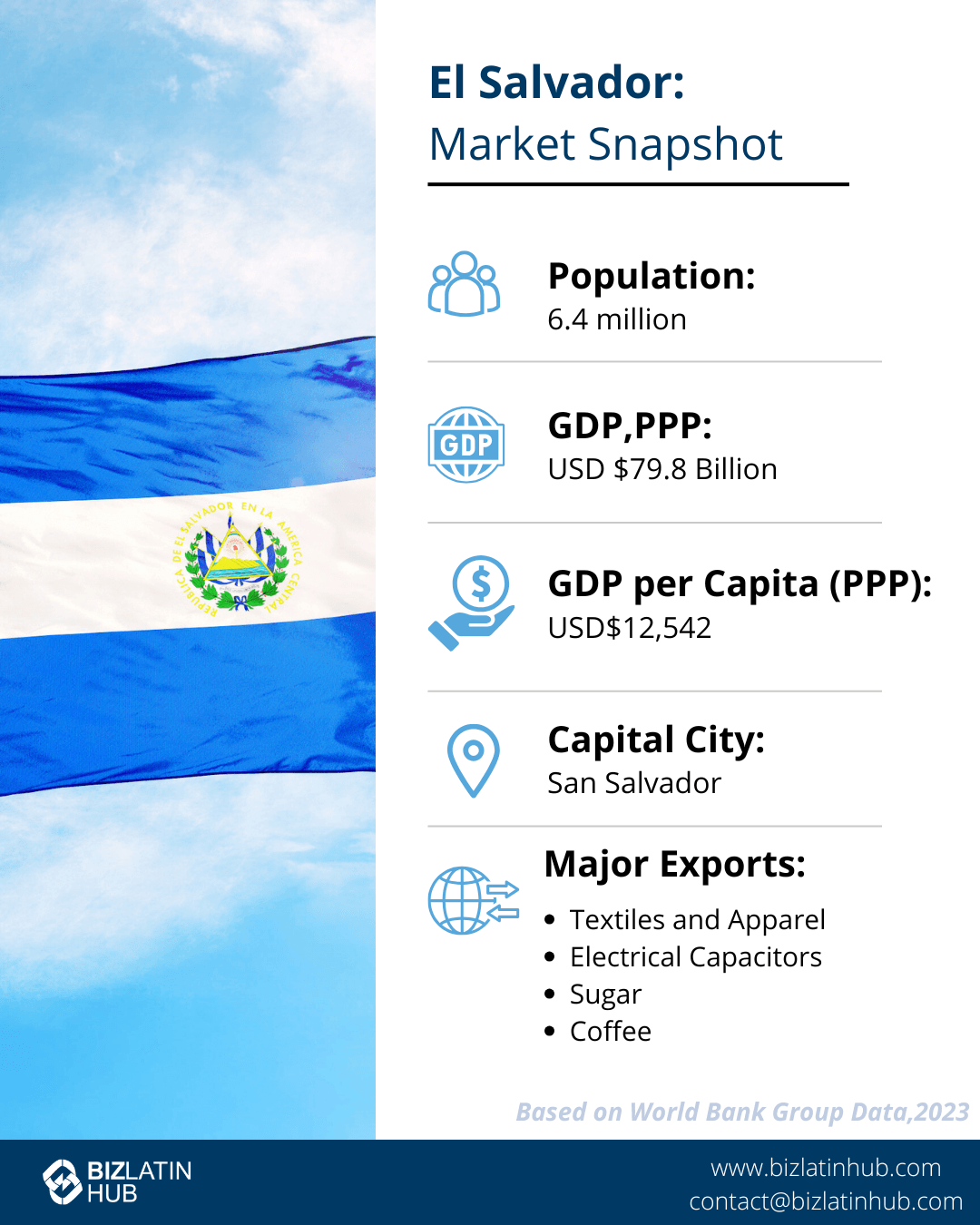

Since the end of a civil war in the early 1990s, El Salvador has witnessed consistent economic growth, with gross domestic product (GDP) growth only disrupted by the 2009 global financial crisis and the recent COVID-19 pandemic. Those decades of growth saw GDP hit $27.03 billion in 2019, while gross national income — a key marker of prosperity — reached $4,000 per capita that same year, taking the country into “upper-middle income” status by World Bank standards.

Today the Central American nation enjoys significant political stability and its improving economic markers make it an increasingly attractive destination for investment. Between 2018 and 2019 alone, foreign direct investment (FDI) rose 75% to hit $720 million.

El Salvador also has also numerous free trade agreements (FTAs) in place, largely due to its participation in regional associations that have signed FTAs, such as the Central American Common Market (CACM), which also includes Costa Rica, Guatemala, Honduras, and Nicaragua. Together, those countries have an economic association with the United States and the Dominican Republic, via the Central America-Dominican Republic FTA (CAFTA-DR). Meanwhile, El Salvador also has FTAs in place with the likes of Chile, Colombia and Taiwan.

Some of El Salvador’s most important exports are sugar, garments, and electrical devices, with its main export destinations being the United States and its four CACM partners.

If you are thinking of doing business in the country, read on to learn about the when you need due diligence in El Salvador, the advantages it offers, and the types of audit to choose from. Or go ahead and contact us now to discuss your business options.

Due diligence in El Salvador: why and when you need it

If you are going to be purchasing or partnering up with a local company, it is strongly recommended to conduct due diligence in El Salvador to avoid legal inconveniences and enter negotiations with a clear understanding of the value of all assets under consideration.

A process of due diligence in El Salvador involves a rigorous investigation of the operations of the local organization, aimed to identify possible risks that may affect its finances or business reputation. By conducting due diligence, you will be able to verify the legal and financial status of a local company, allowing you to make an informed decision, modify your negotiating tactics, or even change your plans entirely to protect your ongoing interests.

A process of due diligence can also imply a thorough examination of a company’s labor and environmental management, as well as sales figures, assets, liabilities, and clients. Some of the documents that are often reviewed during a due diligence process include:

- Balance sheets and tax returns

- Bank loans obtained

- Minutes of shareholders’ meetings

- Income statements

- Profit and loss reports

- Records of invoices receivable and payable

- Reports of deposits and cash payments

- Utility bills

Main advantages of due diligence in El Salvador

The main advantages of conducting a process of due diligence in El Salvador when carrying out commercial operations in the country include:

Better insight: By carrying out a due diligence process in El Salvador, you will not only gain a better understanding of the company in focus but also of the market in general, as well as local corporate requirements. This can be crucial to making sure you make the right move with your market entry.

Reduced risks: Due diligence allows you to identify operational problems with a specific company, and possible future consequences. This way, you will be able to reevaluate your business plan, reduce your offer, or impose stipulations for that company to implement certain measures prior to buying a company.

Cost saving: While undertaking due diligence in El Salvador will come at a cost, that fee could pale in comparison with the savings you make thanks to inefficiencies or issues that are identified, or in extreme cases, when the audit shows up a critical issue that renders the deal unsuitable.

Types of due diligence processes

Among the different types of due diligence processes that you could undertake, some of the most common include:

- Corporate due diligence: implying a detailed review of corporate books, shareholders’ records, corporate structure, and other vital aspects of a company’s corporate arrangements.

- Financial due diligence: involving a review of the financial statements of a company to verify its economic status and outstanding debts. In addition, the company’s tax compliance is also reviewed.

- Legal due diligence: includes an exhaustive review of information related to the legal aspects of a company, such as licenses, permits, and contracts, to verify that they are in proper compliance.

Note that a comprehensive due diligence process will involve all or a combination of these, as well as additional audits as needed.

Biz Latin Hub can conduct due diligence in El Salvador

At Biz Latin Hub, our multilingual due diligence services team has years of experience undertaking comprehensive audits to ensure your commercial operations are protected while doing business in El Salvador. With our complete portfolio of legal, recruitment, and tax advisory services, we can be your single point of reference for support when doing business in El Salvador, or any of the other 15 countries across Latin America and the Caribbean where we are present.

Get in touch with us today for personalized advice.

Learn more about our team and expert authors.