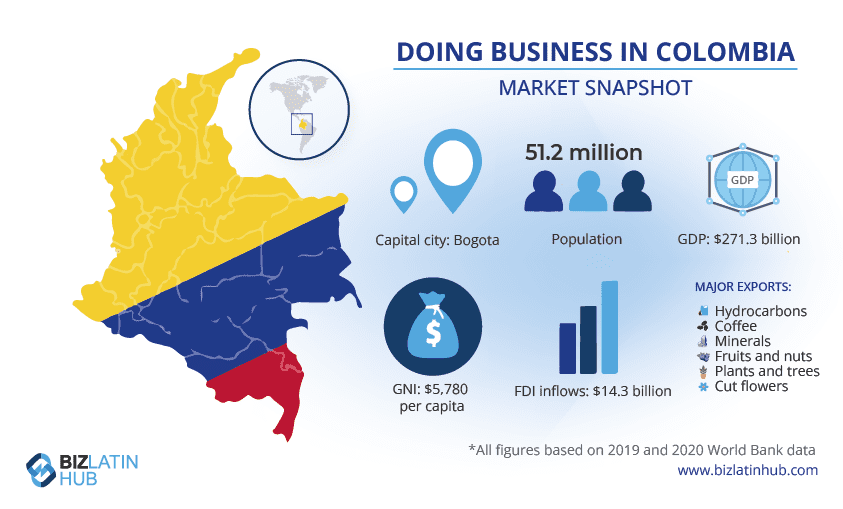

Colombia is an attractive emerging country and a strong economic force in Latin America. Many foreign individuals and companies are deciding to enter the market and start a business in Colombia. There are three common types of legal entity structures in Colombia; a corporation, a limited liability partnership, and a branch office of a foreign company.

A branch office of a foreign company must operate under the Colombian corporation rules. Most companies choose to work with a local group to ensure 100% legal compliance when operating in Colombia.

This article will answer any questions you may have regarding the creation of a branch office of a foreign company in Colombia.

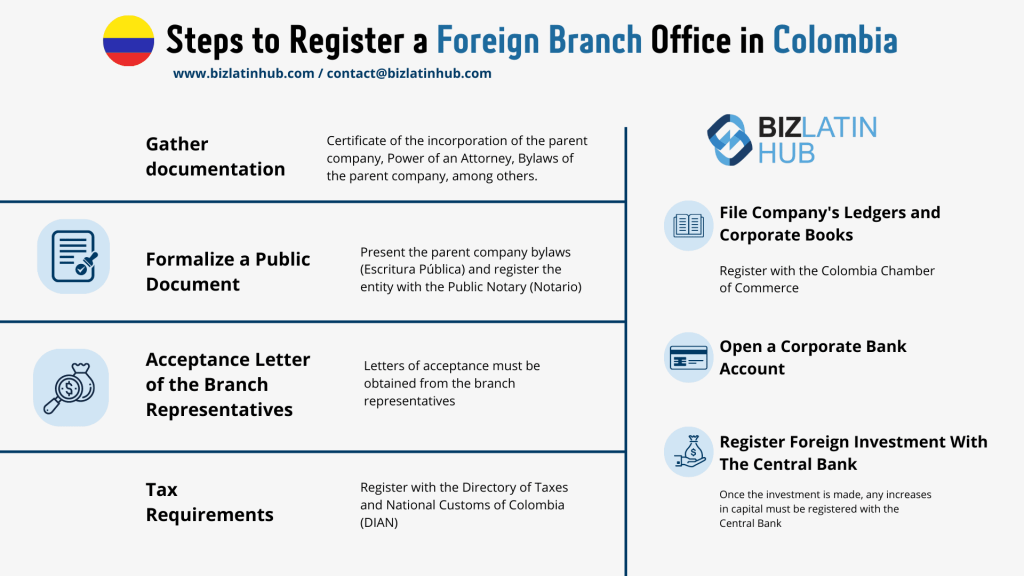

Summary of the Colombian Branch Office Set-Up Process

Documentation Required to Incorporate a Branch Office in Colombia

- Certificate of the incorporation of the parent company.

- Power of an Attorney authorizing the branch representative to act on behalf of the parent company.

- Bylaws of the parent company.

- Resolution from the parent company authorizing the opening of its branch in Colombia, indicating at least the following:

- Main business purpose/activities of the branch

- The amount of capital allocated to the branch

- Branches legal address

- The appointment of a legal representative of the branch

- The appointment of an auditor

Additional and Useful Information

Formalize a Public Document

The company will be required to present the parent company bylaws (Escritura Pública) and register the entity with the Public Notary (Notario) stating the purpose of the firm, capital, legal representative, etc.

*This process may take two to three days and will have costs involved base on the assigned capital value.

Acceptance Letter of the Branch Representatives

Letters of acceptance must be obtained from the branch representatives which are approved in the bylaws of the company, such as the legal representative. Such letters should include the full name of the person accepting the position, title, identification number and signature.

Tax Requirements in Colombia

All companies in Colombia will be required to register with the Directory of Taxes and National Customs of Colombia (DIAN). Once registered, the company will obtain a Unique Registration Number (RUT). This RUT is a document that contains extensive data on the taxpayer, including the company´s Tax ID number (NIT).

The process to register with DIAN can be completed personally or with a representative at the Tax Office. The by-laws, letters of acceptance, and additional forms for tax purposes must be filled out indicating the taxes to which the company is subjected to.

*This registration must be renewed annually at the Chamber of Commerce.

File Company´s Ledgers and Corporate Books

All foreign branch offices domiciled in Colombia, must register themselves with the Colombia Chamber of Commerce and have accounting books, including:

- Balance sheets

- Daily journal entries

- Meeting minutes

Open a Corporate Bank Account

Every new foreign branch office must open a Colombian bank account at the bank of their choosing.

Register Foreign Investment With The Central Bank

Once the investment is made (the initial capital registered by the company), any increases in capital must be registered with the Central Bank (Banco de la República).

*The registration process may vary according to the origin of the funds.

Need More Information Regarding Colombian Branch Offices?

Colombia is an expanding market and the region provides many attractive commercial opportunities for foreign businesses. However, market complexities and variations in local law can make the initial stages of a company incorporation difficult.

At Biz Latin Hub, we can support your business in Latin-America through the provision of commercial representation and company formation services. Please contact us now, or visit our website at bizlatinhub.com to see how we can be of assistance.

Watch this video and learn why Colombia is an attractive place to do business.