Corporate Bank Account Setup in Latin America

We specialize in helping foreign businesses open corporate bank accounts in Latin America, navigating KYC, local banking regulations, and compliance with tax authorities.

Our Banking and Treasury Services

We provide end-to-end support for bank account setup, documentation, and liaison with local banks in Colombia, Mexico, Peru, and more.

As your business expands, you may need to embark on international expansion, including incorporating foreign companies and setting up local payrolls. And for such, you will need to open a local corporate bank account, which can be complicated and time-consuming, especially with understanding local requirements and regulations, and often in a foreign language. At the Biz Latin Hub group, we can assist you with opening a local bank account. We can advise on local banking requirements and regulations based on our extensive local presence and understanding.

After understanding your business and its needs, our local banking experts will advise on suitable banks and jurisdictions which you may wish to consider.

We are your one-stop shop for bank account opening needs in Latin America and the Caribbean!

Treasury and Cash Flow Support

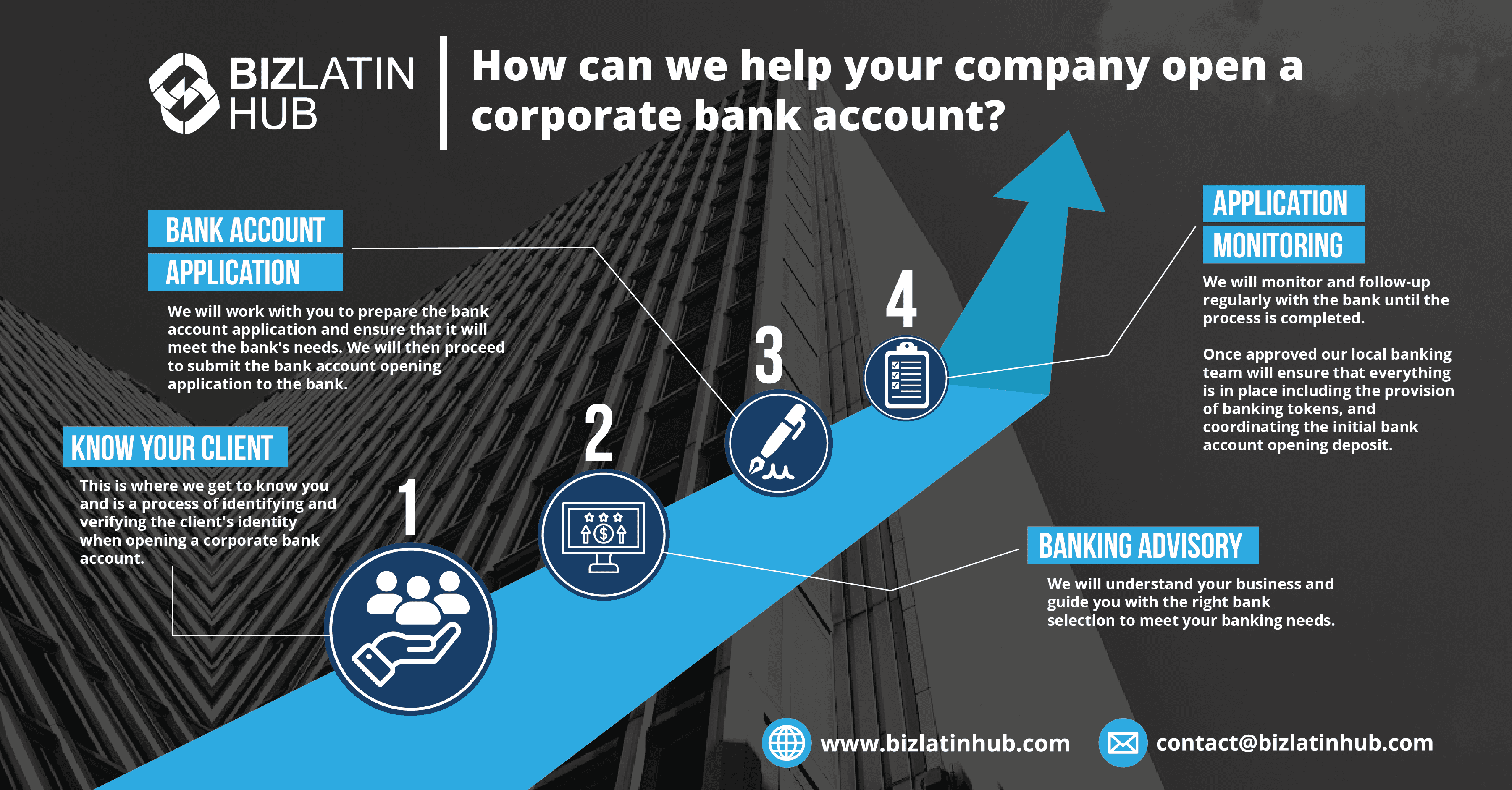

Know Your Client (KYC)

Bank Account Advisory

Bank Account Application

Application Monitoring

Why Choose Biz Latin Hub for Banking Support?

- Proven experience opening corporate accounts in 17+ jurisdictions

- Local legal and tax compliance managed under one roof

- Direct bank liaison with bilingual experts

- Integrated support across legal, finance, payroll, and treasury

- Trusted by multinational clients across Latin America

What Clients Say About Our Bank Account Opening Services

Frequently Asked Questions on Banking

Based on our experience, these are the most commonly asked questions on how to open a bank account in Latin America and the Caribbean.

The process to open a company bank account is usually comprised of 4 steps.

- Finalizing the application process at a local branch

- Selecting a bank that aligns with your business needs

- Providing fundamental information about yourself and your business

- Submitting legal business documentation

To open a corporate bank account, most banks will require the following documents at a minimum:

- Certificate of Incorporation

- Memorandum & Articles of Association

- Certificate of Good Standing

- Recent Financial Statements

- Bank Reference (if applicable)

- Passport and Proof of Address for all shareholders and directors.

- Summary of company business activities and plans

- Summary of expected value/ volume of transactions

Depending on the bank, additional documents and/or supporting information may be requested.

Yes, solutions for opening a bank account fully online are available for most of our international clients. If a face-to-face meeting is mandatory, logistics can be coordinated to meet your availability requirements.

No, solutions for opening a business bank account without the need for travel are available for most of our international clients. If a face-to-face meeting is mandatory, logistics can be coordinated to meet your availability requirements.

The primary advantage of opening a corporate account is the separation of your personal and business finances. This separation facilitates easier management of business expenses and provides additional legal protections.

The following information is typically required to open a company bank account:

- The language preference for the online banking platform

- Your expectations from the bank account

- The nature of your business activity

- The ultimate beneficial owners (UBO) of the account

- The expected incoming and outgoing transactions

The process typically varies by country, but can take 2-4 weeks on average. Banks need time to verify documentation, conduct due diligence, and process KYC requirements. Some countries like Colombia require a pre-approval process while others like Panama may require in-person interviews.

Minimum deposits vary by country and bank. These will be in a range from US $100 to $2500 depending on the country and bank.

Most major Latin American banks now offer digital banking platforms, though capabilities vary. While initial account opening usually requires physical presence or a local representative, ongoing management can typically be done online. Some banks provide platforms in both English and Spanish, though most are Spanish-only.

Foreign companies must typically provide proof of company registration, identification of directors, evidence of business activities, certified financial statements, tax declarations, and complete KYC documentation. Banks also require understanding of the company’s ownership structure and source of funds.

To open a business bank account in most LATAM countries, banks typically request the company’s bylaws, tax ID (RUC or equivalent), proof of registered office address, identification of the legal representative, and the UBO (Ultimate Beneficial Owner) declaration. Depending on the jurisdiction, some banks may also request a business plan or initial financial projections. Biz Latin Hub prepares and manages these documents for streamlined submission.

Yes, many countries in Latin America allow remote bank account setup via Power of Attorney (PoA). We support clients throughout this process, including document legalization, bank application preparation, and liaising directly with local banking institutions. Remote setup is common in Panama, Colombia, and Mexico, though some banks may still request a video verification call.

On average, corporate account opening takes between 4–8 weeks from the moment all required documents are submitted. Factors that influence timing include the jurisdiction, completeness of the documents, and internal due diligence procedures at the selected bank. Biz Latin Hub shortens this timeline by preparing clients in advance and using pre-established banking contacts.

Yes. Latin American banks are governed by strict KYC (Know Your Customer) and AML (Anti-Money Laundering) policies. Clients are required to provide full corporate documentation, shareholder identity verification, source of funds declaration, and, in some cases, financial background details. We provide complete KYC support to ensure applications are accepted without delays.

Absolutely. We specialize in multi-jurisdictional support and regularly coordinate bank account setups across 17+ countries in Latin America. Whether you need simultaneous openings or a phased approach aligned with entity formation and operational rollout, our team ensures consistent compliance and process management across all jurisdictions.

Biz Latin Hub provides comprehensive services to assist businesses in opening a bank account. We guide you through the entire process, from selecting a bank to submitting the necessary documentation, and coordinating logistics if a face-to-face meeting is required.

To begin the process of opening a corporate bank account, please reach out to Biz Latin Hub via our contact us page.

WHAT MAKES BIZ LATIN HUB DIFFERENT?

Your Local Partner

We can provide you the complete, fully-integrated and tailored back office, PEO and entity incorporation solution

Your Need is Our Focus

We know one size doesn’t fit all – we will work with you to understand your business needs and to provide a personalized market entry and back office solution

Globally Minded & Local Expertise

Trust our local team of lawyers and accountants to establish your business, form your legal entity, hiring employees and legal entity compliance

Communication at its Best

English, Spanish or Portuguese – Our local and expatriate team of accountants and lawyers can support you in multiple languages