Find out how the special economic zones of Panama can support your expanding business in Central America.

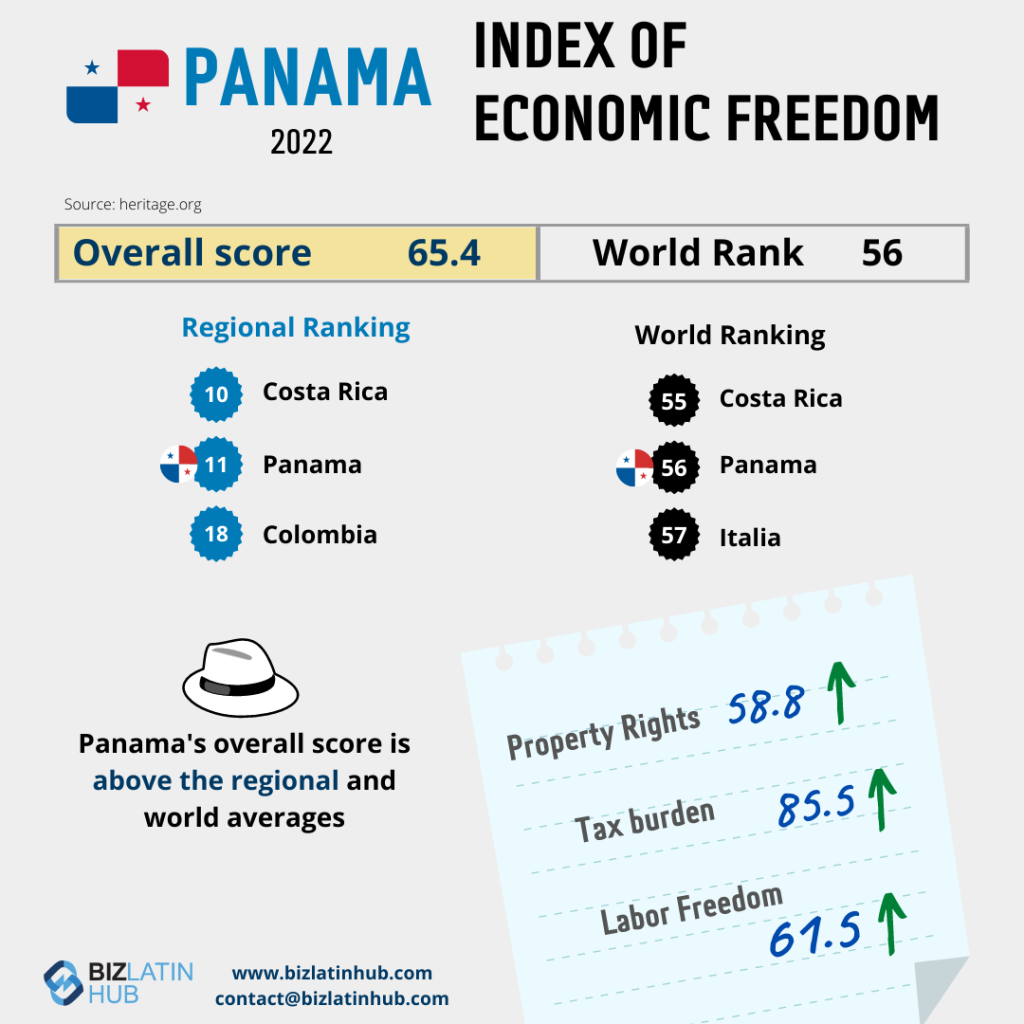

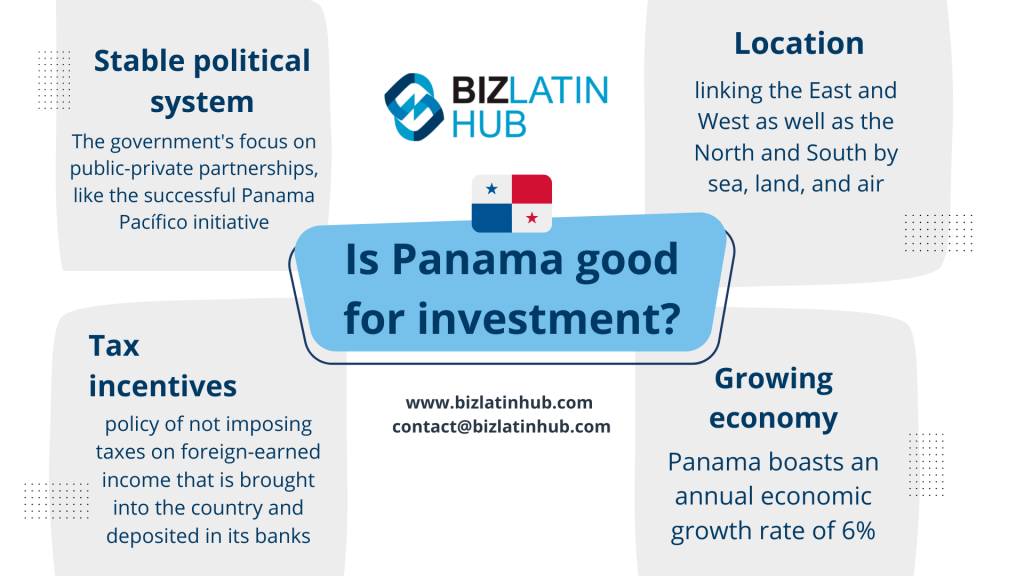

It has one of the strongest and stable economies of Central America and the special economic zones of Panama are absolutely central to this. This consistent growth supports increasing business confidence in establishing a company in Panama.

If your business is related to import and export goods, it is the country you’re looking for to start expanding. The special economic zones of Panama offer wide-ranging benefits to companies operating within them.

However, in recent years the country has opened new zones that focus more on service provision alongside the classic import/export model.

Choosing the right special economic zone in Panama for your business needs depends on the location where you want to trade goods from, and/or your principal business activity. Biz Latin Hub can help you do just that. We make sure you stay fully compliant and allow you to focus on what you do best: running your business.

How do special economic zones in Panama benefit business?

The special economic zones in Panama offer benefits related to immigration, labor and fiscal incentives to encourage foreign investment into the country. Depending on your commercial focus, each special economic zone offers a different set of incentives to suit different business models.

The most important special economic zones in Panama are the following:

- Colon Free Zone

- Panama Pacifico

- City of Knowledge.

Establishing your company in the Colon Free Zone in Panama

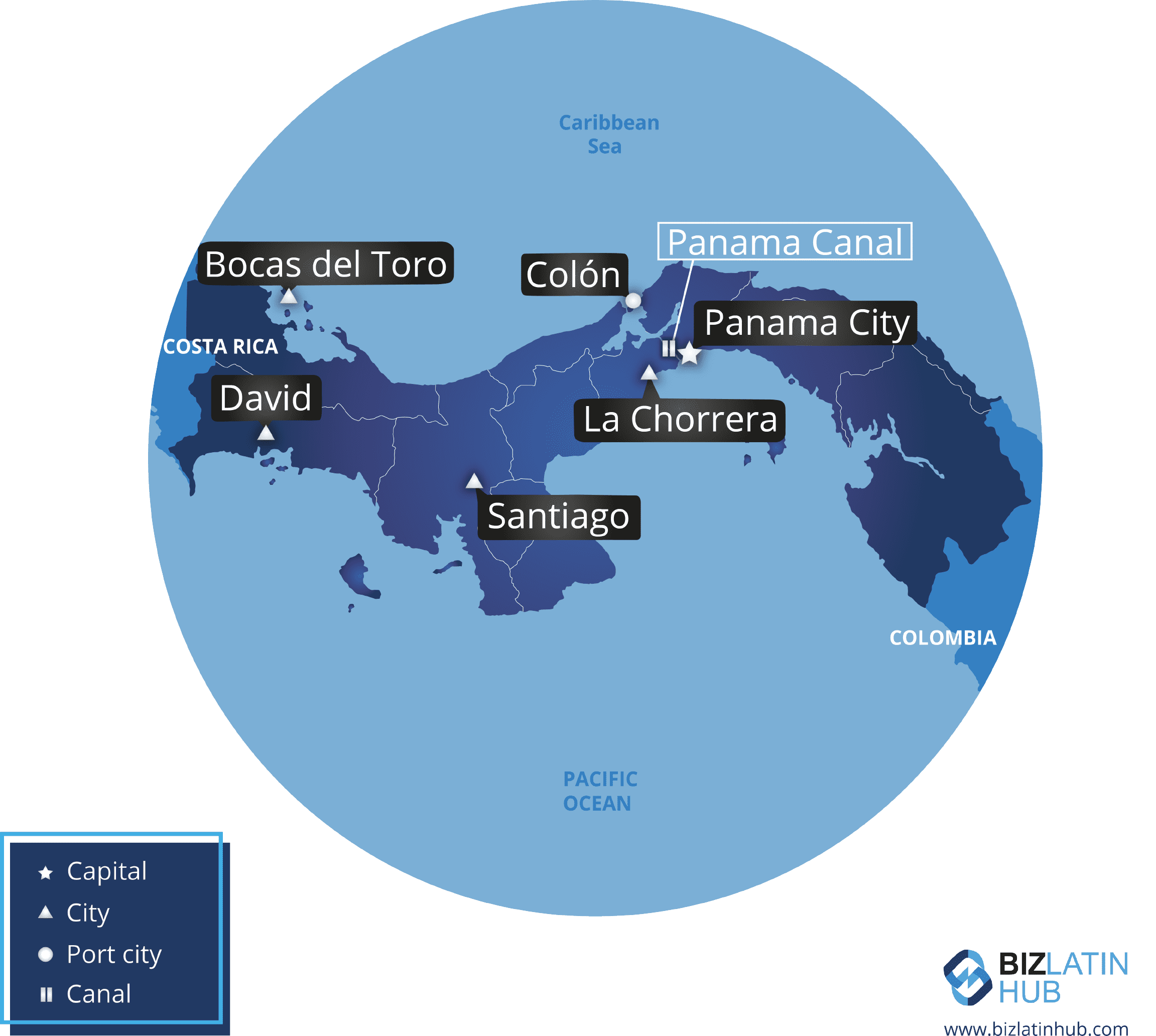

The Colon Free Zone in Panama was the first special economic zone established in the country, in 1984. This special economic zone is divided into 9 different sectors covering 1,064 hectares and housing more than 1,800 local and foreign companies.

The principal purpose of the Colon Free Zone in Panama is to attract foreign businesses by offering tax exemptions to companies that import goods and reexport them outside of the country.

What are the available incentives for businesses in the Colon Free Zone?

- Tax exemption on imports, re-exports and manufacturing of goods

- Tax exemption on re-export incomes

- Tax exemption on invoicing

- Tax exemption on other national or provincial taxes

- Low cost on the rent of land, building or any required spaces

- Migratory facilities for foreign executives

- Digitalized security system

- A large financial network of national and international banks

- Sales through e-commerce.

Incorporate your company in Panama Pacifico

The Panama Pacifico special economic zone is the newest of its kind in the country. In this zone, businesses can access major technological advances while conducting commercial activities. Establishing your company in Panama Pacifico will grant your company similar benefits to the Colon Free Zone, but you would instead be located near the Pacific Ocean.

This special economic zone incentivizes the development of different business sectors such as logistics, sea and air transportation, high-technology and innovation, call centers and shared services.

The Panama Pacifico special economic zone allows the entrance of any kind of business. This means that even if your company is not a beneficiary of local exemptions, you can offer your services to all the companies already allocated within the special economic zones.

Which commercial activities receive tax exemptions in the Panama Pacifico special economic zone?

- Direction, administration and/or operations support

- Strategic planning services

- Business development

- Management and/or training of personnel

- Operations and/or logistics control

- Technical assistance

- Technical, logistical market support

- Management or administration, financial, treasury and accounting

- Import and export activities

Tax incentives in the Panama Pacifico special economic zone

- Income tax declarations (5%)

- Exempt Dividend tax

- Exempt the Valued Added tax (called ITBMS in Panama)

- Reduce withholding tax of 2%

Other incentives in the Panama Pacifico special economic zone

- Integrated Procedures System: inside Panama Pacifico, companies can access the necessary public institutions to apply for licenses or permits.

- Single Record: Panama Pacifico facilitates the procedure of establishing the company in Panama Pacifico by allowing business owners to undertake all the necessary processes with one single entity located inside the special economic zone.

- Education centers: inside this special economic zone, companies will also have at your disposal schools if needed.

- Private institutions such as banks, pharmacies, restaurants, gyms, among others.

- Fixed rates for overtime (maximum 25%) and for work done on holidays

- The weekly rest days are negotiable between the employer and the employees. According to the Panamanian Labor code, the rest days are on Sunday.

- Companies can be open for business, even in National Holidays.

- A 15% foreign labor force is allowed (only 10% is permitted outside of the zone according to the Panamanian Labor code).

- All work permits and residence visas can be obtained at Panama Pacifico authority facilities.

- All types of residence visas obtained in Panama Pacifico can be extended for the direct family members (Sons or Parents).

- Foreign staff hired as specialists have the right to import 100% duty-free, for a single time, all types of articles for personal or domestic use, up to the sum of USD100,000

- Investment stability law: this benefit will allow your company to maintain the benefits obtained for 10 years, even if the law that granted the benefits change.

Is the City of Knowledge the special economic zone for you?

The City of Knowledge is another of the 3 more important special economic zones in Panama. This special economic zone encourages the development of new technologies, granting labor, immigration and tax benefits to companies that establish themselves to create or develop any kind of technologies that promote the development of Panama.

The City of Knowledge as a main special economic zone in Panama focuses on boosting the innovative and competitive capacities of the users that are in the compound.

Which benefits are offered by the City of Knowledge?

Taxes

- The import of products such as equipment, furniture or machines that are important for the development of the companies that are located in the City of Knowledge will be exempt from all taxes, contributions, and fees.

- The purchase or sales of machines, equipment, furniture and services that are necessary to the development of the company inside of these special economic zones in Panama will also be exempt from Valued Added Tax, in Panama called (ITBMS).

The production, processes of high-tech goods, assembly or similar services provided by companies located in the City of Knowledge in Panama will benefit from the following incentives:

- All the operations, transactions, and procedures will be completed free of National taxes, contributions and fees.

- The capital of the company will also be exempt from direct national tax, including patent, trademark or any kind of license taxes.

Migratory

The State will grant special visas to foreign personnel who enter the country to contribute to the development of the City of Knowledge project.

Labor

The companies affiliated with this special economic zone can hire the foreign personnel needed to carry out their tasks.

FAQs on Free Trade Zones in Panama

Yes, foreign companies can operate a company in a Free Trade Zone in Panama by following the designated registration procedure and fulfilling regulatory requirements.

Yes, but it is relatively inocuous. Expect to pay a few thousand USD to set up and then ongoing annual costs around the same, although this varies widely according to sector, company size and free trade zone.

It depends on which trade zone you are in.

In the City of Knowledge:

The import of products such as equipment, furniture or machines that are important for the development of the companies that are located in the City of Knowledge will be exempt from all taxes, contributions, and fees.

The purchase or sales of machines, equipment, furniture and services that are necessary to the development of the company inside of these special economic zones in Panama will also be exempt from Valued Added Tax, in Panama called (ITBMS).

The production, processes of high-tech goods, assembly or similar services provided by companies located in the City of Knowledge in Panama will benefit from the following incentives:

All the operations, transactions, and procedures will be completed free of National taxes, contributions and fees.

The capital of the company will also be exempt from direct national tax, including patent, trademark or any kind of license taxes.

In Panama Pacifico:

Income tax declarations (5%)

Exemption on Dividend tax

Exemption on the Valued Added tax (called ITBMS in Panama)

Reduced withholding tax of 2%

Integrated Procedures System: inside Panama Pacifico, companies can access the necessary public institutions to apply for licenses or permits.

Single Record: Panama Pacifico facilitates the procedure of establishing the company in Panama Pacifico by allowing business owners to undertake all the necessary processes with one single entity located inside the special economic zone.

Education centers: inside this special economic zone, companies will also have at your disposal schools if needed.

Private institutions such as banks, pharmacies, restaurants, gyms, among others.

Fixed rates for overtime (maximum 25%) and for work done on holidays

The weekly rest days are negotiable between the employer and the employees. According to the Panamanian Labor code, the rest days are on Sunday.

Companies can be open for business, even in National Holidays.

A 15% foreign labor force is allowed (only 10% is permitted outside of the zone according to the Panamanian Labor code).

All work permits and residence visas can be obtained at Panama Pacifico authority facilities.

All types of residence visas obtained in Panama Pacifico can be extended for the direct family members (Sons or Parents).

Foreign staff hired as specialists have the right to import 100% duty-free, for a single time, all types of articles for personal or domestic use, up to the sum of USD100,000

Investment stability law: this benefit will allow your company to maintain the benefits obtained for 10 years, even if the law that granted the benefits change.

The Colon free zone:

Tax exemption on imports, re-exports and manufacturing of goods

Tax exemption on re-export incomes

Tax exemption on invoicing

Tax exemption on other national or provincial taxes

Low cost on the rent of land, building or any required spaces

Migratory facilities for foreign executives

Digitalized security system

A large financial network of national and international banks

Sales through e-commerce.

Very few, although you will find that not every type of company can operate in every free trade zone. This is why it is so important to choose the correct zone for you.

Yes, absolutely. It does depend on the zone though. Panama Pacifico is generally best for this, with the City of Knowledge also standing out if you are investing in tech-based services.

Biz Latin Hub can help you enter the special economic zones of Panama

There are many benefits to establishing your company in Panama. To be able to take advantage of the special economic zones in Panama, you’ll need to seek advice from experienced local experts.

At Biz Latin Hub, we can assess your needs and determine which special economic zone in Panama may be the best fit for your business, allowing you to expand safely and in full compliance with local regulations.

Given the favorable conditions in the country and the region as well as the economic growth, Biz Latin Hub through its company a Panamanian company Business Services offers the experience and support necessary for investors to have a successful market entry in Panama. Feel free to contact us now.