Whether you are considering company formation, registering a branch, or you simply want to be doing business in Paraguay, read on to find out how the country’s residency opportunities and taxation regime could be to your benefit. The country is a founder member of Mercosur, giving it access to ports for exportation and lessening the impact of being landlocked. Doing business in Paraguay is already attractive and looks set to strengthen.

Key takeaways on doing business in Paraguay

| Is foreign ownership allowed in Paraguay? | Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals). Capital flows are not restricted. |

| Most important sectors in Paraguay | The main drivers of its economy are agriculture, livestock, retail, and construction. |

| Are there Free Trade Zones in Paraguay? | There are two in Ciudad del Este by the Argentine and Brazilian borders, focused on manufacturing and warehousing for export. |

| Are there incentives for Foreign Direct Investment in Paraguay? | REDIEX is an organization run by the Ministry of Commerce which aims to assist foreign companies doing business in the country. Law 60/90 encourages FDI in certain regions. |

| What international links does the country have? | Paraguay has membership of Mercosur. The country also has free trade access to other key markets in the region. |

Consistent growth & stability

Despite being a landlocked country, it is in a strong position for trade due to its proximity to Brazil and Argentina. These two countries have the region’s largest and third-largest economies, and gaining access to their markets is a strong reason for starting a business in Paraguay.

Paraguay’s rapid growth has been met with a concomitant increase in interest among international investors, with foreign direct investment (FDI) inflows growing to USD$207 million. In the past decade, Paraguay averaged four per cent yearly GDP growth.

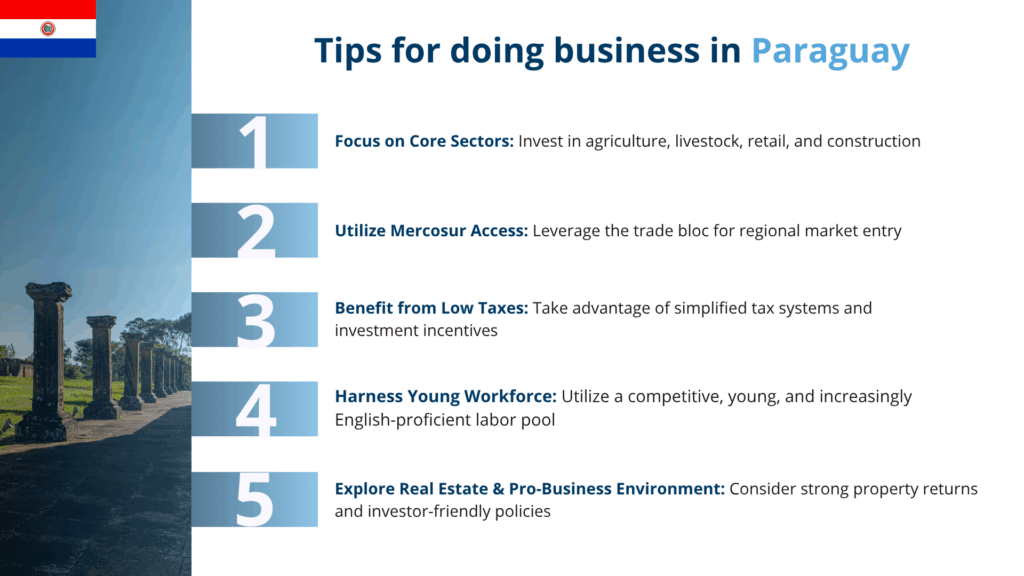

The main drivers of its economy are agriculture, livestock, retail, and construction. Paraguay has a low tax burden and low public debt. There are strong trade relations with its neighbors, especially Brazil and Argentina.

Starting a business in Paraguay also means membership of the Mercosur trade bloc, a free trade initiative that recently celebrated its 30th anniversary. The country also has free trade access to other key markets in the region, thanks to its membership in the Southern Common Market (MERCOSUR), with the government maintaining a pro-business regulatory framework.

With the country also having relatively low labor costs, doing business in Paraguay represents an attractive prospect to foreign investors seeking to expand into the region, especially given the government’s move to simplify gaining permanent residency.

Opportunities for doing business in Paraguay

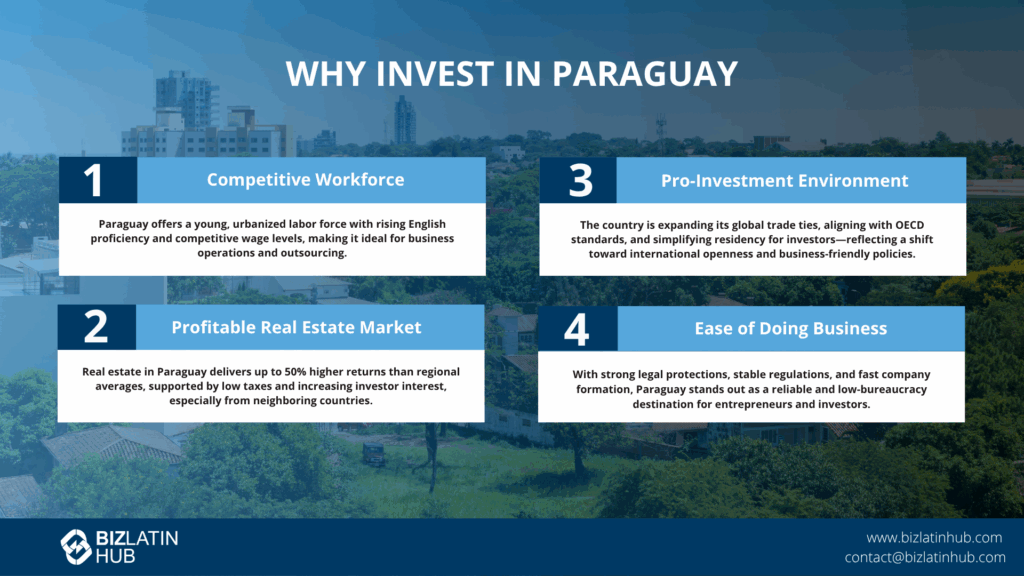

Companies and entrepreneurs should be looking to invest in Paraguay for the following five reasons:

1. A young and competitive workforce

Paraguay boasts one of the youngest workforces in the region, with an average age of 26.3 years old. That workforce is also increasingly urbanized, with 62.5% of the population currently living in urban areas.

Employees are available at highly competitive rates.

Moreover, Paraguay has seen English proficiency rise in recent years and is now among the top five nations in the region for English proficiency, making it all the more attractive for doing business.

2. Strong real estate returns

Paraguay boasts one of the strongest real estate sectors in the region, with returns on investment often up to 50% higher than in other markets in the region, and buy-to-let

Those strong returns are bolstered by a low-tax regime, with value-added tax (VAT) set at just 10%, offering even more reason to invest in Paraguay.

The opportunities on offer in the Paraguayan real estate market have seen it draw increasing interest from investors, with a particular influx of capital coming from neighbouring Argentina in recent years.

3. An increasingly international outlook

Once somewhat economically isolated from the world, Paraguay is adopting an increasingly international and outward facing outlook that encourages foreign investment.

That has seen it initiate talks with Chile over what would be the country’s first bilateral free trade agreement (FTA), to compliment the agreements it has in place via its membership of the Southern Common Market (Mercosur), an economic association that also includes the other Southern Cone nations of Argentina, Brazil, and Uruguay.

It also saw the country adopt new transfer pricing norms in keeping with standards established by the Organisation for Economic Co-operation and Development (OECD) — an international trade organization known as the “good practice club” that Paraguay is seeking to join as a full member.

4. Streamlined residency for those who invest in Paraguay

Among the measures the country has taken to encourage more people to invest in Paraguay is to streamline the residency process. The country has taken measures to slash the time taken to gain residency through investment from two years to just a few months.

That despite the fact that Paraguay already had one of the most favourable residency regimes for investors in the region.

5. Ease of doing business

Paraguay is a pro-business country that is not only highly encouraging of FDI, but also runs a regime that makes it easy to invest.

That includes no history of confiscations or sudden changes in investment rules, a robust set of employment laws, and strict protection of intellectual property, providing significant confidence to investors.

The country also boasts a company formation process with minimal red tape, a well-established industrial base for anyone seeking to enter the manufacturing sector, and a growing innovation sector.

Taxes to consider when doing business in Paraguay

If you are planning on doing business in Paraguay, you must understand the following corporate taxes in order to fully comply with the tax authorities and ensure the good health of your business:

Business income tax for small and medium businesses

In order to alleviate the tax burden on companies doing business in Paraguay, the government has established a streamlined corporate income tax.

This is known as a ‘simple tax’ for medium-sized companies and a ‘very simple tax’ for small companies.

These taxes are set annually, based on the amount of gross income obtained by the company the previous year.

Note that this fixed annual tax regime significantly reduces the amount of paperwork and bookeeping demanded by law.

Transfer pricing rules in accordance with the OECD’s standards

Paraguayan law enforces general transfer pricing rules based on the stipulations of the Organization for Economic Cooperation and Development (OECD). Entities affected by transfer pricing regulations are encouraged to engage with a trusted tax advisory firm able to perform a professional transfer pricing study.

Tax on dividends and profits for residents and non-residents

This tax is applied to profits, dividends, and income paid to the owner, consortium, partners, or shareholders of entities doing business in Paraguay, as well as to the permanent establishments of entities incorporated abroad. Note that the rate of this tax is 8 percent when the recipient of the profits is a natural, legal, or resident person in the country and 15 percent when the beneficiary of these profits is a non-resident, including parent companies abroad.

Taxes on personal services

The personal income tax (IRP) applies to income from capital gains and income derived from the provision of personal services. The IRP rate on capital gains is 8 percent, while the IRP rate on income derived from personal services is between 8 percent and 10 percent,, depending on the taxpayer’s net income.

Non-resident income tax

Paraguayan law implements a tax on the income of non-residents (INR) that is imposed on the income or profits obtained by natural persons, legal entities, and other non-resident entities doing business in Paraguay. The INR rate is 15 percent and is applied to net income generated within Paraguay.

FAQs on doing business in Paraguay

Answers to some of the most common questions we get asked by our clients.

1. Can a foreigner own a business in Paraguay?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. Are there Free Trade Zones in Paraguay?

| There are two in Ciudad del Este by the Argentine and Brazilian borders, focused on manufacturing and warehousing for export. |

3. How long does it take to register a company in Paraguay?

Registering a company in Paraguay takes 8 weeks.

4. Which sectors are important in Paraguay?

The main drivers of its economy are agriculture, livestock, retail, and construction

5. Does Paraguay have trade agreements with other countries?

Starting a business in Paraguay also means membership of the Mercosur trade bloc, a free trade initiative that recently celebrated its 30th anniversary. The country also has free trade access to other key markets in the region, thanks to its membership in the Southern Common Market (MERCOSUR), with the government maintaining a pro-business regulatory framework.

6. What entity types offer Limited Liability in Paraguay?

In Paraguay, both “S.A.S” (Sociedad por Acciones Simplificada) and “S.A” (Sociedad Anónima) are limited liability entity types.

Biz Latin Hub can help you with doing business in Paraguay

Engage with an expert tax advisor to understanding corporate taxes when doing business in Paraguay. At Biz Latin Hub, our multilingual team of tax experts is ready to help successfully grow your commercial venture in Paraguay, and take advantage of the country’s business-friendly environment.

Reach out to us now so we can start to help you improve your tax compliance in Paraguay.

Learn more about our team and expert authors.