Engaging with a trusted company formation agent in the Dominican Republic could be key to ensuring the success of your business expansion. Because a local specialist can help you to overcome many of the challenges commonly faced by foreign companies when they incorporate a company in the Dominican Republic.

More and more companies are looking at the possibilities of investing in this dynamic economy. In the Caribbean, it stands out for its excellent connections to the US and elsewhere. A company formation agent in the Dominican Republic can smooth that process and explain the local system.

Learn how a company formation agent in the Dominican Republic can help you take advantage of available commercial opportunities, in a country that maintains numerous free trade agreements (FTAs) and free trade zones (FTZs), and enjoys a strategic geographic location.

When Do I Need a Company Formation Agent in the Dominican Republic?

Expanding companies are highly encouraged to engage with a company formation agent in the Dominican Republic, as this will ensure a smooth market entry and avoid the following challenges:

Language barrier: While the country’s booming tourist industry and strong cultural connections with the United States mean English is spoken to a moderate level overall, it is wise to assume that some level of Spanish will be needed in business negotiations.

Immigration bureaucracy: Like many countries in Latin America and the Caribbean, the immigration process in the Dominican Republic would benefit from some streamlining. This is true for business, investment, and residence visas, so engaging with a local expert is one way to best navigate the administrative hurdles you will face.

Taxation system: Understanding the taxation system in the Dominican Republic is crucial to maximizing your commercial benefits, as well as guaranteeing that your business upholds all legal norms in the country and avoids sanction of any kind. A company formation agent will have this knowledge, and in some cases will be able to offer you ongoing legal and accounting services even after your company has formed.

Recruiting personnel: A company formation agent in the Dominican Republic will have a sound knowledge of local labor law and will be able to guarantee that your company is prepared to adhere to all local labor regulations. Moreover, in some cases a company formation agent will actually be able to offer you recruitment and payroll outsourcing services, providing you with a recruitment service with a proven track record of finding the ideal local staff.

Types of Companies in the Dominican Republic

Before working with a company formation agent in the Dominican Republic, you must first understand the types of legal entities in the country.

Limited Liability Company: Known in Spanish as a Sociedad de Responsabilidad Limitada (SRL). This type of company requires a minimum of two shareholders which can be either natural persons or other legal entities. Regarding tax compliance, it is necessary for this type of company to file annual financial statements before tax authorities. Furthermore, the company’s account needs to undergo an annual audit.

Simplified Limited Company: A Sociedad Anónima Simplificada (SAS) is a very common type of company that also requires a minimum of two shareholders, which can be both individuals or legal entities. SAS companies generally require approximately three times the initial company capital needed to incorporate an SRL.

Limited Company: Also known as Sociedad Anónima (SA) in Spanish, a Limited Company is best suited for larger sized companies that will likely participate in the stock market.

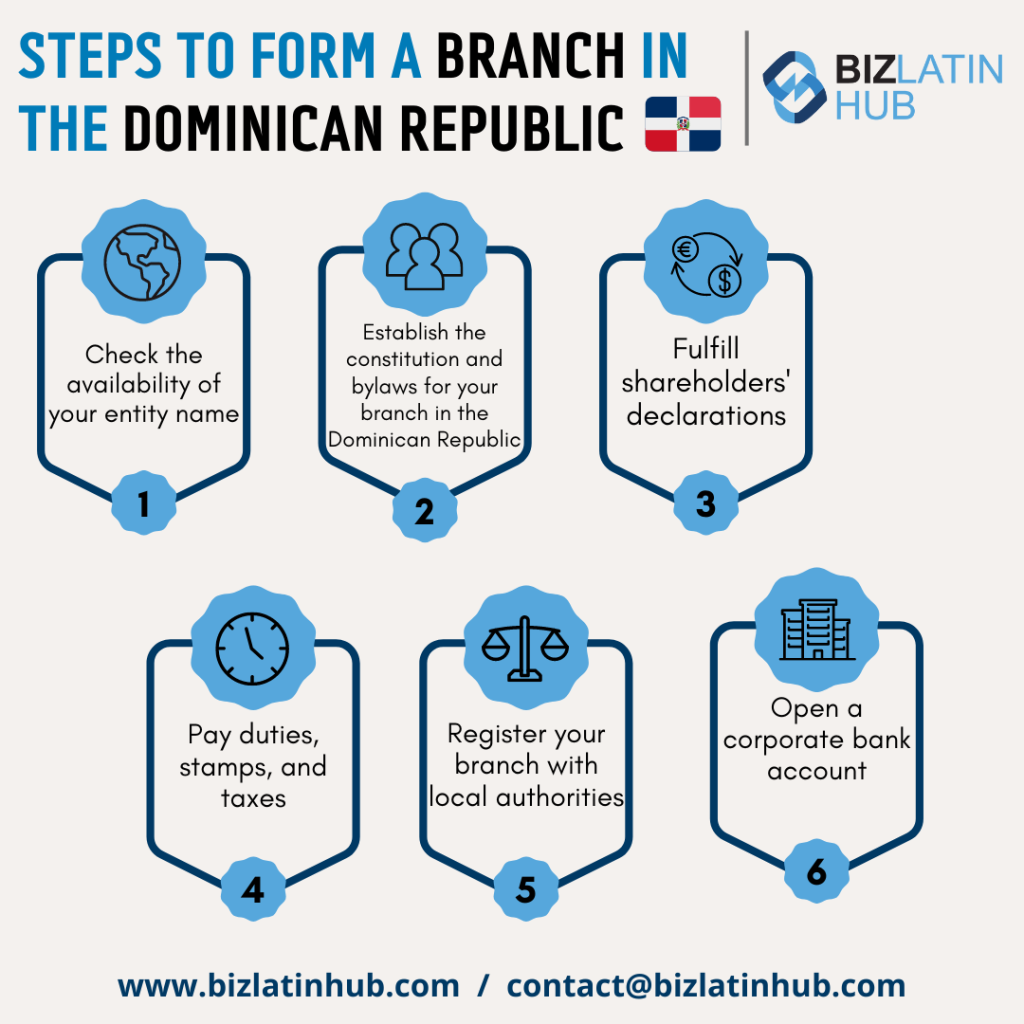

Branch: This type of legal entity is an excellent alternative for larger foreign multinational companies doing business in the Dominican Republic but who do not want to establish a full-sized entity. Branches have a number of benefit that a company formation agent can offer advice on.

Steps to Incorporate a Company in the Dominican Republic

Once you have decided on which type of company is the best for your business needs, there will be some key steps to you forming your company:

Choose the company’s name: Deciding on the name of your company is an important aspect of company formation. If you don’t already have the name in mind, a company formation agent will be able to offer advice based on their knowledge of the local market.

Draft the statutes: The statutes are the internal regulations of the company, providing a legal framework to the partners and board members in the operation and administration of the company.

Sign the charter: The charter is signed before a notary public. Once done, the company can be duly registered in the Mercantile Registry.

Payment of duties, stamps, and taxes: Before incorporating the new company, the payment of the fees, taxes, and stamps must be made.

Register the company with the tax authority and other institutions: The newly incorporated company must be registered in the National Taxpayers Registry (RNC). To do that, information about the company’s economic activity and social security obligations must be provided.

Open a corporate bank account: This is the final step of incorporating a company in the Dominican Republic. In general, you need to provide the bank with information about company activities, shareholder details, and identifications. Waiting times and requirements on what you need to provide may vary from bank to bank.

FAQs for a company formation agent in the Dominican Republic

Based on our extensive experience these are the common questions and doubts of our clients regarding company formation in the Dominican Republic:

Why is the Dominican Republic good for doing business?

The Dominican Republic is good for business due to its stable economic growth, strategic location, expanding tourism industry, and government incentives for foreign investment.

What is the Dominican Republic Company Tax ID?

The Dominican Republic Company Tax ID is the RNC (Registro Nacional de Contribuyentes), which translates in English to National Taxpayer Registry which is issued by the National Tax Authority.

How long does it take to form a business in the Dominican Republic?

It takes between 10 to 14 weeks to form a company in the Dominican Republic after all the required information and documentation is provided.

Can a foreigner own a business in the Dominican Republic?

Yes, a foreigner can own a business in the Dominican Republic.

What is an LLC called in the Dominican Republic?

The equivalent of an LLC in the Dominican Republic is called a Sociedad de Responsabilidad Limitada (SRL).

How many shareholders does it need to form a company in the Dominican Republic?

It requires a minimum of two shareholders to form a company in the Dominican Republic.

Biz Latin Hub can act as a company formation agent in the Dominican Republic

At Biz Latin Hub, our multilingual team of market entry specialists is equipped to deliver expert advice on company formation and many other aspects of doing business in the Dominican Republic. With our full suite of market entry and back-office services, we are your single point of contact to help you to enter the Dominican market in the shortest possible time.

Contact us now to discuss your expansion options.

Learn more about our team and expert authors.