Find out how to make the most from your corporate restructuring project with trusted and professional tax advisory services.

2020 has proved to be a challenging year for most economic sectors due to the financial haze produced by Covid-19. As companies across the world try to adapt their operations to the new economic environment, there has been a growing interest in understanding what corporate restructuring is and how can a trusted tax advisor help you avoid additional risks or liabilities.

What is corporate restructuring?

Corporate restructuring refers to all the activities carried out by a company to modify it’s current financial or operating conditions. Corporate restructuring helps businesses to adapt to new circumstances, comply with late regulations and reduce costs and burdens.

According to Professor Ian Giddy from New York University, Corporate Restructuring “entails any fundamental change in a company’s business or financial structure, designed to increase the company’s value to shareholders or creditors. Corporate restructuring is often divided into two parts: financial restructuring and operational restructuring”.

Note that corporate restructuring tools are available for companies or corporate groups of any size and from any economic backgrounds. Even entities struggling financially may be ideal candidates to undertake ambitious restructuring projects to turn their results around.

Corporate restructuring and tax implications

Business executives must be aware of the importance of taxes and their relevance to corporate success. Likewise, business owners must know that there are always available opportunities to optimize corporate tax burdens and improve corporate structure.

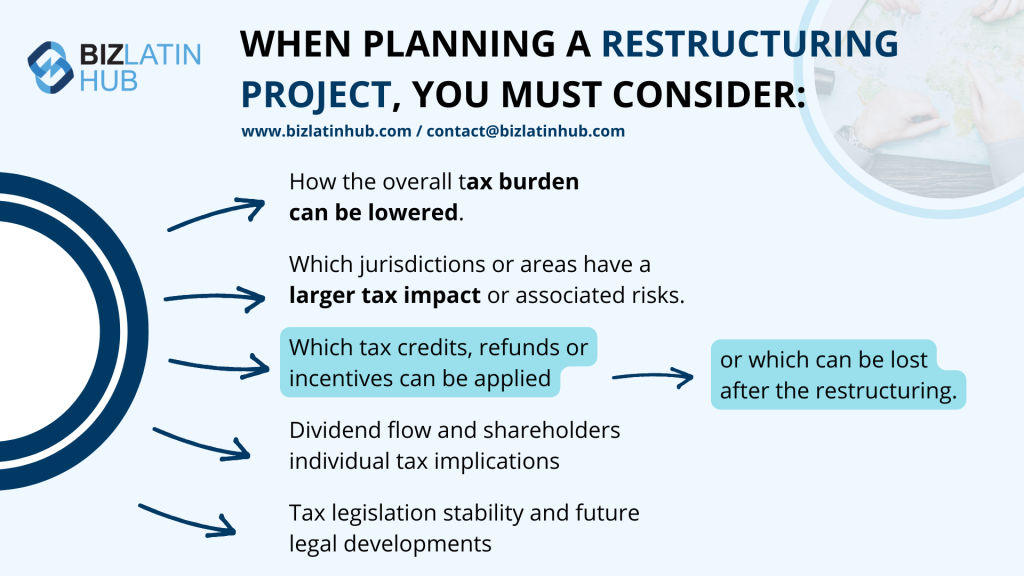

Any successful restructuring project must evaluate all tax implications involved and consider any risks and contingencies that may arise. When planning a restructuring project, you must consider:

- How the overall tax burden can be lowered.

- Which jurisdictions or areas have a larger tax impact or associated risks.

- Which tax credits, refunds or incentives can be applied, or which can be lost after the restructuring.

- Dividend flow and shareholders individual tax implications.

- Tax legislation stability and future legal developments.

All projects must be executed in compliance with the relevant local legislation. This will avoid tax evasion and scheme related misconducts, which can lead to costly penalties if mishandled.

How can your trusted tax advisor help through a restructuring project?

Regardless of the complexity of a restructuring project, you must always have the advice of an expert from the planning stages. A tax advisor has the necessary knowledge to advise on the main jurisdictions in which your corporate structure operates.

Any tax advisor undertaking a restructuring project must first understand the operation and current state of the company. This information will be used to propose a tax optimization strategy and identify cost reduction opportunities.

Furthermore, your tax advisor must consider the risks and liabilities of all activities associated with the restructuring project. Note that engaging with a trusted tax advisor helps to identify situations and behaviours that may attract unwanted attention from tax authorities.

Finally, your tax advisor should work closely with your in-house team in order to make better-informed decisions.

Our team of experts can provide you with professional advice to achieve corporate restructuring

At Biz Latin Hub, our legal and financial experts have broad experience and are equipped to deliver excellence to help you undertake a restructuring project while doing business in Latin America.

We are a global company with a local perspective. We offer a full suite of multilingual market entry and back-office services throughout Latin America, including accounting and taxation services.

Reach out to us today to receive personalized assistance.

Learn more about our team and expert authors.