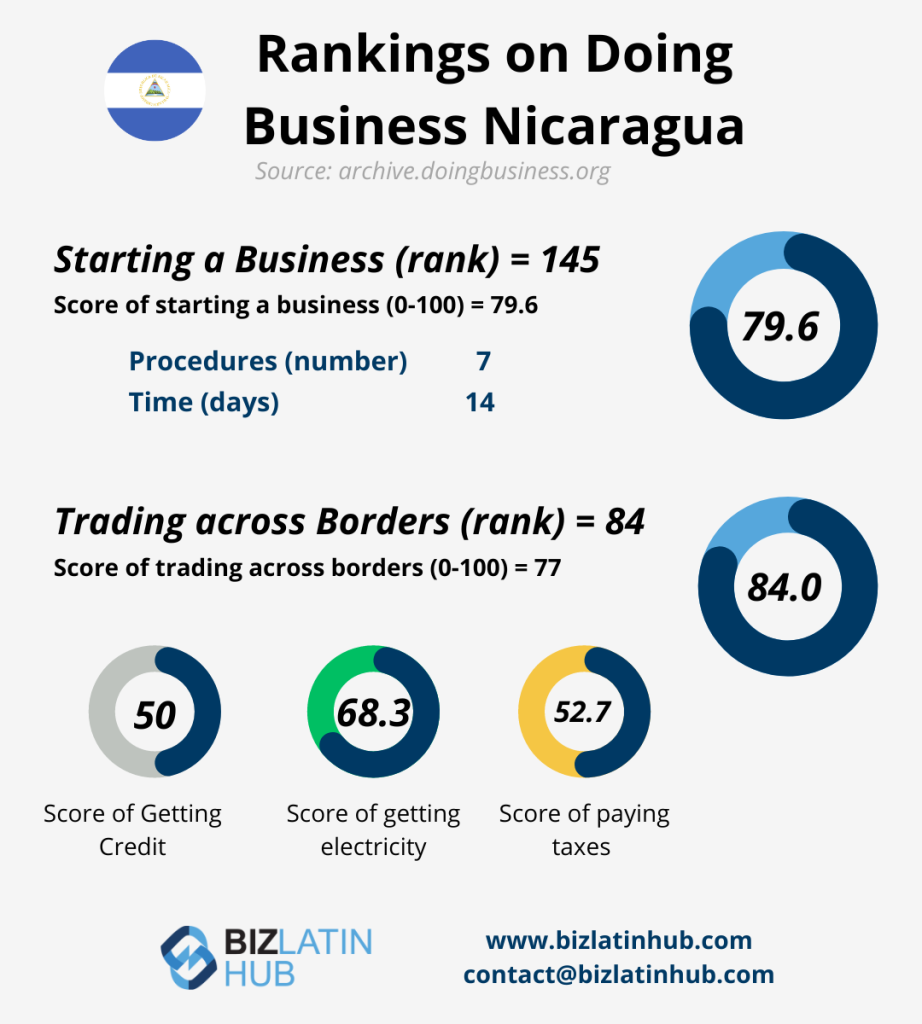

Nicaragua is an attractive destination for global companies. Starting a business there is straightforward, and the tax system encourages ventures in tourism, energy, and innovation.

Before launching a company in the country, it is essential to understand corporate compliance in Nicaragua. The rules and regulations around business compliance can vary greatly from country to country.

To make things easier, we have created this article on corporate compliance in Nicaragua to help clarify what steps to follow. Don’t let legal complexities stop companies from launching or expanding in this beautiful Central American country.

See also: Corporate compliance in Costa Rica

What is the Legal System in Nicaragua?

The Judicial Branch in Nicaragua oversees all national trials and executes judicial sentences. Justices and judges operate independently, adhering to constitutional and legal mandates.

The Organic Law of the Judicial Branch, enacted in 1998, governs this power, establishing a two-tier system and granting the Supreme Court the authority to modify or revoke sentences. The legal system includes local judges, district judges, Courts of Appeals, and the Supreme Court of Justice.

Corporate Compliance in Nicaragua – Registering a Company

To incorporate a company in Nicaragua, organizations must follow these steps:

Draft Act of Incorporation: Require two shareholders with a minimum startup capital of C$10,000. A Nicaraguan resident legal representative must be appointed. The final act needs certification by a Nicaraguan public notary.

Purchase Accounting and Corporate Books: Obtain necessary books for company registration from local bookstores.

Submit Act of Incorporation at VUI: Present documents at the Investment Service. Processing by the Commercial Registry requires a payment of 1% of the company’s capital, up to C$30,000.

Register as a Trader and Accounting Books: After processing, register as a trader and the accounting books at the Commercial Registry through VUI.

Secure Single Registration Document: This document, obtained concurrently with the previous step, provides Municipal License, INSS License, and Tax Payer Registration. It involves a payment of 1% of the company’s capital.

Appoint Legal Representation: Shareholders must appoint a Nicaraguan resident legal representative. The representative’s powers can be limited by the Board of Directors. Choosing a trustworthy individual is essential.

Corporate Compliance in Nicaragua – Liabilities

In Nicaragua, directors of corporations are generally not personally liable for the company’s obligations according to the Code of Commerce. However, they can be held accountable if they fail to fulfill the company’s administrative duties, violate its bylaws, or breach the law, facing liabilities to both the corporation and third parties. Criminal sanctions, including imprisonment, can be imposed if directors participate in self-serving decisions harmful to the company or the public.

Regarding parent company liability, specific regulations are lacking, but claimants can attempt legal action against parent companies in case of disputes. Consumers can pursue claims against parent companies if the parent company is responsible for the production, distribution, or commercialization of goods in Nicaragua through a local distributor. The legal framework allows consumers to seek redress against suppliers in such instances.

FAQs for Corporate Compliance in Nicaragua?

Based on our extensive experience these are the common questions and doubts of our clients.

Corporate Income Tax (CIT) is applied solely to income sourced within the country. The tax rate is determined by the higher of two options:

– 30% of net taxable income: This is calculated as gross taxable income minus allowed deductions.

– A definitive minimum tax: This ranges from 1% to 3% of the gross income earned during the fiscal year. The final income tax amount is the greater figure resulting from comparing the 30% tax on net taxable income with the minimum tax percentage applied to gross income.-

Law 822 in Nicaragua has introduced a clear understanding of ‘permanent establishment’ within the country’s income tax system. This term refers to a location where a non-resident taxpayer conducts business either entirely or partially. This encompasses various entities such as a place of management, branch, office, agent, factory, workshop, or sites for resource extraction like mines, oil wells, or quarries.

Additionally, it includes construction or installation projects lasting more than six months and consultancy services extending beyond six months within a year. This definition provides a comprehensive framework for taxation, ensuring clarity for businesses operating in Nicaragua.

Yes, the Nicaraguan government repealed Decree No. 46-91 and introduced Law 917/2015, known as the Export Free Trade Zone Law. This law establishes various types of export-free zones, including those for processing, industrial production, logistics, and outsourcing services.

In Nicaragua, the typical tax year runs from January 1 to December 31. Nonetheless, businesses can request approval from tax authorities to adopt different fiscal year-end dates: March 31, June 30, or September 30.

Biz Latin Hub Can Oversee Your Corporate Compliance in Nicaragua

At Biz Latin Hub, we offer a comprehensive range of market entry and back-office solutions in Latin America and the Caribbean.

We have expertise in corporate compliance in Nicaragua, with legal services, accounting and taxation, hiring, and visa processing available.

We retain a large presence in LATAM with strong partnerships throughout the region. This far-reaching network gives us lots of tools to help with international projects and entering new markets in different countries.

Contact us today to learn more about our services and how we can help you achieve your business goals in Latin America and the Caribbean.