Find out the essential elements for corporate tax planning strategies and how your company can make the most of them to reduce liabilities and improve profitability.

Businesses and multinational entities must remain compliant with the law administered across all countries they operate within. Depending on tax agreements and arrangements between jurisdictions, this can make for a complex tax compliance burden to bear, especially for foreign companies unfamiliar with these markets.

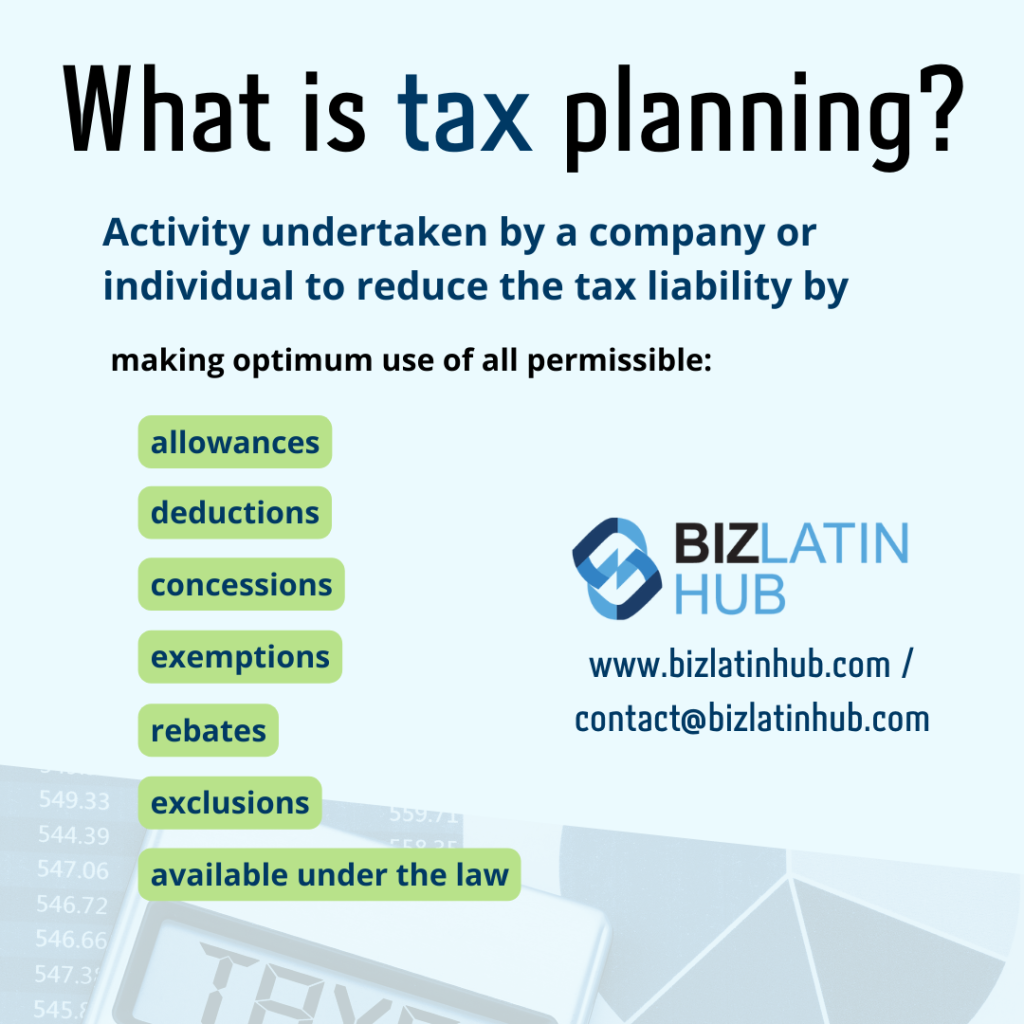

What is tax planning?

In its most basic definition by the Organization for Economic Co-operation and Development – OECD, tax planning refers to the “arrangement of a person’s business or private affairs in order to minimize tax liability.” Corporate tax planning focuses solely on the business element of this definition.

For a more detailed definition, tax planning is understood as “the activity undertaken by a company or individual to reduce the tax liability by making optimum use of all permissible allowances, deductions, concessions, exemptions, rebates, exclusions and so forth, available under the law.”

From these definitions, we can extract that tax planning has 2 fundamental premises. The first is that entities and individuals can develop activities aiming to reduce their tax burdens and optimize their profits. And the second, that said activities must always respect the appliable law.

It is important to note that every activity aiming to optimize the tax burdens of an entity or individual done without compliance of the local or international regulations would not be considered as tax planning but tax evasion. Non-compliant tax activity like this is prosecuted by most tax administrations.

How corporate tax planning works

There are always tax planning opportunities for companies and corporations regardless of their size or the jurisdictions they work on.

At the local level, corporate tax planning is carried out through a review of the company’s income generation activities, expenses, benefits and other deductions, profit distribution, tax rates, and any other variable that may affect the final result, against the applicable law to find optimization opportunities.

In addition to local planning strategies, multinational enterprises (MNEs) can make use of international tax planning to take advantage of the differences in the rates from one jurisdiction to another, and the different tax benefits that may be offered between jurisdictions.

Nevertheless, is important to note that most countries are putting into effect regulations to prevent tax base erosion or profit shifting from one jurisdiction to other, emphasizing instead stricter regulations for transactions that involve lower taxation jurisdictions.

Reducing liability and improving profitability

With a sound corporate tax planning process, companies can understand their requirements to comply with local legislation in the countries they operate.

Further to that, having knowledge of the various incentives and benefits available to them with comprehensive corporate tax planning will also enable the company to improve its profitability. With full compliance and awareness of available benefits, companies can minimize their tax burden and optimize available profits.

Make sure to engage with an experienced and trusted corporate tax planning strategist to receive sound advice and guidance, and make informed decisions on how to protect your company.

Engage with corporate tax planning specialists to ensure your compliance with the law

As explored in this outline, corporate tax planning is a right that taxpayers must exercise to reduce liability and improve profitability while fully complying with the standing legislation to avoid penalties and further risks. To support you with this process, engage with a local tax advisory specialist who can provide guidance and advice, and ensure your company’s compliance.

Our experts at Biz Latin Hub have the knowledge of local and international regulations to help you explore corporate tax planning opportunities in the Latin American region.

Contact us today so we can help your organization optimize its tax burdens and find savings opportunities through corporate tax planning.

Learn more about our team and expert authors.