The region is an exciting place to invest at the moment. While other areas of the world are struggling with growth, it remains buoyant with executives looking at company formation in Latin America. However, there are some local and regional issue that you should be aware of, such as the need for local representation, which includes an auditor in Latin America.

Before you launch or move your business to the region it is crucial that you understand the local tax and accounting requirements, as they may differ from your home market. An auditor in Latin America can help you navigate these new waters and make sure that your business stays compliant under both local and international law, which generally follow IFRS standards.

Partnering with a local specialist such as Biz Latin Hub means that you will have an experienced guide on your side as you enter the new market. We can set you up with an auditor in Latin America and the Caribbean, with our 18 dedicated local offices across the region. Our array of back office services can help you through company formation and ongoing support such as help with accounting or legal compliance.

Why invest in Latin America?

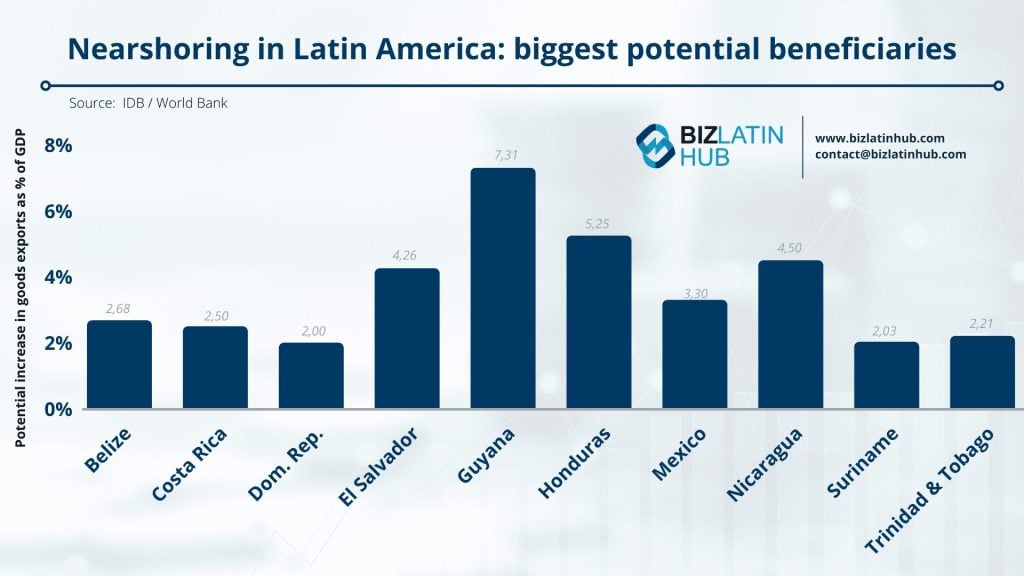

With a US$4.8 trillion economy, over 600 million citizens and a growing middle class, Latin America represents an attractive market for both foreign investment and company expansion.

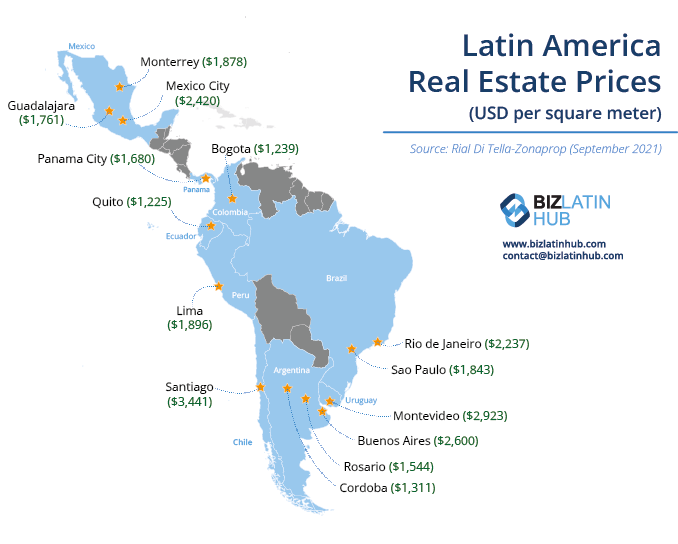

With over (12%) of the world’s land mass, there is a lot on offer, including open and transparent financial markets, attractive incentives for companies to invest, an abundance of natural resources (coal, copper, oil, gold etc.) a ready supply of human talent, well developed infrastructure, and at a low market entry cost, when compared to European and North American Markets.

Now is the perfect time to look to Latin America for investment whether that be through international trade or company formation and full market entry.

Why does a company need an auditor in Latin America?

Local expertise is crucial for foreign investors to navigate the complexities of doing business in a new part of the world. Financial regulations in Latin America, for example, can be particularly intricate, requiring several months or even years to fully comprehend.

As a precaution against potential issues, utilizing the services of local specialists is highly recommended. The two most common legal entity (company) structures in Latin America are a Corporation/Joint Stock Company (Sociedad Anónima – S.A) or a Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L). Some countries also have a simplified stock company known as an S.A.S.

An auditor in Latin America is a legal necessity for companies that are considered to have a significant presence in the country. This is usually defined locally as having a certain value of assets, revenue, income, profits and/or number of employees. This varies widely from country to country.

It is also important to note that accounting records must be kept in the local language, Spanish in most countries and Portuguese for Brazil. Auditors in Latin America must usually be local and often are required to be registered with the local accountancy board. They do not always have to be qualified accountants.

Some company types in some countries require internal auditors in Latin America, typically called fiscales. Depending on the country, they may be allowed to have an interest in the company, but are not usually allowed to be employees in order to maintain professional distance.

What is the role of an auditor in Latin America?

The external auditor is there to check that the company is conducting its business appropriately to aid financial transparency. That means that they may not be an employee of the company, nor may they be connected to the company in any way. This allows them to be impartial and independent when conducting the audit.

They show that the company is conducting itself in an appropriate way, meaning that investors or shareholders can rest assured that the company is legally compliant, transparent and reliable.

What qualities does an auditor need?

When looking for an auditor in Latin America, there are certain factors to keep in mind, including:

- Experience: Look for an auditor that has experience working with foreign investors and in your industry.

- Reputation: Check online reviews and feedback to assess the quality of service you can expect.

- Language: Ensure that the auditor you work with is fluent in a language you are comfortable communicating in.

- Communication: If you will be spending extended periods outside of Latin America, choose a lawyer or firm that is proficient in using online tools for easy management and reporting.

FAQs on an auditor in Latin America

It is important to have an experienced auditor in Latin America to ensure that your company is compliant with local financial rules.

An auditor in Latin America is a legal necessity for companies that are considered to have a significant presence in the country. This is usually defined locally as having a certain value of assets, revenue, income, profits and/or number of employees. This varies widely from country to country.

You do not generally need one by law, but you may find it beneficial to undergo an auditing process in order to demonstrate reliability, company health and transparency.

Some company types in some countries require internal auditors in Latin America, typically called fiscales. Depending on the country, they may be allowed to have an interest in the company, but are not usually allowed to be employees in order to maintain professional distance.

When looking for an auditor in Latin America, there are certain factors to keep in mind, including:

Experience: Look for an auditor that has experience working with foreign investors and in your industry.

Reputation: Check online reviews and feedback to assess the quality of service you can expect.

Language: Ensure that the auditor you work with is fluent in a language you are comfortable communicating in.

Communication: If you will be spending extended periods outside of Latin America, choose a lawyer or firm that is proficient in using online tools for easy management and reporting.

It is important to note that accounting records must be kept in Spanish in most countries, or Portuguese in Brazil.

Biz Latin Hub can provide you with an auditor in Latin America

Starting a company in Latin America requires the support of a qualified financial team from the outset to ensure that your business complies with local laws and is well-regarded by the authorities.

Without this, even a well-planned business may struggle to thrive. At Biz Latin Hub, we have a team of locally-based specialists who possess a comprehensive understanding of the Latin business environment, including its laws and complications.

We are well-equipped to assist foreign companies looking to conduct commercial activity in the region with all accounting, taxation, and financial matters.

If you’re interested in learning more about the regional economy, the opportunities for starting a company there, and need an auditor in Latin America, please contact us today.