A company must have a corporate bank account in Chile to conduct financial transactions, such as receiving payments and paying suppliers or employees. This is an important step in the process for company formation in Chile. Once your bank account has been activated, then the company you have formed can begin commercial operations. Biz Latin Hub can guide you through the process with our comprehensive back-office services, ensuring a soft entry into the Chilean market.

Key takeaways on how to open a corporate bank account in Chile

| Which banks are the best to open a corporate bank account in Chile? | Banco de Chile Banco Santander Chile Banco Estado (Banco del Estado de Chile) Banco de Crédito e Inversiones (BCI) Scotiabank Chile Itaú Corpbanca Chile Banco Security Banco de la Nación Argentina (BNA) – Sucursal Chile |

| The three step process to open a corporate bank account in Chile: | Step 1 – Assistance from the international desk. Step 2 – Accrediting income. Step 3 – Naming a guarantor. |

| Do all banks have the same process? | This is a general guide: you will need to check individual banks’ rules or contact one of our expert advisors for more detailed rules. |

| What are the necessary documents when opening a corporate bank account in Chile? | Company’s Articles of Incorporation Company registrations Company Publications Local Tax ID initiation of activities affidavit issued by local tax authorities Potentially past tax filings |

3 Steps to Open a Cuenta Corriente Corporate Bank Account in Chile

Among the two types of accounts available for companies in Chile, the cuenta corriente (current account) is much more attractive and advisable for a business. A company can open a cuenta corriente in Chile in one of three ways: by qualifying for assistance from the bank’s international desk, by accrediting a significant amount of income to the account, or by naming a guarantor. What follows is more information on each of these three options.

- Step 1 – Assistance from the international desk.

- Step 2 – Accrediting income.

- Step 3 – Naming a guarantor.

1. Assistance from the international desk:

The international desk is a specialized area of a bank that aims to provide assistance for the internationalization of companies, both for foreigners looking to invest in Chile. In general, the requirements to qualify for this assistance are extremely high, so in practice this is only useful for large transnational corporations and conglomerates looking to open offices and agencies in Chile.

2. Accrediting income:

A company that is able to accredit a significant amount of income, sales, and recent accounting movements to the bank, can easily access a cuenta corriente (checking account). The idea is to demonstrate to the bank that the company has the solvency to meet and respond to the obligations linked to the cuenta corriente. The bank will undertake an in-depth commercial analysis of your company if you choose this option.

3. Naming a guarantor:

For new companies, with little or no track record (especially those whose capital or owners are foreign investors), it is recommended they appoint a legal natural person to act as a guarantor, and appears before the bank as someone who can guarantee the payment of all the products which are bought by the new company.

8 Banking Options in Chile

These banks offer a variety of services tailored to international businesses, such as foreign currency accounts, international wire transfers and trade finance solutions.

- Banco de Chile

- Banco Santander Chile

- Banco Estado (Banco del Estado de Chile)

- Banco de Crédito e Inversiones (BCI)

- Scotiabank Chile

- Itaú Corpbanca Chile

- Banco Security

- Banco de la Nación Argentina (BNA) – Sucursal Chile

Our recommendation: We recommend that clients, as far as possible, choose a bank if they have a pre-existing relationship with it. If not, it greatly depends on the volume of transactions and operations. If this is considerable, Santander Office Banking is a great choice as it has a very robust and friendly online platform and customer support. Other good options for lesser volumes are BICE & Itaú.

Documentation Needed to Open a Corporate Bank Account in Chile

One thing to keep in mind when choosing a banking provider is that there are significant differences between the commercial policies of different organizations within the country. Although all banks have a business section, the requirements for obtaining a new corporate bank account are not unified. Although this article will provide general information on the process of opening a corporate account, make sure you are aware of how the specifics differ depending on the policies of each bank.

Typically, to open a company bank account you will require the company’s articles of incorporation, its registrations, publications, a valid local tax ID, an initiation of activities affidavit issued by local tax authorities, and possibly, copies of past tax filings.

Another aspect to consider, especially if your company has been newly incorporated, is that you require a R.U.T. (tax number) to open a company account. This applies for both Chilean companies and those of foreign ownership. Further information about applying for a R.U.T. is available here.

2 Types of Accounts in Chile

There are two types of bank accounts you can open in Chile: a cuenta vista (account at sight) and a cuenta corriente (current account).

- A cuenta vista (account at sight) is very easy to obtain, as banks open them without demanding a great number of requirements. The package of services offered by banks by opening a cuenta vista is very limited. It generally only empowers its holder to operate a debit card and make online transfers. Unfortunately, with this account you have no access to checks, credit cards, or other instruments, including indispensable services that are of high importance in today’s corporate life.

The account is called cuenta vista because it functions as a deposit you can view. It allows you to deposit money and then withdraw it from a debit card or an ATM.

Historically in Chile, these accounts have been used by people who do not meet the financial requirements to qualify for a current account, and by companies during the payroll payment process for their workers.

In addition to the above mentioned, a cuenta vista generally contains Chilean pesos, and banks may charge commissions for their handling and maintenance.

Tip: Consider the limitations of a cuenta vista account, such as the lack of access to checks and credit cards, before opting for this option. If you require additional banking services beyond basic debit card transactions, explore alternative account options that better suit your business needs.

- A cuenta corriente (checking account) is widely used by companies. Legally, a bank contract between a person or company and a bank is established, under which the person or company deposits money.

The money from the cuenta corriente can be withdrawn later through checks and by using a debit card at ATMs and commercial stores. In addition, online transfers can be done.

A cuenta corriente is extremely useful because when requesting and obtaining credit of any nature, these funds will be deposited into the account. In addition, you can have access to a credit line and a credit card, facilitating the operations and logistics of a company enormously.

FAQs on Opening a Corporate Bank Account in Chile

Based on our extensive experience, these are the common questions and doubts of our clients on opening a company bank account in Chile:

1. Can I open a corporate bank account online in Chile?

No, although the application process can be initiated online, there will need to be physical attendance by the named legal representative in the bylaws of the entity at the bank branch.

2. What documents do I need to open a company bank account in Chile?

Typically, to open a company bank account you will require the company’s articles of incorporation, its registrations, publications, a valid local tax ID, an initiation of activities affidavit issued by local tax authorities, and possibly, copies of past tax filings.

3. Who can have access to a company bank account in Chile?

Typically, banks allow both master and read only access, whereby the shareholders and the appointed legal representatives of the company possess master access, whereas view access is provided to back office and accounting members.

It is possible to grant banking access if required by the client by means of the diligence of the corresponding documentation, so that they have powers in the current accounts, access to tokens, coordinates card to make transfers, etc.

4. What is the best bank in Chile for foreign companies?

This would greatly depend on the volume of transactions and operations. If the volume is considerable, Santander Office Banking is a great choice as it has a very robust and friendly online platform and customer support. Other good options for lesser volumes are BICE & Itaú.

5. Why do companies open bank accounts in Chile?

Companies open bank accounts in Chile in order to receive and make local payments. Operating a Chilean entity with a foreign bank account is not recommended. It is costly, involves foreign exchange risk, is impractical, and will make it very difficult to complete some mandatory payments.

6. Does Chile have banking secrecy?

Currently, Chile has baking secrecy. However, the government is proposing to contest this law to fight tax evasion.

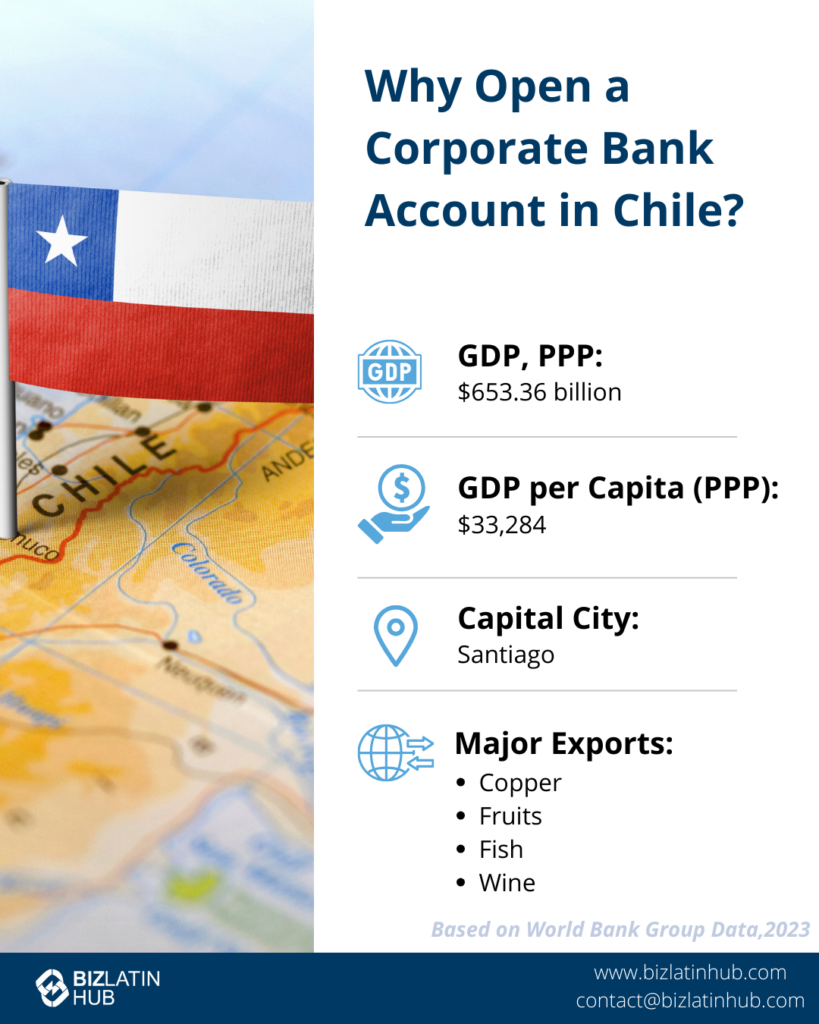

Why Open a Corporate Bank Account in Chile?

Opening a bank account in Chile is an essential step for investors, offering a secure way to manage funds and engage with one of Latin America’s most stable economies. It streamlines transactions in Chilean pesos, reduces the costs of international transfers, and ensures compliance with local financial regulations, providing a strong foundation for investments in sectors like mining, renewable energy, and real estate.

A local account also enhances credibility with Chilean businesses and authorities, while granting access to financial products tailored to the country’s unique economic landscape. With a bank account, investors can navigate Chile’s transparent financial system more effectively, adapt to regulatory changes, and capitalize on the country’s consistent growth and investment-friendly environment.

Biz Latin Hub can Help You Open a Corporate Bank Account in Chile

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge of how to open a corporate bank account in Chile, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise do business in Latin America and the Caribbean.

If this article about opening a corporate bank account in Chile was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.