Understanding how to incorporate a company in Jamaica is essential for foreign investors to thrive in this booming market. By following our guide, it will make your journey starting a business in Jamaica that much easier, assisting with your research and preparation. Biz Latin Hub offers unparalleled local knowledge and a comprehensive suite of back-office services, allowing you to focus on growing your business and making Jamaica part of your success.

Key Takeaways On How To Incorporate a Company in Jamaica

| Is Foreign Ownership Permitted in Jamaica? | 100% foreign ownership is allowed in Jamaica. However, specific industries such as agriculture, fishing, and telecommunications may have restrictions or require local participation. |

| Steps to Incorporate a company in Jamaica | Step 1 – Name Reservation. Step 2 – Prepare Incorporation Documents. Step 3 – Submit Registration Application. Step 4 – Obtain a Taxpayer Registration Number (TRN). Step 5 – Register for National Insurance and Statutory Deductions. Step 6 – Open a Corporate Bank Account. Step 7 – Obtain Business Licenses and Permits (If Required). Step 8 – File Annual Returns and Maintain Compliance. |

| What Common Types of Companies Are There in Jamaica? | Private Limited Company (Ltd). Public Limited Company (PLC). Registered Business/Sole Proprietorship. Partnership (General and Limited). |

| Why Set-up a Business in Jamaica? | Setting up a business in Jamaica offers access to a strategic location, a skilled workforce, and trade agreements with the Caribbean Community (CARICOM) and the Organisation of Eastern Caribbean States (OECS). |

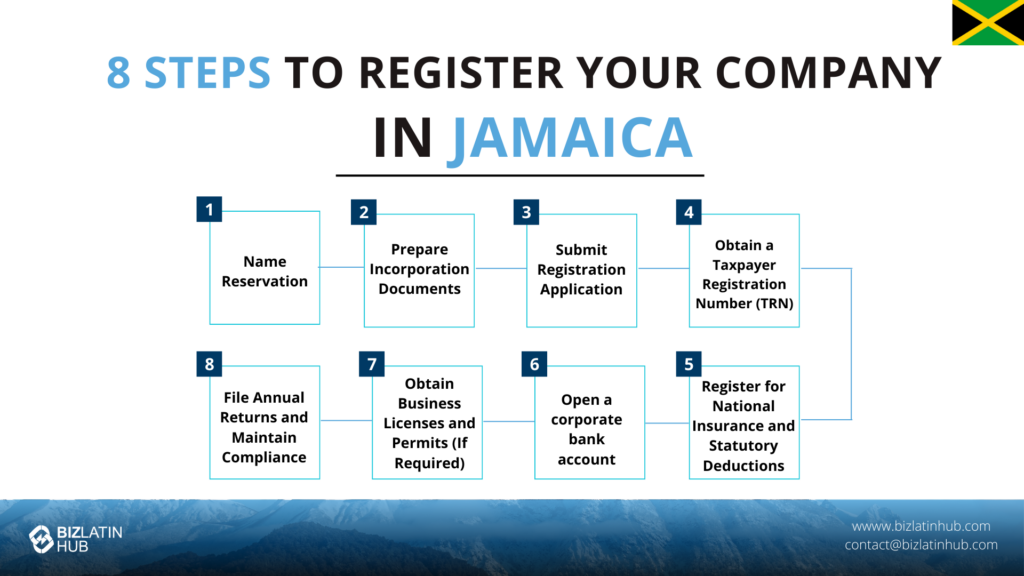

What Are the 8 Steps to Successfully Incorporate a Company in Jamaica?

You must understand each step of the company formation process before you begin. Below is a detailed step-by-step guide to help familiarize yourself with the system in Jamaica.

Below are the 8 steps you will need to follow:

- Step 1 – Name Reservation.

- Step 2 – Prepare Incorporation Documents.

- Step 3 – Submit Registration Application.

- Step 4 – Obtain a Taxpayer Registration Number (TRN).

- Step 5 – Register for National Insurance and Statutory Deductions.

- Step 6 – Open a Corporate Bank Account.

- Step 7 – Obtain Business Licenses and Permits (If Required).

- Step 8 – File Annual Returns and Maintain Compliance.

Step 1 – Name Reservation

Conduct a name search with the Companies Office of Jamaica (COJ) to ensure availability. Reserve the chosen name, valid for 90 days, before proceeding with incorporation. We recommend to always have at least three preferable names incase one is not available.

Step 2 – Prepare Incorporation Documents

During this step, you will be required to:

- Draft the Articles of Incorporation

- Provide a registered office address

- Submit details of directors and shareholders.

A legal professional must certify compliance with the Companies Act. If the company has foreign shareholders, then a Power of Attorney (POA), apostille process, and translation of documents may be required.

Note: If incorporating a Sole Proprietorship, you will have to fill our a registration form.

Step 3 – Submit Registration Application

File incorporation documents with the COJ and pay required fees. Upon approval, receive the Certificate of Incorporation, confirming the company’s legal status.

Step 4 – Obtain a Taxpayer Registration Number (TRN)

Register with the Tax Administration Jamaica (TAJ) for a TRN and, if required, a General Consumption Tax (GCT) number to comply with tax regulations. Currently, the GCT in Jamaica is 15%.

Step 5 – Register for National Insurance and Statutory Deductions

Enroll with NIS, NHT, and HEART for employee contributions and register for Pay As You Earn (PAYE) to facilitate tax deductions from salaries.

Employers become eligible to pay employee HEART contributions when their total gross wage bill exceeds J$14, 444. Under the 1982 HEART Act (amended in 2003), this is a mandatory contribution, and we advice clients to plan accordinly if planning to hire local teams.

Step 6 – Open a Corporate Bank Account

Present incorporation documents, TRN, and director identification to a bank in Jamaica to open a corporate account for business transactions.

Step 7 – Obtain Business Licenses and Permits (If Required)

Secure necessary approvals from regulatory bodies like the Ministry of Industry, Investment & Commerce (MIIC) or Bank of Jamaica (BOJ) based on industry requirements.

Step 8 – File Annual Returns and Maintain Compliance

Submit annual returns and financial statements to the COJ while ensuring tax and regulatory compliance to maintain the company’s legal standing.

Starting a Business in Jamaica: 4 Types of Jamaican Companies

Company formation in Jamaica involves multiple steps, with one of the most critical being the selection of the appropriate business structure. The type of company you choose impacts liability, taxation, and regulatory obligations. Jamaica offers several company types, each with distinct legal and operational requirements.

Here are the main types of companies in Jamaica:

- Limited Liability Company (LLC).

- Private Limited Company (Ltd.).

- Public Limited Company (PLC).

- Registered Business/Sole Proprietorship.

- Partnership (General and Limited).

Below is an overview of the most common company structures in Jamaica to help you make an informed decision for your business.

1. Limited Liability Company (LLC)

A Limited Liability Company (LLC) is a popular choice for businesses in Jamaica. It provides a flexible structure that combines elements of both partnerships and corporations. The key advantage of an LLC is that it limits the personal liability of its members, protecting their personal assets from business debts. This structure is suitable for small to medium-sized enterprises looking for a balance between liability protection and operational flexibility.

Under this structure there are two seperate sub categories, Private Limited Company (Ltd.) and Public Limited Company (PLC). Though similar, below are the main differences:

Private Limited Company (Ltd.)

A Private Limited Company (Ltd.) is the most common business structure in Jamaica. It requires at least one director and one shareholder, with a maximum of 50 shareholders. Shares cannot be publicly traded, and shareholder liability is limited to their investment.

This structure is ideal for small and medium-sized enterprises (SMEs) seeking legal protection and operational flexibility. Registration involves submitting the Articles of Incorporation and other required documents to the Companies Office of Jamaica (COJ).

Public Limited Company (PLC)

A Public Limited Company (PLC) can offer shares to the public and is typically listed on the Jamaica Stock Exchange (JSE). It must have at least three directors and a minimum of one shareholder, with no upper limit. Shareholders’ liability is limited to their share capital, making it an attractive option for large businesses seeking investment.

A PLC must comply with strict financial reporting and corporate governance standards. Incorporation requires filing detailed documentation, including a prospectus, with the COJ and relevant regulatory bodies.

2. Registered Business/Sole Proprietorship

A Registered Business / Sole Proprietorship is the simplest business structure, owned and operated by one individual. The owner assumes full liability for debts and obligations, making it riskier than limited liability entities. This structure is easy to register with the COJ and requires fewer compliance obligations.

Sole proprietors must obtain a Taxpayer Registration Number (TRN) and register for General Consumption Tax (GCT) if earnings exceed the statutory threshold. It is best suited for small businesses or independent professionals with minimal risk exposure.

3. Partnership (General and Limited)

A Partnership involves two or more individuals or entities operating a business together. In a General Partnership, all partners share liability for debts and obligations, while a Limited Partnership includes at least one general partner with full liability and limited partners liable only for their investment.

Partnerships must be registered with the COJ and comply with the Partnership Act. Partners typically sign an agreement outlining profit-sharing, decision-making, and dissolution procedures. This structure is beneficial for professional services and joint ventures requiring shared management and resources.

4. Branch Offices & Subsidiaries of Foreign Companies

Unlike partnerships, a branch operates as an extension of the parent company, not as a separate legal entity. The foreign company retains full responsibility for the liabilities and obligations of the Jamaican branch. The branch must be registered with the COJ and comply with the Companies Act, operating under the same structure and management as the parent company.

All branch companies must appoint a local representative to handle legal and regulatory matters. This setup is useful for foreign companies seeking to expand operations without establishing a separate subsidiary.

What Are the Minimum Requirements to Incorporate an LLC or Registered Business/Sole Proprietorship in Jamaica?

Before diving into the entrepreneurial journey in Jamaica, it is crucial to understand the minimum requirements for incorporating an LLC or Registered Business/Sole Proprietorship.

Here is what you need to register a private company in Jamaica.

Under the provisions of the Companies Act 2004, an individual has the authority to register a private company. It is permissible for the registrant to function as the sole director and shareholder; however, they are ineligible to concurrently serve as the company secretary.

When completing Form 1A, the designated Articles of Incorporation for private and public companies, certain crucial information must be specified:

LLC Company Requirements

- Company Name: Choose a unique and acceptable name for the LLC.

- Registered Office: Establish a registered office address within Jamaica.

- Shareholders: Have at least one shareholder, with the option to have multiple shareholders.

- Articles of Incorporation: Prepare and file the articles of incorporation with the Companies Office of Jamaica.

Registered Business/Sole Proprietorship Requirements

- Business Name: Select a unique business name that complies with registration regulations.

- Owner Information: Provide personal details of the sole proprietor, including name and address.

- Business Address: Specify the location of the business.

- Business Activity: Clearly outline the nature of the business activity

The registration process for public companies aligns with that of private companies, involving the submission of both the Business Registration Form and Form 1A, as previously mentioned. However, there are notable exceptions:

- The value of the allotted shares must be explicitly stated and should not fall below J$500,000.

- The company must have a minimum of three directors. At least two of the directors must not hold employment status with the company or any affiliated entity.

Can a foreigner start a business in Jamaica?

To operate in Jamaica, foreign companies are required to complete registration with the Companies Office of Jamaica, incurring a registration fee of J$25,000 (USD$150). Despite minimal restrictions on foreign ownership, any alterations to registration documents necessitate submission to the Companies Office.

Moreover, in compliance with the Companies Act of 2004, foreign companies are obligated to file a Profit and Loss account and a Balance Sheet. People who are not residents of Jamaica must seek approval from the Ministry of Labour before participating in any profitable activity or seeking employment in the country.

Frequently asked questions when incorporating a company in Jamaica

We’ve compiled a list of commonly asked questions and typical uncertainties that our clients frequently encounter when undertaking the process of incorporating a company in Jamaica.

Yes, a business can be 100% foreign-owned by either legal persons (“legal entities”) or natural persons (“individuals”)

3-5 business days is what it takes to register a business in Jamaica

An LLC is a type of legal structure that combines elements of a corporation and a partnership. It provides limited liability to its owners, known as members, which means that their assets are generally protected from the company’s debts and liabilities

In Jamaica, a Registered Business or Sole Proprietorship refers to a type of business structure where a single individual owns and operates a business.

Companies Limited by Shares (LLC) which is similar to LLCs in other jurisdictions.

LLC (Limited Liability Company): An LLC is a separate legal entity from its owners, known as members. It offers limited liability protection to its members, meaning their assets are generally shielded from the company’s debts and legal liabilities. They are taxed as separate entities and may be subject to Corporate Tax. LLCs are created by filing formation documents with the Companies Office of Jamaica and typically have a more formal legal structure.

Sole Proprietorship: A Sole Proprietorship is not a separate legal entity; it is an unincorporated business owned and operated by a single individual. The business and the owner are considered the same legally. There is no legal separation between personal and business assets and liabilities. The business’s profits and losses are taxed at the owner’s tax rates. The business can be registered at our Companies Office or the proprietor may operate without registration and refer to themselves as a Sole Trader

Company Formation in Jamaica: What Do You Need to Get Started?

Embarking on the journey of company formation in Jamaica requires careful planning and adherence to regulatory processes. To initiate the process, consider the following steps:

- Research and Planning: Understand the market and regulatory environment, and outline a solid business plan.

- Choose a Business Structure: Decide between an LLC and a Registered Business/Sole Proprietorship based on your business goals and preferences.

- Name Reservation: Secure your chosen business name by registering it with the Companies Office of Jamaica.

- Documentation: Prepare and submit the necessary documents for incorporation, such as articles of incorporation for an LLC or the registration form for a Sole Proprietorship.

- Compliance: Ensure compliance with taxation and regulatory requirements, including obtaining a Taxpayer Registration Number (TRN) and adhering to any sector-specific regulations.

Biz Latin Hub can assist with company formation in Jamaica

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in major cities in the region.

We also have trusted partners in many other markets. Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

As well as knowledge about company formation in Jamaica, our range of services includes hiring & PEO accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to learn more about how we can assist you in finding top talent or otherwise doing business in Latin America and the Caribbean.

If this article on company formation in Jamaica interests you, check out the rest of our coverage of the region. Or read about our team and expert authors.