For foreign investors interested in launching in Latin America, the extensive network of free trade zones maintained by the Dominican Republic makes the Caribbean nation an enticing investment prospect. That is because, with 75 Dominican Republic free trade zones found around the country, a wide range of sectors can access the benefits that the zones offer, with more than 690 companies already located in one of them.

Dominican Republic free trade zones can be found in the borderzone near the frontier with Haiti, inside or nearby air and seaports, and in both rural and urban areas. In some cases, they are focused on a particular type of business, which their location is related to, with many companies in the country’s massive call centre industry based in urban free trade zones.

In the border areas, companies are often allowed to operate outside of the zones. Dominican Republic free trade zones can be privately or publicly owned, while in some cases a mixed ownership model is in place. Public parks are most often managed by ProIndustria. Meanwhile private free trade zones are overseen by a particular private company or a group of private actors.

Below, five reasons why the country’s free trade zones make company formation in the Dominican Republic such an enticing prospect are considered, or you may want to go ahead and contact us now to discuss your investment options.

6 Reasons to Invest in Dominican Republic free trade zones

While the reasons to invest in free trade zones begin with the attractive incentives associated with operating in one of them, they extend way beyond that.

- Tax incentives

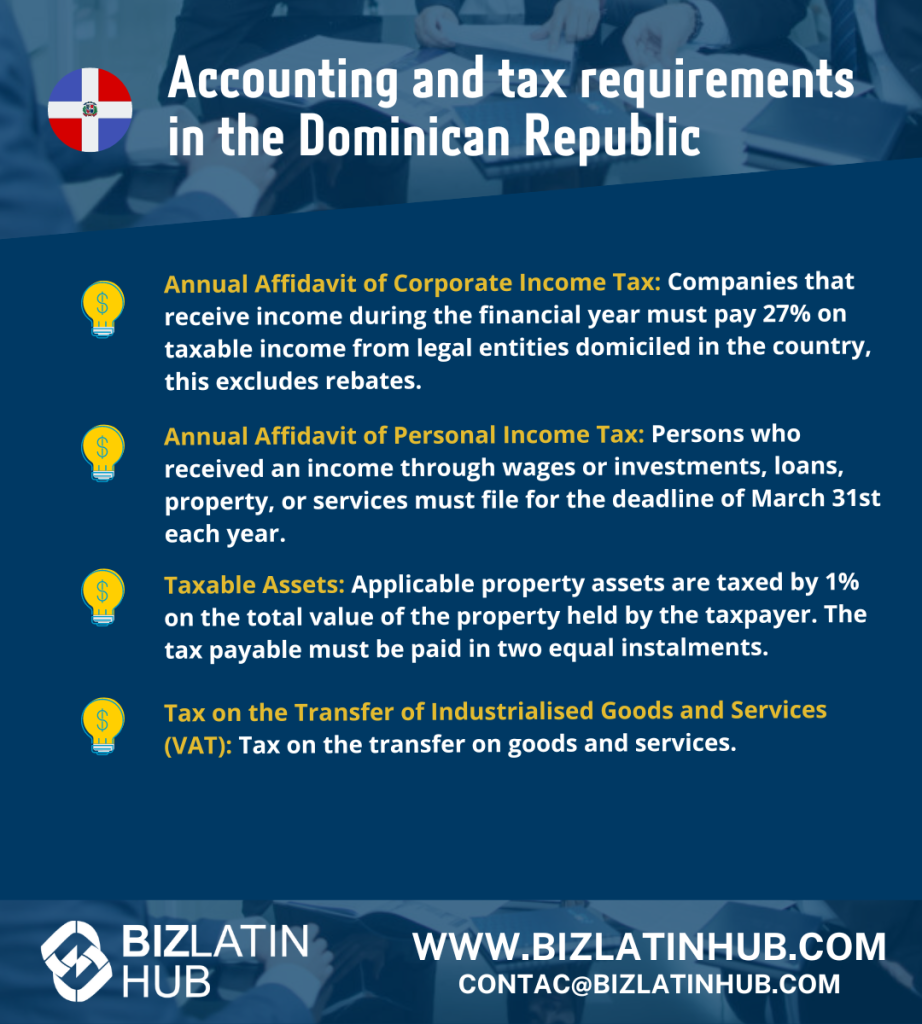

The main advantage is the significant tax advantages. In many cases, and especially when producing goods for export, operating in one of the zones sees companies exempted from a range of taxes, including the likes of corporate income tax, value-added tax, customs duties, real estate transfer taxes, and construction taxes.

- Available financing

Another major advantage of operating in one of the Dominican Republic free trade zones is the availability of credit and financing, even for foreign companies. As long as a financing applicant can meet requirements established by the country’s Monetary Board, it can take advantage of the country’s liberalised banking system and available lines of credit.

- Economic stability

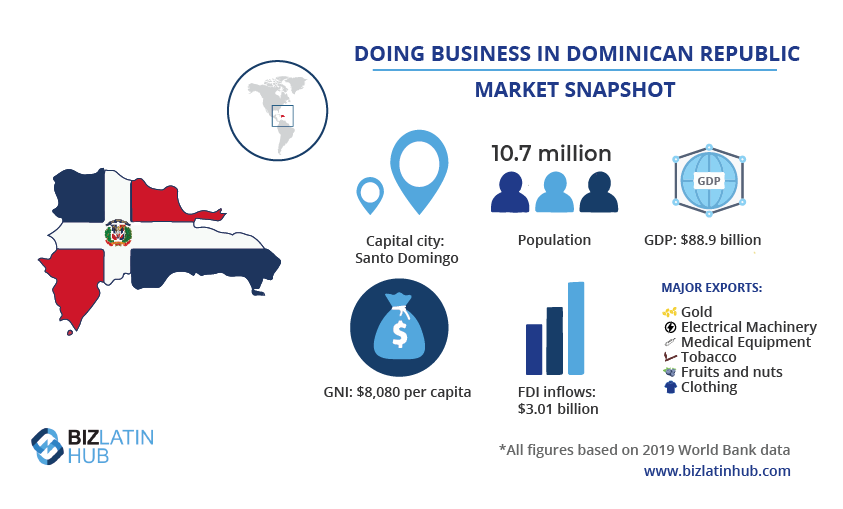

Operating in the Dominican Republic comes with the peace of mind that the country is one of the most stable economies in the Americas, being the largest economy in the Caribbean, and eighth-largest among Latin American nations.

After a decade of stagnation in the 1980s, the Dominican Republic initiated a series of economic liberalisation reforms that have seen it experience a prolonged boom from the mid-90s onwards, emerging as one of the most prosperous markets to do business in the region, as well as a logistical hub.

- Logistical advantages

Doing business in one of the free trade zones is made all the more attractive by the high-quality infrastructure on offer for moving goods in, out, and around the country. That infrastructure was recognized in the World Economic Forum’s Global Competitiveness Report, in which it was ranked as the best in the Latin America region. The Dominican Republic’s world-class infrastructure network includes international airports and seaports, as well as more than 20,000 kilometers of highways and roads.

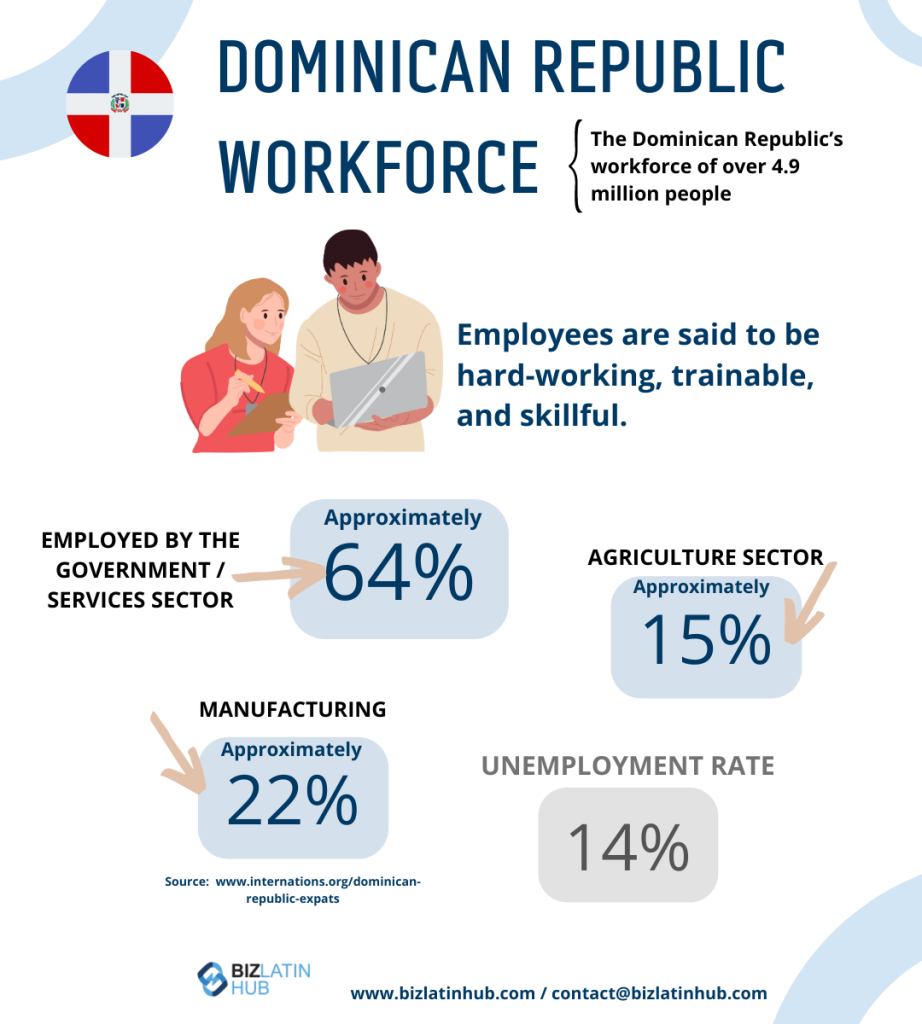

- Available labor

Being a major manufacturing center, as well as a growing hub for tech and contact centers, the Domincan republic boasts an available pool of skilled and unskilled workers with a reputation for hard work and desire to develop.

Although the minimum wage recently saw a significant raise, workers are still available at competitive rates. That is important because the Dominican Labor Code states that at least 80% of employees must be Dominican nationals. Senior management and director-level positions are excluded from that stipulation.

- Not just for goods

While many people think of manufacturing and production when they think of free trade zones, services are just as likely to be present. In the Dominican Republic, that’s most often seen with the famously large and powerful call center industry. While import/export tariffs have little to do with this, reduced tax and easier financing are strong reasons to consider outsourcing services.

FAQs on Dominican Republic free trade zones

Yes, foreign companies can operate a company in a Free Trade Zone by following the designated registration procedure and fulfilling regulatory requirements.

A minimum investment is necessary, but this varies widely depending on the specific free trade zone and the industry in which you are working.

Tax incentives

Available financing

Economic stability

Logistical advantages

Available labor

Yes, in fact this is one of the biggest areas for growth in the Dominican Republic. Call centers are common in the free trade zone, and with good reason. The country has a young, competitively priced and English proficient workforce, known for hard work.

Biz Latin Hub can help you enter the Dominican Republic free trade zones

At Biz Latin Hub, our multilingual teams of corporate support specialists have the experience and know-how to help you launch and do business in the Dominican Republic, or any of the other 17 markets around Latin America and the Caribbean where we have people in place. With our full suite of back-office solutions, including company formation, legal, accounting, and recruitment services, we can be your single point of contact for operating in the Americas and beyond.

Reach out to us now to discuss how we can help you reach your business goals.

Or read about our team and expert authors.