Corporate legal compliance in Argentina reflects the country’s unique approach to providing employment protections, combating corruption, and promoting fair competition. Understanding these regulations is vital when incorporating a business in Argentina, ensuring compliance from the outset and as your company grows. This guide outlines key compliance requirements and offers strategies to avoid non-compliance, considering Argentina’s economic climate. Biz Latin Hub, with expertise in Latin America, can help you navigate these regulations and establish your business successfully.

Key Takeaways On Corporate Legal Compliance in Argentina

| Is a physical address in Argentina necessary for doing business? | A registered local fiscal address is required for all entities in Argentina for the receipt of legal correspondence and governmental visits. |

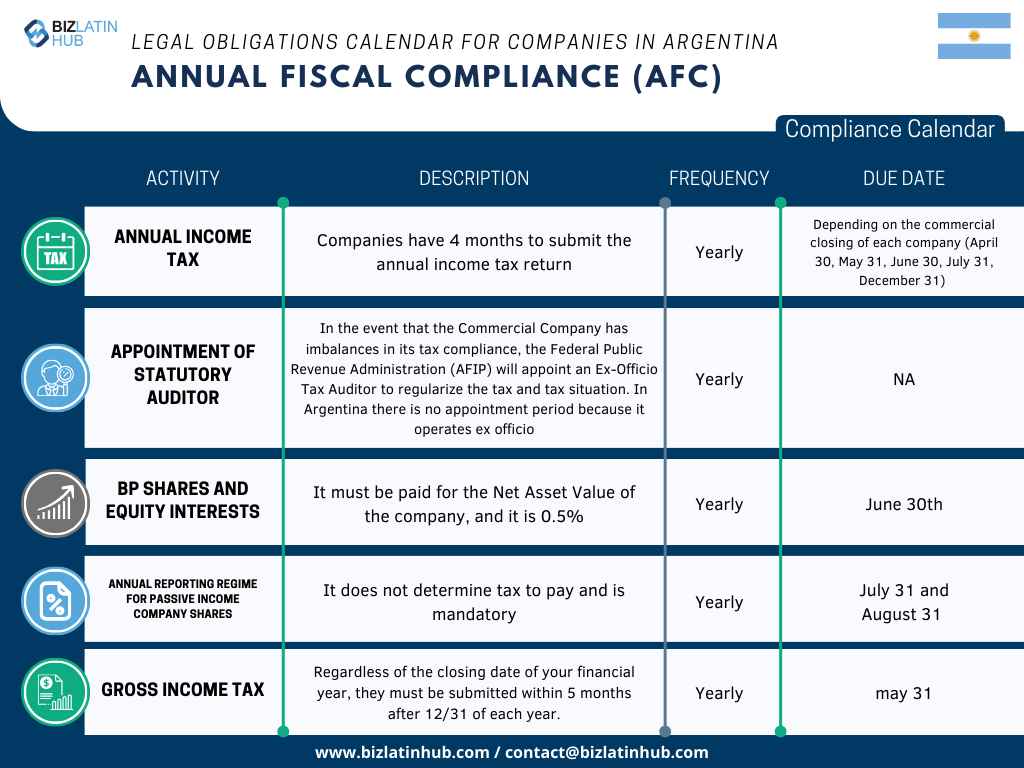

| What are the annual entity fiscal compliance requirements? | Annual Income Tax Appointment of Statutory Auditor BP Shares and Equity Interests Annual Reporting Regime for Passing Income Company Shares Gross Income Tax |

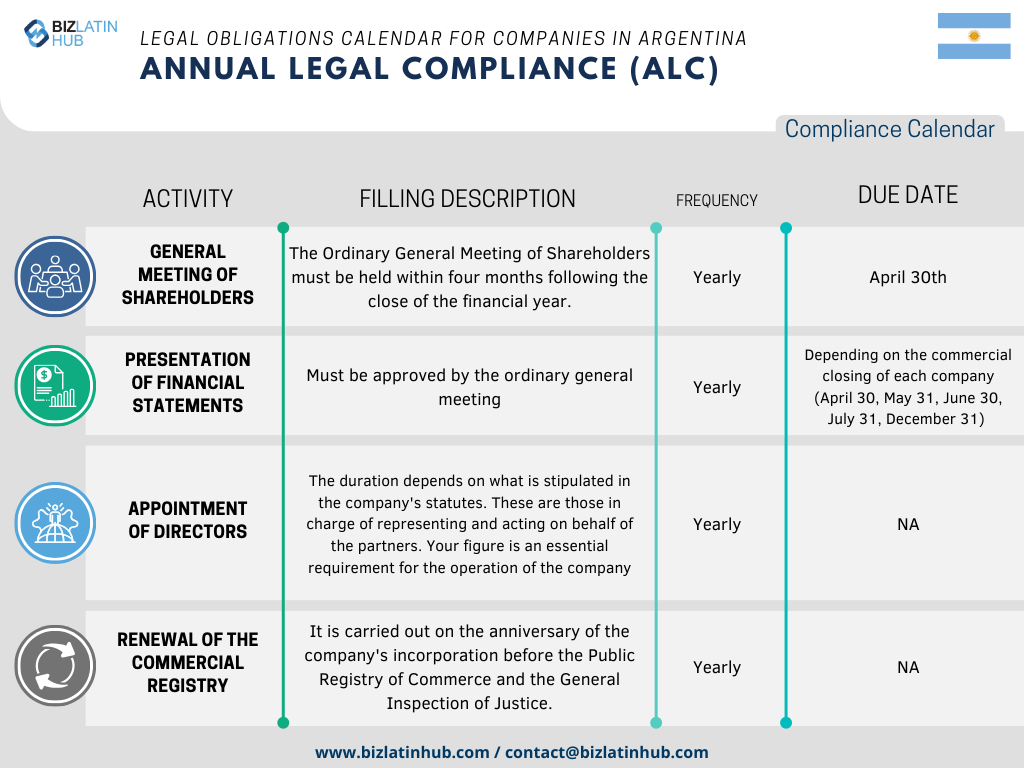

| What are the annual Entity Legal Compliance Requirements? | General Meeting of Shareholders Presentation of Financial Statements Appoint ment of Directors Renewal of the Commerical Register |

| What common statutory appointments do companies make in Argentina? | Local “Principal Director” and a “Substitute Director” Appointed legal representative for each foreign legal entity shareholder |

| Why Choose to Invest in Argentina? | Argentina has a resilient economic culture and is responsible for leaps in technology for finance and agriculture. With an abundance of natural resources and a growing internal market opportunites continue to present themselves. |

Directorship Corporate Legal Compliance in Argentina

Whether you are a foreign investor looking to form a company in Argentina, or a local entrepreneur, understanding the laws on directorship is crucial for long-term growth. All Argentine companies are required to have a majority of resident directors.

If you are not an Argentine national, then you will need to find local business partners or pay for a company to represent your firm and serve as a director in order to bypass the directorship requirements for company incorporation. Failing to do this might put you at odds with the strict laws surrounding entity compliance in Argentina and lead to preventable complications.

You must lodge annual company returns, confirming the details of your company. This includes the names and addresses of your directors, the address of the principal business site, and details on your shareholders and their shareholdings. It is important to keep a record of all of your shareholders’ and directors’ personal information and make them aware that their personal information will be submitted to the government.

It is important to keep a record of all of your shareholders’ and directors’ personal information and make them aware that their personal information will be submitted to the government.

It is also important to note that, whilst company secretaries are not required when forming a new business in Argentina, they are recommended to ensure compliance with the Corporation Act.

Is it easy for foreigners to invest in Argentina?

While Argentina encourages foreign direct investment (FDI), the government places a strong emphasis on fostering the growth of local businesses that cater to the needs of the Argentine people. This policy approach helps explain why there are significant variations in Argentina’s foreign direct investment inflows from year to year.

In the first quarter of 2023, Argentina observed net inflows of USD$3.8 billion in Foreign Direct Investment (FDI), reflecting a modest year-over-year growth of 2%. The primary sources of these inflows were debt transactions and the reinvestment of profits. Notably, sectors such as deposit-taking corporations, the manufacturing industry, and mining and quarrying attracted the lion’s share of FDI.

The United States was the main contributor to FDI flows, followed by Brazil and Spain. As of March 31, 2023, the gross FDI position amounted to USD$133.304 million, encompassing equity holdings and debt. The RIGI came into effect in August and is one of the components of the Ley Bases. It serves as an incentive for foreign companies looking to invest in the country, aiming to attract international capital inflows. The RIGI offers a range of tax, customs, and foreign exchange benefits for investments.

What does it cost to have a startup in Argentina?

One of the positives Argentina offers to investors is low startup costs. Many businesses choose to incorporate a business in Argentina for their Latin American hub because of the startup costs. Moreover, the minimum capital required for incorporating a Limited Liability Company in the country is just USD$300, which reduces barriers to entry and enables businesses to start operations as quickly as possible.

With such little startup capital required, investors and entrepreneurs with varied investment capital can get started. Argentina’s economy will experience an influx of new businesses in the coming years and there will be a growing number of exciting startups to watch.

Data Protection and Discrimination

Argentina’s Data Protection Law (known as Bill No. MEN-2018-147-APN-PTE) was recently overhauled, and re-designed to prevent companies from disclosing private information about an individual, whether that be a customer or an employee. The law is in line with the European Union’s General Data Protection Regulation and includes accountability obligations for all companies.

Another aspect that falls under corporate legal compliance in Argentina is gender laws. It is illegal to discriminate against an employee based on their gender, race, religion, or sexual orientation. Make sure you take this into consideration when designing your recruitment strategy so you end up with a diverse team.

Obtain a Código Único de Identificación Tributaria (CUIT).

This is essential for submitting tax declarations and fulfilling other tax requirements.

UBO information

You must keep records of people that control 10% of shares and/or controlling stakes at directorship level. While you do not have to declare these annually, you should be ready to produce them upon request.

Authorize Repatriation of Profits

Whether launching a new business in Argentina or an Argentine sales branch of a multinational company, you must get authorization from the Central Bank for the repatriation of all profits. This is critical – even more so if you have a foreign director or shareholder – so profits and assets can be delivered to the right people without the company incurring legal challenges.

While growing your business in Argentina, it is recommended you work with an accountant or bookkeeper who can keep on top of your finances and ensure compliance with financial reporting. Indeed, failure to provide appropriate reports on your corporation’s profit and losses can result in fines or prosecution.

Doing so on your own, alongside the other demands that managing a new business requires, is not worth the risk. Be aware that you cannot remove assets from your company and distribute them to shareholders as and when desired. Playing by the books will ensure your business stays within the law and enjoys long-term success.

Anti-corruption, bribery and money laundering regulations

There are laws and regulations in place to prevent bribery, tax evasion, and other crimes. These inform obligations for your business. More information is mentioned below.

Corporate legal compliance in Argentina

In Argentina, entities of all types must perform certain activities to meet regulatory obligations. These include:

- Conducting an Annual General Meeting (AGM)

- Submitting financial statements to the public registry, if applicable based on entity type.

Anti-trust Law Compliance

The final aspect of corporate legal compliance in Argentina is complying with anti-trust laws. Argentina’s anti-trust laws were designed to stop firms from creating or entering into contracts that would create monopolies. Your company must be granted permission to engage in the applicable business activities before beginning operations to ensure the market remains fair and competitive.

What’s more, Argentina’s commercial practices code has a policy on preventing dominant companies in the country from forcing out competitors using predatory techniques such as unreasonable pricing and operating non-profitable stores.

FAQs on corporate legal compliance in Argentina

Based on our extensive experience these are the common questions and doubts of our clients on corporate legal compliance in Argentina:

The following are the most common statutory appointments for Argentinian legal entities:

– A local “Principal Director” and a “Substitute Director” who will be personally liable, both legally and financially for the good operation and standing of the company. The Principal Director can be either a local national or a foreigner with residency in Argentina, meanwhile, the substitute director can be a local national or a foreigner (If a foreigner is selected for this role, he must be duly registered with the country’s governmental authorities).

– An appointed legal representative for each foreign legal entity shareholder. This should be a local national or a foreigner with residency in Argentina and must have a tax identification number assigned within country and a personal fiscal address (different from the company address). Please note that legal representatives are required to contract a surety policy in favor of the entity they represent.

Yes, a registered local fiscal address is required for all entities in Argentina for the receipt of legal correspondence and governmental visits.

Yearly, but at no fixed date.

No more than 4 months after the start of the year – so April 30th or before.

Yearly, on the anniversary of your initial registration.

Why Invest in Argentina?

Argentina’s abundant natural resources make it a prime investment destination. As one of the world’s top producers of lithium, it is poised to benefit from the booming electric vehicle and renewable energy sectors. Additionally, its fertile lands and agricultural expertise drive global exports of soybeans, corn, and beef, offering significant opportunities in agribusiness as demand for sustainable food products grows.

Recent economic reforms are fostering a more stable and investor-friendly climate. Enhanced fiscal policies, trade agreements with key partners like China and the EU, and incentives for foreign investment are unlocking potential across sectors such as technology, renewable energy, and infrastructure. Early investors can capitalize on competitive costs and a skilled workforce.

Situated at the heart of South America, Argentina provides access to regional markets like Brazil and Chile while connecting to global trade routes through its Atlantic ports. Its rising tech scene and innovation-driven industries further enhance its appeal, positioning the country as a gateway to both regional and global business opportunities.

Work with Biz Latin Hub on corporate legal compliance in Argentina

It’s vital to seek corporate law advice when starting a business in Argentina. Biz Latin Hub is best placed to assist in your entry or expansion into Argentina and Latin America. Whether you have spotted a gap in the market and want to operate in the country, or have plans to expand but need guidance on compliance, our team of lawyers and legal experts are on hand to help.

To find out more, get in contact with our team of experts today and check our site regularly for more guides and assistance on corporate legal compliance in Argentina in order to maximize your profitability.

Watch our short video below for insights on what makes Argentina a smart choice for doing business.