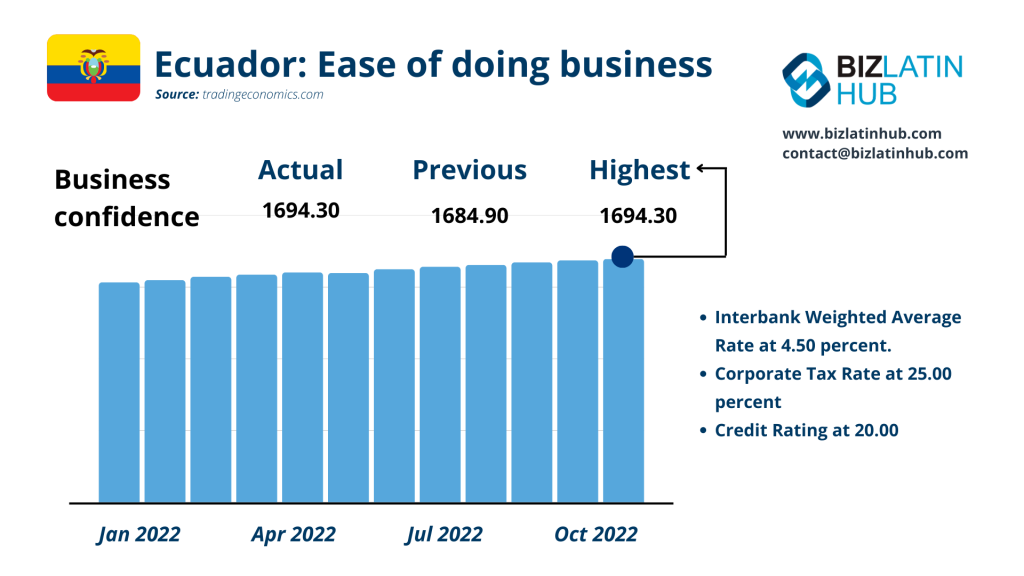

The Ecuadorian economy has shown incredible resistance in the face of turbulent global and political turmoil. If you’re interested in expanding into the country, an auditor in Ecuador might be exactly what you need.

It has the third-lowest inflation in Latin America and its GDP is projected to grow steadily over coming years. The government encourages foreign investment, cutting duties on over 660 products to boost business. With its abundant oil reserves and untapped mining resources, it is an appealing market for foreign investors who will need an auditor in Ecuador to stay compliant with tax authority SRI.

Before you launch or move your business to Ecuador it is essential that you understand the local tax and accounting requirements. In this article, we will explain why you may need an auditor in Ecuador as well as details on legal representation in Ecuador for your business.

Why does a company need an auditor in Ecuador?

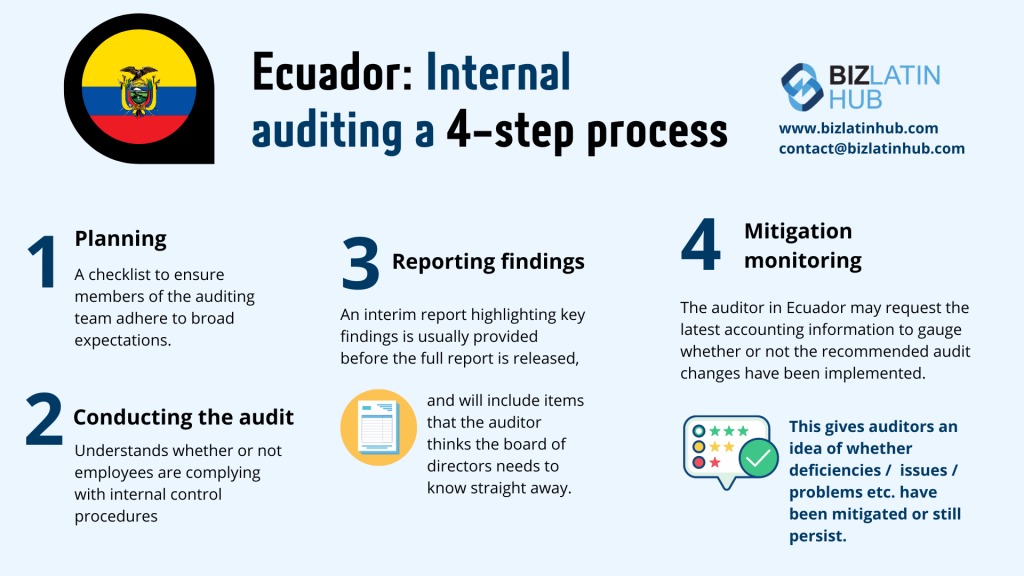

Local expertise is important for foreign investors to navigate the complexities of doing business in a new country. An auditor in Ecuador is mandatory if your assets are over USD$1,000,000 or if you are a foreign branch with assets exceeding USD$100,000. Internal auditors are mandatory for many companies.

Financial regulations in Ecuador, for example, can be particularly complex, requiring several months or even years to fully comprehend.

As a precaution against potential issues, utilizing the services of local specialists is highly recommended.

Here are the five most common legal entity (company) structures in Ecuador:

- Collective Name company (Compañía en nombre colectivo)

- Limited Partnership (Compañía en comandita simple y dividida por acciones)

- Limited Liability Company (LLC) (Compañía de responsabilidad limitada Cía. Ltda)

- Unlimited Liability Company/Corporation (Sociedad anónima S.A.)

- Mixed-capital Company (Compañía de economía mixta)

What is the role of an auditor in Ecuador?

It is important to have an experienced auditor in Ecuador to ensure that your company is compliant with the country’s financial rules.

In late 2022, the Ecuadorian government enacted new regulations on income tax including lower income tax rates for new investments.

For example, new companies or existing companies that develop new investments can benefit from a three-percentage point reduction of the Income Tax rate (22% CIT).

For companies with an Investment Agreement, the benefit is a reduction of five percentage points on CIT (20%).

Another key change from these regulations is that most tax disputes (except those determined by law) may be settled through mediation, which applies to disputes related to any tax levied by the Ecuadorian IRS.

An experienced local auditor in Ecuador can help your business avoid or settle any tax disputes before the legal system gets involved.

What to look for in an auditor in Ecuador

When looking for an auditor in Ecuador, there are certain factors to keep in mind, including:

Experience: Look for an auditor that has experience working with foreign investors and in your industry.

Reputation: Check online reviews and feedback to assess the quality of service you can expect.

Language: Ensure that the auditor you work with is fluent in a language you are comfortable communicating in.

Communication: If you will be spending extended periods outside of Ecuador, choose a lawyer or firm that is proficient in using online tools for easy management and reporting.

5 Things to Consider When Starting a Business in Ecuador

- Select the right company type

- Choose a trustworthy legal representative

- Register with tax authorities

- Adhere to labor regulations

- Safeguard your intellectual property

If you are contemplating starting a business in Ecuador, it is critical to take the following considerations into account:

1 – Select the right company type: Prior to establishing your business in Ecuador, it is imperative to ascertain which company type is most suitable for your needs. There are various types of companies in Ecuador, including joint-stock companies (Sociedad Anónima), limited liability companies (Sociedad de Responsabilidad Limitada), and simplified stock companies (Sociedad Anónima Simplificada).

2 – Choose a trustworthy legal representative: It is necessary to appoint a legal representative in Ecuador who will act as the company’s representative and sign legal documents pertaining to labor and civil matters. Keep in mind that this individual must be a resident of Ecuador.

3 – Register with tax authorities: All companies operating in Ecuador must register with the Internal Revenue Service (SRI) and pay taxes monthly or semi-annually. Therefore, it is essential to seek guidance from a reliable local advisor when initiating a business in Ecuador to ensure compliance with tax authorities. Another reason to hire an auditor in Ecuador.

4 – Adhere to labor regulations: It is crucial to understand the monthly and yearly obligations that an employer must fulfill for their employees, such as paying social security per employee, providing mid-year and year-end bonuses, granting vacations, maternity leave, disability, and severance payments.

5 – Safeguard your intellectual property: To mitigate the risk of competitors copying your company name and logo, it is advisable to explore the options available for protecting them.

FAQs on an auditor in Ecuador

It is important to have an experienced auditor in Ecuador to ensure that your company is compliant with the country’s financial rules.

An auditor in Ecuador is mandatory if your assets are over USD$1,000,000 or if you are a foreign branch with assets exceeding USD$100,000.

Most comapnies require two internal auditors who may be shareholders but not employees. You may find it beneficial to undergo an auditing process in order to demonstrate reliability, company health and transparency.

When looking for an auditor in Ecuador, there are certain factors to keep in mind, including:

Experience: Look for an auditor that has experience working with foreign investors and in your industry.

Reputation: Check online reviews and feedback to assess the quality of service you can expect.

Language: Ensure that the auditor you work with is fluent in a language you are comfortable communicating in.

Communication: If you will be spending extended periods outside of the country, choose a lawyer or firm that is proficient in using online tools for easy management and reporting.

It is important to note that accounting records must be kept in Spanish.

Biz Latin Hub can provide you with an auditor in Ecuador

Starting a company in Ecuador requires the support of a qualified financial team from the outset to ensure that your business complies with local laws and is well-regarded by the authorities.

Without this, even a well-planned business may struggle to thrive. At Biz Latin Hub, we have a team of locally-based specialists who comprehensively understand the Ecuadorian business environment, including its laws and complications.

We are well-equipped to assist foreign companies looking to conduct commercial activity in the region with all accounting, taxation, and financial matters.

If you’re interested in learning more about the Ecuador economy, and the opportunities for starting a company there, and need an auditor in Ecuador, please contact us today.