Corporate compliance requirements in Uruguay are designed to foster economic growth, protect workers, and sustain a competitive business environment. Familiarity with these regulations is essential for registering a business in Uruguay and avoiding potential penalties. Biz Latin Hub offers a comprehensive suite of back-office services to simplify compliance, addressing all your needs under a single service agreement. With customized support, you can optimize operations and concentrate on expanding.

Key Takeaways On Corporate Compliance Requirements in Uruguay

| Fiscal Address Requirements | In Uruguay it is required to have a registered fiscal address to receive legal correspondence and governmental visits. |

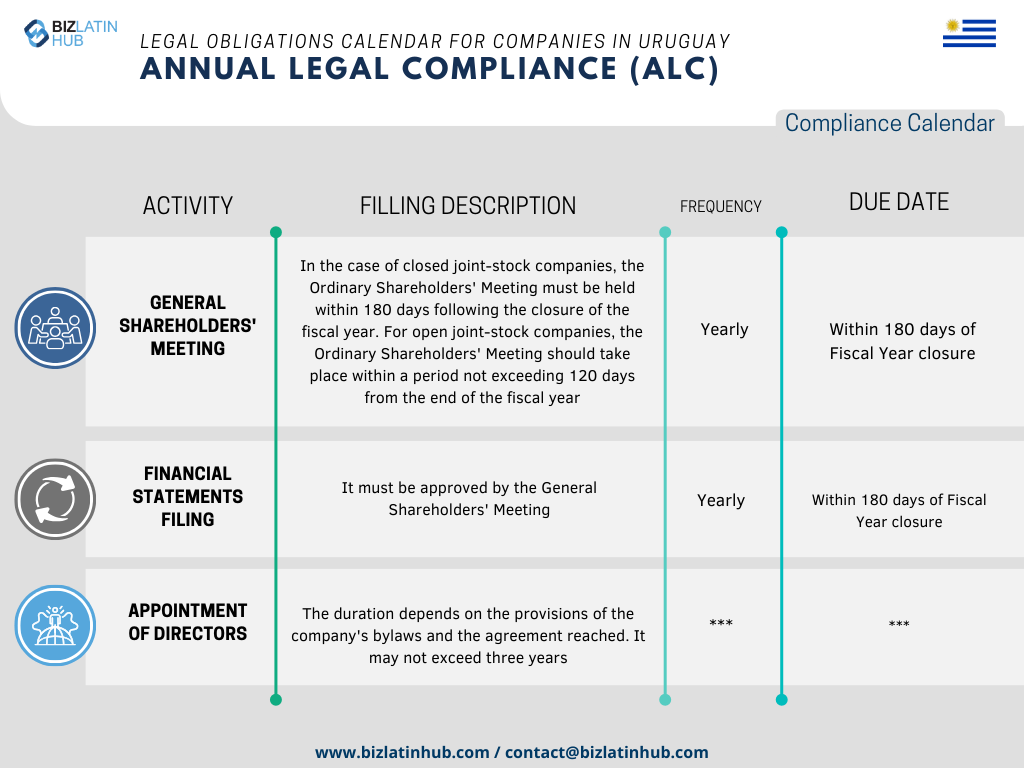

| What Are The Annual Legal Compliance Steps? | General Shareholders Meeting Financial Statements Filing |

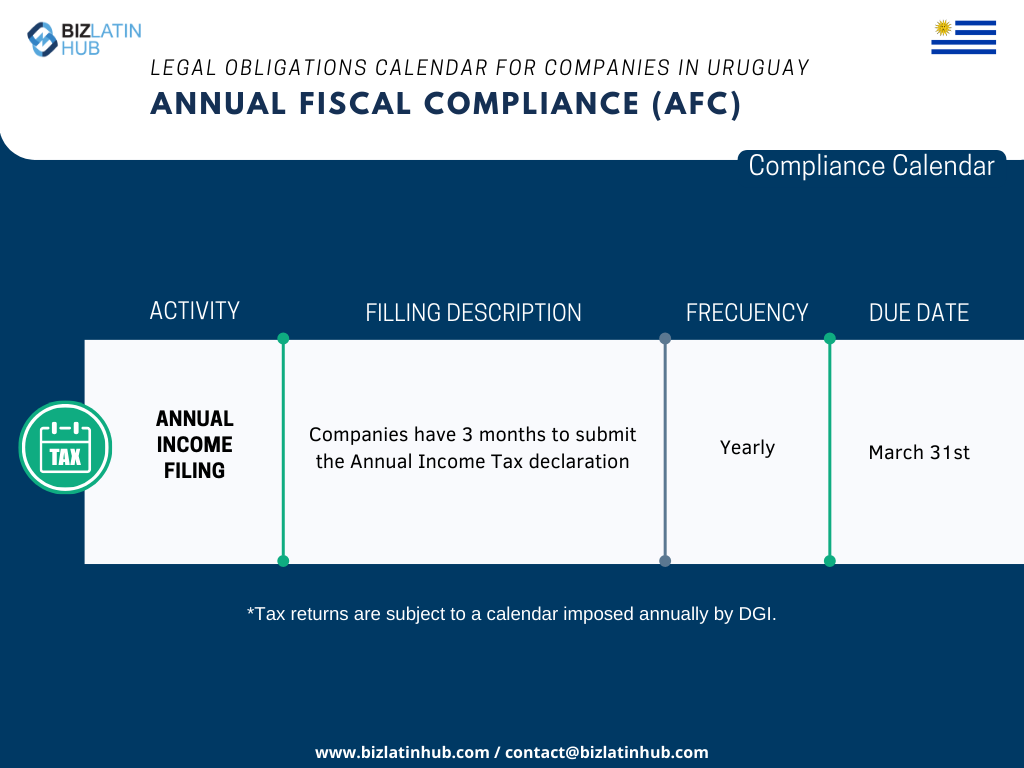

| What Needs To Be Done For Annual Fiscal Compliance? | Annual Income Filing |

| Why Invest in Uruguay? | Uruguay offers a stable economy with consistent GDP growth and low corruption, making it a secure destination for investment. |

Legal structures in Uruguay

A company must fulfill the essential corporate compliance requirements in Uruguay to operate freely within the nation once it has been properly established in Uruguay. Upon seeking the assistance of a local specialist, these legal responsibilities are not very arduous or intricate.

Uruguay presents various legal frameworks for enterprises to establish their operations, ranging from not-for-profit entities to publicly traded corporations. A foreign enterprise has the option to establish a legal entity using one of the subsequent structures:

- Corporation (Sociedad Anónima- S.A.)

- Streamlined Share Companies (Sociedad por Acciones Simplificadas- S.A.S.)

- Limited Liability Company (Sociedad de Responsabilidad Limitada- S.R.L.)

- Foreign Company’s Branch Office (Sucursal)

Do I need a legal representative in Uruguay?

Every established company in Uruguay is obligated to designate a legal representative. This representative assumes the responsibility of representing the organization before external parties. It is important to note that businesses aiming to expand within the country must appoint a legal representative during the company incorporation process. This is crucial to ensure one abides to corporate compliance requirements in Uruguay.

The legal representative bears various responsibilities, including:

- Acting as the authorized legal representative of the company and conveying its intentions.

- Handling formalities with public and/or private entities.

- Representing the company in legal proceedings, if necessary, in collaboration with an attorney.

- Assuming the responsibility for tax and social security compliance on behalf of the company.

- Informing the Central Bank of Uruguay (BCU) about the composition of the company’s Board of Directors.

Fiscal address obligation

In addition, foreign executives seeking to expand their operations in Uruguay must register a fiscal address to facilitate the successful incorporation of a local legal entity. This fiscal address serves as the official registered address of the company and is used for all official communications and correspondence.

It is worth noting that the fiscal address must be explicitly stated in the company bylaws in order to be legally registered during the company incorporation process. This will help ensure one is abiding by corporate compliance requirements in Uruguay.

Executives overseeing companies operating in Uruguay must ensure their familiarity with the various legal obligations regarding employee payments. These obligations encompass salaries, social security contributions, payroll taxes, and severance payments to employees.

Moreover, business owners are responsible for providing workers’ compensation insurance and a bonus known as the ‘thirteenth salary’, which is typically paid every six months or at the end of June and December. The bonus amounts to one month’s salary, divided into two payments. Additionally, employees are entitled to 20 days of paid vacation.

Workers with more than five years of service in the same company, even if the company has changed its owner one or more times, shall also be entitled to one additional day of leave for every four years of seniority.

The obligatory social benefits for employees in Uruguay include:

- Health contributions

- Retirement contributions

- Occupational risk contributions

Accounting and taxation compliance

When establishing a company in Uruguay, it is crucial to take into account the local accounting and tax system in order to obey by corporate compliance requirements in Uruguay.

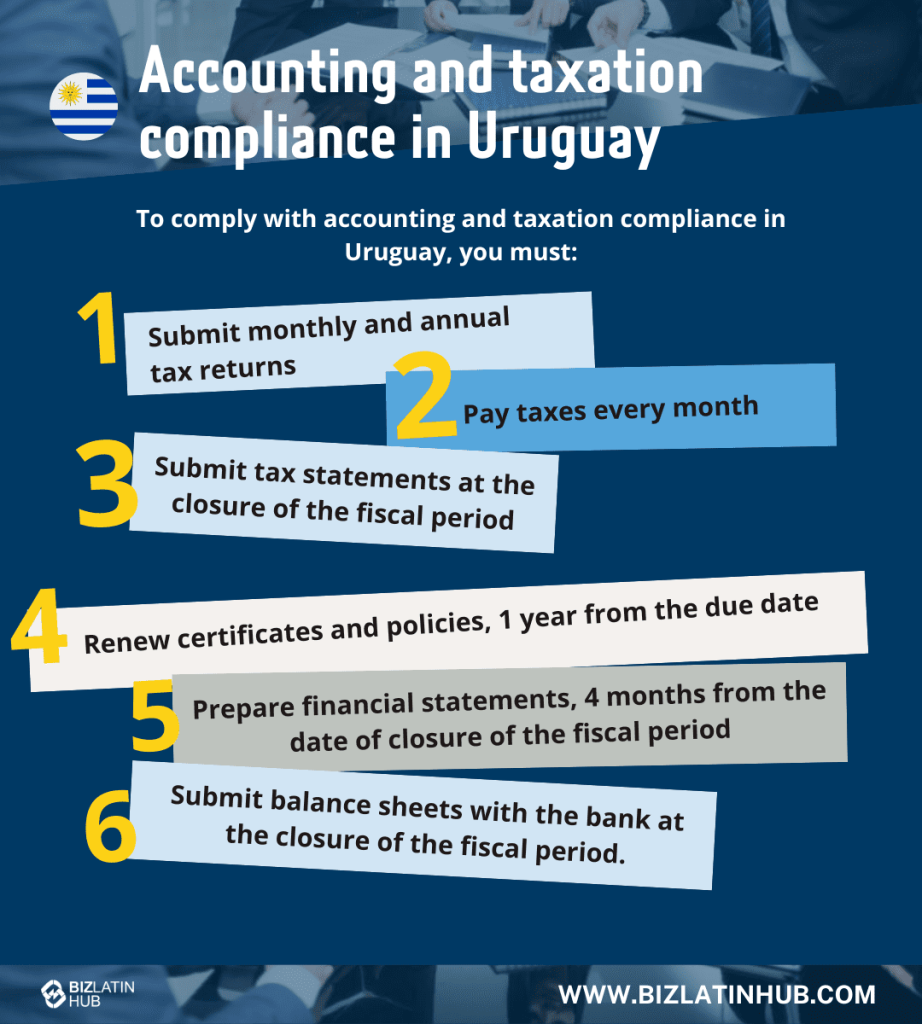

To adhere to the accounting and taxation requirements for corporations in Uruguay, the following measures must be taken:

- File monthly and annual tax returns.

- Make monthly tax payments.

- Submit tax statements at the end of the fiscal period.

- Renew certificates and policies within one year of the due date.

- Prepare financial statements within four months from the closing date of the fiscal period.

- Provide balance sheets to the bank at the conclusion of the fiscal period.

What are the corporate compliance requirements in Uruguay?

The following are requirements of running a company in the country. Together, they make a list of the key corporate compliance requirements in Uruguay.

- Financial Statements

The preparation and presentation of financial statements must adhere to the prescribed accounting standards. These statements are to be reviewed and approved by the partners or shareholders within 180 days after the fiscal year concludes, during an ordinary general meeting. - Annual General Meeting

Part of the annual compliance entails holding a regular shareholders’ meeting, during which the endorsement and approval of the balance sheet is a crucial agenda item. - UBO report

Corporations holding bearer or nominative shares are obligated to notify the Central Bank of Uruguay (CBU) regarding any changes pertaining to their shareholders and the ultimate beneficiaries.

Furthermore, these companies must also disclose information about their ultimate beneficiaries. As per our legislation, a beneficial owner refers to an individual (natural person) who directly or indirectly holds a minimum of 15% of the total capital or equivalent assets, or possesses a comparable percentage of voting rights.

Additionally, this includes individuals who exert ultimate control over an entity, whether that is a legal person, a trust, an investment fund, or any other legal entity or structure, regardless of legal personality.

FAQs for Corporate Compliance Requirements in Uruguay

Based on our extensive experience these are the common questions and doubts of our clients when looking to operate within the country

The following are the most common statutory appointments for Uruguayan legal entities:

– An appointed legal representative who will be personally liable, both legally and financially for the good operation and standing of the company. This should be a local national or a foreigner with the right to live/work in the country.

Yes, a registered office address or local fiscal address is required for all entities in Uruguay for the receipt of legal correspondence and governmental visits.

Companies in Uruguay have 3 months to submit their annual income tax declaration by the deadline of March 31st.

In the case of closed joint-stock companies in Uruguay, the ordinary shareholders meeting must be held within 180 days following the closure of the fiscal year. For open joint-stock companies in Uruguay, the ordinary shareholders meeting should take place within a period not exceeding 120 days from the end of the fiscal year.

The accounting and taxation compliance requirements in Uruguay are as follows:

– Submit monthly and annual tax returns

– Pay taxes every month

– Submit tax statements at the closure of the fiscal period

– Renew certificates and policies, 1 year from the due date

– Prepare financial statements, 4 months from the date of closure of the fiscal period

– Submit balance sheets with the bank at the closure of the fiscal period

Why Invest in Uruguay?

Between 2003 and 2019, Uruguay underwent its longest-ever period of economic expansion. This means an increasing number of foreign investors looking at the country as a destination for investment and/or an exciting market to sell to. However, like any other country, you need to be aware of corporate compliance requirements in Uruguay in order to avoid pitfalls or legal issues.

Uruguay distinguishes itself in the region by being a society that upholds equality and boasts a commendable per capita income. In proportional measures, its middle class stands as the most extensive across the Americas. This encompasses over 60% of the nation’s population. State systems are stable and transparent. This means corporate compliance requirements in Uruguay are strictly followed.

Biz Latin Hub Can Help With Corporate Compliance Requirements in Uruguay

Before expanding your operations to, it is vital to have a thorough understanding of your corporate compliance requirements in Uruguay. While opportunities to do business in Uruguay are numerous, so are the risks for those who do not comply with local law. Therefore, working with a trusted legal and accounting firm is the fittest option.

At Biz Latin Hub, our team of legal specialists provides comprehensive company formation advice and guidance to support your expansion. With our full suite of bilingual market entry and back-office services, we are your single point of contact in Uruguay and Latin America. Reach out to us now to make the most of our market-leading services, and get a customized quote from our team.