If you are looking at doing business in Costa Rica through either the purchase of a company or by entering a commercial relationship with a local firm, you are going to need to carry out due diligence. Because by undertaking due diligence in Costa Rica, you will develop an exhaustive understanding of the financial and operational well-being of an entity prior to becoming financially involved with it, providing you with the clearest picture possible of what to expect from your investment.

Costa Rica is well-known for being one of the most developed, stable, and prosperous nations in Latin America and the Caribbean, and is a highly popular destination for expats and tourists, as well as foreign investors. In a mark of the stability it enjoys, the Central American nation famously has not had a standing army since 1948, while it also has some of the lowest violent crime rates in Latin America.

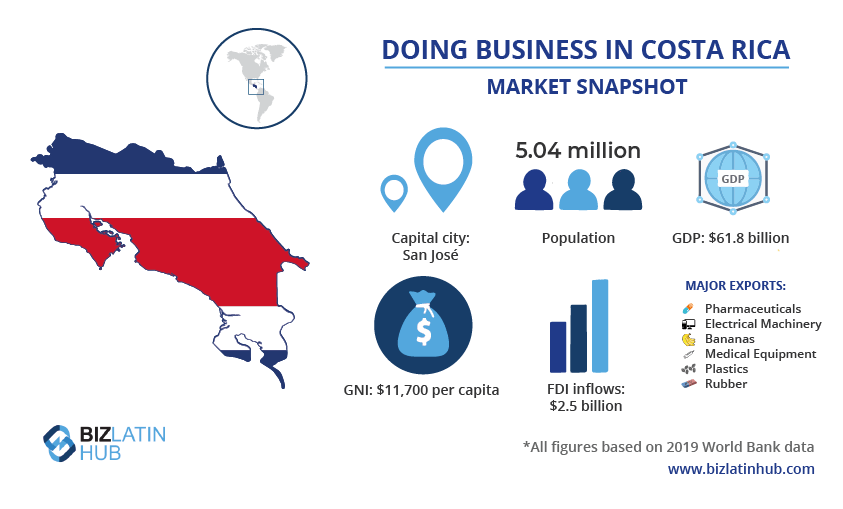

In economic terms, Costa Rica has performed well, witnessing steady gross domestic product (GDP) growth over the last three decades, reaching a GDP of $61.77 billion (all figures in USD) in 2019. The country has also seen a concomitant rise in gross national income (GNI) — a key marker of prosperity — which more than tripled over two decades to reach $11,700 per capita in 2019. That figure places the country at the top end of upper-middle income countries according to international standards.

The Costa Rican government is a heavy promoter of foreign direct investment (FDI) and has reached numerous free trade agreements (FTAs) with the likes of Chile, Panama, and Mexico. Costa Rica is also a member of the Central American Common Market (CACM), along with El Salvador, Guatemala, Honduras, and Nicaragua. It also enjoys preferential access to both the United States and Dominican Republic markets via its participation in the Dominican Republic-Central America FTA (CAFTA-DR).

The country’s prime exports include pharmaceuticals, medical equipment, electrical machinery, and agricultural products such as coffee, bananas, and sugar. Its main export destinations are Belgium, Guatemala, the Netherlands, Panama, and the United States.

If you are considering entering the Costa Rican market, read on to better understand due diligence in Costa Rica, or go ahead and contact us now.

Due diligence in Costa Rica: what does it mean?

Undertaking due diligence in Costa Rica means you will build up a forensic profile of the finances and operations of the entity under focus, receiving in-depth analysis and expert advice related to the findings from the firm you contract to undertake the audit.

Such a study will allow you or your company to determine the feasibility of your investment and identify potential or existing risks that could jeopardize future commercial operations.

A due diligence process can also be used to help existing companies review their compliance with local laws and regulations in order to determine if any corrective measures should be enacted in order to prevent the imposition of fines or sanctions, or to avoid facing judicial or administrative proceedings.

Note that you can perform a due diligence process ahead of a range of different types of business transactions, whether it is an acquisition or investment in an existing company, entering a commercial contract with another party, or acquiring assets such as real estate or other intangible assets from another company.

Key elements to consider when performing a due diligence process

Some of the key areas of analysis when undertaking due diligence in Costa Rica include:

Corporate documents: including corporate records, bylaws, certificates of incorporation, shareholder agreements, and ultimate beneficiary declarations.

Financial records: including financial statements, reports from independent accountants, loan and credit agreements, state and local tax returns, and reports carried out in conjunction with the General Tax Office of Costa Rica.

Management and employment practices: including labor agreements, professional consulting agreements, social security reports issued by the Costa Rican Social Security Fund, presentation of insurance policies for accidents at work, or compensation plans.

Tangible and intangible assets: including leased and owned property, real estate, liens, mortgages, deeds, insurance policies on assets, patents, trademarks, licenses, and other intangible assets.

Material contracts and obligations: including contracts relating to the purchase of products, equipment, fixtures, tools, dies, supplies, industrial supplies, franchise agreements, joint venture agreements, or non-compete agreements.

Litigation and legal claims: including information on all legal disputes or claims, conciliation agreements, releases, decrees, arbitration orders or awards.

Biz Latin Hub can undertake due diligence in Costa Rica

At Biz Latin Hub, our team of multilingual due diligence specialists has the expertise and experience in undertaking extensive due diligence reviews to ensure your company is protected while doing business in Costa Rica. With our full suite of corporate legal, recruitment, and tax advisory services, we can be your single point of contact to ensure the success of your business venture in the Central American nation, as well as any of the other 15 countries across Latin America and the Caribbean where we are present.

Get in touch with us today for personalized advice.

Learn more about our team and expert authors.