Company formation in the Cayman Islands offers access to a stable economy, a strong financial sector, and strategic Caribbean positioning. With tax neutrality, a supportive regulatory environment, and a legal system based on English law, the islands attract global investors. With our full suite of back-office services, Biz Latin Hub can help you register a company or open a bank account in the Cayman Islands, ensuring compliance and efficiency. Partner with us to make this the next success in your business story.

Key Takeaways On Company Formation in The Cayman Islands

| Is Foreign Ownership Permitted? | Yes, 100% foreign ownership is allowed in the Cayman Islands. |

| Steps for Company Formation in the Cayman Islands: | Step 1: Reserve/register company name. Step 2: Collect the necessary documents, submit the application. Step 3: Pay incorporation fees to form your company in the Cayman Islands. Step 4: Open a corporate bank account. |

| What Are The Common Entity Types In The Cayman Islands? | Limited Liability Company (LLC) Resident Company Non-resident Company Overseas Company Exempt Company |

| Why Set-up a Company in the Cayman Islands? | The country allows companies to enjoy tax-free status, exempt from income, capital gains, corporation, and withholding taxes. |

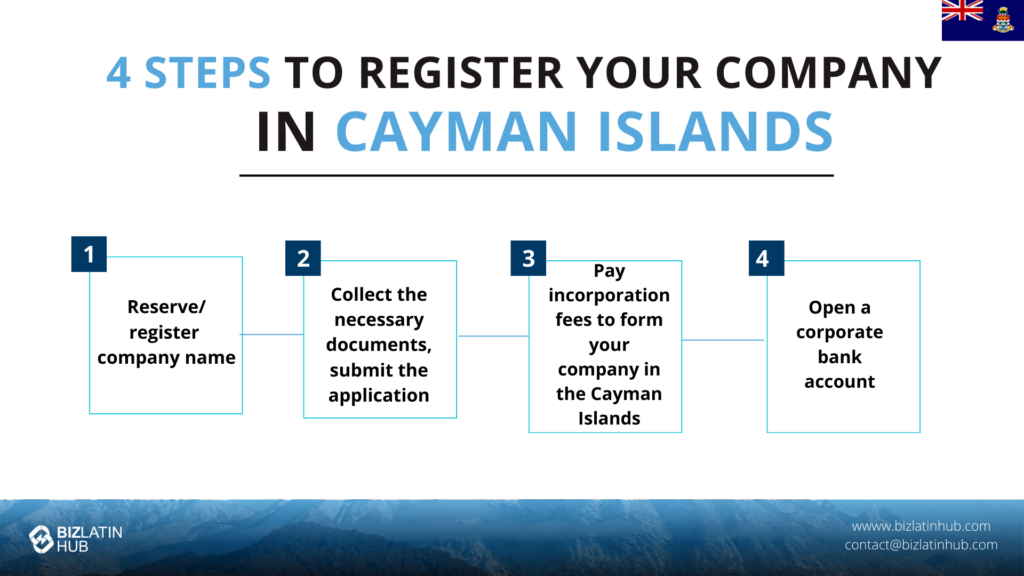

4 Steps for Company Formation in the Cayman Islands:

There are multiple types of companies, and each has its process for incorporation or registering in the Cayman Islands. However, some general steps are similar to any process of company formation in the Cayman Islands. What follows is a general guideline:

- Step 1: Reserve/register company name.

- Step 2: Collect the necessary documents, submit the application.

- Step 3: Pay incorporation fees to form your company in the Cayman Islands.

- Step 4: Open a corporate bank account.

Step 1: Reserve/register company name

For entities incorporated offshore, a company must simply register its legal, trademarked name with the Cayman Islands General Registry. Foreign firms that register as resident companies must run a search with the General Registry to ensure their company name is available for use.

Step 2: Collect the Necessary Documents, Submit the Application

The documents needed to apply for any kind of incorporation will likely include:

- A Memorandum of Association

- Articles of Association

- Approval from the Cayman Islands Monetary Authority

- Proof that accounting records are in good order

The incorporation application is processed on average between 6 to 10 working days.

Step 3: Pay incorporation fees to form your company in the Cayman Islands

The cost of company formation in the Cayman Islands runs between USD$2,000 to USD$3,000. Companies of all kinds must pay an annual renewal fee of USD$5,000 to USD$6,000.

Step 4: Open a corporate bank account

Opening a corporate bank account in the Cayman Islands requires filling out a detailed application form as well as providing company information such as: your new Certification of Incorporation, a written request to open a new account on company letterhead explaining the need for such an account, and a reference from a Caymanian or overseas bank. Some banks require the identification and references of the principal shareholders who own 10 percent or more in shareholdings, as well as the directors and officers responsible for managing the account.

What are the perks of company formation in the Cayman Islands?

There is a vast array of advantages to incorporating in the Cayman Islands, particularly in the investment management, legal, and financial service sectors, to name just a few:

- Cayman is a zero-tax jurisdiction. There areis no corporate, property, capital gains, payroll, or withholding taxes.

- There is no sales tax on goods and services, nor do residents pay income taxes.

- The Cayman Islands is an ideal jurisdiction for corporations to base subsidiary businesses to shield some or all their income from taxation.

- Unlike in other jurisdictions, a single person can assume the role of director and/or shareholder in the Cayman Islands. This person can be of any nationality, and there is no need for them to reside in the Cayman Islands.

- There is no minimum capital requirement for company formation in the Cayman Islands.

- There are no annual auditing requirements for an offshore Cayman Islands Company.

- The territory is widely used as a listing entity in major stock exchanges around the world.

- It’s easy to find Cayman Islands lawyers and legal experts who reside in other countries, even as far away as Asia.

- The island is a well-known jurisdiction to use for establishing corporate bank accounts.

5 types of company formation in the Cayman Islands

There are five main types of companies that foreign businesses and corporations can incorporate in the Cayman Islands. According to the Cayman Islands General Registry, each type has its own set of advantages, rules, and limitations. So before beginning the process of company formation in the Cayman Islands, it’s incumbent upon each foreign entity to carefully consider what type of company best suits their business.

1. Limited Liability Company (LLC) in Cayman – In cases where company activities are to be carried out primarily abroad, a foreign entity can register as an LLC. Executives, managers, and shareholders cannot be held personally liable for the company’s debts or liabilities.

2. Resident Company in Cayman – An ordinary resident company carries on business within the Cayman Islands. The company must have a physical office presence and register its past and present members. A resident company must also report annually to the Registrar.

3. Non-resident Company in Cayman – A non-resident company does not intend to conduct business within the Cayman Islands. Companies, however, are permitted to buy and sell shares of foreign corporations and exempted companies. This company can only do business on the island through a partnership with a local entity.

4. Overseas Company in Cayman – An overseas company (or foreign company) is a company incorporated outside the Cayman Islands. These firms can register as an overseas company and are then entitled to hold land and/or conduct business in the Cayman Islands, or to act as a partner of a Cayman-exempted limited partnership.

5. Exempt Company in Cayman – This type of company formation in the Cayman Islands is suitable for companies whose business activities are mainly carried out outside of the Cayman Islands (i.e., offshore). An exempt company is not required to register its members for public inspection, nor is the entity required to hold annual general meetings in the Cayman Islands.

Frequently asked questions on company formation in the Cayman Islands

According to our experience, these are the most common questions and doubts of our Clients when incorporating a company in the Cayman Islands

1. Can a foreigner have a business in the Cayman Islands?

Yes, foreigners can own and operate businesses in the Cayman Islands. The Cayman Islands is a popular destination for international businesses and provides a favorable environment for foreign investment.

2. What is the Cayman Island Company Tax ID?

The Cayman Island Company Tax ID is obtained by registering with the Cayman Islands Monetary Authority.

3. How long does it take to register a company in the Cayman Islands?

Registering a company in the Cayman Islands typically takes around 8-10 weeks, depending on the type of business entity and the completeness of the application.

4. What does L.L.C. company name mean in the Cayman Islands?

In the Cayman Islands, the term LLC typically stands for Limited Liability Company. An LLC is a legal entity structure that offers its members limited liability, meaning that the personal assets of the members are generally protected from the company’s debts and obligations. LLCs are a popular choice for businesses in the Cayman Islands due to their flexibility and the protection they offer to the owners (referred to as members).

5. What types of entities offer Limited Liability in the Cayman Islands?

Limited liability is commonly offered through the structure of Exempted Companies and Limited Liability Companies (LLCs) in the Cayman Islands.

6. What are the main characteristics of an LLC in the Cayman Islands?

Key characteristics of LLCs in the Cayman Islands may include:

- Limited liability for members.

- Flexibility in management and operation.

- Pass-through taxation.

- Simple and efficient formation and administration.

Biz Latin Hub Can Help You With Company Formation in The Cayman Islands

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

As well as knowledge about company formation in the Cayman Islands, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise do business in Latin America and the Caribbean. If this article on company formation in the Cayman Islands was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.