Belize provides foreign investors and business owners with unique advantages seldom found elsewhere. Being a tax-friendly destination with robust privacy laws, it’s no surprise that Belize is swiftly gaining popularity among international investors. Learn more about PEO in Belize.

Partnering with a Professional Employer Organization (PEO) in Belize streamlines the challenges of global expansion. This strategic approach establishes a strong base for your company to thrive in the Central American country.

This article will explain the benefits of a PEO in Belize and how it could give your business a competitive edge in the region.

See also: Company formation Belize

What is a PEO in Belize?

Imagine having a trusted partner in your business journey – that’s what a PEO in Belize is. It tackles the complex world of HR, from hiring employees to tax and benefits compliance. A PEO handles crucial yet time-consuming jobs. So, business owners and investors can focus on growing the company without the burden of local rules and regulations.

This partnership is a game-changer, particularly for companies eager to employ local talent but hesitant about the complexities of establishing a legal presence in the country.

Benefits of Using a PEO in Belize

Working with a PEO in Belize allows companies to rapidly enter the local market, ensuring that the business hits the ground running. Hiring local talent through a PEO offers many advantages, including:

- Cost-effective solution

- Focus on core operations

- Smooth hiring method

- Rapid setup

- Save time

- Local expertise and compliance

Cost-effective solution

Engaging a PEO saves money by reducing recruitment and administrative expenses, making it especially advantageous if you want to employ local staff without completing your company’s full setup in Belize.

Focus on core operations

By entrusting HR duties to a Belizean PEO, your company can concentrate on its primary functions and directly manage employees. This focus enables a stronger emphasis on business growth and advancement.

Smooth hiring method

A PEO aids in identifying suitable candidates tailored to your company’s needs, saving time and effort in the search for ideal staff.

Rapid setup

Utilizing a PEO service in Belize, which is already a recognized legal entity, grants you quick access to the market without the need for a lengthy entity establishment process.

Save time

Outsourcing payroll and other HR tasks to a PEO eliminates the need for time-consuming paperwork, allowing you to allocate your time and resources more efficiently for strategic business activities.

Local expertise and compliance

A PEO in Belize manages compliance with all local employment laws and regulations. Their expertise guarantees that your company’s employment relationships align with legal requirements, minimizing the risk of fines or legal complications.

Employing Workers in Belize with a PEO

A reputable PEO in Belize can navigate the complexities of various employment agreements within the country. The core employment regulations managed by a PEO in Belize comprise:

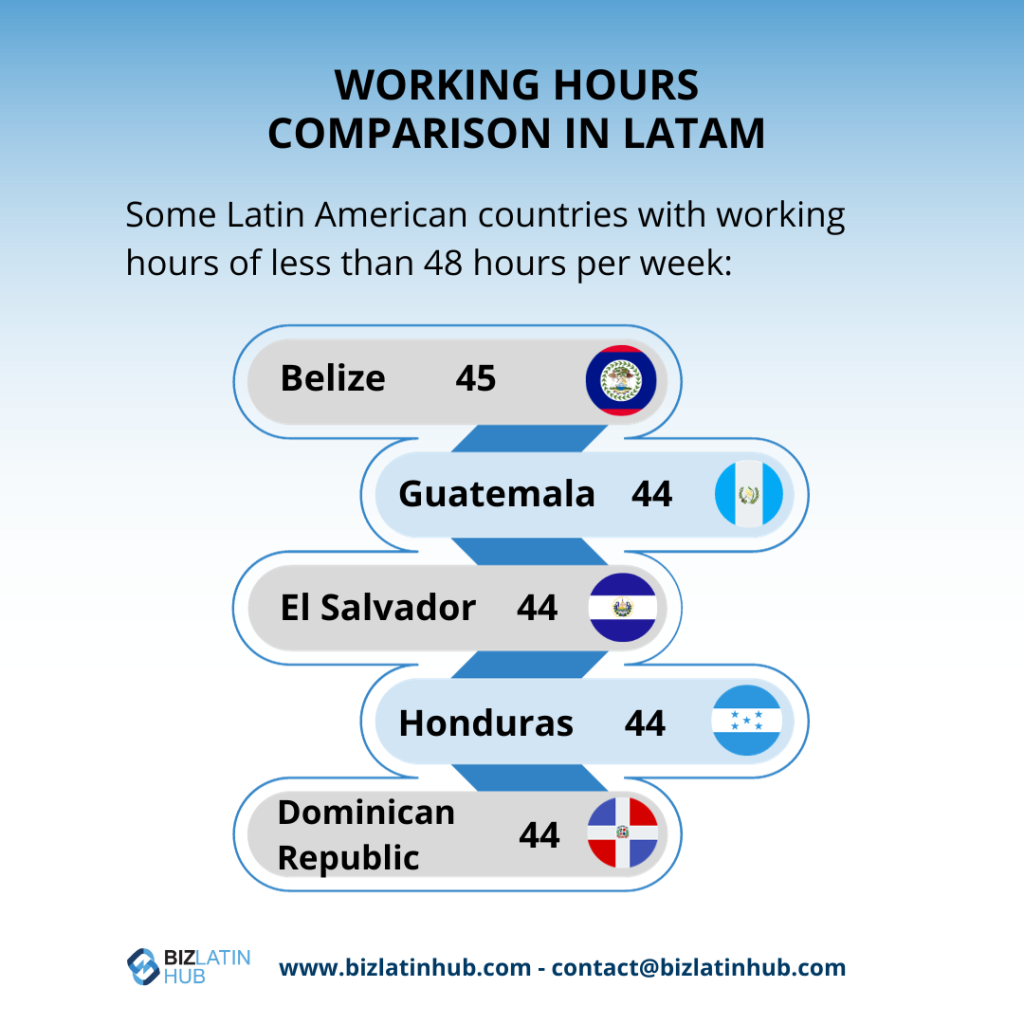

Working Hours: The standard workweek spans 45 hours, 9 hours per day. All employees are entitled to at least one day of rest per week. The overtime rate is one and one-half times the regular hourly pay.

Holidays: Belize observes 13 national holidays, and employees are entitled to 2 weeks of annual leave after completing 150 days in a job.

Bonuses: It is customary for employees to receive a Christmas bonus.

Sick Leave: Employees are entitled to 16 days of sick leave per year provided they work no less than 60 days within 12 months.

Maternity/Paternity Pay: By law, a female worker is entitled to a 14-week paid maternity leave period.

Tax: Income tax is charged at a rate of 25%, and for residents of Belize, the first $26,000 of their annual income is exempt. Pension income is also exempt. To qualify for residency, an individual must be present in Belize for 183 days or more during a calendar year.

Value Added Tax (VAT): Taxable activities for purposes of the Belize sales tax are sales of goods or supplies of services within Belize and the import of goods.

The standard rate is 12.5%. Certain goods and services may be zero-rated or exempt.

Social Security: This is payable to all employees who are over fourteen years old and under sixty-five years old for each contribution week during the whole or any part of which such person is employed in insurable employment. The employer is liable to pay the total contribution due, both his or her own share and the share deducted from the employed person’s salary. The contributions are payable by the employer by the 14th day of each month for the previous month. The weekly contribution is related to the weekly insurable earnings, which, in turn, are related to actual earnings.

Termination of Contracts: Upon contract termination, employers must settle any outstanding salary and proportional bonuses. If termination lacks just cause, severance pay might be offered.

EOR vs. PEO in Belize – What’s the Difference?

When expanding into Belize, businesses often choose between an Employer of Record (EOR) or a Professional Employer Organization (PEO) to hire and manage employees.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. Note that Belize does permit EOR arrangements for foreign businesses.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

Note that EOR and PEO are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Belize. Biz Latin Hub offers both EOR and PEO solutions, helping businesses navigate Belize’s regulations, establish entities, and ensure full HR compliance with local employment laws. Whether you need a fast market entry or a stable long-term presence, we can guide you through the process.

Biz Latin Hub Can Assist You With a PEO in Belize

At Biz Latin Hub, we offer a comprehensive range of market entry and back-office solutions in Latin America and the Caribbean.

We have expertise in being a PEO in Belize, with legal services, accounting and taxation, company incorporation, and visa processing available.

We retain a large presence in LATAM with strong partnerships throughout the region. This far-reaching network gives us lots of tools to help with international projects and entering new markets in different countries.

Contact us today to learn more about our services and how we can help you achieve your business goals in Latin America and the Caribbean.