Historically, Latin America has always been known for its exhaustive and rigorous corporate compliance systems which can vary by country, and prove challenging for foreign investors to understand. Countries such as Brazil and Argentina register high on the global tables when it comes to the complexity of doing business, with other nations in the region not far behind.

When expanding into Latin America, it’s important to understand local compliance requirements, and the overall condition of any business you choose to incorporate.

To get the most out of these prospering markets whilst keeping on the right side of regulatory compliance, an entity health check provides the safest option.

What is an entity health check?

Entity health checks, otherwise known as corporate health checks, are reviews of companies undertaken by independent auditors with local expertise in legal and fiscal compliance matters. Employing the services of a corporate health check provider offers commercial reassurance; prospective business owners can authorize the provider to look into a company’s legal and accounting records in order to understand its overall compliance picture or ‘health’.

Through an in-depth examination of all financial transitions, meeting minutes, employment records, licensing agreements and more, compliance specialists are able to identify possible outlying requirements or non-compliance. In doing so, they can ensure that authorities do not have a reason to enforce fines or other penalties, saving reputation and money in the long run.

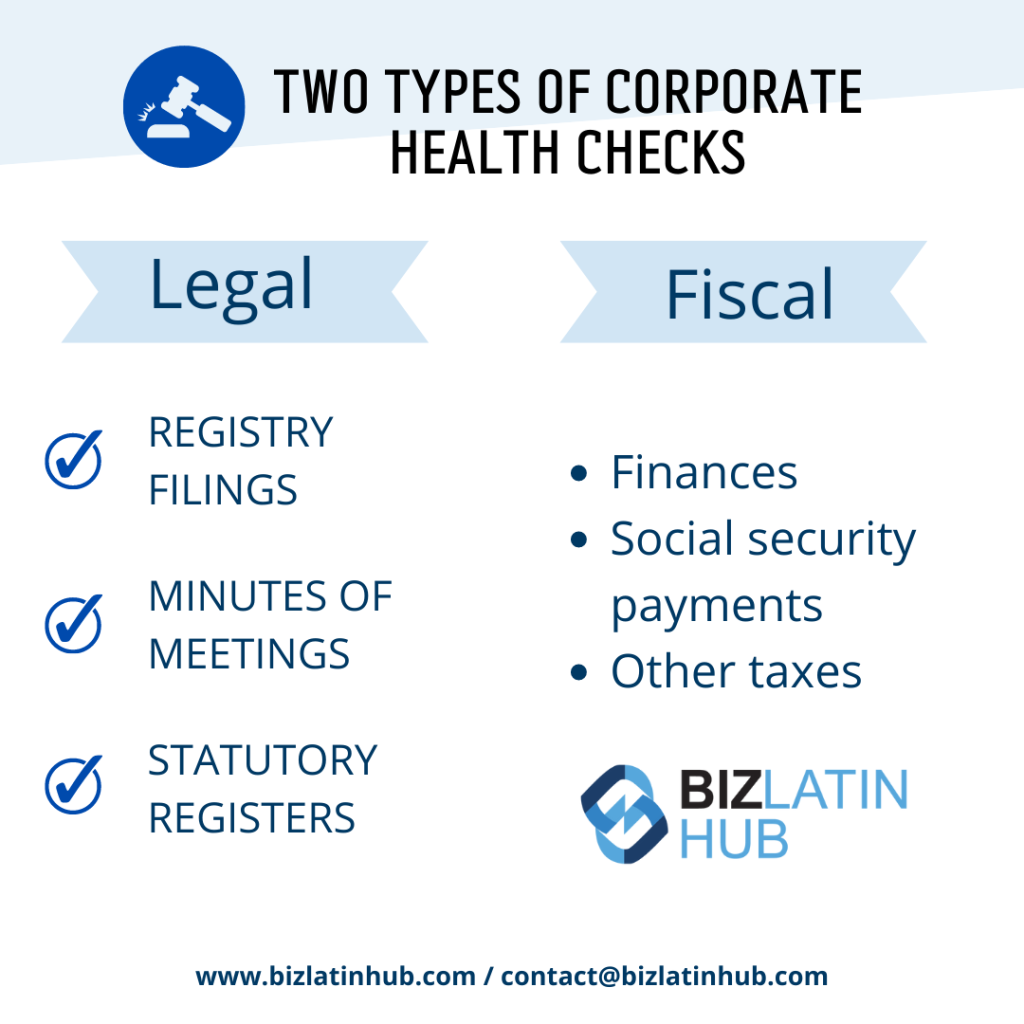

Two types of corporate health checks: fiscal and legal

Entity health checks can focus on the legal or fiscal condition of a company. Those with a legal focus explore 3 key areas of legal compliance: registry filings, minutes of meetings and statutory registers. These three areas generally give a good idea of legal compliance or otherwise.

Fiscal-orientated corporate health checks run a fine-tooth comb through finances, social security payments and other taxes. By diving into the company’s financial statements and investigating every transaction, not only can they ensure compliance but they can highlight unnecessary payments, and save taxes.

Naturally, for the most comprehensive compliance check, employing both legal and fiscal health checks will provide the most conclusive overview of a company’s status in the eyes of local authorities.

Latin America’s corporate compliance climate

Particularly for newcomers to the market, Latin American compliance regulation can seem daunting. Not only must official documents be translated and apostilled in the native language (Spanish or Portuguese), but local bureaucratic requirements can differ greatly from those in Western systems. Brazil and Argentina are two of the most complex compliance systems, yet have two of the largest and most attractive economies in the region to invest in. Engaging with these economies is, therefore, a must for expanding businesses in the region.

Brazil’s company formation process takes on average 10-12 weeks once all documentation is received, for example. In comparison, Costa Rica’s company formation process can take just 3-5 days. Brazil also has a complex tax system, with three different tax boards needing to be paid throughout the year, federal, state, and municipal and payroll and VAT filings need to be shown to the federal tax board every month. It’s, therefore, possible that any company you’re interested in incorporating as an entrepreneur may find itself behind on some compliance measures. To protect yourself and your company, it’s important to know what to expect before you start commercial operations.

When do I get an entity health check?

Compliance is important all year round, however, there are particular times of the year and particular circumstances that make corporate health check services particularly useful.

For instance, in the period running up to the end of the fiscal year, companies of all sizes seek independent auditors to review their fiscal obligations and transactions. There are a number of countries worldwide where tax bills can be extended to a later date. This is not the case in some Latin American nations, where fines start to build up just 24 hours after the deadline. With the help of a fiscal health check provider, you can ensure your business is paying the correct taxes, and on time.

Support for startups in Latin America

Startups, particularly those from abroad, are often the most in need of assistance when it comes to local corporate compliance. The initial formation phase is often the most stressful part of running a business. There are the stresses of bringing in seed capital, hiring staff, seeking out partners, and formalizing bylaws all whilst trying to comprehend Latin America’s painstakingly meticulous corporate compliance regulations.

In these instances, it can be very easy for corporate compliance details to be overlooked. With an entity health check provider, they can prompt teams and business owners into action by highlighting faults or deadlines in either fiscal or legal compliance.

Corporate health checks for branch offices

With increasingly improving economic conditions, more and more companies are stationing branch offices in Latin America. However, what many companies do not account for is not only the changing business culture but a completely different set of corporate laws.

Non-compliant branch offices in new regions can spell disaster for the company as a whole which ends up being liable for potential financial penalties as well as damages in its reputation.

In order to ensure branch offices do not damage the company as a whole, entity health checkers can provide an overview of a company’s status with local government agencies, and ensure local compliance regulations are being adhered to. By looking after the smaller offices, companies as a whole protect themselves.

Mitigate financial and reputational risk

Penalties for corporate non-compliance come in a variety of forms in Latin America, including warnings and fines (and, for more severe cases involving greater criminal intent, imprisonment). Indirectly, failure to comply with local law can have an effect on reputation, one of the greatest enticers for prospective clients and partners. By regularly checking for compliance faults, companies can avoid one of the greatest risks to their company – a bad reputation.

Many of the largest multinational companies in the world have entire teams dedicated to checking compliance every quarter as a dent to a large reputation could spell millions in losses. However, for small-medium-sized companies, compliance branches are simply not viable but by simply getting an entity health check once a year, they can avoid not necessarily millions, but substantial losses nonetheless.

Seek local guidance for your entity health check

The consensus from established foreign investors in Latin America is that corporate compliance is one of the biggest headaches to deal with, especially for newcomers starting out. The hours of paperwork and frequent misunderstanding have the capability to strangle a young company before its had time to thrive. However, with the help of entity health checks, take advantage of the numerous benefits the Latin American economy has to offer.

With offices all over Latin America, Biz Latin Hub, provide a range of business services, from professional employment to company formation. Trained in entity health checks, our teams of lawyers and accountants specialize in providing due diligence services to foreign businesses coming into Latin America.

To learn more about the business opportunities to form a company in Latin America and how you might take advantage of these political shifts, please contact us today.

Learn more about our team and expert authors.