In recent years, the islands have emerged as a beacon for investors and foreign business owners seeking lucrative opportunities and a stable environment for financial growth. You may want to look at company formation in the Cayman Islands or learn more about a PEO in the Cayman Islands. Using a Professional Employer Organization, or PEO in the Cayman Islands helps simplify the complexities of global expansion. It also guarantees a stable base for your company’s growth and success in this tropical paradise.

Key Takeaways On PEO In The Cayman Islands

| Is it legal to hire through a PEO in the Cayman Islands? | Yes, hiring in the Cayman Islands through a PEO is legal. It ensures compliance with labor laws, handles payroll and taxes, and simplifies employment without needing a local entity. |

| What are the benefits of hiring through a PEO in the Cayman Islands? | Hiring through an PEO in the Cayman Islands offers quick market entry without a local entity, ensures compliance with complex labor laws, manages payroll and taxes, reduces legal risks, and allows you to focus on core business operations effortlessly. |

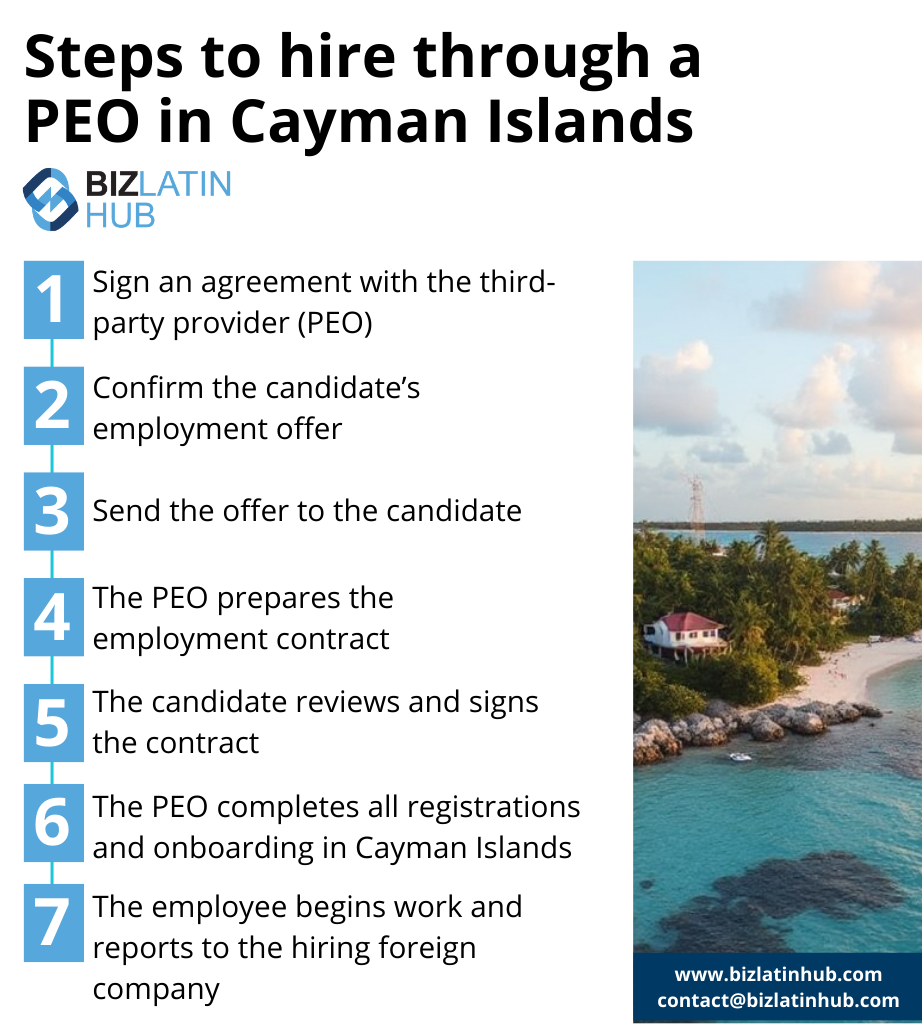

| Steps to hire through a PEO in the Cayman Islands | Assess the Need to Hire in the Cayman Islands Source Local Talent Choose a PEO Approve the Offer Letter Onboard the Employee via the PEO |

| Why employ Caymanian workers? | Employing workers through a PEO in the Cayman Islands streamlines market entry by managing HR, payroll, and legal compliance, allowing you to hire local talent quickly and focus on business growth without establishing a local entity. |

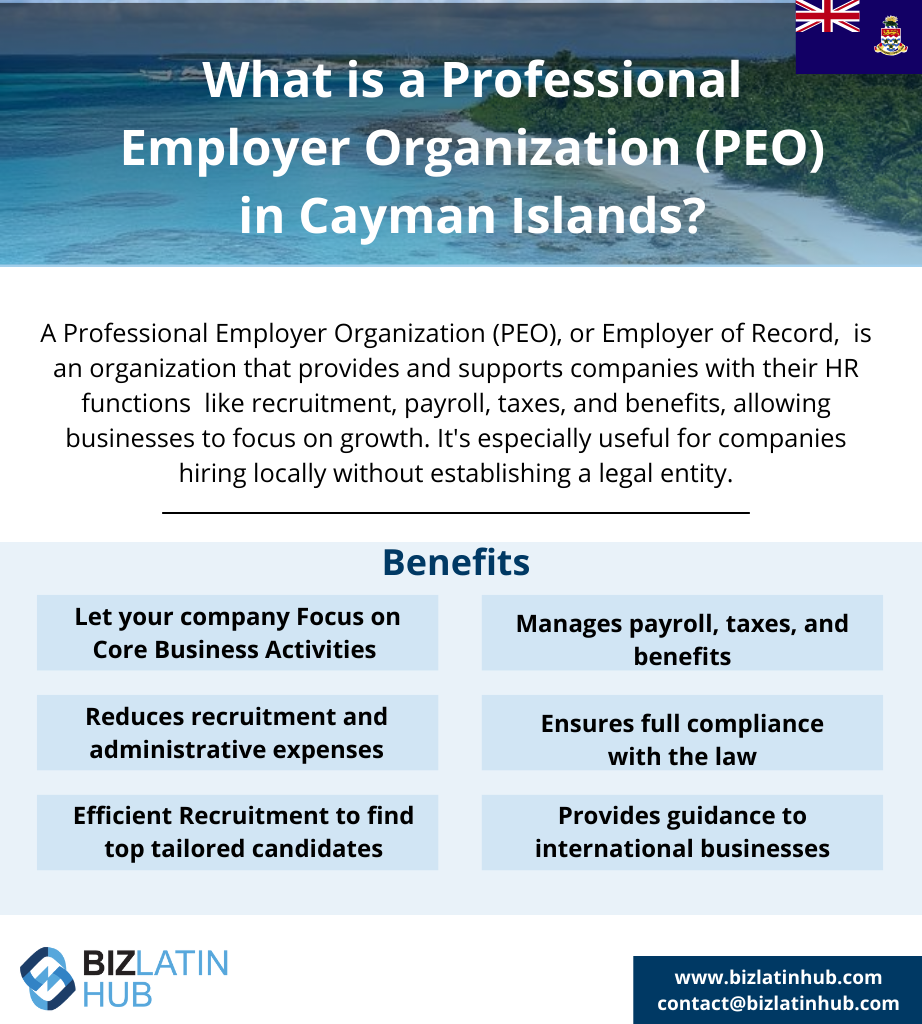

What is a PEO in the Cayman Islands?

A PEO serves as a valuable ally for businesses, managing complex HR responsibilities such as hiring, tax handling, and benefits administration. In the Cayman Islands, a PEO efficiently handles these tasks, allowing businesses to focus on growth without the burden of compliance and paperwork.

This is especially useful if a company wants to employ local workers but doesn’t want to go through the hassle of forming a legal entity in the country.

Main Advantages of Working with a PEO in the Cayman Islands

Collaborating with a PEO in the Cayman Islands enables companies to swiftly enter the local market, ensuring rapid commencement of business operations. Using a PEO for talent acquisition provides various advantages, such as:

- Focus on core business

- Cost-effective approach

- Efficient hiring process

- Time savings

- Local expertise and compliance

- Fast setup

Focus on core business

By entrusting HR duties to a Cayman Islands-based PEO, your company liberates valuable time and resources. This strategic move allows your organization to channel its energy into core operations and direct employee management. With administrative burdens lifted, there’s room for an enhanced focus on business growth and innovation.

Cost-effective approach

Hiring a PEO saves money by cutting down recruitment and administrative costs. This is especially beneficial if you want to hire local staff but haven’t fully set up your company in the Cayman Islands.

Efficient hiring process

A PEO helps in finding the right employees by sourcing and selecting suitable candidates tailored to your company’s needs. This saves time and effort in finding the perfect staff.

Time savings

Outsourcing payroll and other HR tasks to a PEO means you don’t have to deal with time-consuming paperwork. This allows you to use your time and resources more efficiently for strategic business activities.

Local expertise

Engaging a Professional Employer Organization, or PEO in the Cayman Islands, guarantees strict compliance with local labor laws and regulations for your company. Their in-depth local knowledge ensures that all employment relationships align with legal mandates, significantly minimizing the risk of fines or legal complications.

Fast setup

A PEO service in the Cayman Islands should already be recognized as a legal entity, so using it will allow you to rapidly enter the market. There is no need for a lengthy entity establishment.

EOR vs. PEO in the Cayman Islands – What’s the Difference?

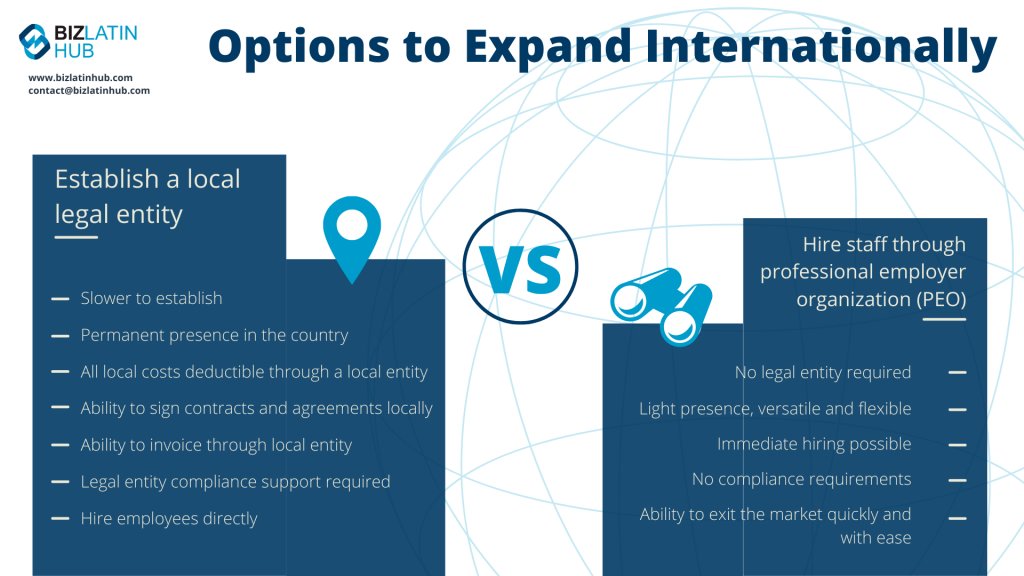

When expanding into the Cayman Islands, businesses often choose between an Employer of Record (EOR) or a Professional Employer Organization (PEO) to hire and manage employees.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. EOR services are legal in the Cayman Islands and provide a way to hire local workers without forming a legal entity.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

Note that EOR and PEO are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution in the Cayman Islands, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in this British Overseas Territory. Biz Latin Hub offers both EOR and PEO solutions, helping businesses navigate regulations, establish entities, and ensure full HR compliance. Whether you need a fast market entry or a stable long-term presence in this tax-friendly financial hub, we can guide you through the process.

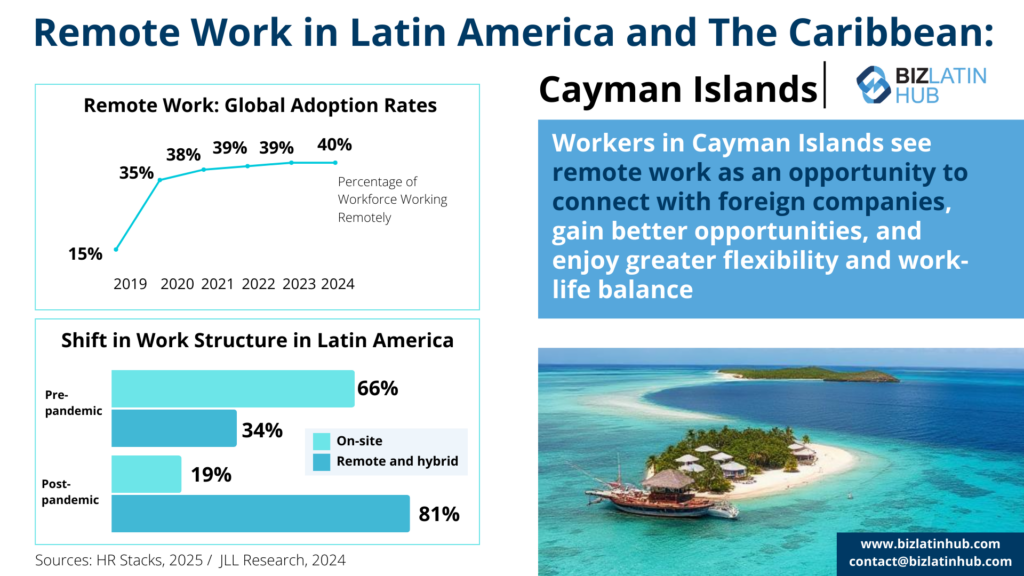

How to use a payroll calculator for a PEO in Latin America and the Caribbean

If you want to get an idea of the possible costs involved with a professional employer organization in Latin America and the Caribbean, using a payroll calculator is one way to get a good estimate.

A payroll calculator will give you the opportunity to look at costs while varying the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, compared to what is most convenient for you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff will cost, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

Hiring staff with a PEO in the Cayman Islands

A reputable PEO in the Cayman Islands can navigate the intricacies of various employment contracts. The crucial employment regulations overseen by a Cayman Islands PEO include:

- Working Hours: The standard workweek spans 45 hours or 9 hours per day.

- Holidays: The Cayman Islands observe 11 national holidays. Employees are entitled to 10 days of annual leave for the first four years of employment, 15 days for 4 to 10 years, and 20 days if employed for over 10 years with the same company.

- Overtime: Overtime must be paid by an employer at a time and a half based on the employee’s basic hourly rate.

- Sick Leave: Employees are entitled to 10 days of sick leave per year.

- Maternity/Paternity Pay: By law, there is a maximum paid 12-week maternity leave period.

- Tax: The Cayman Islands do not levy income tax on individuals.

- Value Added Tax (VAT): There is no VAT in the Cayman Islands.

- Social Security: There are no social security contributions.

- Termination of Contracts: Grounds for dismissal that are considered to be justified are:

Serious misconduct; Less serious misconduct or failure to perform satisfactorily, following completion of the statutory warning procedure; Redundancy; Where continuing the employment would contravene the Labor Law or any other law. Any other substantial reason where the employer acts reasonably. The notice period is the same as the time between paydays (subject to completion of any probationary period and the terms of the employment contract).

FAQs on PEO in the Cayman Islands

You can hire an employee by incorporating your own legal entity in the Cayman Islands, and then using your own entity to hire employees or you can hire through an PEO, which is a third party organization that allows you to hire employees in the islands by acting as the legal employer. Meaning you do not need a local legal entity to hire local employees.

A standard Cayman employment contract should contain the following information:

ID and address of the employer and employee

City and date

The location where the service will be provided.

Type of tasks to be carried out

Remuneration and bonifications/commissions (if applicable)

Method payment frequency

Duration of the contract.

Probation period

Work hours

Additional benefits (if applicable)

A reputable PEO in the Cayman Islands can navigate the intricacies of various employment contracts. The crucial employment regulations overseen by a Cayman Islands PEO include:

Working Hours: The standard workweek spans 45 hours or 9 hours per day.

Holidays: The Cayman Islands observe 11 national holidays. Employees are entitled to 10 days of annual leave for the first four years of employment, 15 days for 4 to 10 years, and 20 days if employed for over 10 years with the same company.

Overtime: Overtime must be paid by an employer at a time and a half based on the employee’s basic hourly rate.

Sick Leave: Employees are entitled to 10 days of sick leave per year.

Maternity/Paternity Pay: By law, there is a maximum paid 12-week maternity leave period.

Tax: The Cayman Islands do not levy income tax on individuals.

Value Added Tax (VAT): There is no VAT in the Cayman Islands.

Social Security: There are no social security contributions.

Termination of Contracts: Grounds for dismissal that are considered to be justified are:

Serious misconduct; Less serious misconduct or failure to perform satisfactorily, following completion of the statutory warning procedure; Redundancy; Where continuing the employment would contravene the Labor Law or any other law. Any other substantial reason where the employer acts reasonably. The notice period is the same as the time between paydays (subject to completion of any probationary period and the terms of the employment contract).

A payroll calculator will give you the opportunity to look at costs while varying the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

The best decision depends on the needs of your company. Forming a legal entity has the following characteristics:

Slower to establish.

Permanent presence in the country.

All costs deductible through a local entity.

Ability to sign contracts and agreements locally.

Ability to invoice through local entity.

Legal entity compliance support required.

Hire employees directly.

A PEO works with your company as a co-employer, while a EOR is the legal employer of your employees. An EOR can provide more services than a PEO.

Biz Latin Hub Can Help You With a PEO in the Cayman Islands

At Biz Latin Hub, we offer an extensive range of market entry and back-office solutions in Latin America and the Caribbean.

We have expertise in being a PEO in the Cayman Islands, legal services, accounting and taxation, company incorporation, and visa processing.

Our presence extends across major cities in the region, bolstered by robust partnerships in numerous other markets. This extensive network equips us with a wealth of resources ideally customized to facilitate cross-border initiatives and market entry strategies in different countries.

Contact us today to learn more about our services and how we can help you achieve your business goals in Latin America and the Caribbean.