In Latin America, few countries are as promising for business investment as Costa Rica, with its rapid growth and exciting potential. As the economy continues to grow despite the current unfavorable global economic conditions, it becomes an even more attractive market for your business to enter. Just like any other country, you will need local representation, including an auditor in Costa Rica.

Before you launch or move your business to the country it is crucial that you understand the local tax and accounting requirements, as they may differ from your home market.

An auditor in Costa Rica can help you navigate these new waters and make sure that your business stays compliant under both local and international law following IFRS standards.

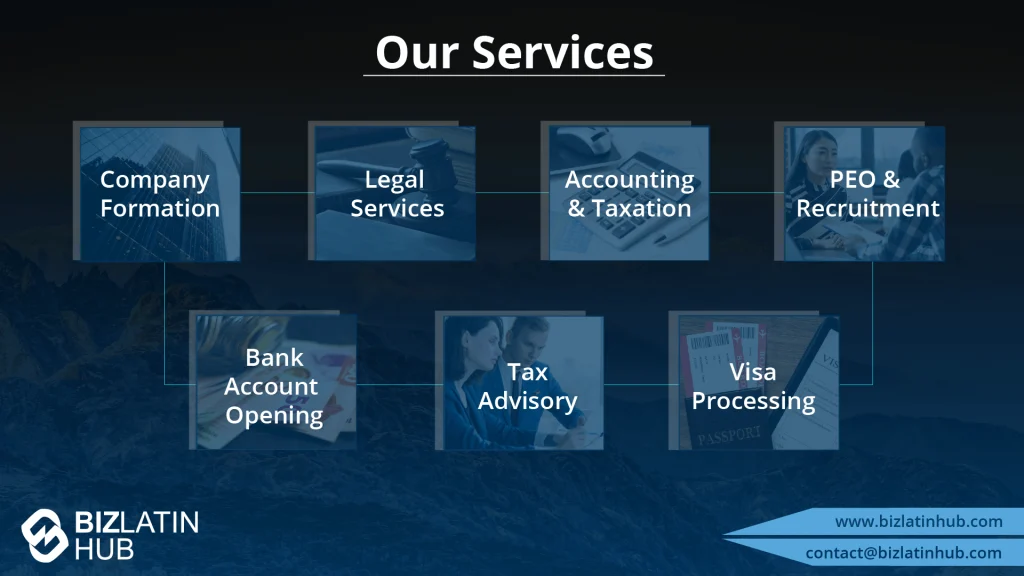

Partnering with a local specialist such as Biz Latin Hub means that you will have an experienced guide on your side as you enter the new market. We can set you up with an auditor in Costa Rica or eslewhere in Latin America and the Caribbean, with our 18 dedicated local offices across the region. Our array of back office services can help you through company formation and ongoing support such as help with accounting in Costa Rica and elsewhere.

5 reasons to expand your business to Costa Rica

- Economic development

- Safe location

- Booming tourism

- Educated workforce

- Clean energy leader

Let’s look in more detail at why Costa Rica is such an attractive location to do business in.

1 – Economic development

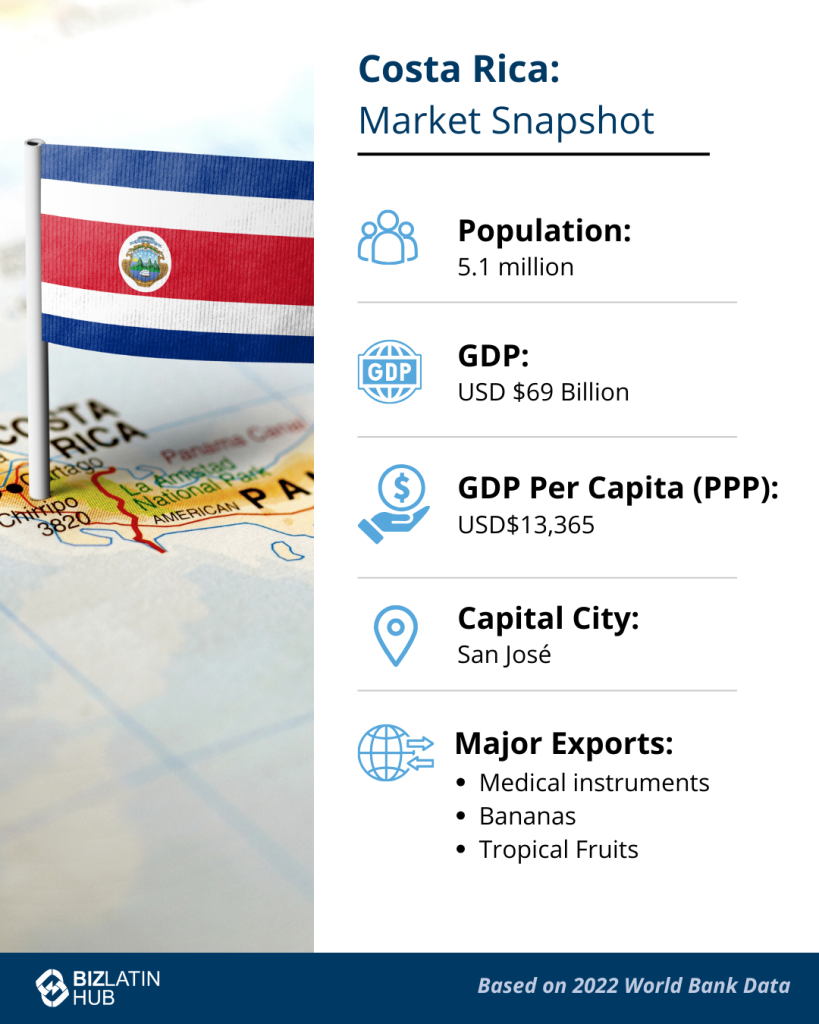

According to the Global Index of Prosperity, Costa Rica is the second most prosperous country in Latin America. The index highlights factors such as individual freedom, government policies, and health care services. Costa Rica’s GDP in 2022 grew 27 percent above official estimates. Costa Rica has free trade agreements with China, Mexico, Chile, Canada, Panama, and the Dominican Republic.

2 – Safe location

Costa Rica is one of the safest places to live and travel to in Latin America. In a recent Gallup survey, Costa Rica ranked seventh among the safest countries in the region and it was ranked second in LATAM by the Global Peace Index.

3 – Booming tourism

In a 2022 report highlighting countries where tourism has increased the most post-pandemic, Costa Rica ranked third in the world. Its tourism grew 74 percent in 2022 with nearly 2.35 million arrivals. The tourism industry is projected to grow by over 12 percent by 2027.

4 – Educated workforce

Primary and secondary education is free and compulsory in Costa Rica. This has led to a 98 percent literacy rate. Costa Rica’s universities are well-funded and professors from around the world share their knowledge there. The government has heavily invested in tech skills training and startup ecosystems. Costa Rica now leads the way for software outsourcing in Latin America.

5 – Clean energy leader

Costa Rica is a global leader in the installation and operation of renewable energy. 100 percent of the power generated within the country comes from five different renewable energy sources – hydropower, wind, geothermal, energy biomass, and solar power. This means there is always a ready supply of affordable energy for the country.

Why does a company need an auditor in Costa Rica?

Local expertise is crucial for foreign investors to navigate the complexities of doing business in a new country. Financial regulations in Costa Rica, for example, can be particularly intricate, requiring several months or even years to fully comprehend.

As a precaution against potential issues, utilizing the services of local specialists is highly recommended. The three most common legal entity (company) structures in Costa Rica are a Corporation/Joint Stock Company (Sociedad Anónima – S.A) or a Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L). The S.A. is the most common legal entity structure in Costa Rica.

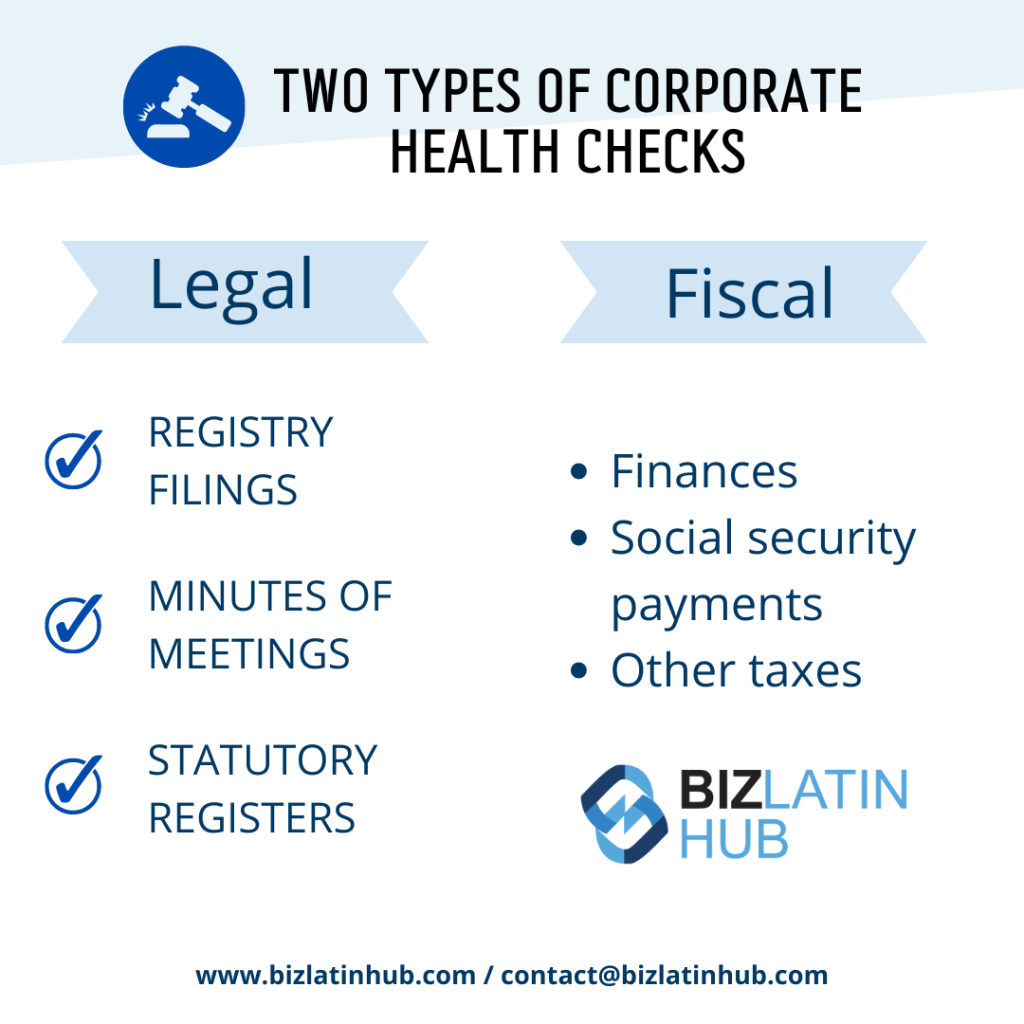

In general, there are no restrictions preventing foreign investment in Costa Rica, except for mining and power generation. However, there are specific local laws and fiscal requirements when registering a new corporation in Costa Rica. As per the Costa Rican Commercial Code, every corporation must designate a Fiscal, who acts as an internal auditor.

The Fiscal can be a member of the Board of Directors, but they don’t need to hold that position. The primary responsibility of the Fiscal is to supervise and protect the shareholders’ investment. So, there is a need for your business to have a designated auditor in Costa Rica. It is also important to note that the Commercial Code mandates that accounting records must be kept in Spanish.

What is the role of an auditor in Costa Rica?

Before 2011, there were no mandatory legal requirements to file audited financial statements for private companies.

Following an administrative rule issued by tax authorities on August 31, 2011, companies classified as “large taxpayers” were obligated to submit audited financial statements prepared in accordance with IFRS within six months after the closing of the fiscal period.

However, in September 2012, a new law was passed granting the tax authorities the power to demand audited financial statements for all “large taxpayers.” Thus, starting from the fiscal period ending in 2012, the requirement for audited financial statements has changed from being an administrative rule to a legally-supported requirement.

Therefore, to meet the fiscal obligation, it is now mandatory for “large taxpayers” to conduct financial statement audits.

It is important to have an experienced auditor in Costa Rica to ensure that your company is compliant with the country’s financial rules.

What qualities does an auditor need?

When looking for an auditor in Costa Rica, there are certain factors to keep in mind, including:

- Experience: Look for an auditor that has experience working with foreign investors and in your industry.

- Reputation: Check online reviews and feedback to assess the quality of service you can expect.

- Language: Ensure that the auditor you work with is fluent in a language you are comfortable communicating in.

- Communication: If you will be spending extended periods outside of Costa Rica, choose a lawyer or firm that is proficient in using online tools for easy management and reporting.

FAQs on an auditor in Costa Rica

It is important to have an experienced auditor in Costa Rica to ensure that your company is compliant with the country’s financial rules.

Starting from the fiscal period ending in 2012, the requirement for audited financial statements has changed from being an administrative rule to a legally-supported requirement.

Not necessarily, but there are still many advantages to an internal audit, such as demonstrating transparency, reliability and entity health.

Also, there are specific local laws and fiscal requirements when registering a new corporation in Costa Rica. As per the Costa Rican Commercial Code, every corporation must designate a fiscal, who acts as an internal auditor.

The Fiscal can be a member of the Board of Directors, but they don’t need to hold that position. The primary responsibility of the Fiscal is to supervise and protect the shareholders’ investment. So, there is a need for your business to have a designated auditor in Costa Rica.

When looking for an auditor in Costa Rica, there are certain factors to keep in mind, including:

Experience: Look for an auditor that has experience working with foreign investors and in your industry.

Reputation: Check online reviews and feedback to assess the quality of service you can expect.

Language: Ensure that the auditor you work with is fluent in a language you are comfortable communicating in.

Communication: If you will be spending extended periods outside of Costa Rica, choose a lawyer or firm that is proficient in using online tools for easy management and reporting.

It is important to note that the Commercial Code mandates that accounting records must be kept in Spanish.

Biz Latin Hub can provide you with an auditor in Costa Rica

Starting a company in Costa Rica requires the support of a qualified financial team from the outset to ensure that your business complies with local laws and is well-regarded by the authorities.

Without this, even a well-planned business may struggle to thrive. At Biz Latin Hub, we have a team of locally-based specialists who possess a comprehensive understanding of the Costa Rican business environment, including its laws and complications.

We are well-equipped to assist foreign companies looking to conduct commercial activity in the region with all accounting, taxation, and financial matters.

If you’re interested in learning more about the Costa Rican economy, the opportunities for starting a company there, and need an auditor in Costa Rica, please contact us today.