Peru has one of the fastest growing economies in Latin America. Over the past two decades, the country has experienced economic growth thanks to the process of modernization and development. More companies are looking to enter the market, driving an increase in the companies incorporating in Peru. The country is currently the sixth largest economy in Latin America, and the seventh among the top 20 border markets ahead of economies such as Colombia, Russia, Mexico and South Africa.

Key takeaways on doing business in Peru

| Is foreign ownership allowed in Peru? | 100% foreign ownership is allowed in Peru, however you will need local representatives. There are no restrictions for foreign shareholders, foreign investment, foreign exchange or the remittance of profits. |

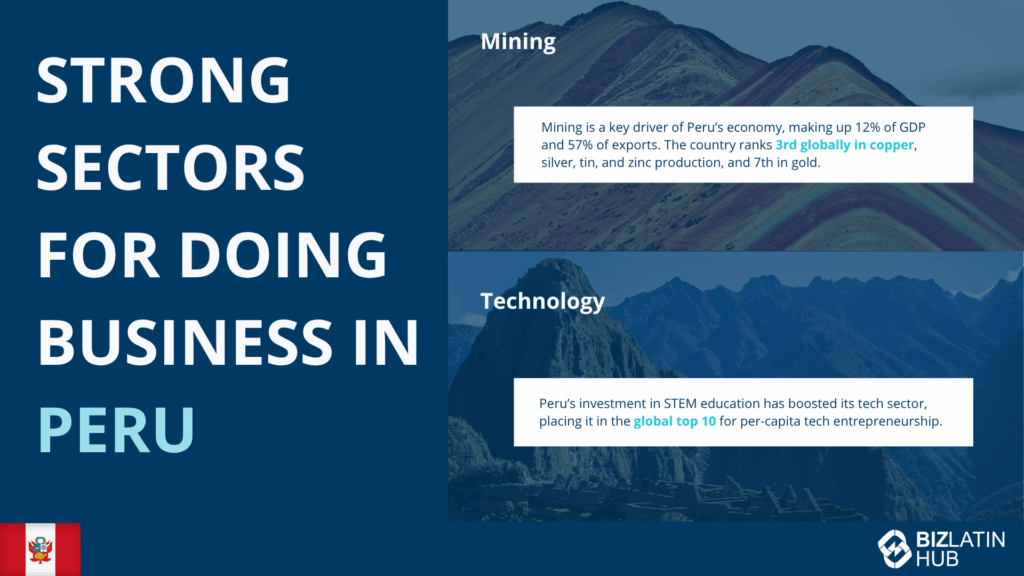

| Most important sectors in Peru | Historically, mining has always been one of the strongest sectors for Peru’s economy. However, services, especially tech, are quickly gaining in importance. |

| Are there Free Trade Zones in Peru? | There are currently four Free Trade Zones in the country, with a further four being developed. |

| What incentives exist for Foreign Direct Investment in Peru? | Recently, legislation has also been passed that facilitates foreign investment and ensures foreign and local companies are treated equally |

| What international links does the country have? | Peru is a member of the TPP and Pacific Alliance and has 27 bilateral investment treaties with countries all over the world, including China and the UK |

Doing business in Peru: an overview

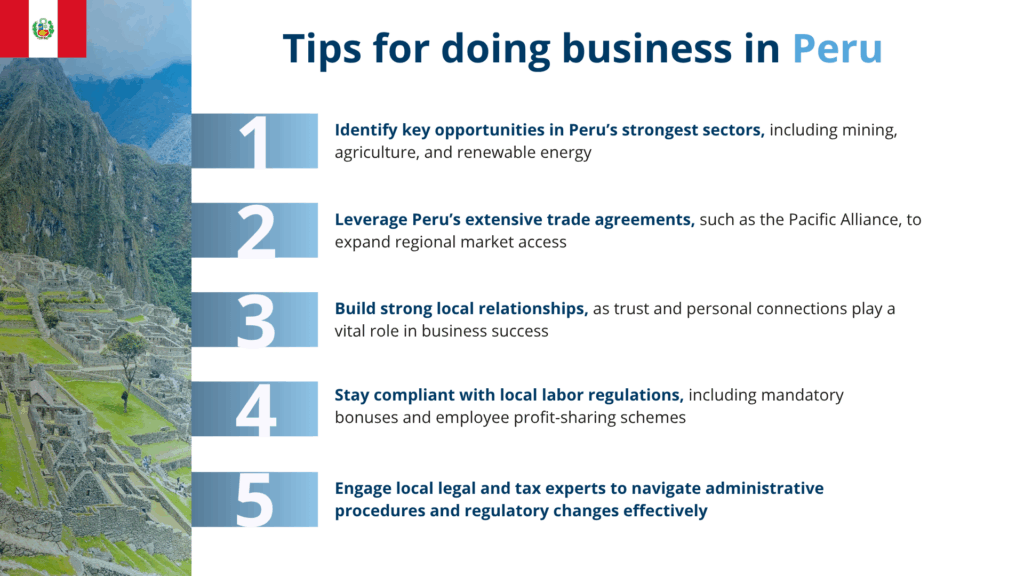

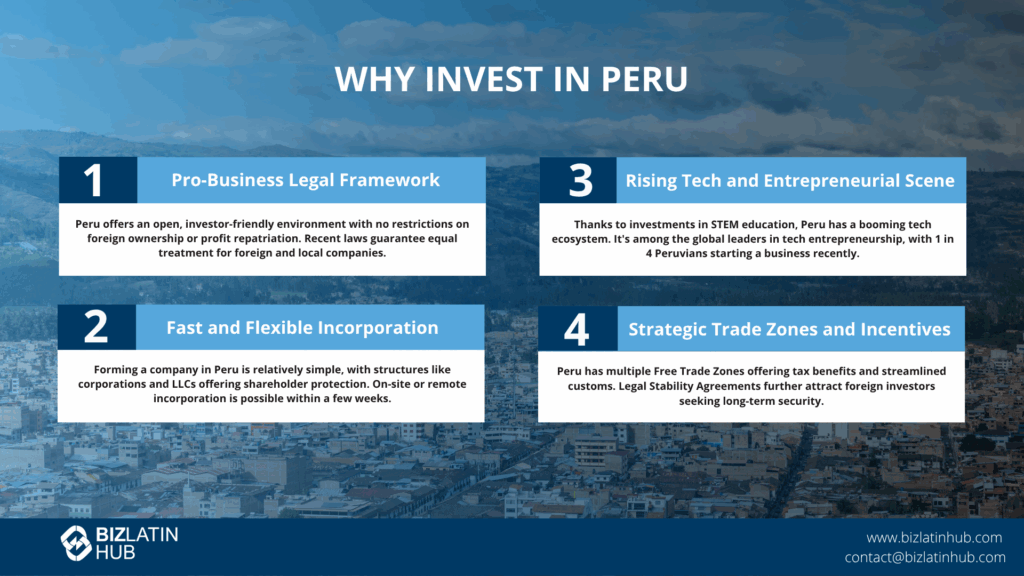

Ease of doing business in Peru is one of the main factors foreigners take into consideration when choosing this destination for either direct or indirect investment. There are no restrictions for foreign shareholders, foreign investment, foreign exchange or the remittance of profits.

Recently, legislation has also been passed that facilitates foreign investment and ensures foreign and local companies are treated equally. Moreover, incorporating a company in Peru is a relatively straightforward process. All of these highly competitive conditions are worth exploring to make the most of what this growing nation has to offer.

Government investments in Science, Technology, Engineering and Mathematics (STEM) education over the past decade have paid off, and Peru now has a thriving tech scene. It ranks in the top 10 countries with the highest per-capital levels of tech entrepreneurial activity (1 in 4 Peruvians have started a business in the past four years).

Whether it is foreign companies or entrepreneurs who want to start a business in Peru, or are thinking of hiring software developers there, the jurisdiction has never looked better, with the strong growth predicted to continue for at least the rest of the decade.

There are currently four Free Trade Zones in the country, with a further four being developed. These zones are overseen by the Ministry of Commerce and offer tax exemptions, simplified customs processes and specialized on-site exportation and importation support. Specific zones also offer particular perks for certain industries.

Legal Stability Agreements are available to investors who meet the minimum legal amounts. In addition, the company incorporation process in Peru is relatively simple and straight-forward. The most frequent company structures are the corporation and the limited liability company; both protect the shareholders up to a certain extent.

It takes up to 15 business days to complete the company formation process should the founding partners be in Peru at the time of incorporation. However, if they are unable to be in the country, registered powers of attorney are required. This can take up to 15 additional business days.

Doing Business – International Trade in Peru

Another factor that attracts foreigners to do business in Peru is the extent of the countries international trade which is highlighted in the country’s multiple free trade agreements and partnerships that encourage international investment. Peru has:

- 27 bilateral investment treaties with countries all over the world, including China and the UK

- Investment chapters in 13 free-trade agreements, including the European Free Trade Association and the US

- 8 double tax treaties, which help avoid double taxation for residents of the contracting states

Additionally, Peru is involved in the Trans-Pacific Partnership (along with Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Singapore, United States and Vietnam) and is a member of the Pacific Alliance (along with Mexico, Chile and Colombia).

Before engaging in international trade, one should make contact with an international trade lawyer who can help one to navigate through the Peruvian laws and regulations relating to the importation and exportation of products.

Doing Business in Peru – Peru’s Advantage in the Mining Industry

Historically, mining has always been one of the strongest sectors for Peru’s economy. The country currently produces copper, gold, silver, lead, tin, molybdenum, iron, cadmium, mercury, selenium and indium among others.

The efficient mining practices in the country have enabled Peru to become one of the largest mining producers in both the region and the world.

The abundance of natural resources that Peru possesses, coupled with the ease of entry and low start-up costs for foreign entities make Peru an attractive destination for foreign investment.

Many foreign companies have taken advantage of this. In addition to company profits, mining provides benefits to the local community through employment, which in turn positively impacts on the economy.

The following statistics highlight the strength and success of the mining industry in Peru:

- 3rd largest producer of copper, silver, tin and zinc in the world

- 7th largest producer of gold in the world

- Mining accounts for 12% of GDP and 57% of exports

Peru Visa Requirements

Despite having quite relaxed regulations in terms of foreign investment in Peru, expats should note that work visas are required to relocate to Peru. There are different kinds of visas for foreigners looking to enter Peru. These visas will vary greatly depending on the purpose of the visit.

Anyone looking to relocate to Peru should contact an immigration lawyer to assist in application and to better understand the requirements, process, time frame and costs in obtaining a Peruvian Visa.

FAQs on doing business in Peru

Answers to some of the most common questions we get asked by our clients.

1. Can a foreigner own a business in Peru?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. Are there Free Trade Zones in Peru?

| There are currently four Free Trade Zones in the country, with a further four being developed. These zones are overseen by the Ministry of Commerce and offer tax exemptions, simplified customs processes and specialized on-site exportation and importation support. Specific zones also offer particular perks for certain industries. |

3. How long does it take to register a company in Peru?

It takes up to 15 business days to complete the company formation process should the founding partners be in Peru at the time of incorporation. However, if they are unable to be in the country, registered powers of attorney are required. This can take up to 15 additional business days.

4. Which sectors are important in Peru?

Historically, mining has always been one of the strongest sectors for Peru’s economy. The country currently produces copper, gold, silver, lead, tin, molybdenum, iron, cadmium, mercury, selenium and indium among others. The efficient mining practices in the country have enabled Peru to become one of the largest mining producers in both the region and the world.

Government investments in Science, Technology, Engineering and Mathematics (STEM) education over the past decade have paid off, and Peru now has a thriving tech scene. It ranks in the top 10 countries with the highest per-capital levels of tech entrepreneurial activity (1 in 4 Peruvians have started a business in the past four years).

Whether it is foreign companies or entrepreneurs who want to start a business in Peru, or are thinking of hiring software developers there, the jurisdiction has never looked better, with the strong growth predicted to continue for at least the rest of the decade.

5. Does Peru have trade agreements with other countries?

Another factor that attracts foreigners to do business in Peru is the extent of the countries international trade which is highlighted in the country’s multiple free trade agreements and partnerships that encourage international investment. Peru has:

- 27 bilateral investment treaties with countries all over the world, including China and the UK

- Investment chapters in 13 free-trade agreements, including the European Free Trade Association and the US

- 8 double tax treaties, which help avoid double taxation for residents of the contracting states

Additionally, Peru is involved in the Trans-Pacific Partnership (along with Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Singapore, United States and Vietnam) and is a member of the Pacific Alliance (along with Mexico, Chile and Colombia).

6. What entity types offer Limited Liability in Peru?

Both the S.A and S.R.L off limited liability in Peru.

Biz Latin Hub can help you to do business in Peru

Once you have your business setup, registered, legal representation, and you have your tax and accounting in order, then you are ready to do business in Peru.

If you have any questions or inquiries about how to set up a company or corporation in Peru, our Peruvian business experts have created a company formation presentation.

We hope it helps! If you have any more questions about how to incorporate your company in Peru, please do not hesitate to contact us now. Our Biz Latin Hub team in Peru includes local and expat professionals who have the knowledge and expertise to support you throughout the process.