Corporate Compliance in El Salvador seeks to drive economic growth, protect workers, and ensure a competitive business environment. Understanding these regulations is critical to incorporate a company in El Salvador and avoiding pitfalls. Biz Latin Hub streamlines the compliances process with its comprehensive back-office services, meeting all your needs under a single service agreement. With customized support, you can focus on growth in one of Central America’s emerging markets.

Key Takeaways On Corporate Compliance in El Salvador

| Fiscal Address Requirements: | A registered office address or fiscal address is required for all entities in El Salvador for the receipt of legal correspondence and governmental visits. |

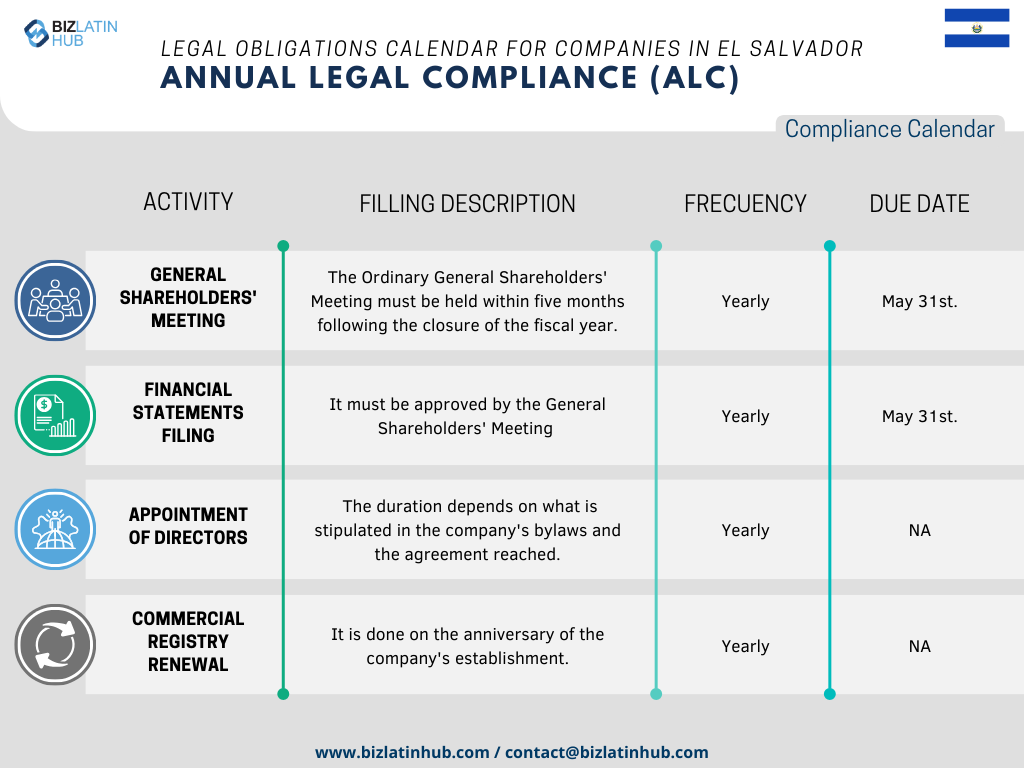

| What Are The Steps For Annual Legal Compliance? | General Shareholders Meeting Financial Statements Filing Appointment of Directors Commercial Registry Renewal |

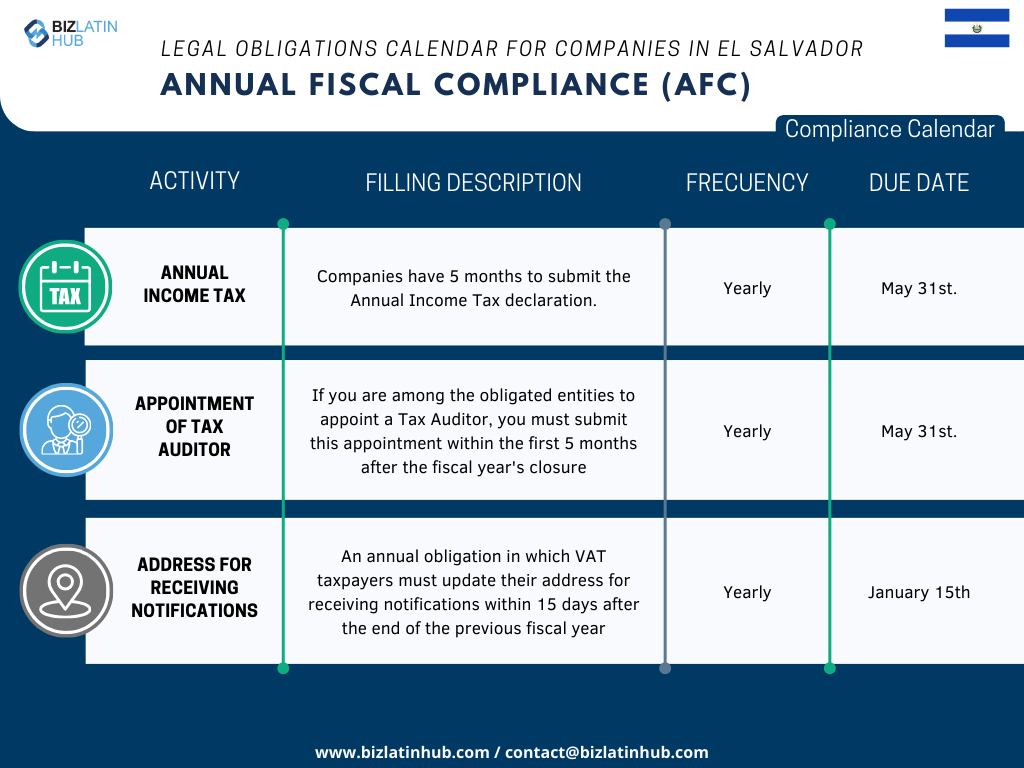

| What Are The Steps For Annual Fiscal Compliance? | Annual Income Tax Appointment of Tax Auditor Address for Receiving Correspondence |

| Why Invest in El Salvador? | After revising and subsequently modifying their legislation, the government now offers fiscal benefits to foreign companies operating in El Salvador. |

7 Key Corporate Compliance Requirements in El Salvador

All legal entities in El Salvador must fulfill minimum statutory requirements to maintain corporate compliance. These obligations are straightforward with a clear understanding of their application. Companies operating in El Salvador must adhere to the following requirements during commercial activities:

- Registered Address in El Salvador

- Tax Compliance

- Renewal of Commerical Liscence

- Annual Shareholder Meeting

- Depositing Annual Financial Statements

- Appointment of External Auditor

- AML Compliance Officer

Provided you follow the 7 requirements, in our experience this will set you up for success and prevent any avoidable hurdles in your business in El Salvador.

1. Registered Address in El Salvador

To establish a legal entity in El Salvador, it is essential to register a local address. The registered address serves as the official tax domicile for the company and is utilized for all official communications and correspondence. The Salvadoran tax authorities mandate this requirement, and compliance is crucial. During the incorporation process, companies must declare their registered address in the company bylaws. This is a prerequisite for legal registration.

2. Tax Compliance

In El Salvador, as in other Latin American countries, companies are obliged to file regular tax declarations with the national tax authorities. Salvadoran tax regulations encompass specific requirements that companies must adhere to, including income tax obligations:

Annually, companies must complete their income tax filings and submit payments. This is typically due within the first five months after the conclusion of the fiscal year. There is also Value-Added Tax (VAT) Compliance:

In El Salvador, VAT, currently set at a standard rate of 13%, is imposed on the sale of goods and services, as well as on imports. This tax is incorporated into the price at each stage of the supply chain. Businesses are tasked with the collection of VAT and its subsequent monthly reporting and payment to the tax authorities.

3. Renewal of Commercial License

In El Salvador, businesses must renew their commercial license annually to sustain their lawful operational status. As dictated by Salvadoran commercial laws, this process entails submitting the required documents to the Registry of Commerce to demonstrate ongoing compliance with local business legislation. Generally, companies must provide their most recent financial statements and affidavits as part of the renewal process. This is typically carried out on the anniversary of the company’s establishment.

4. Annual Shareholder Meeting

In El Salvador, the Annual Shareholders’ Meeting is an important aspect of corporate governance. Legally required to take place annually, this gathering is a forum where shareholders can deliberate and resolve organizational issues. Prominent items on the meeting agenda often include endorsing the yearly financial statements, selecting board members, and making determinations on the distribution of dividends. As per legal stipulations, this meeting must be convened within the first five months of each calendar year, ensuring timely and effective decision-making in alignment with the company’s strategic and financial goals.

5. Depositing Annual Financial Statements

In El Salvador, corporations are statutorily required to submit annual financial statements, a task that is principally managed by the company’s finance team. The following documents must be presented to the Registry of Commerce: the balance sheet, income statement, cash flow statement, and auditor’s report. These documents must provide a true and fair view of the company’s financial standing and performance throughout the previous fiscal year, and adhere to mandated financial reporting standards.

6. Appointment of External Auditor

This is a critical step in corporate governance. The company must select a qualified and independent auditing firm to review and verify the accuracy of the company’s financial statements. The role of the external auditor is to provide an objective assessment of the company’s financial reporting, ensuring that it adheres to accounting standards, and accurately represents the company’s financial position. Companies must appoint and register their External Auditor with the Registry of Commerce every year.

7. AML Compliance Officer

In El Salvador, businesses must have a designated Anti-Money Laundering (AML) Compliance Officer. This role is central to the company’s efforts in identifying, preventing, and reporting any instances of money laundering and associated financial misconduct.

What is a the S.A. de C.V. in El Salvador?

El Salvador has a range of different legal structures for businesses. However, the S.A. de C.V. is the most popular legal entity that the country has to offer, partly because it is the easiest to incorporate. Some characteristics of the S.A. de C.V. include:

- 100% foreign ownership is allowed.

- The legal entity must have at least (2) shareholders.

- Shareholders and their corporate capital are based on stocks.

- The financial liability of the shareholders is limited to their capital contribution.

- The sponsorship of visas for foreign employees is permitted.

Additionally, this business structure offers great opportunities for expansion, because, with a S.A. de C.V., it is possible to raise capital in the stock market.

What are the Corporate Compliance Requirements for an S.A. de C.V?

Before you decide to establish an S.A. de C.V., you will need to meet some corporate requirements:

- Legal Representation – The company must be represented by either a Board of Directors or a Sole Administration. The Board of Directors should be constituted by a minimum of two persons and one substitute. The Unique Administration, or Single Administration, should be formed by one person and a respective substitute. Smaller companies will most likely opt for the latter, whereas larger companies will need a Board of Directors.

- Company Name – There are several requirements for the company name. The name is not allowed to be similar to that of other existing companies – this can be confirmed on the Commercial Registry. Furthermore, companies are obliged to include the words ‘Sociedad Anónima de Capital Variable’ in their title. A minimum of three options for names should be provided during the company registration process.

- Shareholders – Commercial law in El Salvador requires that all companies must have at least 2 shareholders, who can either be individuals (natural persons) or companies (legal persons). The shareholders may reside in El Salvador or abroad. The number of shares doesn’t have to be equally divided between the company shareholders.

- Company capital – A minimum company share capital of USD$2,000 is required in order to incorporate this type of company. At least 5% of this capital must be paid at the moment of registration, and the remaining should be paid within the following year.

- Corporate purpose – All companies need to have a corporate purpose directly related to the company’s principal commercial activities. For example, if you are a marketing company, your corporate purpose must align with your specific marketing activities.

- Public notary – In order to incorporate the company, the shareholders must appear before a public notary in order to sign the Incorporation Deed. However, it is possible to grant Power of Attorney (POA) to another individual to appear before the public notary in their name. The Incorporation Deed contains relevant information on the company, such as the shareholders, corporate purpose, and the name.

FAQs on corporate requirements in El Salvador

Based on our extensive experience these are the common questions and doubts of our clients on entity legal compliance in El Salvador:

– An appointed legal representative who will be personally liable, both legally and financially, for the good operation and standing of the company. This should be a local national or a foreigner with the right to live/work in the country.

– An appointed compliance officer, whose responsibility is to ensure compliance with AML policies and procedures, conducting risk assessments, monitoring transactions, and reporting all required transactions to the fiscal authorities. For such, the appointee must possess a degree in finance, law, or accounting, in-depth knowledge of El Salvador’s AML laws and international AML standards, and obligatory possession of AML certifications.

Yes, a registered office address or fiscal address is required for all entities in El Salvador for the receipt of legal correspondence and governmental visits.

The S.A. de C.V. is the most popular legal structure in El Salvador and it includes the following features:

100% foreign ownership is allowed

The legal entity must have at least (2) shareholders

Shareholders and their corporate capital are based on stocks

The financial liability of the shareholders is limited to their capital contribution

The sponsorship of visas for foreign employees is permitted

If you are among the obligated entities to appoint a Tax Auditor, you must submit this appointment within the first 5 months after the fiscal year’s closure. The deadline for doing this in El Salvador is May 31st.

The Ordinary General Shareholders Meeting must be held within five months following the closure of the fiscal year. That means before May 31st in El Salvador.

After the company has been officially legalized through the signing of the Incorporation Deed, either the public notary, or one or more shareholders, must register with a number of government entities. The first registration is done with the Registry of Commerce, then by the Ministry of Finance. At this point you will obtain a local tax ID. The last registration is done with the Municipality Hall.

IMPORTANT: Depending on the size of the business, the company may have to be registered before the Ministry of Labor. Businesses that contract local employees should also be registered before the Institute of Social Security of El Salvador and the Pension Fund Administration.

Why Choose to Invest in El Salvador?

El Salvador is well known among surfers, with its incredible coastlines and central location in the region, bordering Guatemala, Honduras, and Nicaragua. Recently, more entrepreneurs have been venturing into this exciting market. However, it is important to know about corporate requirements in El Salvador in order to stay on the right side of the law and ensure that your expansion goes smoothly.

GDP rebounded strongly after the pandemic, and the IMF forecasts that real GDP will grow by 2.4 percent in 2023. These statistics shed light on why El Salvador is a great location for savvy investors and foreign companies. To take advantage of the country’s business opportunities, it helps to learn about corporate requirements in El Salvador.

El Salvador’s openness to trade has led to the development of an attractive business environment for foreign companies looking to engage in commercial activities in the country. After revising and subsequently modifying their legislation, the government now offers fiscal benefits to foreign companies operating in El Salvador. These include exemption of tariff duties, and reduced income and municipal taxes.

El Salvador has a strategic location in Central America, which facilitates trade. Heavy investment in infrastructure has led to an increase in exports to both North and South America. Free Trade Zones, located in special industrial sites, grant export-focused manufacturing companies with attractive fiscal benefits and tax-free imports of raw materials. With a number of international trade agreements, El Salvador has put itself on the map as a global trading power.

Biz Latin Hub can help with corporate requirements in El Salvador

It is important that investors can obtain a deep understanding of the requirements and processes involved in registering a corporation in El Salvador. This understanding, combined with the support of a local partner, will ensure your commercial success in the region. For those familiar with the local processes in El Salvador, establishing an S.A de C.V is a straightforward and painless procedure.

To learn more about the Salvadoran economy, business opportunities in El Salvador, and how you might take advantage of the country’s political shifts, please contact us today.

El Salvador offers foreign companies with an unexploited market with unique commercial opportunities. Check out our video below to learn more…