If you are considering expanding into the Ecuadorian market, you are going to need to find a corporate accounting firm to support you. Because a reliable accounting firm in Ecuador will be able to provide expert advice on all aspects of your company’s bookkeeping and related regulations, helping you to keep your business in good standing with local authorities and maximize your profits.

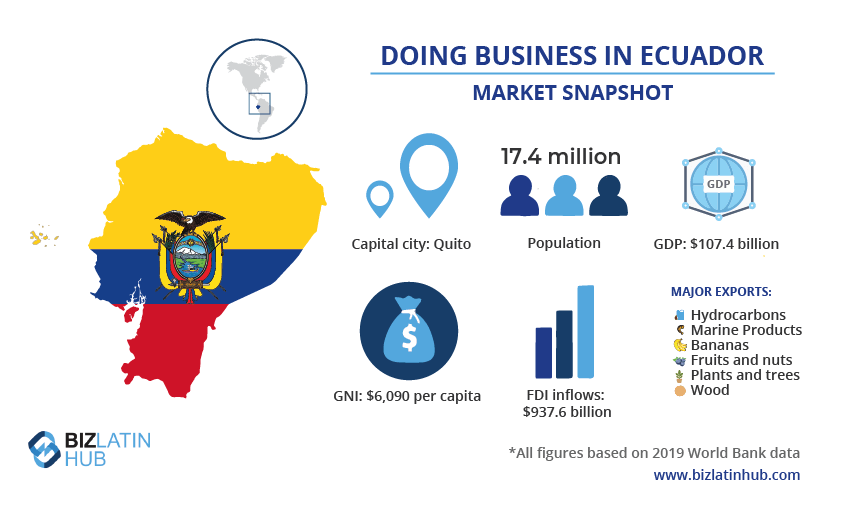

Ecuador is the seventh-largest economy in Latin America, registering a gross domestic product (GDP) of $107.4 billion in 2019 (all figures in USD), according to World Bank data. That same year, gross national income (GNI) reached $6,090 — a figure that places it as an upper-middle income nation by World Bank standards.

The capital city, Quito, is known as a growing software development hub, and boasts a ready supply of skilled workers. Meanwhile, the country plays an important role in Pacific coastal logistics thanks to its massive port city of Guayaquil, which had the seventh-highest throughput of containers in Latin America and the Caribbean in 2018.

Ecuador’s main export commodities include agricultural products, such as bananas, fruits and nuts, plants and trees, and wood. While the country is also a significant oil producer, with production picking up in recent years to never drop below 500,000 barrels per day since 2014.

The Andean country’s main commercial partners and largest recipients of exported Ecuadorian goods include Chile, China, Panama, Peru, and the United States. Over recent years, foreign direct investment (FDI) into Ecuador has fluctuated significantly, while remaining on a generally upward trajectory, with the $948.6 million of FDI inflows registered in 2019 being the third-highest annual investment the country has recorded, despite representing a 32 percent drop on the $1.39 billion registered the previous year.

If you are doing business in Ecuador, or planning to launch there, read on to understand more about what to expect from and how to choose a reliable corporate accounting firm in Ecuador, as well as some of the main taxes they will help you manage. Or go ahead and reach out to us now to discuss your commercial needs.

Corporate accounting firm in Ecuador: what to expect?

A corporate accounting firm in Ecuador will guarantee that your financial operations comply with local tax regulations, while seeking to boost your profits by identifying tax planning and management opportunities. They will also undertake tax calculations, and oversee the filing of corporate tax returns and payment of taxes, as needed.

On top of which, your chosen accounting firm will take care of realizing financial business reports at the end of the year and act in your company’s interests when interacting with local authorities.

Where your corporate accounting firm in Ecuador provides a broader portfolio of back-office services beyond accounting and taxation, they will also be able provide further ongoing commercial support based on your needs.

Choosing the right corporate accounting firm in Ecuador

When it comes to choosing the right accounting firm in Ecuador to support your needs, some aspects to take into consideration include:

Track record: If you want to appoint a corporate accounting firm in Ecuador that you feel confident you can rely on, you will need to check out the track record of potential providers. That means its client base and history, as well as what current and past clients have said about them online.

Efficiency: Working with an accounting firm with a good track record and strong knowledge of the market should bring greater efficiency to your accounting practices, so when exploring providers, it is worth questioning them on expected turnaround times for tasks they will be responsible for.

Technological engagement: An high-quality accounting firm that is set up to deal with foreign investors will be using state of the art technology and programmes, both to carry out accounting calculations, and also to share information with clients outside the country. If you will not be locating to the country as part of your market entry, it is worth asking accounting firms how they intend to keep you up to date about their work and your finances.

Ongoing advice: a corporate accounting firm in Ecuador will be abreast of the latest and upcoming tax law changes, and will be able to provide you with ongoing advice in order to guarantee that your finances are set up in the best way possible to meet your commercial goals.

Taxes your accountant in Ecuador will oversee

Some of the most significant taxes that your corporate accountant in Ecuador will handle for you include:

Valued added tax (VAT): Ecuador’s VAT rate is generally 12 percent — a low rate compared to other countries in the region — with some products, such as unprocessed foods and medicines, exempt.

Income tax: Corporate income tax in Ecuador stands at 25 percent of company profits. However, you can receive a 10 percent reduction when you reinvest profits back into the business.

Corporate income tax: All companies registered in Ecuador must pay a 22 percent tax on their total income, with a potential discount on this tax available to those who hire senior citizens or people living with disabilities.

Forex outbound tax: Transactions undertaken in a foreign currency are each subject to a 5 percent tax, which will affect you if your business requires the import of materials from abroad. Since 1999, Ecuador’s official currency has been the United States dollar, meaning that such dealings with the United States, or other dollarized countries such as Panama or El Salvador, are not subject to this tax.

Property taxes: This tax must be paid for any property you have, whether it is a home or a commercial property, with its cost depending on the price of the property.

Total assets tax: This municipal tax is fixed at 0.15 percent of the total assets of your company, with the municipality using the previous year’s financial statement to deduct the amount you will have to pay. It is very important to file this tax correctly, because a mistake or late filing can result in a 3 percent penalty fine, equivalent to twenty-times your original total assets tax burden.

Biz Latin Hub can be your accounting firm in Ecuador

At Biz Latin Hub, our multilingual team of accounting & taxation experts in Ecuador is equipped to support your business interests. With our full-suite of corporate support services, we can also be your single point of contact within the country to provide the likes of company formation, due diligence, and legal advice, in Ecuador or any of the other 15 countries in Latin America and the Caribbean where we are present.

Contact us now to discuss your accounting needs, or get a free quote.

Or learn more about our team of expert authors.