If you wish to enter the local market, you must be aware of your corporate compliance in Puerto Rico. After you incorporate a business in Puerto Rico, this will kick in. Understanding and complying with local legislation will help you expand in the territory as smoothly as possible. Just like every other part of the USA, this is of paramount importance. However, you may find that a dedicated provider of back office services to help with corporate compliance in Puerto Rico is your most suitable partner.

Key Takeaways On Corporate Legal Compliance in Puerto Rico

| Is a physical address in Puerto Rico necessary for doing business? | Yes, a registered office address or local fiscal address is required for all entities in Puerto Rico for the receipt of legal correspondence and government visits. |

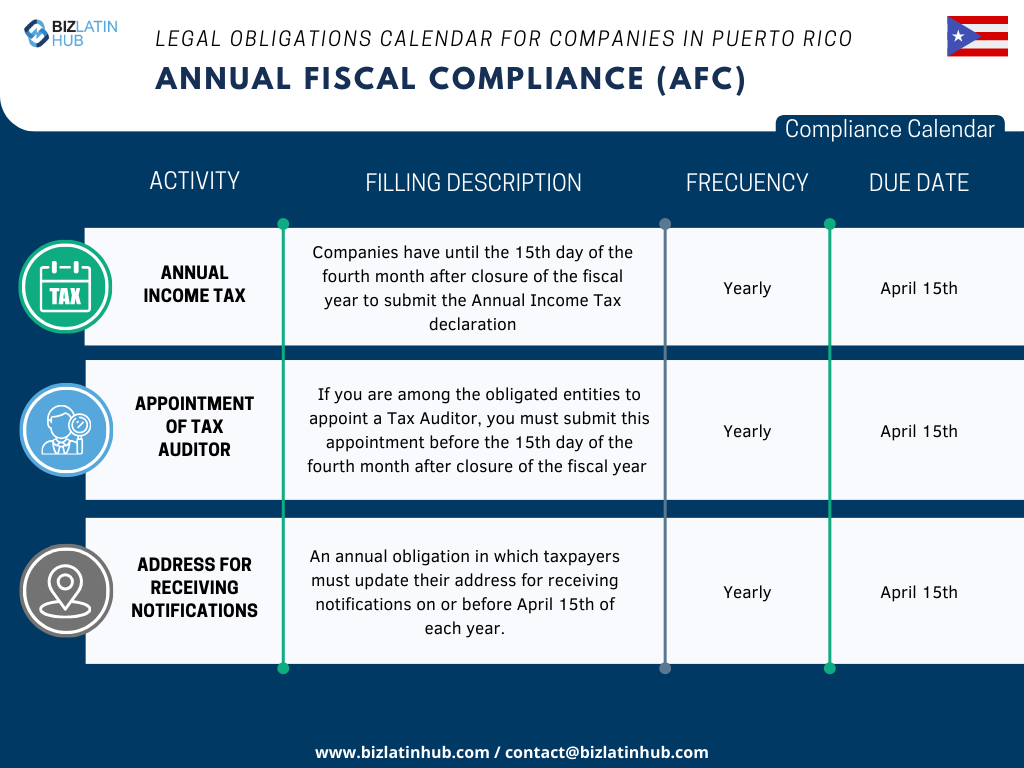

| What are the annual entity fiscal compliance requirements? | Companies in Puerto Rico have until the 15th day of the fourth month after closure of the fiscal year to submit their annual income tax declaration. |

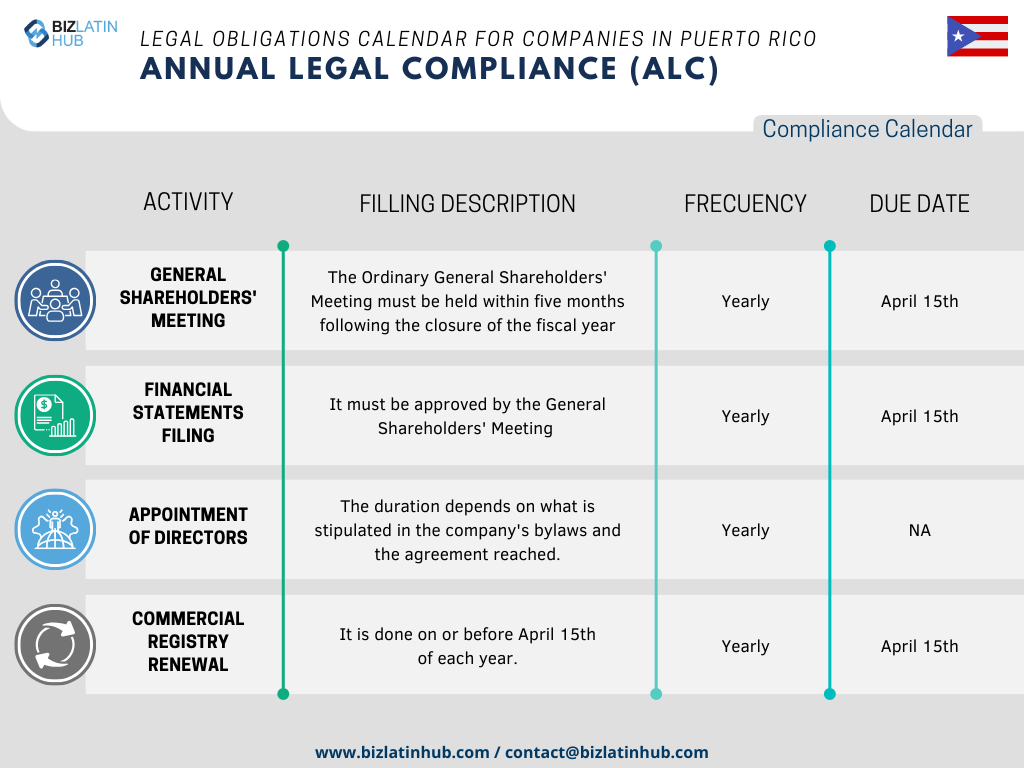

| What are the annual Entity Legal Compliance Requirements? | The ordinary general shareholders meeting must be held within five months following the closure of the fiscal year and by the deadline of April 15th in Puerto Rico. |

| What common statutory appointments do companies make in Puerto Rico? | An appointed legal representative who will be personally liable, both legally and financially for the good operation and standing of the company. If you are among the obligated entities to appoint a tax auditor, you must make this appointment too. |

| Why Choose to Invest in Puerto Rico? |

What are the key requirements for corporate compliance in Puerto Rico?

Every corporation admitted to do business in the US territory must maintain a physical office and at least one resident agent on the island.

- Resident agent: The resident agent can be an individual residing in Puerto Rico, or a legal person organized under the laws of the island, or authorized to do business there. The agent is responsible for representing the company. They will receive and process any official communication

- Legal address: A company must register a legal address in Puerto Rico to operate, undergo inspections, and receive official notifications.

Requirements established by the State Department

All corporations must file an annual report with the Department of State on or before April 15 of each year, or the next business day if it is a weekend or holiday, containing the following information:

- Name and registration number of incorporation

- Physical and mailing address of the designated office

- Name and physical address of the resident agent

- Name and postal address of at least 2 officers of the corporation who are in an established office at the date of filing the report, including that of the officer who signs the report, and the expiration dates of their respective positions

- The report must contain a status statement of the economic condition of the corporation at the close of operations during the previous calendar year

- If the business volume of the corporation exceeds USD$3 million, this report must be audited by a certified public accountant licensed in Puerto Rico

- The report must be signed by an authorized officer, a director or incorporator

LLCs will not have to file an annual report with the Department of State. They only pay annual fees in the amount of USD$150 on or before April 15 of each year, or the next business day if it is the end of the year or a holiday.

Tax obligations for companies in Puerto Rico

Companies operating in Puerto Rico must obtain a Merchant Registration Number with the Department of Treasury and declare all financial transactions to determine what taxes must be paid.

The four main taxes that any type of entity must declare and pay are:

| Tax | Declaration to the tax office |

| Income Tax: A maximum tax of 39% is applied to the earnings obtained each year. | It must be filed annually, no later than the 15th day of the fourth month following the close of the taxable year. |

| Personal property tax: The maximum tax rate is 9.83% and varies according to the municipality in which the entity is located. | It must be filed annually, no later than May 15 following the taxable year. |

| Municipal Patent: A tax of 0.5% is applied to the operations of non-financial companies, and a maximum of 1.5% for financial companies. | It must be declared each year, no later than the fifth day after April 15 following the taxable year, together with the income tax return. |

| IVU: An 11.5% tax is applied to company invoices, which must be withheld and paid to the Department of the Treasury. | All withheld tax must be declared and paid no later than the 22nd of the following month. |

What labor regulations must be followed in Puerto Rico?

Foreign executives doing business in Puerto Rico must comply with labor regulations of the territory. These regulations include:

- The national minimum wage is $10.50/hr (from July 2024)

- Companies are required to pay a December Christmas bonus if the employee meets the established requirements

- Standard working time is 8 hours per day

- Employees are entitled to paid vacation and sick days, depending on their weekly working time

When a company hires a new employee, it must register with the Department of Labor and Human Resources, the Social Security Administration, the Department of the Treasury, and the State Insurance Fund Commission. In addition, the contributions established by the labor laws of Puerto Rico will be calculated based on the salary of each employee, as follows:

| Employer Contributions | Employer Contributions (%) |

| Social Security | 6.2% |

| Medicare | 1.45% |

| State Unemployment Federal Unemployment | Up to 4.4% +1% 0.6% |

| Disability CFSE policy | 0.3% 0.7% |

| TOTAL | 14.65% (calculated from an employee’s salary) |

Types of Companies

Foreign executives who want to enter the Puerto Rican market must decide what type of company incorporation will best suit their needs. Then, they must prepare all the documents and requirements necessary to register their company with the Department of State of Puerto Rico. The most common company types in Puerto Rico are:

- Limited Liability Company (LLC): This is the most common type of company. Setting it up requires 1 or more people.

- Corporation: In a corporation, the capital stock can be divided into shares that can be transferred. In this type of company, the partners are not personally liable for corporate debts. A minimum of 3 shareholders is required and there is no maximum limit. Corporations can be classified into domestic and foreign corporations, and for-profit or non-profit corporations.

- Domestic corporations: Are those created under the General Corporations Act of Puerto Rico. That is, these are corporations of Puerto Rico.

- Foreign corporations: Those entities which were created in another jurisdiction. In order for a foreign corporation to operate on the island territory, foreign corporations must obtain authorization from the Department of State of Puerto Rico by presenting the following documents:

- A certificate of existence or its equivalent from your jurisdiction of origin, no more than 3 months old

- The name and address of the representative of the corporation who resides in Puerto Rico

- Documents showing the corporation’s assets and liabilities

- Documents showing what kind of business the corporation plans to conduct in Puerto Rico

- Names and business addresses of its current directors.

- Any other documents or data that the company believes it should include in the registry report

- For-profit corporations: Are domestic or foreign corporations where owners derive economic benefit from their operation based on their participation in the business.

- Non-profit corporations: Are domestic or foreign corporations in which the proceeds of its operation, if any, are used to promote it.

- Social benefit corporation: These are domestic or foreign corporations that have a social benefit aspect to their business, that is, their purpose is not to generate net profits, but if there is a net profit, it could be distributed to their owners.

- Partnerships: Where the main company regulates the rules and assumes the responsibilities before third parties.

Once the company is registered, entrepreneurs must comply with the corporate compliance requirements established in Puerto Rico. Some of these requirements include: requesting the employer identification number, registering with the Department of the Treasury, requesting the Merchant’s Registry, and opening a corporate bank account.

FAQs on corporate compliance in Puerto Rico

Based on our extensive experience these are the common questions and doubts of our clients on entity legal compliance in Puerto Rico:

The following are the most common statutory appointments for Puerto Rican legal entities:

– An appointed legal representative who will be personally liable, both legally and financially for the good operation and standing of the company. This should be a local national or a foreigner with the right to live/work in the country.

Yes, a registered office address or local fiscal address is required for all entities in Puerto Rico for the receipt of legal correspondence and government visits.

If you are among the obligated entities to appoint a tax auditor, you must submit this appointment before the 15th day of the fourth month after the closure of the fiscal year and by the deadline of April 15th in Puerto Rico.

The ordinary general shareholders meeting must be held within five months following the closure of the fiscal year and by the deadline of April 15th in Puerto Rico.

Companies in Puerto Rico have until the 15th day of the fourth month after closure of the fiscal year to submit their annual income tax declaration which will be by the deadline of April 15th.

Biz Latin Hub can help with corporate compliance in Puerto Rico.

At Biz Latin Hub, our team of legal and accounting specialists provides comprehensive company formation advice and guidance to support your expansion. With our full suite of bilingual market entry and back-office services, we are equipped to deliver excellence and ensure your business operations’ success in Puerto Rico.

Learn more about our team and expert authors.