As technology continues to transform economies globally, Central America is experiencing a surge in tech and innovation hubs, with several cities emerging as vibrant centers for startups, incubators, and accelerators. This article showcases some of the most promising Central American cities that are cultivating tech ecosystems and explores the potential impact of online banking and cryptocurrency revolutions on the region’s development.

SEE ALSO: Nearshoring in Guatemala: What are the Benefits?

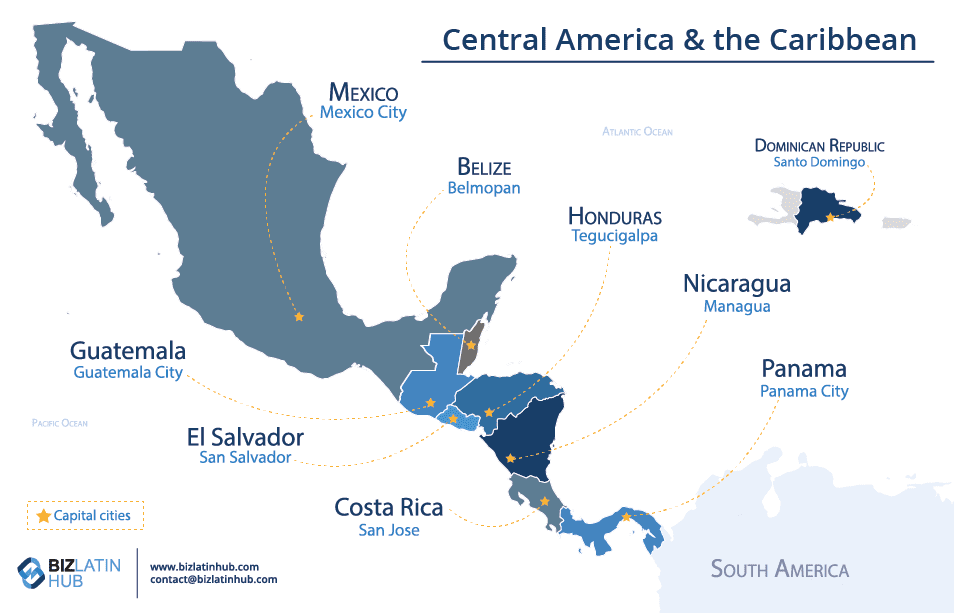

- San José, Costa Rica.

- Panama City, Panama.

- Guatemala City, Guatemala.

1. San José, Costa Rica: A Blossoming Startup Ecosystem

San José, the capital of Costa Rica, is increasingly becoming a hub for technology and innovation. With its highly educated workforce, stable political environment, and commitment to sustainability, the city has attracted numerous startups, incubators, and accelerators. Additionally, the Costa Rican Investment Promotion Agency (CINDE) has been instrumental in promoting the country as an ideal destination for foreign investment in the tech sector.

2. Panama City, Panama: The Gateway to Latin America’s Tech Scene

Panama City, with its strategic location and thriving economy, has emerged as a significant player in the Latin American tech ecosystem. The city boasts a City of Knowledge technology park, which has become a hub for research, innovation, and entrepreneurship. The government’s commitment to fostering a business-friendly environment has attracted various tech companies and startups, positioning Panama City as a gateway to the region’s tech scene.

3. Guatemala City, Guatemala: Fostering Innovation and Collaboration.

Guatemala City is another Central American city making strides in tech and innovation. With a growing number of startups, incubators, and accelerators, the city is fostering an environment of collaboration and innovation. The Tecnológico de Monterrey’s Campus TEC has played a crucial role in nurturing the local tech ecosystem by offering coworking spaces, training programs, and networking opportunities to entrepreneurs and startups.

The Impact of Online Banking and Cryptocurrency on Central America’s Tech Hubs

Online banking and cryptocurrencies are poised to revolutionize the financial landscape in

Central America, impacting the growth of tech and innovation hubs in several ways:

- Financial Inclusion

- Cross-border Transactions

- Innovation in Fintech

- Regulatory Environment

- Financial Inclusion: With a large percentage of the Central American population being unbanked or underbanked, online banking and cryptocurrencies can help promote financial inclusion by providing accessible and affordable financial services. This increased access to financial services can, in turn, spur innovation and entrepreneurial activity in the region’s tech hubs.

- Cross-border Transactions: As technology startups in Central America look to expand beyond their borders, online banking, and cryptocurrencies can facilitate faster, cheaper, and more secure cross-border transactions. This can help attract foreign investment and talent, boosting the growth of the region’s tech ecosystems.

- Innovation in Fintech: The rise of online banking and cryptocurrencies can stimulate innovation in the fintech sector, encouraging the development of new products and services tailored to the unique needs of Central American consumers and businesses. This can lead to the emergence of more fintech startups, accelerators, and incubators in the region’s tech hubs.

- Regulatory Environment: As online banking and cryptocurrencies gain traction in Central America, governments in the region will need to establish clear regulatory frameworks to protect consumers and businesses while fostering innovation. A supportive regulatory environment can encourage more tech startups to enter the fintech space and contribute to the growth of the region’s tech ecosystems.

Central America’s Tech Revolution: Online Banking and Cryptocurrencies Drive Economic Development

Central American cities such as San José, Panama City, and Guatemala City are emerging as tech and innovation hubs, driven by a growing ecosystem of startups, incubators, and accelerators. The ongoing revolution in online banking and cryptocurrencies has the potential to significantly impact the growth and development of these tech ecosystems, by promoting financial inclusion, facilitating cross-border transactions, stimulating innovation in fintech, and encouraging the establishment of supportive regulatory environments.

As the region continues to embrace digital transformation, online banking, and cryptocurrencies will play a pivotal role in shaping Central America’s tech and innovation landscape. This, in turn, will help unlock new opportunities for entrepreneurs, investors, and businesses, fostering economic growth and development throughout Central America.

Governments, private sector stakeholders, and educational institutions will need to collaborate to create an enabling environment that nurtures innovation and ensures that the benefits of the digital revolution are accessible to all. With the right support and resources, Central American cities can continue to thrive as tech and innovation hubs, contributing to the region’s overall economic prosperity and global competitiveness.

Biz Latin Hub can help you expand into Central America’s Tech Hubs

We welcome the opportunity to provide you with our professional company formation and back-office services in Central America.

At Biz Latin Hub, we are a market leader in supporting businesses from all over the world to start their business in Central America.

Our team of qualified, multilingual professionals in Central America provides a suite of customizable market entry and back-office services to support your expansion. Contact us now for more information and become part of the Central American business scene. Learn more about our team and expert authors.