You will need to open a corporate bank account in Mexico for seamless financial transactions, enabling you to manage operational expenses, pay salaries, and comply with local tax obligations efficiently. This needs to be completed before any service contract can be signed. With business-friendly policies supporting company formation in Mexico, opening a corporate bank account in Mexico is a key step in this process. Biz Latin Hub provides expert assistance with our comprehensive back-office services, ensuring a smooth entry into the Mexican market.

Key takeaways on a corporate bank account in Mexico

| Which are the best banks to open a corporate bank account in Mexico? | BBVA Mexico. Banco Santander Mexico. Scotiabank Inverlat. Banco Mercantil del Norte (Banorte). HSBC Mexico. Banco Inbursa. Banco Nacional de Mexico. |

| The five step process to open a corporate bank account in Mexico: | Step 1 – Bank’s team will share the account requirements. Step 2 – Submit corporate docs for approval. Step 3 – The company’s legal representative needs to sign the bank paperwork. Step 4 – Fund the account. Step 5 – Electronic banking. |

| Do all corporate bank accounts follow the same process? | This is a general guide: you will need to check individual banks’ rules or contact one of our expert advisors for more detailed rules. |

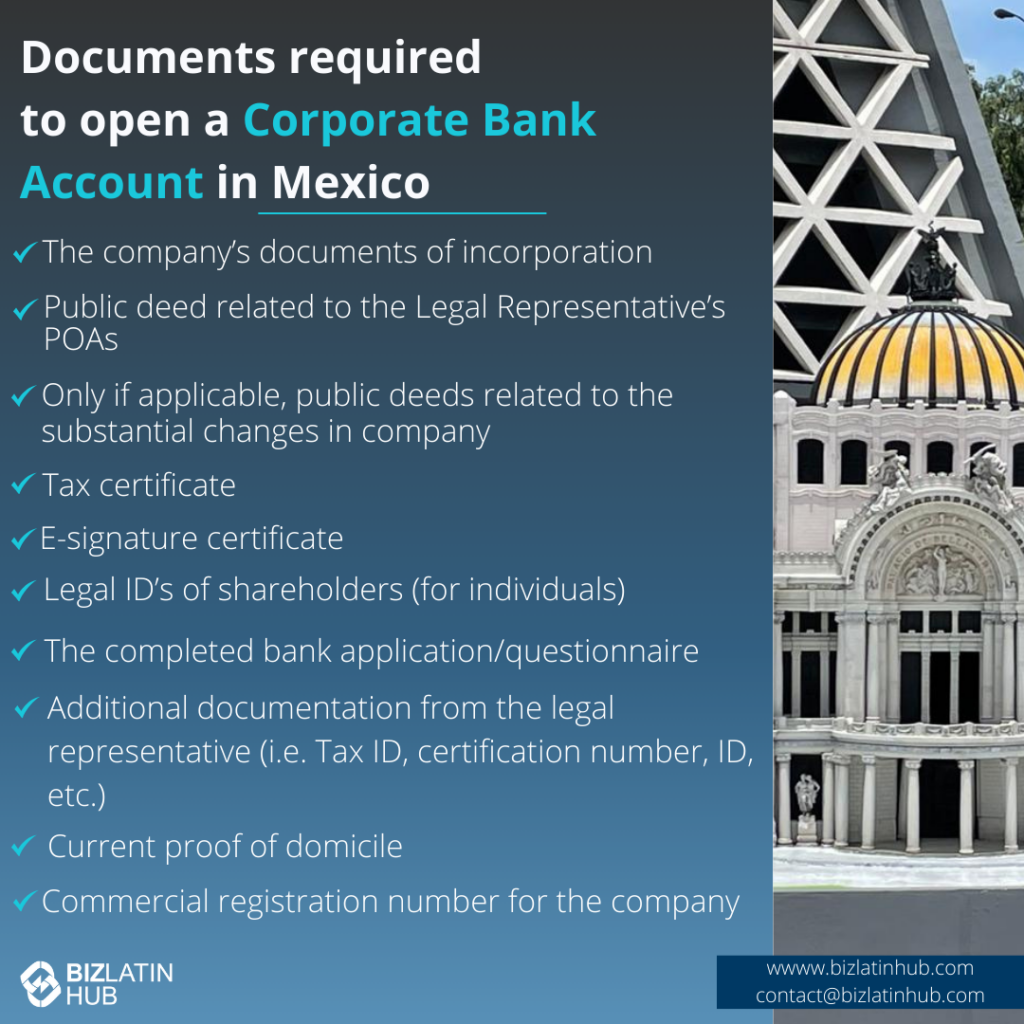

| What documents are necessary when opening a corporate bank account in Mexico? | The company’s documents of incorporation. Public deed related to the Legal Representative’s POAs. Only if applicable, public deeds related to the substantial changes in company (e.g. corporate name). Tax certificate (in Spanish Constancia de Situación Fiscal or CSF). E-signature certificate. Legal ID’s of shareholders (for individuals). The completed bank application/questionnaire. Certain additional documentation from the legal representative (i.e. Tax ID, certification number, ID, etc.) and current proof of domicile (utility services bills usually accepted). Commercial registration number for the company. |

Open a corporate bank account in Mexico: 5 Step guide

To open a corporate bank account in Mexico you must follow these 5 steps:

- Step 1 – Bank’s team will share the account requirements.

- Step 2 – Submit corporate docs for approval.

- Step 3 – The company’s legal representative needs to sign the bank paperwork.

- Step 4 – Fund the account.

- Step 5 – Electronic banking.

Below we expore each of these steps in further detail

1. Bank’s team will share the account requirements.

The Bank’s executive management team will communicate the specific requirements for the account. Account specifications may vary, as selected to satisfy the individual needs of the clients. In Mexico there are many different types of bank accounts companies can choose from. Furthermore, it is possible to open a US dollar account in addition to an account in pesos.

This may be beneficial for companies by facilitating their operations with customers and suppliers abroad. The dollar account can be opened in a parallel process. The list of requirements stated above is not exhaustive, as it depends on the account type you choose. The bank will communicate its requirements to you in this case.

2. Submit Corporate Documents for Approval

Once the account specifications are confirmed, corporate documentation is sent to the bank’s legal division for the approval of the application. The company should prepare all the required documents and hand them over to the bank.

3. The Company’s Legal Representative Needs to Sign the Bank Paperwork

Afterwards, banking paperwork (ie. contracts, KYC) will be drafted, by the bank, for the signature of the company’s legal representative, (documents in wet ink). The legal division of the bank is responsible for making the decision of whether or not the application is approved. Once approved, you can proceed to the formal opening of the bank account which will take approximately a week and a half.

4. Fund the Account

Upon the bank’s confirmation, you will need to fund each account. Deposit the required minimum amount: The minimum amount required to open a bank account varies according to each bank; it can range from MXN$10,000 to MXN$20,000. This is also applicable to the minimum monthly average balance required by banks to keep the account active.

In the case of US dollar accounts, the minimum opening amount and the minimum balance vary depending on the bank. The opening of the bank account is normally free, however, it must be noted that each bank has different policies in relation to what service and commission fees apply and may be deemed additionally to the minimum monthly average.

5. Electronic Banking

Finally, electronic banking will start to operate. Electronic devices (ie. tokens) may be requested and provided by the bank. At this point, your account should be fully operational.

Overall, in our experience the entire process should take approximately 4 to 6 weeks to complete.

7 bank options in Mexico for foreign companies:

Mexico offers a variety of banking options tailored to the needs of foreign companies looking to establish a presence in the country. Your ideal choice will depend on factors such as your business objectives and the specific services each bank offers. Here’s a selection of well-regarded banks in Mexico to help guide your decision-making process:

- BBVA Mexico.

- Banco Santander Mexico.

- Scotiabank Inverlat.

- Banco Mercantil del Norte (Banorte).

- HSBC Mexico.

- Banco Inbursa.

- Banco Nacional de Mexico.

Recommendation: The choice of a bank would depend on various factors including the specific needs of the client, the range of services required, the locations of the company’s operations, and more. Some of the most popular banks in Mexico are BBVA Bancomer, Santander, HSBC, CitiBanamex, and Scotiabank.

What is required to open a corporate bank account in Mexico?

Once the company is registered in the Federal Taxpayers Registry, part of the Mexican Tax Authority (SAT), it is possible to begin the bank account opening process. You will need to have the following documents to open your bank account:

- The company’s documents of incorporation.

- Public deed related to the Legal Representative’s POAs.

- Only if applicable, public deeds related to the substantial changes in company (e.g. corporate name).

- Tax certificate (in Spanish Constancia de Situación Fiscal or CSF).

- E-signature certificate.

- Legal ID’s of shareholders (for individuals).

- The completed bank application/questionnaire.

- Certain additional documentation from the legal representative (i.e. Tax ID, certification number, ID, etc.) and current proof of domicile (utility services bills usually accepted).

- Commercial registration number for the company.

During the bank account opening process, the bank will ask for a questionnaire to be submitted by the applicant in order to know the activities and the general history of the company. This can include the origin of the capital with which the company was founded and the general information of its partners.

The type of documentation required by the legal representative depends on whether the person is a Mexican citizen or a foreign national. For Mexican national acceptable forms of documentation include the Elector’s Credential (INE) or a Mexican passport. For foreigners, acceptable documentation is a temporary/permanent residency visa.

Foreigners may be required by the bank to bring more than one ID. They may also ask for a driver’s license or another ID widely accepted in the country of origin. The legal representative of the company will also need to validate legal entrance into Mexico in order to open the bank account. However, this process can be facilitated by a professional legal services provider.

Companies acquire a commercial registration number when they register with the Public Registry of Commerce. This must be done during the incorporation process. If your company is newly formed, and waiting to complete registration, the public notary will issue you a document which indicates that the company is in the process of registration.

It is very important to take into consideration that the registration at the Public Registry of Commerce should be obtained as soon as possible, otherwise the bank may close the account.

FAQs on how to open a corporate bank account in Mexico

Based on our extensive experience these are the common questions and doubts from our clients when looking to open a company bank account in Mexico.

1. Can I open a corporate bank account online?

No, although the application process can be initiated online there will need to be physical attendance by the named legal representative in the bylaws of the entity at the bank branch.

2. What documents do I need to open a company bank account in Mexico?

Typically to open a company bank account you will require the following:

- The bank account application form.

- Company: Articles of incorporation, bylaws, public deeds where a substantial change to the company has been made, tax ID / certificate (CSF) and E-signature.

- Shareholders & legal representatives: Formal identification issued from a government authority, tax ID / CURP (for Mexican nationals, proof of address).

3. Who can have access to a company bank account in Mexico?

Only the legal representatives registered before the bank, although through the online banking platform, people can be assigned to operate the account (tokens), without the need of granting a Power of Attorney.

4. What is the best bank in Mexico for foreign companies?

The choice of a bank would depend on various factors including the specific needs of the client, the range of services required, the locations of the company’s operations, and more. Some of the most popular banks in Mexico are BBVA Bancomer, Santander, HSBC, CitiBanamex, and Scotiabank.

5. Why do companies open bank accounts in Mexico?

Foreign companies that have business operations, subsidiaries, or branches in Mexico may need local bank accounts to manage their financial transactions within the country. Having a local bank account makes it easier to process payments from local customers, and partners in Mexican pesos, which can streamline business operations and improve customer convenience. If a company has employees in Mexico, it’s necessary to have a local bank account to process the payroll and disburse employees’ salaries.

Why Open a Corporate Bank Account in Mexico?

Opening a bank account in Mexico is a crucial step for investors, providing easy access to one of Latin America’s largest and most dynamic economies. It simplifies transactions in Mexican pesos, reduces international transfer costs, and ensures compliance with local financial regulations, enabling investments in sectors like manufacturing, energy, and technology.

A local account improves credibility with Mexican businesses and authorities while offering access to financial products tailored to the country’s diverse market. It supports investors in navigating the regulatory framework, adapting to local economic conditions, and leveraging Mexico’s growing opportunities, forming a solid base for success.

Biz Latin Hub can help you get started in Mexico

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge about how to open a corporate bank account in Mexico, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise do business in Latin America and the Caribbean.

If this article about how to open a corporate bank account in Mexico was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.