Corporate Entity Regulatory Compliance in Colombia aims to drive economic growth, protect workers, and sustain a competitive business environment. Understanding these regulations is essential for registering a business in Colombia and avoiding penalties. Biz Latin Hub can simplify compliance with its full suite of back-office services, covering all your needs under a single service agreement. With tailored support, you can streamline operations and focus on growth in one of Latin America’s most dynamic markets.

Key Takeaways on Corporate Entity Regulatory Compliance in Colombia

| Fiscal Address Requirements | A registered local fiscal address is required for all entities in Colombia for the receipt of legal correspondence and governmental visits. |

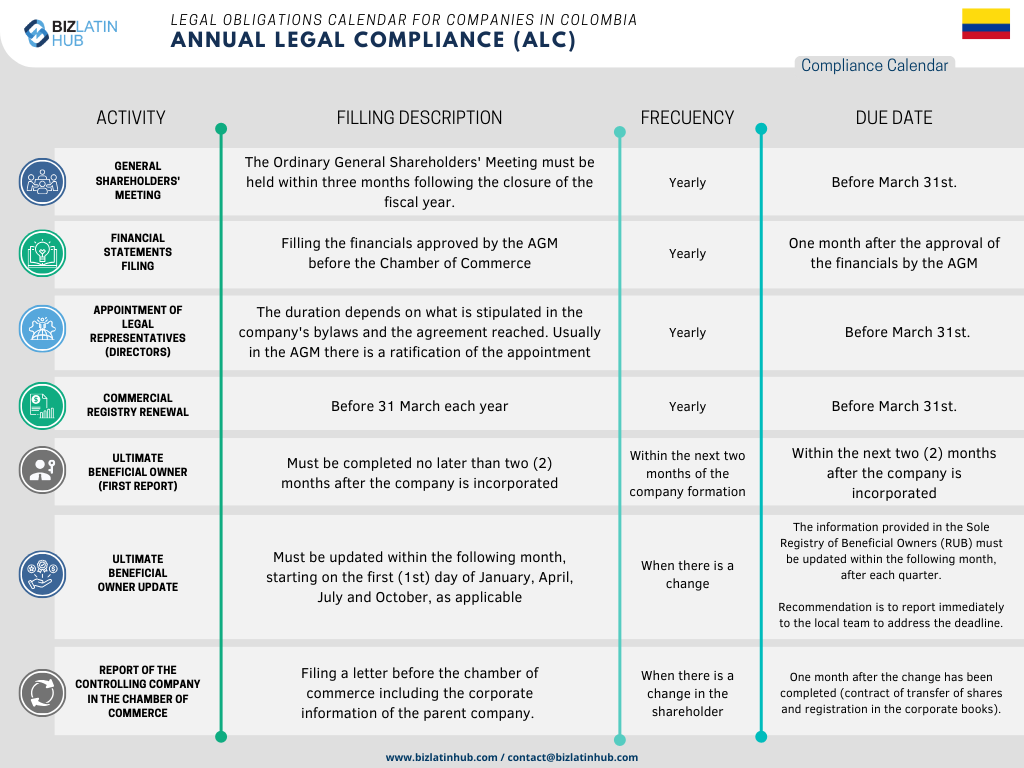

| What Are the Steps For Annual Legal Compliance? | General Shareholders Meeting Financial Statements Filing Appointment of Legal Directors Commerical Registry Renewal |

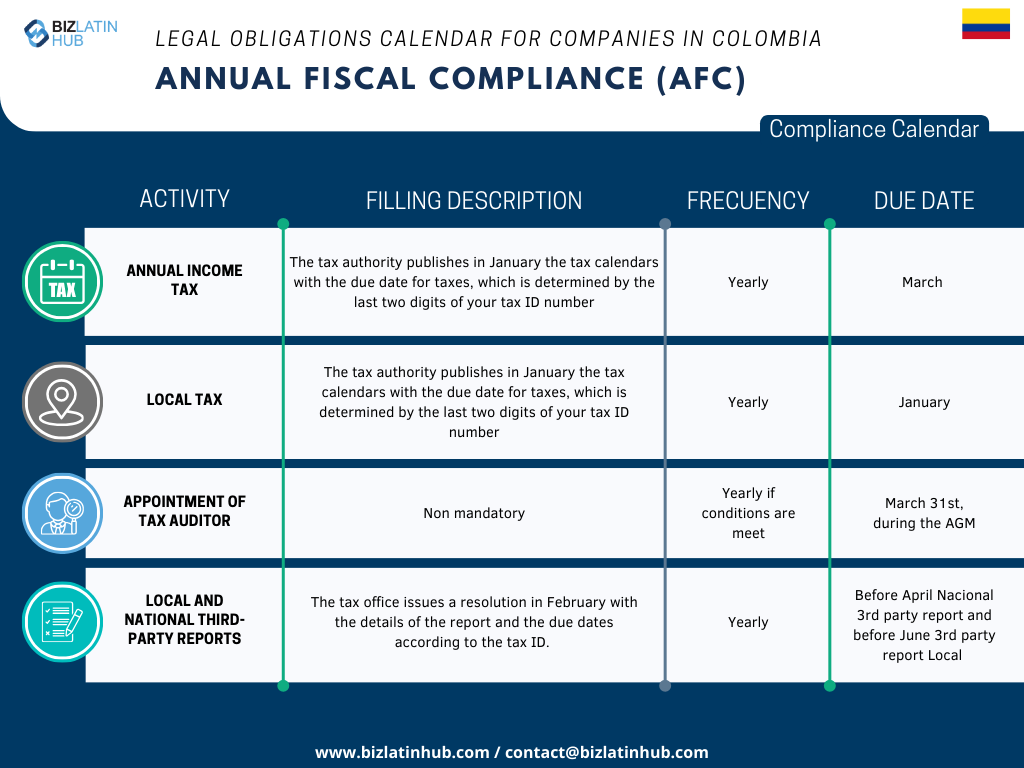

| What Are The Steps For Annual Financial Compliance? | Annual Income Tax Local Tax Local and National Third-party Reports |

| Why Invest in Colombia? | Colombia offers strategic trade access, economic stability, diverse industries, investment incentives, and abundant natural resources. |

What are the 6 Main Requirements for Corporate Compliance in Colombia?

Once duly incorporated, all legal entities in Colombia, including the Simplified Share Company (SAS), must meet some minimum statutory requirements:

- Appoint a company legal representative

- Register a Fiscal Address

- File monthly and annual tax declarations

- Annual renewal of the company’s commercial license

- Annual shareholder Meeting

- Ultimate Beneficial Owner registration

They are not overly complex, however, it is important that all companies meet the following requirements and ensure full corporate compliance while engaging in commercial activities in Colombia.

1. Appoint a Company Legal Representative

All companies in Colombia must appoint a company legal representative during the business registration process to serve during the company’s lifetime. The individual who undertakes this role must have a good understanding of what is required and the implications should the company break the law.

This role can be appointed to a local Colombian national or a foreign citizen. However, if the person is a foreign citizen, they must be registered before the Tax Authority.

Responsibilities of the company legal representative include signing documents on behalf of the company, submitting tax declarations, dealing with contracts and handling local regulations and obligations. They will usually handle banking as well.

Should the company break the law in any way, for example, by submitting fraudulent tax declarations, the company legal representative will be held responsible, as the ‘legal face’ of the company. For this reason, it is not a role that should be taken lightly.

When the company legal representative is appointed, their powers are typically given through a formally notarized document, within the company bylaws. To assist them in finding a company legal representative, many foreign companies work with a local law firm – giving them peace of mind with the knowledge that their company is in safe hands.

2. Register a Fiscal Address in Colombia

During the business registration process, companies must register a permanent fiscal address for the company. In Colombia, this is the official registered office address and is obligatory for all incorporated companies. This address is used to receive correspondence and formal notices from governmental authorities, investors, financial institutes, shareholders, and the general public.

3. File Monthly and Annual Tax Declarations

All companies in Colombia, regardless of their commercial activity, must file monthly and annual tax declarations. The authority that manages this is called the DIAN – Dirección de Impuestos y Aduanas Nacionales. Regardless of your income, revenue, or volume of invoices or transactions, the filing of monthly tax declarations is required. Failure to submit tax declarations on time, or according to the requirements of DIAN can result in penalties. The company legal representative is responsible for the correct filing of company tax declarations and will be the person responsible should there be errors. Additionally, once a year, all companies must file their annual tax declaration.

All companies in Colombia must be registered with the Colombian Chamber of Commerce – ‘Cámara de Comercio’ (in the location where you have operations). By doing so, you will obtain a Merchant’s Certificate, necessary for engaging in commercial activities. The certificate must be renewed every year, to allow the company to continue operating.

5. Annual shareholders’ meeting

By law, in Colombia, at least one shareholders’ meeting must be held annually before March 31st of each year so financial statements for the previous fiscal period can be approved.

6. Ultimate Beneficial Owner registration

Since 2021, the Colombian Tax Authority DIAN has introduced a new requirement on ultimate beneficial owner reporting. During the incorporation process, companies must report the ultimate beneficial owner on their portal. This only needs to be updated when the ownership or ultimate beneficial owner composition is changed.

In accordance with Colombian corporate governance norms, certain entities are required to hold annual shareholder meetings, a practice particularly significant for stock corporations (Sociedades Anónimas – S.A.). According to the Colombian Commercial Code, these meetings provide a forum for essential corporate decisions, including the approval of financial statements, profit distribution, and election of board members (Article 446 of the Commercial Code).

While Simplified Stock Companies (Sociedades por Acciones Simplificadas – S.A.S.) and Limited Liability Companies (Sociedades de Responsabilidad Limitada – S.R.L.) are not subject to the same statutory requirement for annual general meetings, they are often required to hold periodic meetings as stipulated in their bylaws or when requested by shareholders or partners to address key strategic or financial matters. Companies must comply with these governance standards to maintain regulatory compliance and ensure transparency (Article 431, Colombian Commercial Code).

FAQs on corporate compliance in Colombia

Based on our extensive experience these are the common questions and doubts of our clients on corporate compliance in Colombia:

The following are the most common statutory appointments for Colombian legal entities:

– An appointed legal representative who will be personally liable, both legally and financially, for the good operation and standing of the company. This should be a local national or a foreigner with the right to live/work in the country.

Yes, a registered local fiscal address is required for all entities in Colombia for the receipt of legal correspondence and governmental visits.

The ordinary General Shareholders’ Meeting must be held within three months following the closure of the fiscal year and before the deadline of March 31st in Colombia.

Companies must submit this report one month after there has been a change in the shareholder and this change has been completed (contract of transfer of shares and registration in the corporate books). This report includes filing a letter before the Chamber of Commerce including the corporate information of the parent company.

The tax authority publishes in January the tax calendars with the due date for taxes, which is determined by the last two digits of your tax ID number. The deadline for declaring income tax is in March and the deadline for declaring local taxes is in January.

Why Choose to Invest in Colombia?

As Colombia’s middle class grows, their disposable income increases, giving them greater purchasing power. This, in turn, creates a large consumer market. This is another attractive opportunity for foreign companies looking for additional sources of revenue. Read on to learn more about corporate compliance in Colombia.

All companies interested in doing business here should be aware of their obligations for corporate compliance in Colombia. Personalized support and advice from a local firm can ensure that your business remains in good standing with governmental authorities.

Biz Latin Hub can help you with corporate compliance in Colombia

With an infinite amount of business opportunities available in the region, it is not surprising that keen investors are looking towards Colombia as an attractive location to set up business operations.

Before jumping in, it is vital to have a sound understanding of your corporate obligations in Colombia. While the opportunities are great, so are the risks for individuals and companies who do not comply with local Colombian law.

For this reason and more, working with a trusted local legal and accounting firm can ensure that your company remains compliant when operating in Colombia. Biz Latin Hub was established in 2014 to assist foreign companies in setting up their business in Colombia.

Given the favorable conditions in the country and its strong economic growth, Biz Latin Hub, through its company Colombian Business Services, offers experience and support on market entry in Colombia. Feel free to contact us now.

Learn more about our team and expert authors.