In recent years, market observers have recognized a high potential for stronger Colombia-China trade relations. As many know, China is the second-largest economy in the world. Colombia is the fourth-largest economy in whole Latin America. A pairing like this offers strong potential trade channels for exporters and importers operating in Colombia.

In the last decade, all of Latin America’s economies have grown more accustomed to receiving Chinese investment and commercial attention. China is the biggest trading partner for Brazil, Chile and Peru. As part of that, Brazil received US$66 billion in Chinese investment, Peru US$25 billion and Chile US$9 billion. Chinese trade with Latin America jumped to US$225 billion in 2016 from US$12 billion in 2000, according to Jason Marczak, Director at the Atlantic Council.

We outline the potential for a stronger context for Colombia-China trade relations and opportunities for multinationals to enter the market.

Overview: current Colombia-China trade relations

With Colombia-China trade relations strengthening in recent years, China has become Colombia’s second-largest trading partner. Colombia is now China’s fifth-largest trading partner in Latin America. In 2018, Colombian imports from China reached US$4.06 billion.

Top 10 imports from China in 2018 include (table adapted from TradingEconomics):

| Colombia imports from China in 2018 | Value |

| Mineral fuels, oils, distillation products | $3.48 billion |

| Iron and steel | $297.79 million |

| Copper | $171.67 million |

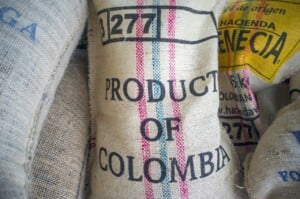

| Coffee, tea, mate and spices | $16.66 million |

| Ores slag and ash | $15.46 million |

| Raw hides and skins (other than furskins) and leather | $10.86 million |

| Sugars and sugar confectionery | $10.22 million |

| Wood and articles of wood, wood charcoal | $9.99 million |

| Animal, vegetable fats and oils, cleavage products | $9.08 million |

| Miscellaneous chemical products | $6.87 million |

Colombia exported over US$10.5 billion to China in 2018. According to current Colombian President Ivan Duque, 85% of Colombian exports to China are now petroleum products. This also includes machinery and electronics, consumer and intermediate goods, textiles and clothing, chemicals, plastic and rubber.

Chinese trade and business activity in Latin America

China’s growing foreign influence is, of course, propelled by the Belt and Road Initiative (BRI). Through this initiative, the country invests in multimillion-dollar projects in infrastructure, energy, mining, and agriculture.

According to the OECD, Chinese trade flow in Latin America was approximately US$500 billion from 2015–2019. Its foreign direct investment topped US$250 billion. The Inter-American Dialogue’s Asia and Latin America Program estimates that Beijing has loaned nearly 140 billion dollars to Latin America since 2005. 90% of those loans have gone to Venezuela, Brazil, Argentina, and Ecuador.

Strikingly, in recent years, these loans surpass what the World Bank, the IMF, and the CAF combined have loaned to South American countries, highlights Octaviano Canuto, former vice-president and executive director at the World Bank.

Opportunities for Chinese companies in Colombia

For many years, Colombia was the Latin American country with the smallest Chinese investment. However, that is changing in the last year because Chinese companies have reached deals on infrastructure-building, 5G network infrastructure, and oil and gas opportunities. This amounted to a bigger total investment than over the previous 15 years, according to the American Enterprise Institute’s China Investment Tracker.

Chinese companies investing in Colombia’s infrastructure

In October 2019, state-owned China Harbour Engineering Co. led a group of companies that won the more than US$12 billion-dollar contract to build Bogotá’s long-awaited metro system. This is the largest planned infrastructure project in the Andean country with the potential to create thousands of local jobs.

Furthermore, China Harbour Engineering Co, which joined China’s Xi’an Metro and Canada’s Bombardier Inc., will operate it for 20 years. 2 months later, a separate Chinese consortium won a US$1.1 billion contracts to construct the rail line.

Opportunities in the Colombian mining industry

In January, China’s Zijin Mining Group Co. announced its decision to buy Continental Gold Inc. for US$1 billion. This deal gives them control of the Buriticá gold mining project in Colombia, the current country’s largest project.

Mining, oil and gas are all key opportunities in Colombia for large multinationals looking to expand mining and exploration activity. Closer Colombia-China trade relations may support reduced barriers to entry into these valuable industries.

Chinese commercial activity in the renewable energy industry

Chinese firms are also increasingly financing solar and renewable energy projects around the country. A good example is the part-Chinese owned company Energías de Portugal and recently purchased wind energy projects in the northern region of La Guajira.

Sinopec, the largest Chinese state-owned company, operates now 14 oil and gas camps in the country and its exploring in other regions. In 2020, Sloane Energy will start building a thermoelectrical plant in Cesar region.

Colombia, like many other countries are turning to exploring renewable sources to generate energy. In particular, La Guajira is considered a prime location for wind energy projects, with winds classified as Class 7 (close to ten metres per second annual average). Hydropower and biomass energy are other opportunities to develop profitable renewable energy projects in Colombia.

Chinese technology in Colombia

Beyond energy and infrastructure, Chinese commercial actors are moving into other industries in Colombia. Huawei recently increased its market presence in the country. It now sells 26% of the cellphones in Colombia. Didi, Uber’s competitor, has 20,000 registered drivers, and ZTE just recently agreed to sells hundreds of video cameras to the national government.

Increasing export and import activities between China and Colombia

It is a strong goal and valuable opportunity for Colombia to expand and diversify exports to China. Duque explained that Colombia hopes to expand exports of agricultural products, including coffee, flowers, and beef to China. The government also wants to provide Chinese consumers “with the [new] type of flavours they are searching for,” as China is increasing its intake of “Latin American flavours” which have found their way onto the dinner tables of Chinese homes. This interest in Colombian food and produce brings more opportunities for agricultural and packaged food trade between China and Colombia.

Colombia-China cooperation in artificial intelligence and the internet of things

There is also a possibility for cooperation in the fields of artificial intelligence (AI) and the Internet of Things (IOT). Such cooperation helps further strengthen Colombia-China trade relations, noting that some Chinese companies are already working on IOT in Colombia.

Preference for Colombian tourism, culture and education

On the other hand, the annual number of Chinese tourists to Colombia is only 15,000, which is considered low.

As a result, there is a big opportunity to use the growing Colombia-China bilateral partnership to boost tourism, and cultural and academic exchanges between both countries. In fact, David Mauricio Castrillon, a teacher at the Universidad Externado de Colombia, observed that there are growing Chinese investments in smaller Colombian industries, such as hotels and consumer industries.

Take advantage of Colombia-China trade relations

China and Colombia are looking for ways to strengthen their bilateral trade relationship. As a result, there are plenty of business and trade opportunities for multinationals emerging in both countries. However, it can be very challenging when engaging in foreign investment and other international business operations. Therefore, it is strongly recommended to seek professional guidance and assistance.

Biz Latin Hub has vast experience in doing business in Latin America. Our multilingual team of local lawyers and expert accountants provides a wide range of market entry and back-office services. We ensure high-quality work by supporting your business with tailor-made solutions. Take advantage of advice from our trade law specialists and other legal providers, hiring and recruitment services, taxation and accounting, visa procedure assistance, payroll management, and other professionals.

Get in touch with us to start your international business adventure now.

Learn more about our team and authors.