Explore the comprehensive guide to doing business in Uruguay in 2025, including steps for company registration, legal compliance, and key investment opportunities for foreign entrepreneurs.

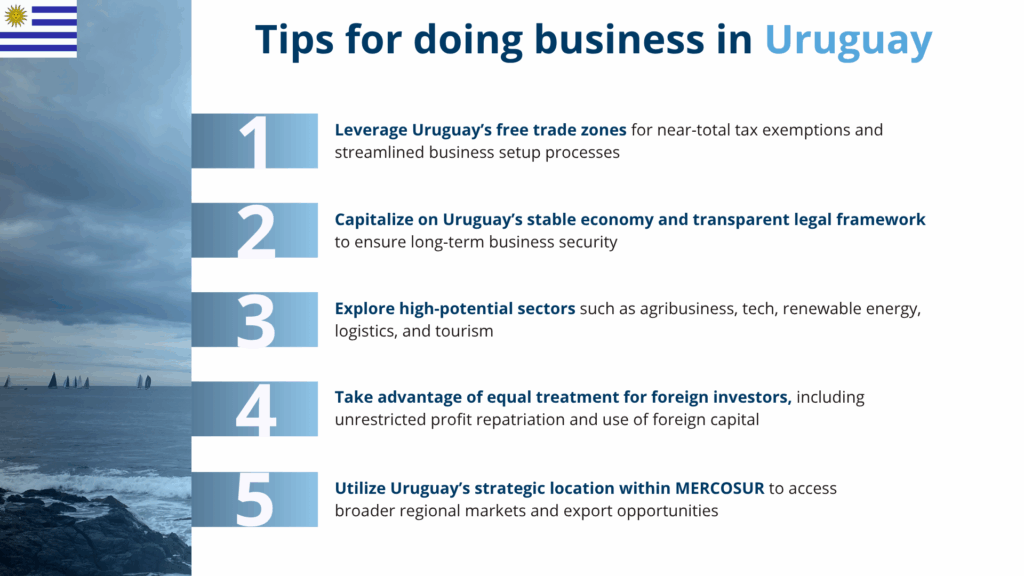

Doing business in Uruguay in 2025 presents a strategic opportunity for foreign investors, thanks to its stable economy, transparent regulations, and investor-friendly policies. This growth in foreign investment is associated to its attractive free zones, free trade agreements, as well as its participation in Mercosur, ALADI and other regional blocks. With a bright future, company formation in Uruguay is a good bet for the years to come. Companies doing business in Uruguay benefit from its central location within MERCOSUR, a skilled workforce, and a commitment to technological advancement.

Key takeaways on doing business in Uruguay

| Is foreign ownership allowed in Uruguay? | 100% ownership is permitted. Additionally, the law states there is no restriction on the transfer of profits abroad or on the use of foreign capital, allowing for free movement of capital and bank secrecy. |

| Most important sectors in Uruguay | Agriculture accounts for the bulk of exports, while the industrial sector punches above its weight for the size of the country. Services dominate, with tourism and finance standing out for opportunities. |

| Are there Free Trade Zones in Uruguay? | Uruguay currently has 11 free economic zones, most of them located in the metropolitan area, Montevideo. The companies that settle in these zones of Uruguay have an almost absolute tax exemption. |

| Are there incentives for Foreign Direct Investment in Uruguay? | Foreign companies are treated identically to locals. Some of the most attractive tax incentives for companies doing business in Uruguay are: Exemption from Tax on Income from Economic Activities (IRAE) Exemption from Wealth Tax (IP) for civil works of approximate duration of 10 years Refund of the Value Tax through credit certificates. |

| What international links does the country have? | Uruguay is a founding member of Mercosur and is a member of ALADI and other regional blocks. There are also a number of free trade agreements with countries across the world. |

Doing business in Uruguay

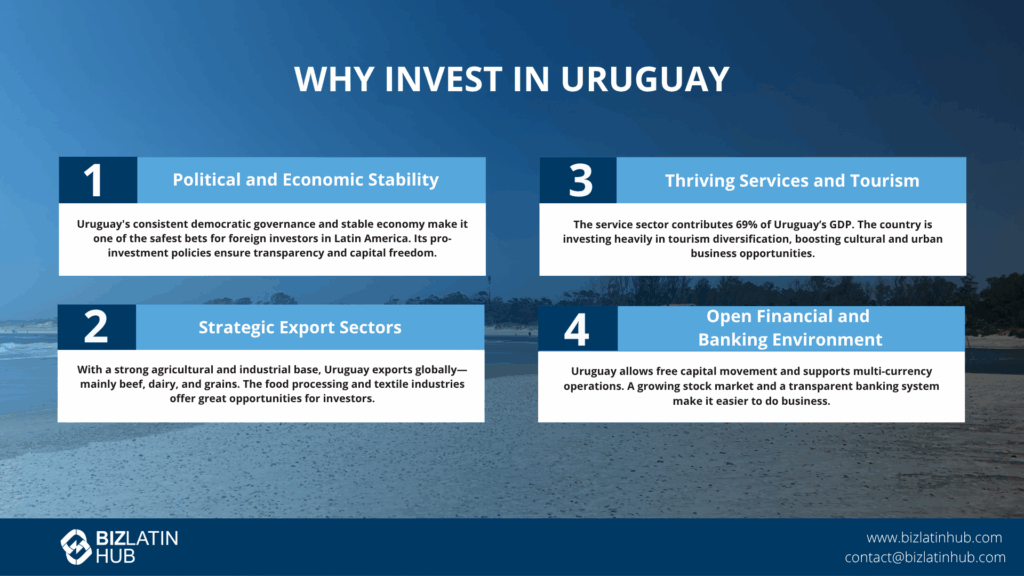

Uruguay is a small country with approximately 3,500,000 inhabitants. It is a founding member of Mercosur and for the last decade its political and economic stability has attracted the attention of foreign investors seeking to incorporate a company and do business in Uruguay.

The country has a pro-investment policy that eliminates restrictions on the use of foreign capital, allowing for free movement of capital and bank secrecy.

The country’s main exports are agricultural, mainly beef, dairy products and various crops. The main export destinations were China (28%), the European Union (15%), Brazil (14%), Argentina (9%) and the United States (6%) (World Bank, 2024).

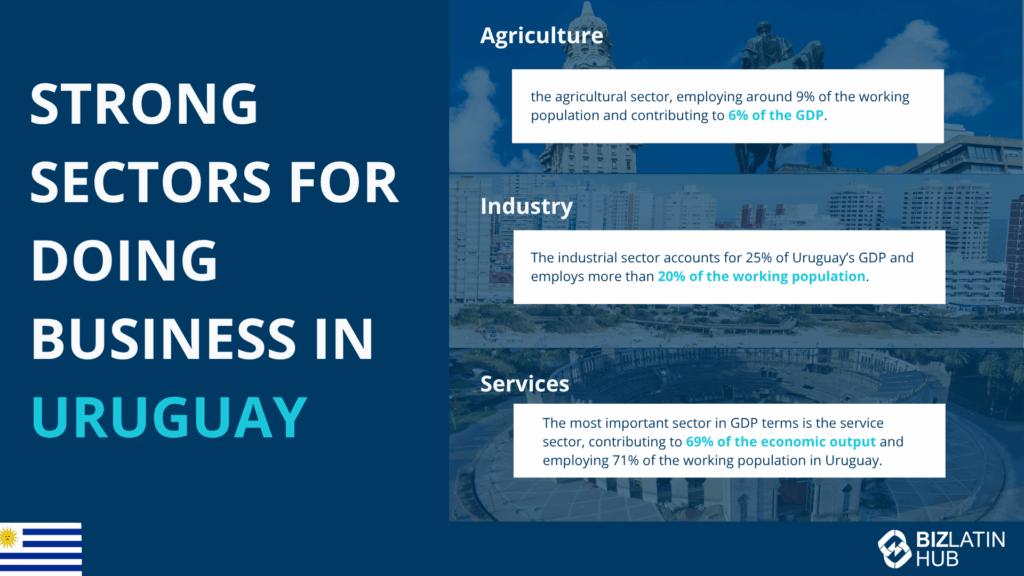

The country has a diverse and mature business environment, positioning itself as one of the best countries to set up a business in Latin America. Furthermore, Uruguay’s economic activity is divided into three major sectors: agriculture, industry and services.

The largest field for exports is the agricultural sector, employing around 9% of the working population and contributing to 6% of the GDP. A major share in this rate is occupied by the fishing industry, livestock breeding (especially cattle) and food products, such as rice and wheat.

The industrial sector accounts for 25% of Uruguay’s GDP and employs more than 20% of the working population. The most important industrial fields are food processing of animals and agricultural products, very attractive industries for those investors who want to set up a business in Uruguay. Other important sectors include wine production and textile manufacturing.

The most important sector in GDP terms is the service sector, contributing to 69% of the economic output and employing 71% of the working population in Uruguay.

The tourism service field is the most important area of the tertiary sector in Uruguay. According to Carlos Fagetti, the director of National Tourism, “Uruguay is investing in the diversification of the tourism sector”. This kind of diversification seeks to stimulate the cultural sector in different cities of the country, increasing the opportunities to set up a business in Uruguay.

Elsewhere, the financial system in Uruguay promotes foreign currency operations and a high amount of capital transactions. Furthermore, Uruguay’s stock market has been growing continuously in the last decade, especially because of its large primary stock market.

Laws that promote business in Uruguay

The Uruguayan government is constantly working on creating new incentives to encourage investment in the country through a series of laws and reforms. Key sectors for doing business in Uruguay include agribusiness, renewable energy, information technology, logistics, and tourism, each offering unique opportunities for investment and growth. Here are some of the most important laws to in keep in mind while doing business in Uruguay:

Law for the Protection and Promotion of National and Foreign Investments

Law 16.906 was approved in 1998 with the main objective of providing equal conditions for national and foreign investors. Additionally, the law states there is no restriction on the transfer of profits abroad and a series of tax incentives are applied to both local and foreign investors.

Some of the most attractive tax incentives for companies doing business in Uruguay are:

- Exemption from Tax on Income from Economic Activities (IRAE) if requirements specially demanded in the law are met

- Exemption from Wealth Tax (IP) for civil works of approximate duration of 10 years

- Refund of the Value Tax through credit certificates.

Special Regime of Free Economic Zones

The Special Regime of Free Economic Zones has as its main objective to promote investments, generate employment, promote activities with high technological content and innovation, and favor the country’s insertion in the dynamics of international trade of goods and services, among others.

Uruguay currently has 11 free economic zones, most of them located in the metropolitan area, Montevideo. The companies that settle in these zones of Uruguay have an almost absolute tax exemption, with the only exception of the contribution of social security to their workers.

Goods, services, merchandise and raw materials can be imported and exported to and from the free economic zones exempt from any tax. Additionally, the business creation processes within these zones in Uruguay only take 9 weeks. Compared to other free economic zones in the world, this is a highly competitive duration of time for the formation of a company. This allows you to more quickly start doing business in Uruguay.

There are several specialized and suitable zones offering the latest technology and the greatest ease for the provision of your services. Some of the best known are:

- Aguada Park

- Zone America

- Science Park

- World Trade Center Free Zone.

Why Uruguay Remains a Prime Investment Destination in 2025

Uruguay continues to be a top choice for foreign investors in 2025, offering a stable political environment, strategic geographic location, and a pro-business government. The country’s commitment to infrastructure development and economic diversification further enhances its appeal.

Key reasons to invest in Uruguay:

- Stable Economy – Uruguay boasts one of the most stable and prosperous economies in Latin America, with consistent growth and low inflation.

- Transparent Regulations – The country’s transparent legal and regulatory framework facilitates ease of doing business.

- Extensive Trade Agreements – Uruguay has numerous free trade agreements, providing access to markets around the world.

- Skilled Workforce – A highly educated and skilled workforce supports diverse business operations.

- Innovation and Technology – Uruguay’s commitment to innovation and technology makes it an ideal destination for companies looking to expand their horizons.

Local Tip:

When establishing a presence in Uruguay, consider leveraging the benefits of special economic zones and government incentives to maximize operational efficiency and cost savings.

Foreign business and investment in the technology sector

Uruguay’s modern technological infrastructure and skilled labor position it as a technological leader in Latin America. This has attracted many companies in the technology sector to do business in Uruguay.

One of the best examples of foreign multinational interest in the country is Google, who in 2019 announced its installation in the country with the construction of its data center in the Science Park free economic zone.

In April 2019, Uruguay became the first country in Latin America to launch 5G technology in its territory. The implementation of this technology is crucial for the development of artificial intelligence and big data management. In this sense, it is notable that Uruguay is taking the initiative for its implementation.

Technology companies interested in doing business in Uruguay and using the country as a platform for its global expansion can take advantage of the following factors:

- World-class solutions

- Start-ups and an innovative entrepreneurship ecosystem

- Committed, competitive and highly qualified STEM talent

- ICT Exports 100% exempt from Income Tax.

Depending on the activities carried out by technology companies, they are now eligible for certain additional tax exemptions supporting their growth, attracting new companies to invest and do business in Uruguay.

Company formation in Uruguay

Doing business in Uruguay requires compliance with local regulations, including company registration with the National Trade Register (RNC), obtaining a Tax Identification Number (RUT), and adhering to labor and tax laws.

To start a company in Uruguay, foreign investors must choose a legal structure (commonly a Sociedad de Responsabilidad Limitada or Sociedad Anónima), register with the National Trade Register (RNC), obtain a Tax Identification Number (RUT) from the General Tax Directorate (DGI), and comply with local labor and tax regulations. The process typically takes 4–6 weeks with proper legal assistance.

Local Insight for 2025:

Uruguay’s commitment to economic diversification and infrastructure development continues to create new opportunities for foreign investors, particularly in sectors aligned with sustainable growth and innovation.

FAQs on doing business in Uruguay

Answers to some of the most common questions we get asked by our clients.

1. Can a foreigner own a business in Uruguay?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals). Additionally, the law states there is no restriction on the transfer of profits abroad or on the use of foreign capital, allowing for free movement of capital and bank secrecy.

2. Are there Free Trade Zones in Uruguay?

| Uruguay currently has 11 free economic zones, most of them located in the metropolitan area, Montevideo. The companies that settle in these zones of Uruguay have an almost absolute tax exemption, with the only exception of the contribution of social security to their workers. Goods, services, merchandise and raw materials can be imported and exported to and from the free economic zones exempt from any tax. Additionally, the business creation processes within these zones in Uruguay only take 9 weeks. Compared to other free economic zones in the world, this is a highly competitive duration of time for the formation of a company. This allows you to more quickly start doing business in Uruguay. There are several specialized and suitable zones offering the latest technology and the greatest ease for the provision of your services. Some of the best known are: Aguada Park Zone America Science Park World Trade Center Free Zone. |

3. How long does it take to register a company in Uruguay?

The incorporation process usually takes around one to two weeks, depending on various factors such as the complexity of the company structure and the efficiency of the registration authorities.

4. Which sectors are important in Uruguay?

The largest field for exports is the agricultural sector, employing around 9% of the working population and contributing to 6% of the GDP. A major share in this rate is occupied by the fishing industry, livestock breeding (especially cattle) and food products, such as rice and wheat.

The industrial sector accounts for 25% of Uruguay’s GDP and employs more than 20% of the working population. The most important industrial fields are food processing of animals and agricultural products, very attractive industries for those investors who want to set up a business in Uruguay. Other important sectors include wine production and textile manufacturing.

The most important sector in GDP terms is the service sector, contributing to 69% of the economic output and employing 71% of the working population in Uruguay.

The tourism service field is the most important area of the tertiary sector in Uruguay. According to Carlos Fagetti, the director of National Tourism, “Uruguay is investing in the diversification of the tourism sector”. This kind of diversification seeks to stimulate the cultural sector in different cities of the country, increasing the opportunities to set up a business in Uruguay.

Elsewhere, the financial system in Uruguay promotes foreign currency operations and a high amount of capital transactions. Furthermore, Uruguay’s stock market has been growing continuously in the last decade, especially because of its large primary stock market.

5. Does Uruguay have trade agreements with other countries?

Uruguay is a founding member of Mercosur and is a member of ALADI and other regional blocks. There are also a number of free trade agreements with countries across the world.

6. What entity types offer Limited Liability in Uruguay?

The Sociedad por Acciones (S.A) and Sociedad de Responsabilidad Limitada (S.R.L) both provide limited liability protections to their owners in Uruguay.

7. Is Uruguay a good country for doing business in 2025?

Yes. Uruguay offers a stable economy, transparent regulations, and investor-friendly policies, making it an attractive destination for foreign businesses.

8. How long does it take to start a company in Uruguay?

With legal support, incorporation and registration can take approximately 4 to 6 weeks, depending on the business structure and sector.

9. What types of businesses succeed in Uruguay?

Businesses in agribusiness, renewable energy, information technology, logistics, and tourism thrive due to Uruguay’s strategic advantages and supportive regulatory environment.

Biz Latin Hub supports you to expand your business in Uruguay

The beneficial Uruguayan market allows investors easy access to international markets, free economic zones, growing industries and tax incentives, thus maximizing the profitability of their business. If you’re considering doing business in Uruguay in 2025, Biz Latin Hub offers comprehensive support for company formation, legal compliance, and strategic market entry.

At Biz Latin Hub, we help entrepreneurs and multinationals enter the Uruguayan market and carry out their commercial operations in compliance with the law. Our local team of attorneys and accountants can assist you with legal representation, company incorporation, visa services, and more.

Contact us here at Biz Latin Hub for personalized information on how we can help you expand your business in Uruguay and Latin America.