The Bahamas attracts many entrepreneurs with its promise of thriving business opportunities. Nestled in the Caribbean, this nation offers unique advantages for establishing various business entities.

Understanding the types of business structures available is crucial for success. These include International Business Companies (IBCs), Limited Liability Companies (LLCs), and Exempted Limited Partnerships (ELPs), each bringing distinct characteristics and benefits.

This article explores these business entities in the Bahamas. We will discuss their advantages, the regulatory framework for incorporation, and how to choose the right entity for your needs.

What are the Types of Business Entities in the Bahamas?

The Bahamas offers several types of business entities. Each type caters to different business needs and preferences. These include International Business Companies (IBCs), Limited Liability Companies (LLCs), and Exempted Limited Partnerships (ELPs).

International Business Companies (IBCs)

International Business Companies (IBCs) are a preferred choice in the Bahamas. They offer notable tax advantages. IBCs are exempt from corporate income tax, capital gains tax, and inheritance tax. This makes them appealing to international investors. Another benefit is privacy. Directors and shareholders of IBCs do not have their identities publicly disclosed. IBCs require a minimum authorized share capital of just USD 1. No minimum paid-up capital or annual return filings are needed. The tax exemption lasts for 20 years after incorporation. IBCs require a completed application, identification documents, and proof of address to form.

Limited Liability Companies (LLCs)

Limited Liability Companies (LLCs) in the Bahamas offer flexibility and protection. There is no need for a minimum share capital. LLCs benefit from no corporate tax, which attracts entrepreneurs. The structure separates personal assets from business liabilities, protecting personal wealth. Unlike other corporations, LLCs do not need a board of directors or formal meetings. This simplifies governance. The Bahamas’ regulatory environment supports straightforward shareholder requirements. The rules allow flexible director appointments. LLCs can operate locally or internationally.

Exempted Limited Partnerships (ELPs)

Exempted Limited Partnerships (ELPs) suit those who prefer a blend of partnership and corporate elements. ELPs need one general partner and one limited partner. Limited partners enjoy limited liability, protecting personal assets. General partners have unlimited liability and manage the partnership. ELPs have no minimum share capital and are exempt from corporate tax. Like IBCs, ELPs focus on offshore activities, which attracts international investments.

What are the Advantages of Establishing a Business in the Bahamas?

The Bahamas offers several compelling advantages for businesses looking to establish operations in a tax-neutral and investor-friendly environment. The country provides numerous benefits that enhance its appeal to international and foreign investors.

Tax neutrality benefits

The Bahamas stands out for its tax-neutral environment. There is no corporate income tax, capital gains tax, or income tax. Businesses are free from sales tax and inheritance tax. The absence of these taxes allows companies to reinvest and grow without significant tax burdens. Businesses only pay licensing fees, property taxes, stamp taxes, and import tariffs. This limited tax liability can lead to substantial savings. Moreover, Bahamian International Business Companies (IBCs) enjoy 20 years of tax and exchange control exemptions.

Flexible corporate structures

The Bahamas offers a variety of corporate structures. Businesses can choose from International Business Companies (IBCs), limited liability companies (LLCs), and partnerships. These structures provide flexibility to meet different business needs. An IBC requires only one shareholder and one director, with no nationality requirements. There is no minimum capital requirement for IBCs, which gives investors the flexibility to decide the investment scale. Also, there are no annual return or audited account obligations for IBCs, easing reporting duties.

Significant privacy protections

Privacy is a key benefit of Bahamian business operations. The country does not have a public registry for offshore companies. This means information about beneficial owners stays confidential. The Bahamas has strict confidentiality laws, ensuring only a company’s registration number, name, and registered office are public. Trusts in the Bahamas also have strong privacy protections for settlors and beneficiaries. Companies can use nominee directors and officers for added privacy. Finally, offshore entities have no personal or corporate tax reporting needs, further protecting financial confidentiality.

Regulatory Framework for Business Incorporation

The Bahamas offers a strong legal system for business incorporation. The International Business Companies (IBC) Act of 2000 is key to its corporate legislation. It supports the setup and operation of global businesses. Companies benefit from no minimum capital requirements. There are also no taxes on income or dividends. This makes the Bahamas attractive for international businesses. A legal representative is necessary for every business. They manage operations and ensure legal compliance. This includes filing tax declarations and signing documents. The Bahamas Investments Authority (BIA) oversees company setup and related activities.

Simple incorporation processes

Incorporating a business in the Bahamas is straightforward. The process suits both local and international businesses. Setting up a company here can take just a week. This speed is appealing to entrepreneurs. A local address is required for registration. The process involves choosing a company name and deciding on the structure. Then, you register with the Registrar General’s Department. Total registration costs are around $1,455. This fee covers legal documents, registration, and an official address for one year.

Compliance with international standards

Companies in the Bahamas must follow anti-money laundering (AML) laws. Both local and international businesses need thorough checks and reporting. Know Your Customer (KYC) verification is vital. It confirms the identity of stakeholders. The International Business Act 2000 and 2010 governs company operations. Businesses must also get a license to work in the Bahamas. Economic Substance compliance requires some activities to be directed from within the country. This aligns with global regulations.

Economic substance requirements

Certain sectors in the Bahamas must meet economic substance rules. These sectors include banking, insurance, and fund management. Companies in these areas need a physical presence in the Bahamas. Those outside these activities do not need physical facilities. Businesses must report their economic presence regularly. Non-compliance can lead to audits or large fines. Companies have 28 days to meet these requirements.

Choosing the Right Business Entity

The Bahamas offers several business entity types. You can choose from International Business Companies (IBCs), Sole Proprietorships, Partnerships, Joint Ventures, and Foundations. Each option has its own set of benefits and requirements. Many entrepreneurs prefer IBCs. This is due to their flexibility and tax exemptions on corporate taxes for the first 20 years. They are also exempt from stamp and estate duties. Registering a business in the Bahamas is quick. Typically, it takes about one week after submitting the necessary forms and documents. For foreign investors, Simplified Stock Companies (SACs) are appealing. They offer simplicity and fewer formalities compared to other corporate structures.

Assessing Business Needs

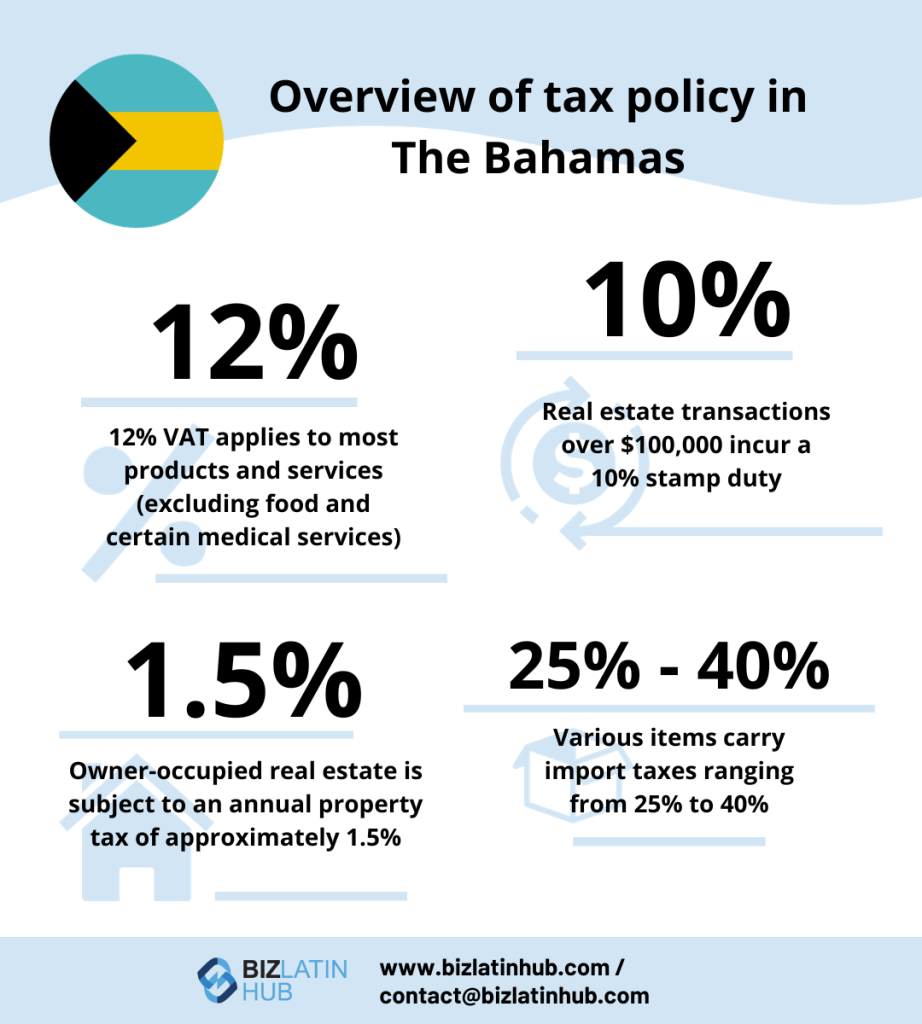

Understanding financial structures and banking arrangements is crucial in the Bahamas. You will need a corporate bank account suited to your business. Opening one involves choosing the right bank and submitting documents, such as identity and company registration papers. While there is no income tax, be aware of other taxes. These include value-added tax (VAT), stamp tax, real property tax, and import duties. Operating costs can be high. Budget for office space, utilities, and labor. Also, if hiring foreign employees, plan for the process of obtaining work permits.

Evaluating Operational Goals

The Bahamas provides a tax-neutral environment. This means no corporate income, capital gains, or inheritance tax, maximizing your retained earnings. A business license is required. Fees are based on gross turnover. For small businesses with turnover below BSD50,000, the annual fee is BSD100. You must submit a detailed Project Proposal to the Bahamas Investment Authority. This ensures your business aligns with national economic interests. If your IBC carries on active business, you need a license and must pay an annual business license tax.

Considering Compliance and Regulatory Factors

Businesses must promptly report major changes. This includes changes in address, company name, share structures, or membership. Compliance with local regulations and industry guidelines is mandatory. This affects operations, marketing, and sales. Register with the National Insurance Board to cover employees, as required by law. A Business License is necessary, though some activities may be exempted. Annually, businesses must file an Annual Return to the Registrar. This document details directors, shareholders, and financial health.

Professional Services from Biz Latin Hub

Looking to establish your business in the Bahamas? Biz Latin Hub provides comprehensive support for company formation, regulatory compliance, and tax advisory services. Their experienced team helps entrepreneurs navigate the incorporation process, maintain compliance, and optimize their business structure.

For expert assistance with your Bahamas business venture, contact us here.