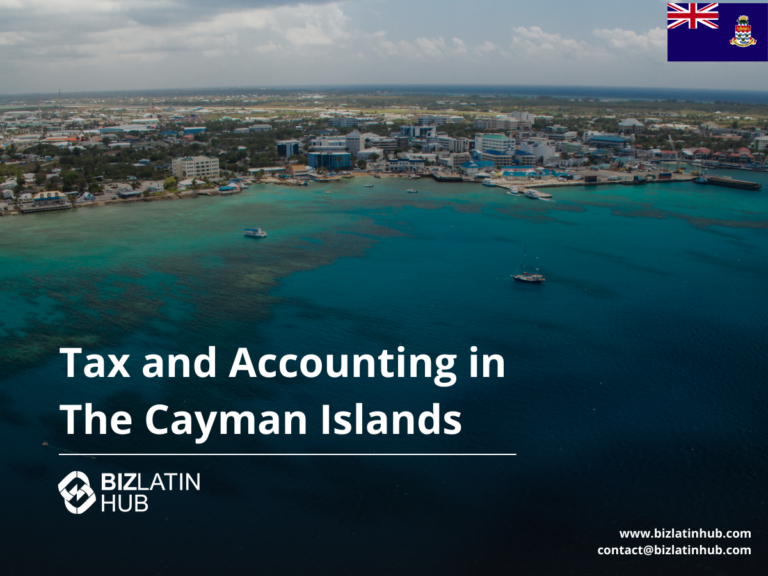

The Cayman Islands, a picturesque paradise in the Caribbean, are not only known for their stunning beaches and crystal-clear waters but also for their thriving financial services sector. For businesses and individuals looking to explore the world of accounting and taxation, understanding the regulations in the Cayman Islands is essential. This article provides a comprehensive overview of accounting and taxation in this unique jurisdiction, offering invaluable insights for those considering company formation in the Cayman Islands.

Key Takeaways On Tax and Accounting Requirements in the Cayman Islands

| What Are The Accounting Standards in the Cayman Islands? | In the Cayman Islands, companies are required to adhere to International Financial Reporting Standards (IFRS), also known as International Accounting Standards (IAS). Companies operating in the Cayman Islands must maintain financial records per IFRS/IAS to meet international standards. |

| What Is The Corporate Tax Rate in the Cayman Islands? | Companies in the Cayman Islands are not subject to a corporate tax rate, making it an attractive destination for businesses seeking tax efficiency. |

| What Is The Cayman Value Added Tax Rate? | Unlike some countries, the Cayman Islands does not have a Value Added Tax (VAT) or equivalent tax, making it easier for businesses to manage their financial operations. |

| Dividend Tax Rate in the Cayman Islands | The Cayman Islands does not impose withholding tax on dividends, interest, or royalties paid to non-residents, simplifying international transactions. |

Accounting and Taxation in the Cayman Islands: Key Highlights

Accounting Standards – IFRS/IAS in the Cayman Islands:

Like many parts of the world, companies operating in the Cayman Islands must adhere to International Financial Reporting Standards (IFRS), also known as International Accounting Standards (IAS). This global accounting framework provides a standardized method for reporting financial information, ensuring transparency and comparability.

When seeking accounting services in the Cayman Islands, it is imperative to engage experts who are well-versed in IFRS/IAS, as compliance with these standards is essential.

Non-compliance with accounting standards can result in substantial fines, starting at a minimum of USD 200. The potential maximum fine can reach a staggering USD 45,000, considering the significant value of the US dollar.

Corporate Taxation in the Cayman Islands:

One of the primary attractions of the Cayman Islands for businesses is its favorable tax environment. The Cayman Islands does not impose corporate income tax, which is a significant advantage for companies looking to establish a presence in this jurisdiction.

However, this unique tax structure does not mean businesses are entirely exempt from taxation obligations. Let’s explore the key aspects of corporate taxation in the Cayman Islands:

No Corporate Income Tax: Unlike many other countries, the Cayman Islands does not levy corporate income tax, which is a significant benefit for businesses of all sizes.

No Capital Gains Tax: Capital gains earned by businesses are also not subject to taxation in this jurisdiction, further enhancing its appeal.

No Withholding Tax: The Cayman Islands does not impose withholding tax on dividends, interest, or royalties paid to non-residents, simplifying international transactions.

No Value Added Tax (VAT): Unlike some countries, the Cayman Islands does not have a Value Added Tax (VAT) or equivalent tax, making it easier for businesses to manage their financial operations.

Import Duties and Fees: While direct corporate taxes are not applicable, the Cayman Islands does impose import duties and fees on certain goods and services.

Annual Fees: Companies registered in the Cayman Islands must pay an annual fee to maintain their legal status and continue conducting business.

Reporting Requirements in the Cayman Islands

The Cayman Islands, as an offshore financial center, has specific reporting requirements tailored to ensure transparency and compliance with international standards. Unlike the monthly tax reporting requirements in some jurisdictions, the Cayman Islands follows a different approach to reporting:

Annual Financial Statements: Companies registered in the Cayman Islands must prepare and submit annual financial statements in compliance with IFRS/IAS. These statements provide an accurate depiction of the company’s financial status, essential for transparency and accountability.

Auditing: Depending on the size and nature of their operations, companies in the Cayman Islands may be required to have their financial statements audited by an independent auditor. This step further ensures the accuracy and reliability of financial reporting.

Tax Transparency: The Cayman Islands has implemented measures to enhance tax transparency. This includes the automatic exchange of financial information with tax authorities in other jurisdictions as part of global efforts to combat tax evasion and promote financial transparency.

AML/CFT Compliance: Anti-Money Laundering (AML) and Counter Financing of Terrorism (CFT) regulations are crucial for the Cayman Islands’ reputation as a trustworthy financial center. Companies in the jurisdiction must adhere to these regulations, which help safeguard against financial crimes.

FAQs When Understanding Accounting and Taxation in the Cayman Islands

Based on our experience these are the common questions and doubts of our clients.

The Cayman Islands are known for their business-friendly tax environment, and one of the key advantages is the absence of corporate income tax. Companies in the Cayman Islands are not subject to a corporate tax rate, making it an attractive destination for businesses seeking tax efficiency.

Unlike many other countries, businesses in the Cayman Islands are not taxed on their income. There is no corporate income tax, capital gains tax, or withholding tax on dividends, interest, or royalties paid to non-residents. Instead, the Cayman Islands relies on alternative revenue sources, such as import duties and annual company fees to maintain their legal status.

The tax authority in the Cayman Islands is the Department for International Tax Cooperation (DITC). They are responsible for overseeing international tax compliance, including the collection and exchange of financial information with other jurisdictions, as part of global efforts to enhance tax transparency.

In the Cayman Islands, companies are required to adhere to International Financial Reporting Standards (IFRS), also known as International Accounting Standards (IAS). These global accounting standards provide a standardized framework for financial reporting, ensuring transparency and comparability. Companies operating in the Cayman Islands must maintain financial records per IFRS/IAS to meet international standards.

The equivalent of a Certified Public Accountant (CPA) in the Cayman Islands is a Chartered Professional Accountant (CPA). CPAs are highly qualified professionals who provide expert accounting and financial services, ensuring compliance with international accounting standards and tax regulations.

Yes, the Cayman Islands report following International Financial Reporting Standards (IFRS). These global accounting standards ensure consistency and transparency in financial reporting. Compliance with IFRS is crucial for businesses operating in the Cayman Islands, as it aligns them with international accounting best practices.

Biz Latin Hub can help you understand the accounting and taxation requirements in the Cayman Islands.

Navigating the accounting and taxation landscape in the Cayman Islands is essential for individuals and corporations looking to operate in this jurisdiction. Whether it’s compliance with IFRS/IAS, understanding the absence of corporate income tax, or adhering to international transparency standards, staying informed and seeking professional advice is key to success in the Cayman Islands’ financial world.

Biz Latin Hub can help you with expert guidance from qualified accountants and legal professionals. With a business-friendly tax environment and a commitment to international accounting standards, the Cayman Islands offer a unique financial landscape for those seeking opportunities in the global marketplace. Contact us now.