Over the years, Belize and Panama have grown as locations to form and incorporate companies as a means of protecting wealth and assets from the government or from creditors. There is a wide range of reasons why one would choose to incorporate offshore companies in Belize and Panama.

Wealth and Asset Protection in Panama and Belize

Offshore wealth and asset protection is an effective and legal way to protect personal wealth and assets from creditor claims, frivolous lawsuits, business failure and divorce. This is done by taking an individual’s assets out of their home country and transferring them to an offshore jurisdiction. If the assets are threatened, the assets must be pursued through the jurisdiction’s legal system. Since pursuing these assets takes a long and tedious process, a lawsuit might stop there. However, if they are taken to court, the statute of limitations is two years, during which the case must be opened and closed, or it’s thrown out.

Offshore wealth and asset protection is an effective and legal way to protect personal wealth and assets from creditor claims, frivolous lawsuits, business failure and divorce.

Company Incorporation

There are several techniques for asset protection, such as offshore trusts and foundations, but one of the best ways to protect your assets is by incorporating a company in an offshore jurisdiction. In some jurisdictions, such as Panama and Belize, laws were created to improve the functions and features of an offshore company as much as possible.

Confidentiality is essential to any asset protection strategy, but not all offshore jurisdictions offer it. However, both Panama and Belize offer protection from corporate veil permeation which means that the identity of the individual or company will be kept private from any third party, including international court rulings.

Privacy laws and legal bearer shares help people incorporating in Panama or Belize insulate their assets, consequently making them unattainable to creditors from their home country.

Belize Offshore Asset Protection

Belize offshore asset protection covers all the assets of an offshore company registered in the country. Strict laws protect assets of an offshore company in Belize, which means these assets are protected against third parties and foreign judgments.

The same kind of asset protection is provided for the assets in Belize offshore trusts. Asset protection is legally guaranteed and protects both the company owners and the beneficiaries of offshore trusts.

Strict laws protect assets of an offshore company in Belize

Privacy Levels in Panama

It should be noted that there are little details that might become problematic while protecting one’s assets by incorporating an offshore company in any offshore jurisdiction.

For example, any asset protection structures should be set up before the fact given that, in certain countries, a substantial money transfer abroad is deemed fraudulent. Due to fine points like this one, it is prudent to consult with experts who can guide you through the legal issues such as corporate law and aspects regarding company formation, incorporation.

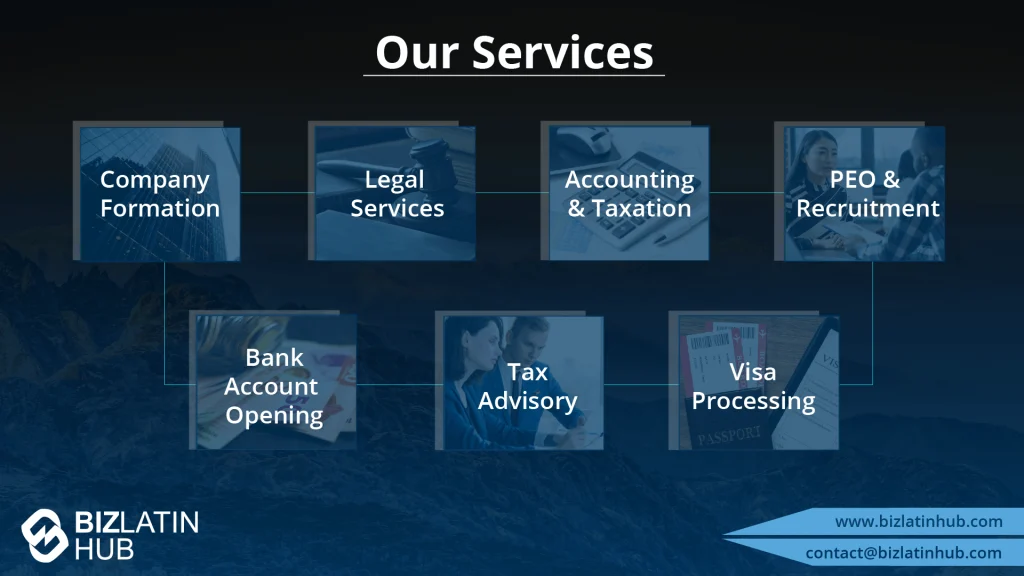

At the Biz Latin Hub, we have a team of local experts that can guide you through the entire process of Protect your Assets. For more information, contact us now, or visit our website at bizlatinhub.com.