Panama is a regional business and logistics hub offering investor-friendly laws, tax advantages, and strategic positioning. Selecting the appropriate legal entity to register a company in Panama, whether it’s an S.A., SRL, or Private Interest Foundation, is essential to meet your business, tax, and regulatory goals. This guide outlines Panama’s company types and helps you select the best structure for success.

Key Takeaways On Legal Entities In Panama

| Common legal entity types in Panama | Corporation (Sociedad Anonima – S.A.). Limited Liability Company LLC (Sociedad de Responsabilidad Limitada – S.R.L.). International Business Company (IBC). Private Interest Foundation (Fundacion de Interes Privado). Foreign Branch (Sucursal). |

| What is the most common Panamanian business entity? | Frequently the SA in Panama is the most common entity type that functions in a similar way to an LLC in the US. There is also the option to convert it into an IBC at a later stage if it becomes required. |

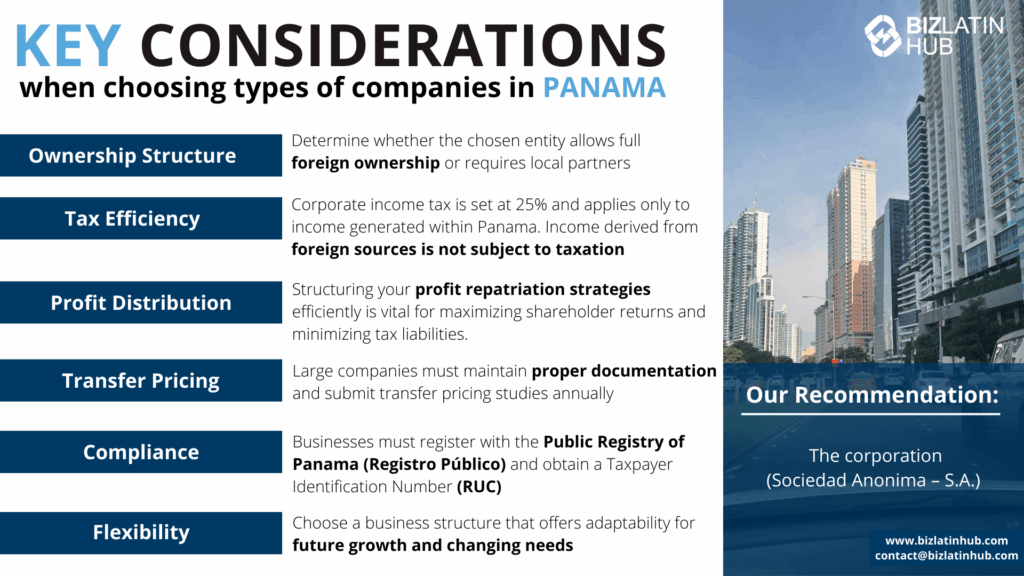

| What are the primary considerations when choosing a business entity in Panama? | Ownership Structure. Tax Efficiency. Profit distribution. Transfer Pricing. Compliance. Flexibility. |

Main Legal Entity Types in Panama

There are 5 main types of companies in Panama to choose from, the most commonly utilized options are:

- Corporation (Sociedad Anonima – S.A.).

- Limited Liability Company LLC (Sociedad de Responsabilidad Limitada – S.R.L.).

- International Business Company (IBC).

- Private Interest Foundation (Fundacion de Interes Privado).

- Foreign Branch (Sucursal).

All these legal entities must have a company legal representative and a legal/fiscal address in Panama. They also must make monthly and annual tax declarations to the local tax authorities.

Comparison Table: Key Legal Entity Types in Panama

| Entity Type | Best For | Participants | Liability | Legal Personality | Tax Status |

|---|---|---|---|---|---|

| S.A. | Most common for commercial operations | 2 shareholders / 3 directors | Limited to shares | Yes | Territorial tax system |

| SRL | Partnerships and closed ownership | 2–20 partners | Limited to capital | Yes | Territorial tax system |

| PIF | Asset protection or estate planning | Founder, council, beneficiaries | None (non-commercial) | Yes | Exempt unless commercial use |

| Branch | Foreign entities operating in Panama | 1 (foreign HQ) | Parent company liable | Yes | Taxed as a Panamanian entity |

Keep reading if you are interested in doing business in Panama and need to find out about the different types of companies available.

1. Sociedad Anónima (S.A.)

In Panama, an SA or Corporation is similar to a public limited company. The Sociedad Anónima (S.A.) requires between three and fifty founders, regardless of their nationality. One of its key advantages is the ability to issue shares, with shareholders’ liability limited strictly to the amount of their contributions. This structure is particularly well-suited for larger companies aiming to raise capital by offering shares to investors.

Other key characteristics associated with the formation of this entity are notably, shareholders bear responsibility solely for their own assets and contributions. Panama’s legislation does not specify a minimum social capital requirement for the company, although a recommended minimum of USD$10,000 is advised. The incorporation of an S.A can typically be completed within a period of two to three weeks (without a bank account), provided the business fulfills the following essential requirements:

- Maintain a minimum of three directors.

- Appoint a president, secretary, and treasurer, who also serve as named dignitaries.

- Have at least two subscribers, who may be individuals from the board of directors or the appointed dignitaries listed in the Social Pact. Each subscriber must

- commit to subscribing to at least one share at the time of registration.

- Elect a legal representative for the company, who can be one of the directors.

- Designate a resident agent (as mandated by law, a Panamanian lawyer is required).

- Register a fiscal address for the company.

- Submit monthly and annual tax declarations.

- Maintain a minimum of one shareholder.

- Fulfill the annual payment obligation to the Public Registry for account maintenance.

2. Sociedad de Responsabilidad Limitada (SRL)

Establishing a Limited Liability Company (S.R.L) is the initial step in the process of incorporating a company in Panama, followed by the same subsequent steps as for forming an S.A. These incorporations occur within specific legal structures in Panama.

Typically, one can accomplish the incorporation of an S.R.L within a timeframe of approximately two weeks (excluding the bank account setup). From an investor’s perspective, an S.R.L may seem like the most appealing option as it provides personal liability protection, relieving individuals of personal responsibility for the company’s funds or debts. The key prerequisites for forming an S.R.L in Panama are outlined below:

- To form an S.R.L in Panama, the following principal requirements must be fulfilled, alongside considering the key legal structures in Panama:

- Appoint at least one administrator.

- Elect a president, secretary, and treasurer, who also serve as named dignitaries.

- Have a minimum of two subscribers, who may be individuals from the board of directors or the appointed dignitaries listed in the Social Pact. Each subscriber must agree to subscribe to at least one share at the time of registration.

- Appoint a legal representative for the company, who can be the president, an associate, or one of the administrators as established in the Social Pact.

- Elect a resident agent (a Panamanian lawyer is mandatory by law).

- Register a fiscal address for the company.

- Prepare and submit annual tax declarations.

- Maintain a minimum of two shareholders or associates.

- Fulfil the annual payment obligation to the Public Registry for account maintenance.

3. International Business Company (IBC) in Panama

An International Business Company (IBC) in Panama is a flexible legal structure designed to facilitate international trade, asset management, and investment activities. IBCs are widely used by foreign investors due to their tax advantages, confidentiality, and ease of management. While the incorporation process typically takes two to three weeks, the structure offers significant benefits for international business operations.

The following are the key characteristics and requirements of an International Business Company (IBC) in Panama:

- Tax Exemptions: IBCs are exempt from taxes on income generated outside of Panama, provided they do not conduct business within the country.

- Corporate Flexibility: The company can operate in various sectors, including trade, asset management, and intellectual property.

- Confidentiality: Shareholder and director information is not publicly disclosed, ensuring privacy.

- Capital Requirements: There is no minimum capital requirement; however, a recommended capital of USD $10,000 is often used as a starting point.

- Shareholders and Directors: IBCs require at least one shareholder and three directors, who can be of any nationality and need not reside in Panama.

- Legal Representative: A Panamanian lawyer must be appointed as the company’s registered agent.

- Registered Address: A fiscal address in Panama is mandatory.

- Corporate Records: The company must maintain a minute book and register of shareholders in Panama.

- Bank Account: A corporate bank account is typically required and may take several weeks to establish.

4. Private Interest Foundation (PIF)

Forming a Private Interest Foundation offers specific legal advantages that appeal to foreign businesses. While establishing this type of company requires a minimum of three weeks, the entity enjoys exemption from all taxes and contributions in Panama, with the exception of the annual quota payment.

If the entity intends to engage in commercial development, it must obtain a license and comply with tax declaration requirements as mandated by law. This is an additional legal structure in Panama that must be considered. The following outlines some key characteristics and requirements of a Private Interest Foundation:

- Does not issue shares like other types of companies do

- Includes a Private Protectorate Document from a notary

- One beneficiary and one protectorate must be designated by the Foundation Council

- Not subject to judicial orders on the seizure or confiscation of assets

- Recommended shared social capital of the company USD$50,000 (not obligatory)

- A fiscal address is required

- A company legal representative (a Panamanian lawyer) is required

- The aim/purpose of the foundation and the period of time (indefinite or definite) that you wish the company to be open for, must be stated

- In the case of dissolution – name the recipient/destination of the assets of the foundation and the type of liquidation process

- A bank account must be set up (this process can take a minimum of four weeks). Some references must be supplied from the founder and protectorates.

5. Branch of a Foreign Company

A Sucursal (branch) in Panama allows foreign companies to expand their operations and establish a presence in the Panamanian market without creating a separate legal entity. The branch operates as an extension of the parent company, meaning it is subject to the same liabilities and obligations. The incorporation of a branch typically takes two to four weeks, depending on the documentation provided.

The following are the key characteristics and requirements of a Foreign Branch in Panama:

- Bank Account: The branch may need to open a corporate bank account, which can take several weeks and may require references and supporting documents.

- Legal Status: A branch is not an independent legal entity; it is fully dependent on the parent company, which is responsible for its liabilities.

- Taxation: A branch is subject to Panamanian taxes on income generated within the country, including corporate income tax and value-added tax (VAT).

- Registration Requirements: The branch must be registered with the Public Registry of Panama and obtain a taxpayer identification number (RUC) from the Tax Authority.

- Capital Requirements: No minimum capital is required for a branch, but the parent company must declare its capital contribution for branch operations.

- Fiscal Address: The branch must maintain a registered fiscal address in Panama.

- Legal Representative: A Panamanian resident legal representative must be appointed to act on behalf of the branch in local legal matters.

- Required Documentation:

- Articles of incorporation of the parent company.

- A certificate of good standing for the parent company.

- A resolution from the parent company authorizing the creation of the branch in Panama.

- Copies of passports for directors and legal representatives.

Our recommendation: The corporation (Sociedad Anonima – S.A.) structure provides limited liability to shareholders and is versatile for various business activities. It offers a well-established framework with clear regulations and governance procedures, making it a reliable choice for businesses of different sizes and sectors.

Who Should Choose Which Entity Type?

S.A. – Sociedad Anónima

Who should choose this: Entrepreneurs and foreign companies operating in Panama. Offers high flexibility and limited liability, with strict confidentiality.

SRL – Sociedad de Responsabilidad Limitada

Who should choose this: Ideal for small partnerships or family businesses. Partners manage the business directly with fewer governance obligations.

PIF – Private Interest Foundation

Who should choose this: Designed for estate planning, asset protection, and philanthropy. Cannot engage in commercial activities unless explicitly allowed.

Branch

Who should choose this: Large international companies operating directly in Panama while maintaining centralized control.

Choosing the Right Legal Structure in Panama

Ownership Structure

Evaluate whether your chosen business entity allows for foreign ownership. Panama generally permits 100% foreign ownership in most industries, making it highly attractive to foreign investors. However, certain sectors, such as media, retail, and specific professional services (e.g., law and accounting), are restricted to Panamanian nationals or require local partnerships. Additionally, the maritime sector and businesses in the Panama Canal Zone may involve specialized regulatory oversight. Ensuring compliance with these rules is essential for seamless operations and regulatory approval.

Tax Efficiency

Analyze how Panama’s territorial tax system will impact your business. Corporate income tax is set at 25% and applies only to income generated within Panama. Income derived from foreign sources is not subject to taxation, making Panama especially appealing for international businesses. A 7% value-added tax (ITBMS) applies to most goods and services, although exemptions exist for certain items like food and medicines. Companies operating in special economic zones, such as the Colon Free Zone or Panama Pacifico, may qualify for significant tax incentives, including exemptions on income tax, VAT, and import/export duties. Strategic tax planning is vital to optimize costs while adhering to Panama’s tax regulations.

Profit Distribution

Understand the tax implications of distributing profits. Dividends distributed to non-residents from income generated in Panama are subject to a 10% withholding tax, reduced to 5% if the income is foreign-sourced. However, dividend taxes may be further reduced or eliminated under Panama’s network of double taxation treaties with countries such as Mexico, Spain, and the Netherlands. Proper structuring of profit repatriation strategies can help maximize shareholder returns and minimize tax liabilities.

Transfer Pricing

Comply with Panama’s transfer pricing regulations, which are aligned with OECD guidelines. Businesses involved in cross-border transactions between related parties must ensure that these transactions reflect arm’s-length market values. Transfer pricing documentation and annual reporting are mandatory for companies meeting certain revenue thresholds. Accurate reporting and preparation are essential to avoid penalties and minimize audit risks, particularly for multinational entities with significant intercompany transactions.

Compliance

Prepare for Panama’s compliance requirements. Businesses must register with the Public Registry of Panama (Registro Público) and obtain a Taxpayer Identification Number (RUC) from the tax authority (DGI). Financial reporting must adhere to International Financial Reporting Standards (IFRS), with specific requirements depending on the company’s size and activities. Annual income tax declarations, monthly VAT filings, and employee social security contributions to the Social Security Fund (CSS) are mandatory. Non-compliance with labor laws, such as failing to meet Panama’s labor code requirements or minimum wage standards, can result in fines. Meeting these compliance obligations is critical for maintaining legal standing and avoiding penalties.

Flexibility

Choose a business structure that aligns with your operational goals and allows for future growth. Common business entities in Panama include:

- Sociedad Anónima (S.A.): The most widely used structure, suitable for businesses of all sizes. It offers limited liability, the ability to issue shares, and a high level of privacy, as shareholder information is not publicly disclosed.

- Sociedad de Responsabilidad Limitada (SRL): Ideal for smaller businesses or those with fewer shareholders (maximum of 20). It provides limited liability and a straightforward governance structure.

- Empresa Individual de Responsabilidad Limitada (EIRL): Designed for sole proprietors, offering limited liability while maintaining simplicity in management.

- Branch of a Foreign Company: Suitable for multinational corporations wishing to establish a direct presence in Panama. The branch operates under the rules of the parent company but is subject to Panamanian regulations.

- Free Zone Companies: Businesses operating in special zones like the Colon Free Zone or Panama Pacifico can enjoy tax and operational benefits tailored to export-oriented or international service industries.

Steps to Incorporate a Company in Panama

Please see below the 6 steps for incorporating a Sociedad Anónima (S.A.) in Panama:

- Step 1 – Organize the name and structure of your company.

- Step 2 – Company Incorporation: Draft and sign bylaws.

- Step 3 – Register your company in Panama.

- Step 4 – Obtain a Tax Identification Number (RUC).

- Step 5 – Open a Corporate Bank Account.

- Step 6 – Obtain Municipal Commercial License.

Compliance Tip:

All entities in Panama must register with the Public Registry, obtain a RUC (tax ID) from the Dirección General de Ingresos (DGI), and maintain accounting records in compliance with Law 254.

Common Pitfalls When Choosing a Legal Entity in Panama

- Using a PIF for active business (PIFs are for non-commercial use)

- Registering an S.A. without appointing three directors (required by law)

- Assuming SRLs are fully anonymous (they are more transparent than S.A.)

- Failing to maintain accounting records (mandatory even for offshore entities)

- Not registering for economic substance when required

Partnering with Biz Latin Hub for Company Formation in Panama

At Biz Latin Hub, our team of multilingual specialists is equipped to deliver excellence and help you recruit the most suitable employees to ensure the success of your commercial operations in Panama. With our experience in forming companies across the region, we can be your single point of contact to incorporate your business in Latin America and the Caribbean.

Reach out to us now to receive personalized assistance.

FAQs: Legal Entities in Panama

1. Can a foreigner register a company in Panama?

Yes, foreigners and businesses can register their company in Panama. Panama has a welcoming business environment and allows foreign investors to establish various types of legal entities, including corporations, limited liability companies (LLCs), and private interest foundations.

2. What type of legal entity is a Corporation (Sociedad Anonima – S.A.) in Panama?

A Corporation (Sociedad Anonima – S.A.) is a corporate structure that provides limited liability to shareholders and is commonly employed for various business activities in Panama. It offers a separate legal identity from its shareholders and is regulated by Panamanian corporate law.

3. How do I create a Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L.) in Panama?

To create a Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L.) in Panama, you need to follow specific legal procedures outlined by the Panamanian authorities.

4. What is an LLC in Panama?

An LLC (Limited Liability Company) in Panama is known as a Sociedad de Responsabilidad Limitada (S.R.L.). It is a company structure that offers limited liability to its members and is well-suited for small to medium-sized enterprises.

5. What is the business structure of a Private Interest Foundation (Fundacion de Interes Privado) in Panama?

A Private Interest Foundation (Fundacion de Interes Privado) in Panama is a unique legal entity that operates similarly to a trust. It provides a flexible framework for asset management, estate planning, and charitable purposes.

6. What is the most flexible structure for business in Panama?

The Sociedad Anónima (S.A.) is the most popular due to its flexibility, confidentiality, and suitability for commercial operations. It allows bearer or nominative shares and is ideal for international business.

7. Can a foreigner own 100% of a Panamanian company?

Yes. There are no nationality restrictions on shareholders or directors. Foreigners can fully own and control any Panamanian legal entity.

8. How is a PIF different from a company?

A PIF is a non-commercial legal entity used for estate planning and asset protection. It has no shareholders, only a founder, foundation council, and beneficiaries.

9. How long does it take to register a company in Panama?

Most companies can be incorporated within 5–10 business days, though tax and banking setup may take longer.

10. Do Panama companies have to pay tax?

Under the territorial system, only income earned within Panama is taxed. Offshore income is generally exempt, though accounting and substance rules apply.

11. What accounting obligations do companies have?

All companies must maintain proper accounting records and submit an annual declaration of accounting compliance. Failure to comply may lead to penalties or deregistration.

12. Can I change my entity type later?

Yes, but it requires formal dissolution and re-incorporation under a new structure. It’s best to choose the correct entity from the beginning.

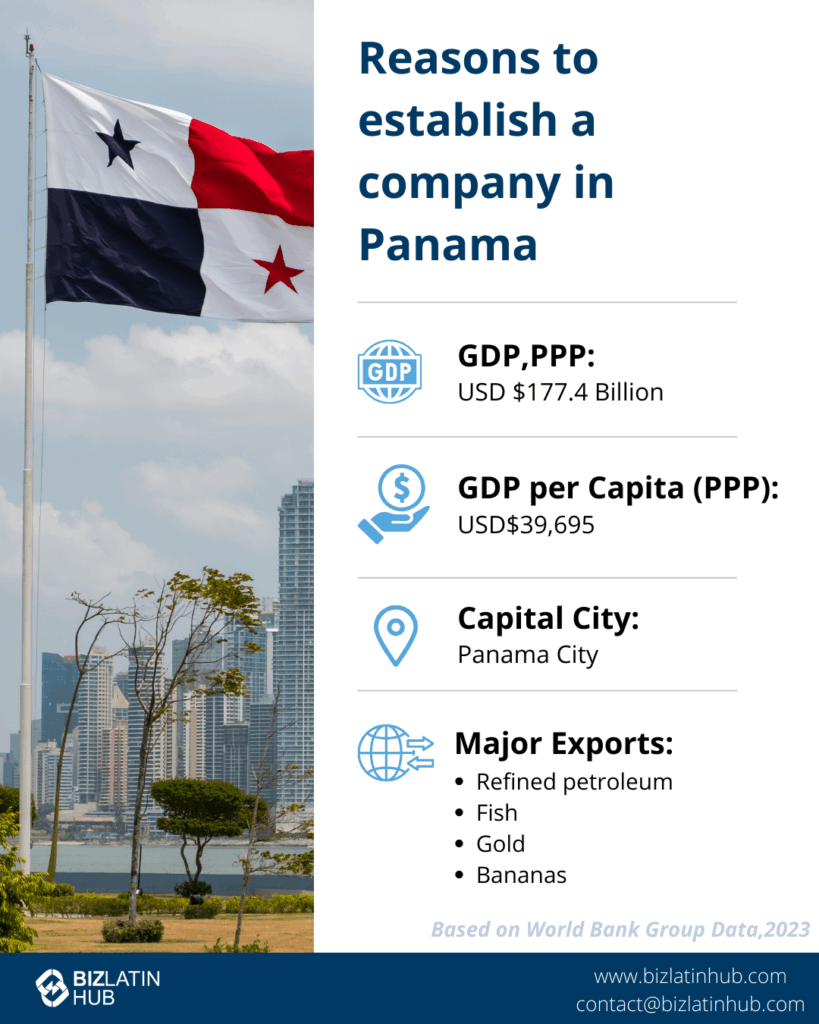

Why Choose to Invest in Panama?

One of the smallest countries in Latin America presents a plethora of opportunities and benefits for companies. These benefits vary depending on the different types of legal structures in Panama. Its appeal in attracting Foreign Direct Investment (FDI) is significant.

The nation maintains political stability, boasts a robust and expanding economy, and its strategic location is ideal for trade.

There are many different types of legal structures in Panama that serve diverse purposes, including facilitating international trade, establishing trusts and foundations, setting up offshore banking and investment accounts, holding real estate and intellectual property, and managing various assets.

Panama’s territorial tax system ensures that income generated outside of Panama remains untaxed even if the business has operations within the country.

The service sector, encompassing legal, banking, and financial services, holds a prominent position and makes a significant contribution of around 75% to the country’s GDP. These contributions are made by all the different types of legal structures in Panama.

Additionally, Panama presents enticing opportunities for foreign investors due to its trade liberalization policies, a multitude of Free Trade Agreements (FTAs), and the presence of Free Trade Zones (FTZs). The Colón Free Trade Zone stands as the world’s second-largest.