The Caribbean country receives one of the largest pools of European funding for infrastructure and development, showing great potential in attracting future investment. Read on to learn more about the benefits of doing business in the Dominican Republic, and why you should consider expanding to this Caribbean country. Biz Latin Hub can help you to incorporate a company in the Dominican Republic or elsewhere in the region.

Key takeaways on doing business in the Dominican Republic

| Is foreign ownership allowed in the Dominican Republic? | Yes, 100% foreign ownership is fully legal. |

| Most important sectors in the Dominican Republic | The country has a strong manufacturing and industrial sector, with services such as tourism and media also booming. Tech is also developing rapidly, thanks to investment in education. |

| Are there Free Trade Zones in the Dominican Republic? | There are 92 Free Trade Zones for doing business in the Dominican Republic |

| Are there incentives for Foreign Direct Investment in the Dominican Republic? | The country offers specific tax incentives for businesses operating in: – Renewable energy. – The industrial sector. – Tourism. – Film production. – Haiti-Dominican Republic border development. |

| What international links does the country have? | The Dominican Republic benefits from a free flow of goods and services as a member of CARICOM and DR-CAFTA. |

Why invest in the Dominican Republic?

Located on the crossroads between the Eastern and Western Caribbean, the Dominican Republic is a trade link between the large markets of Central, South, and North America for trade and transport. The country shares a border with Haiti, is close to the US hub Miami and other developing Central American economies, offering wide trade opportunities.

The Dominican Republic also benefits from a free flow of goods and services as a member of CARICOM and DR-CAFTA. The CARICOM is made up of 15 member countries and an additional five associate members based in the region, and aims to develop regional economic integration and deepen trade ties. The CAFTA comprises the United States, Costa Rica, El Salvador, Guatemala, Honduras, and Nicaragua, and is the United States’ third-largest export market in Latin America.

Businesses setting up in the Dominican Republic can explore their trade opportunities with minimal barriers to trade among fellow members of these groups. They may also explore their prospects further afield in the developing, highly accessible Southern American markets.

What is the workforce like in the DR?

Education is affordable in the Dominican Republic compared to other countries in Latin America and the Caribbean. The high level of education of Dominican people is one of the benefits of doing business in the Dominican Republic.

The country’s labor market holds a healthy population of talented programmers, webmasters, and designers from well-known tech institutions. English levels are generally high for the region, taking advantage of longstanding ties to the United States. This also means that there are many cultural similarities in terms of doing business in the country.

Doing business in the Dominican Republic: favorable business environment

The Dominican Republic is the second-largest economy in the Caribbean by GDP, reporting a GDP of US$120 billion in 2023. Its local market has a strong appetite for imported goods and technology.

The country works to promote foreign direct investment and business through its legal framework and promotion initiatives such as ProDominica, launched in 2017. Foreign business and investment is allowed in almost all sectors, with few exceptions.

The country also offers specific tax incentives for businesses operating in:

- renewable energy.

- the industrial sector.

- tourism.

- film production.

- Haiti-Dominican Republic border development.

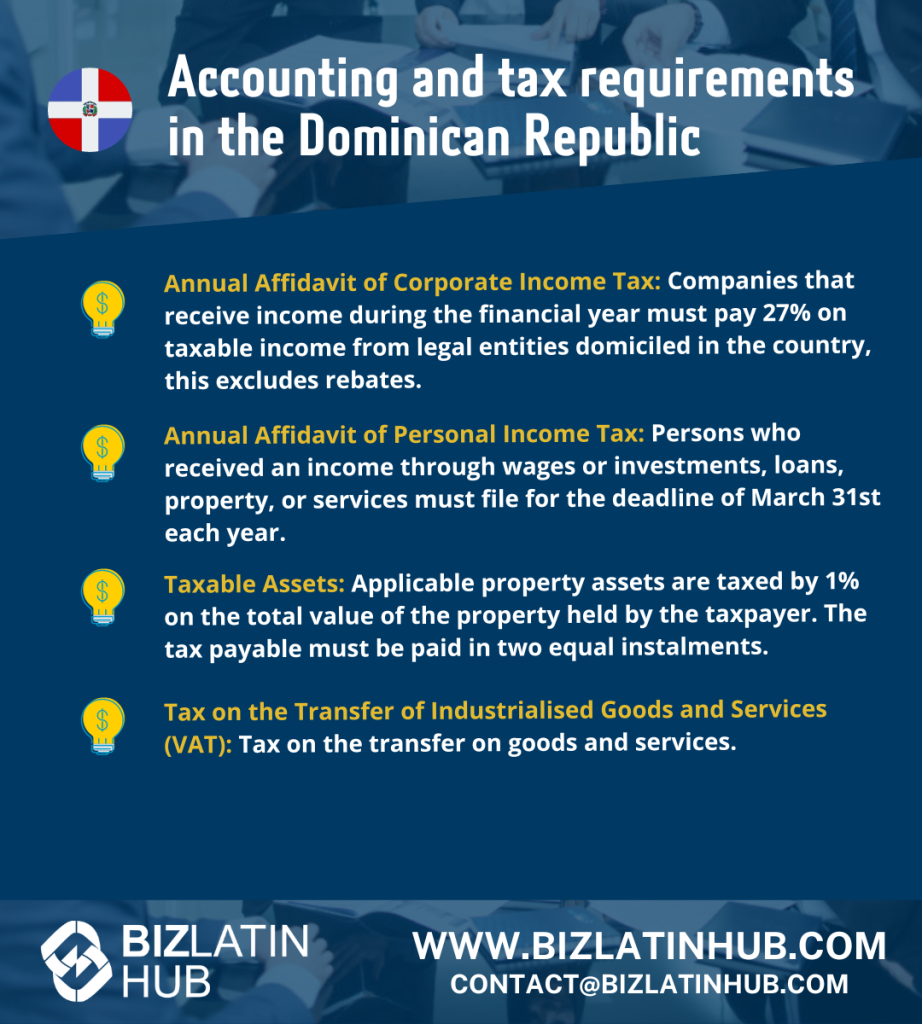

The tax rate is about 42.2% which is slightly lower than the continent’s average (45.3%). Additionally, opening a business in the Dominican Republic takes only 14.5 days, significantly less than the Latin American average of 30 days.

Public institutions such as the National Council of Free Trade Zones for Export, and the Export and Investment Center of the Dominican Republic, also provide support to foreign executives and investors doing business in the Dominican Republic.

In a number of key sectors, foreign executives may be provided with incentives to do business in the Dominican Republic. They may also have access to one of the many available free trade zones. This minimizes costs for exporters and other businesses, and can facilitate long-term success.

What is the local market like?

Doing business in the Dominican Republic implies expanding to a market of over 10 million consumers.

Additionally, there is a thriving export market for products made in the Dominican Republic. Thanks to relatively low operating and labor costs, companies from the Dominican Republic can achieve economies of scale. This gives them a significant competitive advantage over CARICOM counterparts.

Doing business in the Dominican Republic: competitive prices

Doing business in the Dominican Republic allows your company to expand into the national market, and reach over 11 million consumers.

Additionally, there is a thriving export market for products made in the Dominican Republic. Thanks to relatively low operating and labor costs, companies from the Dominican Republic can achieve economies of scale. This gives them a significant competitive advantage over CARICOM counterparts.

FAQs on doing business in the Dominican Republic

Answers to some of the most common questions we get asked by our clients.

1. Can a foreigner own a business in Dominican Republic?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. Are there Free Trade Zones in Dominican Republic?

| Yes there are, 92 of them and public institutions such as the National Council of Free Trade Zones for Export, and the Export and Investment Center of the Dominican Republic, also provide support to foreign executives and investors doing business in the Dominican Republic. |

3. How long does it take to register a company in Dominican Republic?

It takes 10-14 weeks if all your paperwork is in order.

4. Which sectors are important in Dominican Republic?

The country has a strong manufacturing and industrial sector, with services such as tourism and media also booming. Tech is also developing rapidly, thanks to investment in education.

5. Does Dominican Republic have trade agreements with other countries?

Yes, the nation has signed an agreement with CAFTA to unlock the Central American market, has numerous agreements with the USA and is a prominent member of CARICOM, the association of Caribbean economies. The Dominican Republic benefits from a free flow of goods and services as a member of CARICOM and DR-CAFTA.

6. What entity types offer Limited Liability in Dominican Republic?

The S.R.L, S.A and S.A.S company structures all offer limited liability in the Dominican Republic.

Biz Latin Hub can help you with doing business in the Dominican Republic

The Dominican Republic offers a lot of benefits for entrepreneurs and investors looking to do business in the Caribbean and Central America. While the country’s business potential is still largely undiscovered, now is the perfect time to expand your business in a growing market.

At Biz Latin Hub, we provide expert corporate legal and accounting advice to foreign businesses expanding into Central and South America, and the South Pacific. Our multilingual team of local and ex-pat professionals provides in-depth guidance and comprehensive business solutions for all market entry and back-office needs. This includes company formation, corporate compliance, due diligence, hiring and PEO services, and visa processing.

Contact us now, or visit our website at bizlatinhub.com to find out how we can be your single point of contact for doing business in the Dominican Republic.

Learn more about our team and expert authors.