Navigating regulatory requirements can feel overwhelming for many businesses, especially in a foreign landscape. Honduras presents unique challenges that demand clear understanding and adherence to local laws.

In this environment, compliance health checks become critical. These checks help businesses maintain the necessary standards set by key regulators and safeguard against potential penalties.

Key Regulators in Honduras

In Honduras, the insurance industry operates under the watchful eye of key regulators. The Central Bank of Honduras (Banco Central de Honduras – BCH) and the National Banking and Insurance Commission (Comisión Nacional de Bancos y Seguros – CNBS) are the primary bodies overseeing this sector.

Key Responsibilities of Regulators:

- BCH and CNBS:

- Ensure compliance with insurance regulations.

- Establish and oversee the operation of insurance entities.

- Promote market stability and protect policyholders.

- ASSAL:

- Offers oversight and regulatory guidance for the insurance market in Honduras.

These regulators play a vital role in maintaining a secure and fair insurance system for all stakeholders. Their effective governance promotes trust and strengthens the market’s resilience.

Honduran Insurance Regulation Overview:

| Regulator | Main Function |

|---|---|

| BCH | Oversees insurance operations |

| CNBS | Enforces compliance |

| ASSAL | Provides regulatory guidance |

Understanding these roles helps insurers meet legal requirements and safeguard policyholder interests.

Essential Regulatory Framework in Honduras

In Honduras, financial regulation compliance is crucial for businesses. Failure to comply can lead to legal problems and financial penalties. The Ministry of Labor and Social Security enforces workplace health and safety laws. They specify technical standards for various hazards. Employers must follow these standards to ensure worker well-being. Serious negligence can lead to fines, closures, or criminal charges.

Honduras has accepted key International Labor Organization (ILO) conventions. These affect national standards on occupational health and safety. The Central Bank of Honduras manages the insurance industry. Businesses must meet specific insurance standards to operate legally. Compulsory insurance classes include aviation liability and motor third-party liability. Professional indemnity insurance is also necessary for agents and brokers.

| Regulation | Responsible Entity |

|---|---|

| Health and Safety | Ministry of Labor and Social Security |

| Insurance Industry | Central Bank of Honduras |

| ILO Conventions | Affect national standards |

Compulsory Insurance Requirements in Honduras

In Honduras, some insurances are mandatory. Motor third-party liability insurance is compulsory. This is required for vehicle owners. Aviation liability insurance is necessary for relevant operations. Marine liability insurance is also required in the industry. Professional indemnity insurance is a must for many professionals. Employers must provide social security insurance for employees.

These requirements ensure protection and legal compliance in various sectors. Understanding these obligations helps entities avoid legal issues.

Compulsory Insurance:

- Motor third-party liability

- Aviation liability

- Marine liability

- Professional indemnity

- Social security insurance

Honduras ensures its insurance industry complies with compulsory standards. Entities must adhere to these for smooth operation and legal peace.

Employer Compliance Regulations in Honduras

Employer compliance with health and safety regulations in Honduras is crucial. Violations can lead to fines, administrative closures, or even criminal charges for severe negligence. Employers must stay informed and ensure their practices meet both national and international standards. This includes implementing safety procedures and conducting regular risk assessments. Employers should also create systems for medical surveillance, incident reporting, and investigation, to uphold a safe working environment.

Employment Regulations

Honduras enforces a labor law framework that favors employee rights. Employers must consider entitlements and legal requirements before hiring. The minimum wage depends on the industry and workforce size, ranging between HNL 100 and HNL 1000. Following Executive Decree Number PCM-019-2020, both employers and employees must comply with COVID-19 health protocols. Reporting accidents is mandatory under the Labor Code, and employers face specific deadlines based on the accident’s severity. Workplace inspections check compliance, and violations require prompt corrective action to avoid penalties.

Distinction Between Contractors and Full-time Employees

In Honduras, contractors work on specific short-term tasks, unlike full-time employees with longer commitments. Contracts for contractors can be renewed, reflecting the work’s nature and the employer’s needs. Full-time employees offer businesses more stability, which can lower training costs and time. Employment policies treat these groups differently, making compliance essential. The work type often decides if a person is a contractor or a full-time employee.

Onboarding Processes

The onboarding process in Honduras requires filing necessary employee documents and setting up payment methods and provident funds. A formal job offer during this phase should include details like salary, job role, workplace location, termination rules, and leave policies. Gaining written consent from employees for background checks, including past employment and basic financial and criminal checks, is also essential. Employer of Record (EOR) services like Skuad can streamline the onboarding process, saving time and resources. In Honduras, employee probation cannot exceed 60 days, necessitating a structured probation approach.

| Onboarding Steps | Details |

|---|---|

| Document Filing | Submit employee documents |

| Payment and Funds Setup | Establish salary payment and provident funds |

| Job Offer Details | Include salary, role, location, and policies |

| Background Check Consent | Obtain written consent for employee checks |

| Probation Period | Maximum of 60 days |

Incorporate these guidelines and processes to ensure compliance and efficiency in your business operations in Honduras.

Corporate Compliance Necessities

Corporate compliance in Honduras is crucial. It helps avoid legal issues and financial penalties. Companies must comply with financial regulations. A full guide to annual compliance is important. It helps before formally setting up a business in Honduras. Tailored help for annual compliance is useful. It supports businesses in Honduras and those entering the market. Effective compliance services should maintain statutory registers. They should manage approval and filing of financial statements. They should also guide directors in document execution. Technology in compliance management is useful. It helps track and monitor a company’s legal standing.

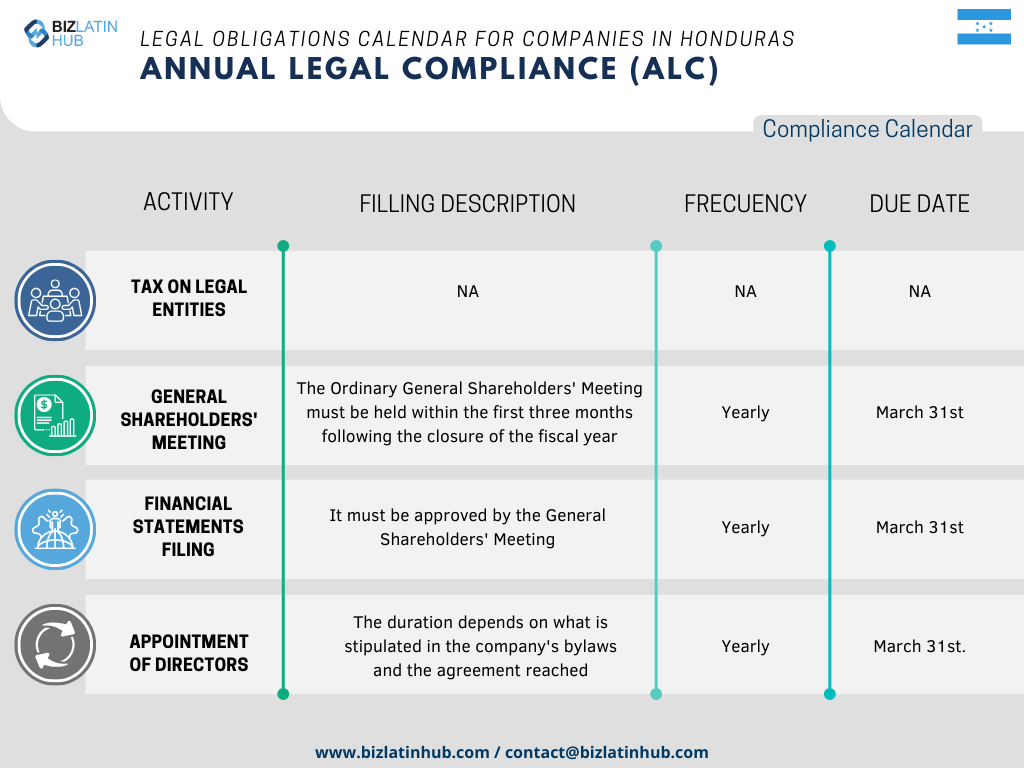

Annual Requirements

Understanding annual compliance requirements is vital for investors in Honduras. Meeting these prevents legal challenges and financial penalties. The service covers all required statutory requirements. It ensures compliance with Honduras’ regulatory framework. Key parts include maintaining company records. Preparing and filing recurring returns with the local registry is crucial. Updating in-house legal management systems is also necessary. Reminders about compliance deadlines help ensure timely filing and reporting. Real-time compliance reporting aligns with broader financial regulatory efforts.

Tax Obligations

In Honduras, corporate income tax is 25%. This applies to both resident and non-resident companies. They must pay taxes on income from Honduran sources. Main taxes include income tax, sales tax, and municipal taxes. These taxes apply to income from capital, labor, or both. Personal income tax increases progressively. Rates range from 0% to 25%, depending on income. Health insurance contributions total 8.50%. Employers contribute 5% for sickness and maternity, and 3.5% for disability. Employees pay 5%. Both the government and employers contribute to healthcare funding. Deductions are based on employees’ monthly wages.

Labor Regulations

Honduras labor laws favor employees. Employers must consider entitlements and regulations before signing contracts with locals. Minimum wage varies by industry and the number of employees. It averages between HNL 100 to 1000 per day. COVID-19 safety protocols are mandatory in workplaces. Non-compliance leads to administrative penalties. Employers must address occupational hazards. They need to ensure proper lighting, ventilation, clean water, and emergency procedures. The Ministry of Labor and Social Security enforces health and safety laws. They inspect workplaces and impose penalties for violations. However, challenges exist due to limited resources and worker awareness.

Compliance Checklist

- Maintain statutory registers

- File annual financial statements

- Guide directors with documents

- Record-keeping

- Meet compliance deadlines

- Update legal systems

Tax Essentials

- Corporate Tax: 25%

- Personal Income Tax: 0% – 25%

- Health Insurance: 8.50%

Labor Law Highlights

- Employee-focused policies

- Minimum wage HNL 100-1000

- COVID-19 protocols

- Ministry inspections

By adhering to these guidelines, companies can efficiently manage their compliance and legal responsibilities in Honduras.

Health and Safety Laws

Honduran health and safety laws require employers to manage various workplace hazards. These hazards include physical, chemical, biological, and ergonomic factors. Employers must ensure adequate conditions, which cover good lighting, proper ventilation, safe drinking water, and sanitary facilities. Additionally, first-aid supplies and emergency procedures are mandatory.

Industries like construction, mining, and agriculture have extra health and safety rules. These regulations aim to reduce risks inherent in high-risk workplaces. The Ministry of Labor and Social Security enforces these laws. This Ministry inspects workplaces to ensure compliance.

Violating health and safety regulations leads to severe consequences. Penalties include fines, administrative closure, and even criminal charges for extreme negligence.

Enforcement in the Workplace

The Ministry of Labor and Social Security enforces health and safety rules in Honduras. It conducts workplace inspections to spot hazards and ensure compliance. The purpose of these inspections is also to prevent unsafe conditions.

The Honduran Social Security Institute supports the Ministry by providing occupational health services. However, enforcing regulations is challenging in sectors with many informal workers. Such conditions hinder effective regulatory compliance.

Worker involvement is crucial for workplace safety. Mechanisms like safety committees allow for effective consultation and decision-making. These groups play a vital role in maintaining and improving workplace safety standards.

Conducting Regulatory Health Checks

Regulatory health checks act like mini audits. They are essential for understanding risk exposure and maintaining compliance with regulations. Businesses need to review policies, procedures, and compliance registers regularly. Interviewing senior managers and testing team members’ knowledge are key steps. Staying updated on regulatory changes helps adjust compliance strategies. These health checks also provide dynamic reports. These reports show corporate data issues and compliance breaches. They highlight potential risks and suggest remedial actions.

Key Steps in a Regulatory Health Check:

- Review policies and procedures

- Interview senior managers

- Test team knowledge

- Track regulatory changes

Enhancing Business Sustainability

Implementing an Environmental, Health, and Safety (EHS) Management System is crucial. This system fosters a safe work environment and ensures compliance. ISO 14001 helps organizations minimize environmental impact. Achieving ISO certification boosts operational efficiency. It also increases customer satisfaction. Continuous improvement is vital under ISO standards. It encourages regular enhancements in business operations. Proactive risk identification ensures business continuity.

- Benefits of ISO 14001:

- Minimizes environmental impact

- Enhances reputation

- Improves operational efficiency

Risk Mitigation Strategies

A risk-based approach ensures compliance predictability. It helps in identifying and mitigating potential issues. Conducting a cost analysis can uncover inefficiencies. Compliance with local to international regulations is essential. It helps avoid legal issues and penalties. Safety policies and objectives are vital in risk management. Systematic risk evaluation identifies hazards and assesses their impact.

- Strategies for Mitigating Risk:

- Implement a risk-based approach

- Conduct cost analysis

- Ensure regulatory adherence

Performance Evaluation and Compliance

Performance evaluation involves verifying adherence to regulations. This is crucial for mitigating legal risks in Honduras. Internal audits play a key role in assessing compliance. They help find improvement areas. Safety policies as part of compliance enhance workplace safety. Clear documentation and procedures improve transparency. This helps in better compliance efforts and operational efficiency.

- Focus Areas in Performance Evaluation:

- Adherence verification

- Conducting internal audits

- Establishing safety policies

By adhering to these structured approaches, businesses can secure their operations, stay compliant, and achieve long-term sustainability and efficiency in Honduras.

Bespoke Training and Development

EY provides a tailored training program for directors and officers. This program helps reduce subsidiary governance risk. It also supports directors across international subsidiaries. The training can be customized to meet an organization’s specific needs. It includes creating director handbooks with practical information and reference materials. Training can be accessed online or in person, making it accessible worldwide. A recent project included a director training program in 40 jurisdictions for a US-based multinational, showcasing EY’s expertise and global reach. Regular training programs help employees stay knowledgeable and engaged, boosting job satisfaction.

Insights from Industry Experts

Understanding annual entity compliance in Honduras is crucial for investors. It helps avoid legal challenges and financial penalties tied to regulatory compliance. Businesses entering the Honduran market can access tailored assistance to meet all compliance requirements. A tech-enabled approach connects businesses with global experts for effective governance and compliance. The Ministry of Labor and Social Security in Honduras inspects workplaces to check for hazards and ensure compliance with occupational health and safety regulations. Challenges in adhering to these standards include informal work and limited enforcement resources, like staff and funding.