To form a company in Guyana provides access to a growing economy, rich natural resources, and a business-friendly environment. Its strategic location in South America and investor-focused policies make it an attractive choice for entrepreneurs. Establishing a business here offers competitive costs and opportunities in emerging markets. At Biz Latin Hub, we specialize in company formation in Guyana. Let us help you navigate the process and make this another success in your business journey.

Key Takeaways On Company Formation in Guyana

| Is Foreign Ownership Permitted in Guyana? | Yes, foreigners can own a company in Guyana, however, certain restrictions or additional requirements may apply for certain types of investments or businesses deemed strategic to national interest. |

| Steps to Incorporate a Company in Guyana: | Step 1 – Choose a name. Step 2 – Receive a declaration of compliance. Step 3 – Register your company formation in Guyana. Step 4 – Apply for a tax identification number (TIN). Step 5 – Register for a Value Added Tax (VAT). Step 6 – Register for the Social Security. Step 7 – Create a company seal. |

| What Are The Common Entity Types In Guyana? | Sole proprietorship. Partnership. Private Limited Liability Company (PLLC or LLC). Public Liability Company (PLC). |

| Why Choose to Incorporate a Company in Guyana? | Guyana offers a rapidly growing economy with significant opportunities in various sectors, particularly due to recent oil discoveries. The country provides a business-friendly environment with equitable treatment for foreign and domestic investors, as well as access to preferential trade agreements like CARICOM. |

How to Form an LLC in Guyana in 7 steps

In this section, we outline the 7 steps it takes to form an LLC in Guyana. It is critical for your business’s future success in this region that you follow these steps meticulously.

Step 1 – Choose a name.

Step 2 – Receive a declaration of compliance.

Step 3 – Register your company formation in Guyana.

Step 4 – Apply for a tax identification number (TIN).

Step 5 – Register for a Value Added Tax (VAT).

Step 6 – Register for the Social Security.

Step 7 – Create a company seal.

1. Choose a name

You will need to verify that your company name is not the same or too similar to another locally registered company. This process is done through Guyana’s companies registry and can be completed in one day.

2. Receive a declaration of compliance

During this type of company formation in Guyana, a declaration of compliance must be signed by a locally registered attorney. That document will state that, to the best of the attorney’s knowledge, all signatories to the new company’s articles of incorporation are eligible to be signatories. That means they are at least eighteen years old, of sound mind, and are not prevented from participating in the company formation by past or ongoing legal matters. This step will usually be completed in approximately two days, as the attorney gathers what information they need to be able to sign the declaration.

3. Register your company formation in Guyana

To continue with the process of company formation in Guyana, the new company must be registered with the Guyana Registry of Companies, which will publish the issuance of the company’s certificate of incorporation in the Official Gazette of Guyana. Such a registration process will usually take a week and involves submitting the likes of the company name, its registered address, information related to shares the number of directors (including their listed addresses), and any sort of restrictions that will apply to the business activities of the company.

4. Apply for a tax identification number (TIN)

Once the company has been registered, you will need to apply to the Guyana Revenue Authority Agency for a TIN. This will be used to identify your company on tax declarations and invoices, as well as import and export documents. The process requires submission of the certificate of incorporation, valid identification documents from named directors, and a properly completed TIN application form. This process usually can be completed in a single day.

5. Register for a Value Added Tax (VAT)

A specialist department of the Guyana Revenue Authority deals with VAT, and applications to register for VAT must be made to it within 15 days of your business operations beginning. As long as that application is OK, the corresponding certificate will be issued by the Authority within 10 days of your submission. This process will generally be completed within a week.

In 2017, Guyana dropped VAT from 17 per cent to 14 per cent, while simultaneously raising the annual sales threshold at which VAT registration is mandatory to 15 million Guyanese dollars (approximately USD$71,800 as of April 2024).

6. Register for Social Security

The sixth step you must complete for company formation in Guyana, which will take around a week to complete but can be undertaken simultaneously with the fifth step, is to register with the National Insurance Scheme. This scheme covers all persons between the ages of 16 and 60 who are engaged in insurable employment. People outside this age range can be covered voluntarily, but only for industrial benefits, while self-employed people are not covered for industrial benefits.

Social security contributions for standard employees within the statutory age range amount to a total of 14 percent of salaries, with employers liable for 8.4 per cent of that salary, while the employee has 5.6 per cent deducted from their pay. Meanwhile, self-employed people must contribute 12.5 percent of their declared income, and voluntary contributors pay 9.3 per cent of average earnings, based on the previous two years of income.

7. Create a company seal

Once this process has been completed, a company must create an embossed or rubber seal — with most opting for the latter. Embossed seals are made of steel and can usually be delivered in less than a week, while rubber stamps can come even sooner. This process can also be undertaken simultaneously with steps five and six.

Business Formation in Guyana: Which Types of Companies to Choose?

There are four main types of legal entities in Guayana to choose, including:

- Sole proprietorship.

- Partnership.

- Private Limited Liability Company (PLLC or LLC).

- Public Liability Company (PLC).

Each comes with its prerequisites and advantages or drawbacks. For example, a sole proprietorship is one of the easiest types of companies in Guyana to set up, however the liability is not limited, so the owner holds full responsibility for all assets and debts. A partnership is similar, however that liability is spread across the named partners.

Meanwhile, an LLC can be fully foreign-owned by a minimum of two and a maximum of 20 shareholders, with each shareholder’s liability limited to what they have contributed to the company’s share capital. On that note, there is no minimum required capital, making this entity type low-cost to establish. If you set up an LLC, only one director is required to be appointed, and that can be one of the shareholders.

A PLC on the other hand, which is a company for which ownership is divided into shares that are publicly traded on a stock exchange, requires a minimum of two directors to be appointed. In both cases, a director can be anyone of legal age who is not otherwise prohibited from occupying such a role.

Given the convenience of establishing an LLC in Guyana, this tends to be the most popular choice among foreign investors and, as such, is the focus of the step-by-step guide for company formation. Note that, while the shareholders of an LLC can be foreign and do not have to reside in Guyana, in the case that all of them are based abroad, a local agent should be appointed to receive legal and other official documents at a Guyanese address.

What are The Minimum Requirements for Forming a Company in Guyana?

The minimum requirements to incorporate a Limited Company in Guyana typically include:

- Directors: At least one director, who can be a natural person or a corporate entity. Directors must be at least 18 years old and not disqualified from holding office.

- Shareholders: At least one shareholder, who can be a natural person or a corporate entity. There is no residency requirement for shareholders.

- Company Secretary: While not mandatory, appointing a company secretary is recommended. The secretary can be an individual or a corporate entity and must reside in Guyana.

- Registered Office: The company must have a registered office address in Guyana, which serves as the official address for receiving legal documents and notices.

- Name Reservation: The proposed company name must be unique and not identical or similar to existing registered companies. Before incorporation, the name must be reserved with the Deeds and Commercial Registries Authority.

- Articles of Incorporation: The company’s articles of incorporation must be prepared, outlining details such as the company’s name, registered office address, objectives, share capital, and internal governance structure.

- Declaration of Compliance: A declaration of compliance confirming that all legal requirements for incorporation have been met must be signed by the directors and shareholders.

- Payment of Fees: All applicable registration fees must be paid to the Deeds and Commercial Registries Authority upon submission of the incorporation documents.

FAQ about company formation in Guyana

Here are some of the most common questions we receive about forming a company in Guyana.

1. What types of business entities can I form in Guyana?

In Guyana, you can form various types of business entities, including sole proprietorships, partnerships, limited liability companies (LLCs), and private and public companies.

2. What is the Guyana Company Tax ID?

The Guyana Company Tax ID is obtained by completing forms CB001 and F16 to apply for a TIN.

3. What are the steps involved in incorporating a company in Guyana?

The steps typically involve choosing a company name, drafting articles of incorporation, obtaining a tax identification number (TIN), registering with the Deeds and Commercial Registries Authority, and paying the necessary registration fees. It will then be necessary to open a corporate bank account in Guyana.

4. What are the requirements for registering a company in Guyana?

Requirements may include identification documents of directors and shareholders, proof of address, articles of incorporation, a declaration of compliance, and payment of registration fees.

5. Are there any specific permits or licenses required to operate a business in Guyana?

Depending on the nature of your business, you may need to obtain permits or licenses from various government agencies, such as the Guyana Revenue Authority, the Environmental Protection Agency, or sector-specific regulatory bodies.

What are the tax implications for businesses operating in Guyana?

Businesses in Guyana are subject to corporate income tax, value-added tax (VAT), and other taxes. It’s important to consult with a tax advisor to understand your specific tax obligations and incentives available for certain industries or investments.

Can foreigners own a company in Guyana?

Yes, foreigners can own a company in Guyana. However, certain restrictions or additional requirements may apply, such as obtaining approval from the Foreign Investment Review Committee for certain types of investments or businesses deemed strategic to national interest.

Why Choose to Incorporate a Company in Guyana?

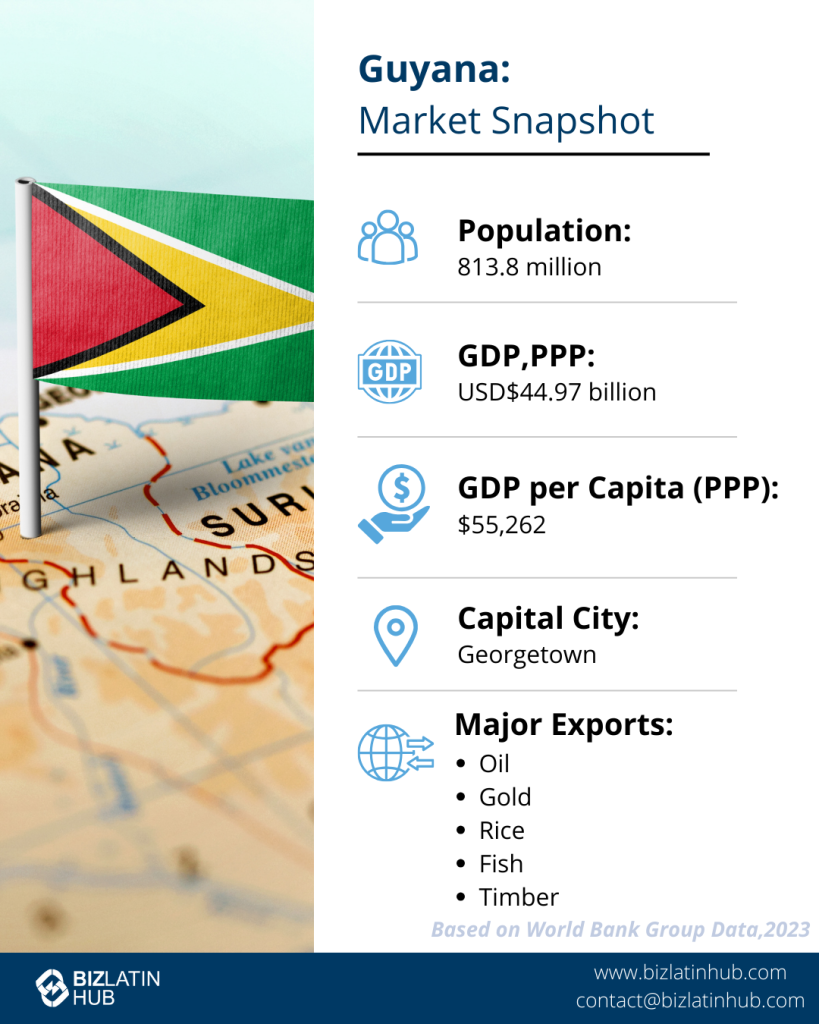

Located in the northeast of South America and bordered by Brazil, Suriname, and Venezuela, Guyana is considered a Caribbean nation and is one of only three mainland Latin American countries to be a member of the Caribbean Community (Caricom) — an economic association that also includes Belize and Suriname, as well as 13 largely English-speaking Caribbean island nations. Five British Overseas Territories from the region are also associates.

Membership to that bloc means that Guyana is a party to free trade agreements with the Dominican Republic and Costa Rica, while the Caribbean Basin Trade Partnership Act (CBTPA) offers Guyana-based businesses preferential access to the US market. The country also signed an investment cooperation and facilitation agreement with Brazil in December 2020.

Recent years have seen Guyana experience significant economic growth, with new oil discoveries driving rapid development. This makes company formation in Guyana particularly attractive right now.

The country has also seen a major rise in foreign direct investment (FDI), which grew tenfold in the five years up to 2019, when it reached USD$1.695 billion.

Biz Latin Hub can help you with company formation in Guyana

At Biz Latin Hub, our multilingual team of company formation specialists has broad experience supporting foreign executives starting businesses throughout Latin America and the Caribbean. We have offices in 18 countries around the region and trusted partners in many more. With our strong track record of providing comprehensive back-office services to foreign investors — including legal, accounting, and recruitment support — we are ready to help you achieve your business goals in Guyana.

Reach out to us now for personalized assistance or a free quote.

Learn more about our team and expert authors.