With the rising interest in nearshoring, more and more C-suite executives are considering company formation in Mexico. Based in the same time zone as the rest of North America, it has a similar business culture. Just like any other country, you will need local representation, which includes an auditor in Mexico.

Key takeaways

| External auditor | An auditor in Mexico is required for all companies with a ‘significant presence in the country’. |

| Internal auditor in Mexico | Not necessary but useful |

| Accounting language | Spanish |

| IFRS rules | Widely followed, especially for larger companies |

| What to look for in an auditor in Mexico? | Experience Reputation Language proficiency Communication |

Why does a company need an auditor in Mexico?

Local expertise is crucial for foreign investors to navigate the complexities of doing business in a new country. Financial regulations in Mexico, for example, can be particularly intricate, requiring several months or even years to fully comprehend.

As a precaution against potential issues, utilizing the services of local specialists is highly recommended. The two most common legal entity (company) structures in Mexico are a Corporation/Joint Stock Company (Sociedad Anónima – S.A) or a Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L). The S.A. is the most common legal entity structure in Mexico.

An auditor in Mexico is a legal necessity for companies that are considered to have a significant presence in the country. This is defined locally as MXN$80 million of assets, MXN$100 million in annual revenue or more than 300 employees.

It is also important to note that accounting records must be kept in Spanish.

What is the role of an auditor in Mexico?

The auditor is there to check that the company is conducting its business appropriately to aid financial transparency. That means that they may not be an employee of the company, nor may they be connected to the company in any way. This allows them to be impartial and independent when conducting the audit.

What qualities does an auditor need?

When looking for an auditor in Mexico, there are certain factors to keep in mind, including:

- Experience: Look for an auditor that has experience working with foreign investors and in your industry.

- Reputation: Check online reviews and feedback to assess the quality of service you can expect.

- Language: Ensure that the auditor you work with is fluent in a language you are comfortable communicating in.

- Communication: If you will be spending extended periods outside of Mexico, choose a lawyer or firm that is proficient in using online tools for easy management and reporting.

FAQs on an auditor in Mexico

It is important to have an experienced auditor in Mexico to ensure that your company is compliant with the country’s financial rules by local authority RNIE.

An auditor in Mexico is a legal necessity for companies that are considered to have a significant presence in the country. This is defined locally as MXN$80 million of assets, MXN$100 million in annual revenue or more than 300 employees.

You do not need one by law, but you may find it beneficial to undergo an auditing process in order to demonstrate reliability, company health and transparency.

When looking for an auditor in Mexico, there are certain factors to keep in mind, including:

Experience: Look for an auditor that has experience working with foreign investors and in your industry.

Reputation: Check online reviews and feedback to assess the quality of service you can expect.

Language: Ensure that the auditor you work with is fluent in a language you are comfortable communicating in.

Communication: If you will be spending extended periods outside of Mexico, choose a lawyer or firm that is proficient in using online tools for easy management and reporting.

It is important to note that accounting records must be kept in Spanish.

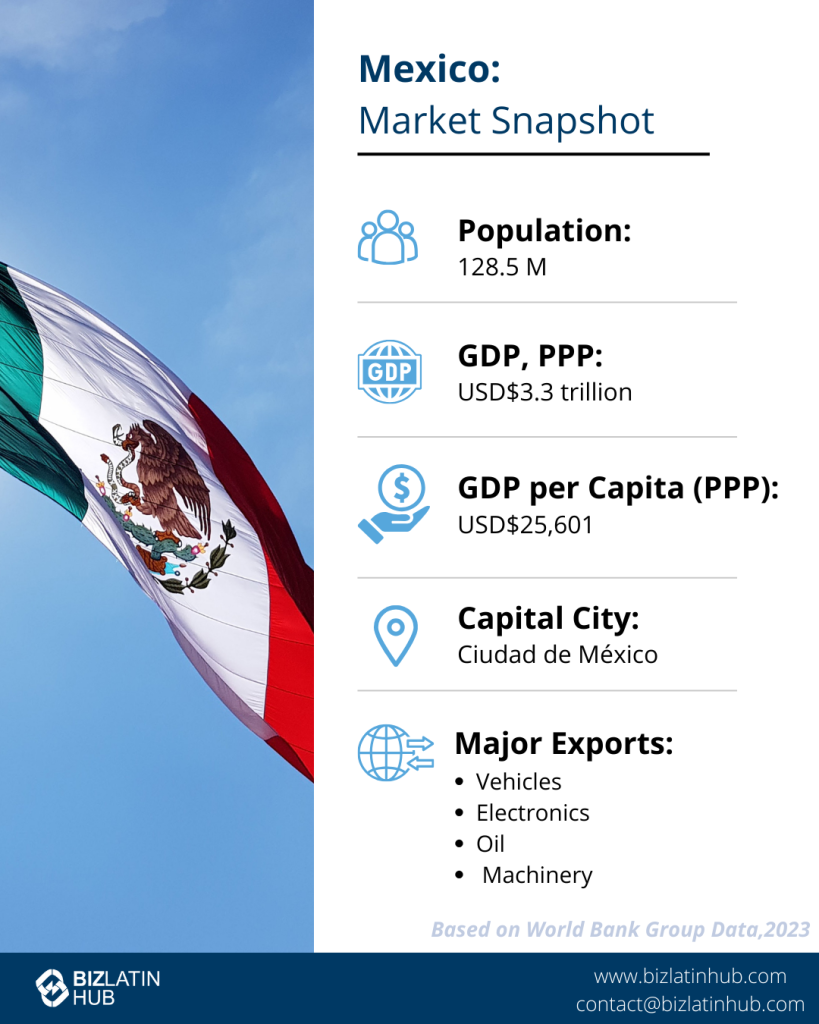

Why invest in Mexico?

Mexico boasts the second-largest economy in Latin America based on gross domestic product (GDP), behind only Brazil. While GDP has fluctuated, it has continued on a generally upward trajectory, increasing almost six-fold in the three decades after 1989 to hit USD$3.3 trillion (PPP) in 2024, following three years of strong growth.

Mexico is a major trade hub in the Americas, with high-volume ports serving both the Pacific Ocean and the Gulf of Mexico, and the country is the 17th-largest exporter in the world. Meanwhile more than $1.7 billion of goods transit its 3,145 km (1,954 mile) border with the United States every day.

Businesses based in Mexico benefit from preferential access to the massive US and Canadian markets thanks to the United States-Mexico-Canada Agreement (USMCA) — a free trade arrangement signed in 2018 to replace the North American Free Trade Agreement (NAFTA) and which came into force in 2020.

Mexico also has a slew of FTAs in place with major economies from around Latin America, as well as Japan, while it is also a founder member of the Pacific Alliance — a ten year old economic integration initiative that also includes Chile, Colombia, and Peru, and which has ambitions to extend beyond the Western Hemisphere.

All of these factors contribute to make the Mexican market one of the top destinations for foreign direct investment (FDI) in Latin America, with more than $38.59 billion in FDI inflows registered in 2024.

Biz Latin Hub can provide you with an auditor in Mexico

Starting a company in Mexico requires the support of a qualified financial team from the outset to ensure that your business complies with local laws and is well-regarded by the authorities.

Without this, even a well-planned business may struggle to thrive. At Biz Latin Hub, we have a team of locally-based specialists who possess a comprehensive understanding of the Mexican business environment, including its laws and complications.

We are well-equipped to assist foreign companies looking to conduct commercial activity in the region with all accounting, taxation, and financial matters.

If you’re interested in learning more about the Mexican economy, the opportunities for starting a company there, and need an auditor in Mexico, please contact us today.