Understanding the types of companies in Australia is essential for choosing the right corporate structure when opening a company in Australia. Understanding and adhering to all legal and accounting requirements specific to the types of companies is paramount for smooth operations and compliance. Collaborating with local experts allows you to navigate the regulatory framework with confidence and clarity. Whether opting for flexibility or liability protection, at Biz Latin Hub, we provide the knowledge and support you need to ensure seamless integration into Australia’s entrepreneurial ecosystem.

Key Takeaways

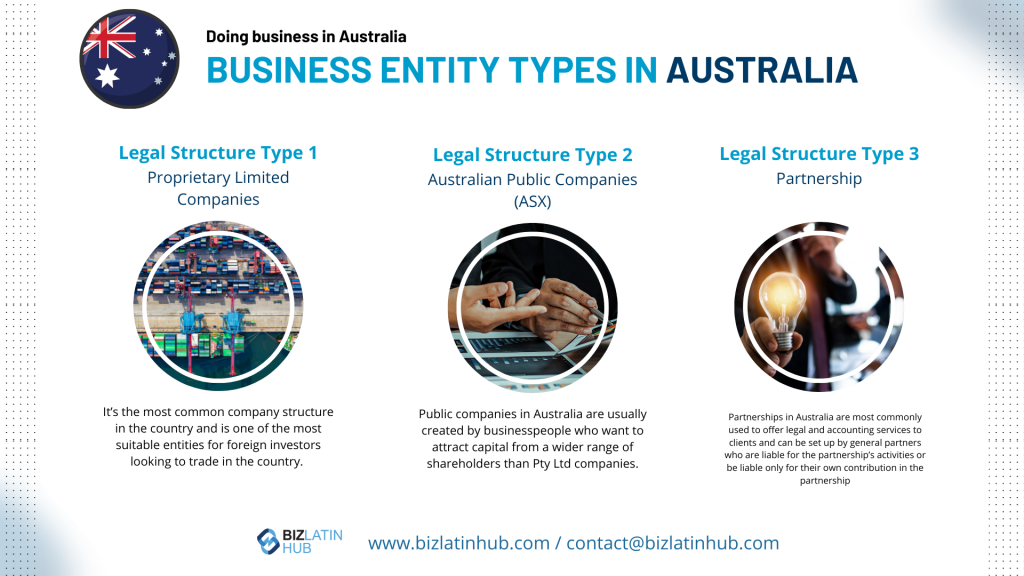

| Common legal entity types in Australia | Proprietary Limited Companies (PTY Ltd.) Public Companies (Ltd.) Partnership. Branch Office. |

| What is the most common Australian business entity? | The most frequently encountered comapny type in Australia is the Proprietary Limited Company (PTY Ltd.). |

| What are the primary considerations when choosing a business entity in Australia? | Ownership Structure. Tax Efficiency. Profit distribution. Transfer Pricing. Compliance. Flexibility. |

4 Main Types of Companies in Australia

There are several different types of companies in Australia to incorporate your company in Australia. Each legal entity offers different conditions and governance structures to suit varying business needs.

The legal entity you choose will influence the amount of capital to invest, economic activities to be carried out, how many shareholders you will have, and other factors.

The most common types of legal entities that are usually used to establish a company are included below.

- Proprietary Limited Companies (PTY Ltd.)

- Public Companies (Ltd.)

- Partnership

- Branch Office

Below explores each company types in further detail.

1. Proprietary Limited Companies (PTY Ltd.) in Australia

The business structure closest to a Limited Liability Company is the Proprietary Limited company (“Pty Ltd”). It’s the most common company structure in the country and is one of the most suitable entities for foreign investors looking to trade in the country. Incorporating a Pty Ltd company requires at least one resident director (if you don’t live in Australia, you’ll need to find a director who does, or work with a company who can provide a nominee director). Pty Ltd companies can be 100% foreign-owned and the initial share capital is as little as $1. As with all businesses in Australia, a Pty Ltd company must register for the Goods and Services Tax should its annual turnover exceed AU$75,000. They must also appoint a Public Officer for tax purposes. Pty Ltd companies can have no more than 50 shareholders.

2. Australian Public Companies (Ltd.)

For businesses hoping to make an Initial Public Offering (IPO) on the Australian Stock Exchange, a Public Company is the usual business structure to assume. Public companies in Australia are usually created by businesspeople who want to attract capital from a wider range of shareholders than Pty Ltd companies. Often the management team is separate from the owners of the firm. This entity type follows a similar incorporation process to that of a Proprietary Limited Company, although you will need at least three directors (including two Australian resident directors) for your registration to be approved, as well as a Company Secretary, and a Public Officer for tax purposes.

3. Partnership

Partnerships in Australia are most commonly used to offer legal and accounting services to clients and can be set up by general partners who are liable for the partnership’s activities or be liable only for their own contribution in the partnership. In order to incorporate in Australia, you will need at least one Australian resident partner; an Australian Investor Visa may help.

Income and losses will be shared amongst partners, and the partnership must lodge annual tax returns which show where income has been distributed. Although a partnership does not pay tax on the profit it earns, each partner must report their share of earnings and pay their own income tax. Registration for the Goods and Services Tax is compulsory if turnover exceeds AU$75,000.

4. Australian Branch Office

To create an Australian branch office as part of an international expansion plan, a foreign company can register with ASIC and the Australian Taxation Office. A branch office is an option for businesses that want a presence in Australia, and want to consolidate earnings in their home country. You’ll need to appoint a local agent who can accept notices on your company’s behalf, and register an address in the country. Branches are taxed in Australia on their Australian profits and must submit annual financial statements to ASIC.

Key Considerations When Choosing Types of Companies in Australia

Ownership Structure

Evaluate whether your chosen business entity allows for foreign ownership. Australia permits 100% foreign ownership in most industries, although certain sectors, such as media, telecommunications, aviation, and defense, may have restrictions or require Foreign Investment Review Board (FIRB) approval. Ensuring compliance with these rules is crucial for smooth operations and regulatory approval.

Tax Efficiency

Analyze how Australia’s tax framework will affect your business. The corporate tax rate is 30% for most companies, with a reduced rate of 25% for small businesses with an aggregated turnover below AUD 50 million. Additionally, the Goods and Services Tax (GST) of 10% applies to most goods and services. Businesses involved in R&D, renewable energy, or export-oriented industries may qualify for incentives, such as the R&D Tax Incentive or Export Market Development Grant (EMDG). Strategic tax planning is essential to optimize costs while maintaining compliance with the Australian Taxation Office (ATO).

Profit Distribution

Understand the tax implications of distributing profits. Dividends paid to non-resident shareholders are subject to withholding tax, typically 30%, but this may be reduced to 15% or lower under Australia’s extensive network of double taxation agreements with countries such as the U.S., U.K., and Singapore. Australia’s imputation system allows resident shareholders to receive franking credits, reducing double taxation. A clear strategy for profit repatriation ensures efficient shareholder returns and minimizes tax liabilities.

Transfer Pricing

Comply with Australia’s transfer pricing regulations, which align with OECD guidelines. Businesses must ensure that cross-border transactions between related parties reflect arm’s-length pricing. Transfer pricing documentation and Country-by-Country (CbC) reporting may be required for larger multinational entities. Failure to comply can result in significant penalties and increased scrutiny from the ATO, making accurate reporting a priority for international businesses.

Compliance

Prepare for Australia’s rigorous compliance requirements. Companies must register with the Australian Securities and Investments Commission (ASIC) and obtain an Australian Business Number (ABN) and Tax File Number (TFN) from the ATO. Financial reporting must follow Australian Accounting Standards (AAS), which are based on IFRS. Annual financial statements and tax filings are mandatory, alongside monthly or quarterly GST filings. Labor compliance, including superannuation contributions and adherence to the Fair Work Act, is critical to avoid penalties. Meeting these obligations ensures legal standing and operational continuity.

Flexibility

Choose a business structure that aligns with your operational goals and provides flexibility for future growth. The most common business structures in Australia include:

- Proprietary Limited Company (Pty Ltd): The most popular structure for private businesses, offering limited liability and flexibility for small to medium-sized enterprises. It requires at least one shareholder and director.

- Public Company (Ltd): Suitable for larger businesses or those seeking to raise capital publicly through the Australian Stock Exchange (ASX). It requires at least three directors and follows stricter regulatory requirements.

- Partnership: Ideal for small businesses with multiple owners, with shared liability and simpler compliance requirements.

Selecting the right structure ensures your business can adapt to Australia’s dynamic regulatory and economic environment while meeting operational needs.

Our recommendation: Based on experience we recommend clients the PTY Ltd. company strucutre, as it offers limited liability protection to shareholders, flexibility in shareholding structure, management and capital contributions.

Frequently Asked Questions about the Types of Companies in Australia

Yes, foreign nationals can register companies in Australia. The process involves fulfilling certain requirements and may require partnering with local individuals or entities in certain cases.

The main distinction between Pty Ltd and Ltd lies in their business structures. A Pty Ltd is a proprietary limited company, whereas an Ltd is a public limited company. Proprietary limited companies are restricted to a maximum of 50 non-employee shareholders, while public limited companies can have an unlimited number of shareholders and are typically listed on the stock exchange. Both types of companies, however, provide limited liability protection to their owners.

Operating a business as a partnership in Australia offers several advantages, including the opportunity to combine resources and expertise, as well as the ability to share profits among the partners.

Yes, trusts are allowed in Australia. Family-owned businesses generally use discretionary trusts, while larger businesses with more than one family involved tending to use unit (or fixed) trusts. Trusts are established by deed and do not have to register with the Australian companies registrar (“ASIC”). As with companies and partnerships, trusts carrying on a business must apply for an Australian Business Number and Tax File Number.

In Australia, a Limited Liability Company (LLC), referred to as a Proprietary Limited Company (Pty Ltd), provides limited liability protection to its members. This structure safeguards personal assets from the company’s debts and allows for flexible management.

Why Choose to Invest in Australia

Australia offers a highly developed and investor-friendly environment supported by a robust economy and transparent governance. Its political stability and strong regulatory framework create confidence for savvy investors. The country has free trade agreements with key global markets, including the United States, China, Japan, and the European Union, enhancing access to international trade.

Rich in natural resources, Australia is also a leading global exporter of iron ore, coal, gold, and liquefied natural gas (LNG). Its vast landscapes offer significant opportunities for renewable energy projects, including solar, wind, and hydropower, particularly in regions with abundant natural resources. World-class infrastructure in transportation, energy, and digital connectivity supports efficient business operations nationwide.

Additionally, Investment incentives such as tax concessions and grants, attract foreign participation in industries like mining, renewable energy, technology, and agribusiness. As it continues to closen ties with its bi-latteral trade partners there is an increasing demand from investors to expand and grow in the Pacific continent.

Let Biz Latin Hub Help You

If you’re finding it difficult to navigate the Australian business world and require assistance in incorporating a business or getting to grips with Australian business law, you can depend on the experts at Biz Latin Hub, a global law form with a local perspective. With more than five years’ experience in the industry, we’ve helped businesses from around the world plan and execute their business expansion into Australia, unlocking revenue streams and diversifying businesses in a whole host of niches.

Given the favorable conditions in the country and the region as well as the economic growth, Biz Latin Hub through its company Colombian Business Services offers the experience and support necessary for investors to have a successful market entry in Australia. Feel free to contact us now.