An Professional Employer Organization (PEO) in Antigua & Barbuda is a valuable resource for testing market entry and establishing your business successfully. By managing critical HR functions, a PEO enables you to focus on scaling operations while navigating Antigua and Barbuda’s legal and operational landscape. Collaborating with a trusted local partner is essential, and Biz Latin Hub delivers expert support with its extensive experience across Latin America. From market entry to company formation in Antigua and Barbuda, we offer the services needed to help your business succeed in Mexico and beyond.

Key Takeaways

| Is it legal to hire in Antigua and Barbuda through PEO services? | Yes it is legal in to hire employees and contractors using a PEO in Antigua and Barbuda. |

| What are the benefits of hiring through an PEO in Antigua and Barbuda | Entrusting your payroll in Antigua and Barbuda to a PEO providor ensures you remian compliant when testing a new market. |

| Steps to hire through a PEO in Antigua and Barbuda | Sign an agreement with the third-party provider (PEO). Confirm the employment offer for the candidate. Share the employment offer with the candidate. Once the candidate accepts the offer, the PEO prepares the employment contract, acting as the employer of record. The candidate reviews and signs the employment contract. The PEO completes all mandatory employee registrations in Antigua and Barbuda. The employee starts work and reports to the hiring foreign company. |

| Why employ Antigua and Barbudan workers? | Hiring employees in Antigua and Barbuda enables businesses to hire a skilled and cost-effective workforce while gaining a foothold in a new market. |

What is a PEO in Antigua and Barbuda?

Antigua and Barbuda offers a wealth of business opportunities for foreign investors and companies looking to expand in the region. With its stable political climate, investor-friendly policies, and strategic location, Antigua and Barbuda has become a hub for various industries, including tourism, offshore banking, technology, and renewable energy. Learn more about how to hire a PEO in Antigua and Barbuda.

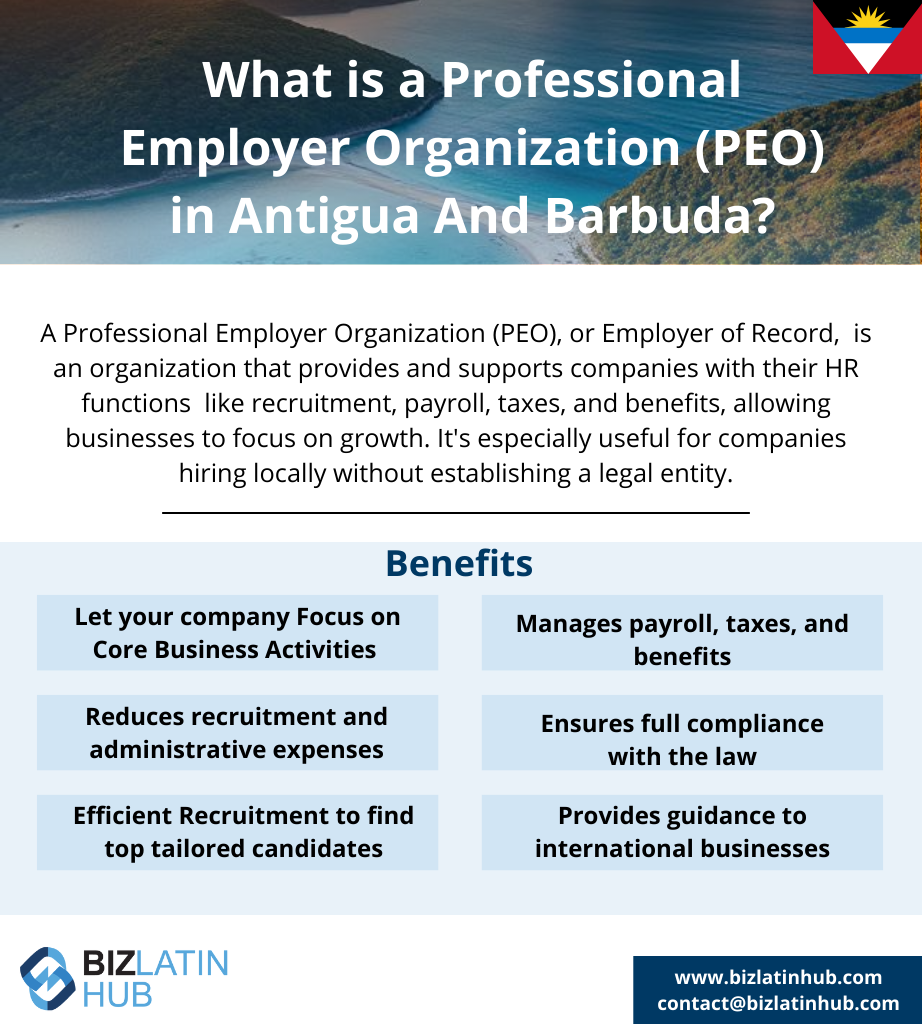

A Professional Employer Organization (PEO) is a helpful partner for businesses. It handles all the tricky HR tasks, from hiring to handling taxes and benefits. In Antigua and Barbuda, a PEO takes care of these important but time-consuming jobs so businesses can concentrate on growing without worrying about staying compliant and the extensive paperwork.

This is especially useful if a company wants to hire local workers but isn’t ready to go through the hassle of setting up a legal entity in the country.

6 Benefits of Using a PEO in Antigua and Barbuda

Partnering with a PEO in Antigua and Barbuda enables companies to quickly enter the local market, ensuring that business operations start promptly. Hiring local staff through a PEO offers several advantages, including:

- Focus on core business

- Cost-effective approach

- Efficient hiring process

- Time savings

- Local expertise and compliance

- Fast setup

1. Focus on core business

By delegating HR responsibilities to a PEO in Antigua and Barbuda, your company can focus on its main tasks and managing employees directly. This concentration enables a stronger emphasis on business expansion and development.

2. Cost-effective approach

Hiring a PEO saves money by cutting down recruitment and administrative costs. This is especially beneficial if you want to hire local staff but haven’t fully set up your company in Antigua and Barbuda.

3. Efficient hiring process

A PEO helps in finding the right employees by sourcing and selecting suitable candidates tailored to your company’s needs. This saves time and effort in finding the perfect staff.

4. Time savings

Outsourcing payroll and other HR tasks to a PEO means you don’t have to deal with time-consuming paperwork. This allows you to use your time and resources more efficiently for strategic business activities.

5. Local expertise

A Professional Employer Organization in Antigua and Barbuda ensures a company adheres to all local employment laws and regulations. Their local expertise guarantees that an organization’s employment relationships meet legal requirements, reducing the risk of fines or legal issues.

6. Fast setup

A PEO service in Antigua and Barbuda should already be recognized as a legal entity, so using it will allow you quick access to the market. There is no need for a lengthy entity establishment.

How to Partner With an Professional Employer Organization in Antigua and Barbuda?

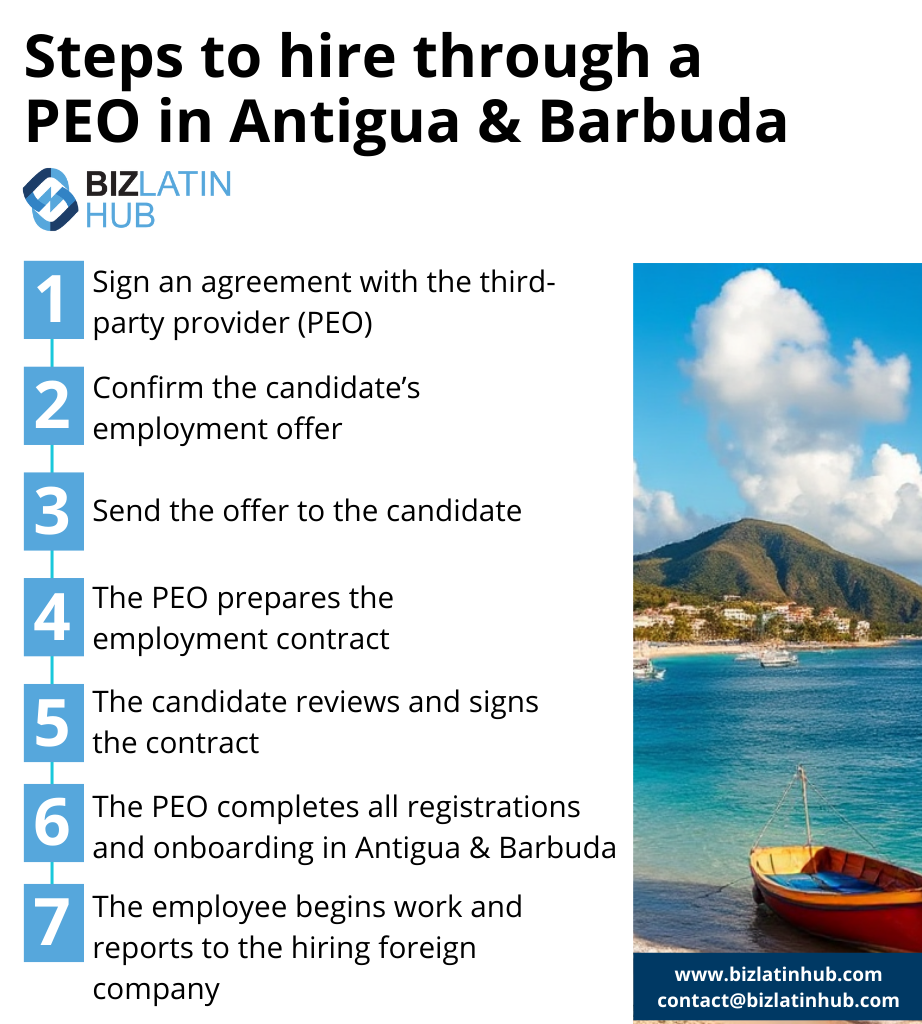

To partner with a PEO, the hiring company enters into an agreement with a third-party organization, designating them as the professional employer of record (EOR) for the employees they wish to hire in Antigua and Barbuda. This arrangement ensures that the third-party organization (the PEO/EOR) is legally responsible for meeting all employment regulations for the staff, as reflected in official documentation in Antigua and Barbuda.

This partnership eliminates the need for the foreign company to navigate the complexities of Antigua and Barbuda’s labor laws independently. By reducing the risks associated with non-compliance, the foreign company can focus its resources on business growth and market expansion within the region.

- Sign an agreement with the third-party provider (PEO).

- Confirm the employment offer for the candidate.

- Share the employment offer with the candidate.

- Once the candidate accepts the offer, the PEO prepares the employment contract, acting as the employer of record.

- The candidate reviews and signs the employment contract.

- The PEO completes all mandatory employee registrations in Antigua and Barbuda.

- The employee starts work and reports to the hiring foreign company.

Hiring Employees in Antigua and Barbuda with a PEO

A reliable PEO in Antigua and Barbuda can handle the complexities of different employment contracts in the country. The essential employment regulations as set down in law from the government managed by a PEO in Antigua and Barbuda comprise:

Working Hours: The standard workweek spans 48 hours, but most people work 40 hours, with overtime compensated at one and a half times the regular rate.

Holidays: Antigua and Barbuda observe 10 national holidays, and employees are entitled to 12 days of annual leave after completing 150 days in a job.

Bonuses: It is customary for employees to receive a Christmas bonus.

Sick Leave: Employees are entitled to 12 days of sick leave per year.

Maternity/Paternity Pay: By law, there is a maximum paid 13-week maternity leave period.

Tax: Antigua and Barbuda do not levy income tax on individuals.

Value Added Tax (VAT): Taxable activities for purposes of the Antigua and Barbuda sales tax are sales of goods or supplies of services within Antigua and Barbuda and the import of goods.

The standard rate is 15%, with a reduced rate of 12.5% applying to hotels. Certain goods and services may be zero-rated or exempt

Social Security: Effective 1st January 2021, the contribution rate increased to 14% of insurable earnings for private-sector workers; of which the employee pays 6% and the employer pays 8%.

Contracts: Written contracts must be provided to employees and submitted to the government.

Termination of Contracts: Upon contract termination, employers must settle any outstanding salary and proportional bonuses. If termination lacks just cause, severance pay might be offered.

How to use a payroll calculator for a PEO in Antigua and Barbuda or elsewhere in Latin America

If you want to get an idea of the possible costs involved with a professional employer organization in Latin America, using a payroll calculator is one way to get a good estimate.

A payroll calculator will give you the opportunity to look at costs while varying the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, compared to what is most convenient for you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff will cost, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

EOR vs. PEO in Antigua and Barbuda – What’s the Difference?

When expanding into Antigua and Barbuda, businesses often choose between an Employer of Record (EOR) or a Professional Employer Organization (PEO) to hire and manage employees.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. EOR services are legal in Antigua and Barbuda, allowing foreign companies to hire local employees without establishing a legal entity.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

Note that EOR and PEO are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Antigua and Barbuda. Biz Latin Hub offers both EOR and PEO solutions, helping businesses navigate regulations, establish entities, and ensure full HR compliance in Antigua and Barbuda. Whether you need a fast market entry or a stable long-term presence, we can guide you through the process.

FAQs on using a PEO in Antigua and Barbuda

You can hire an employee by incorporating your own legal entity in Antigua and Barbuda, and then using your own entity to hire employees or you can hire through an Employer of Record (EOR), which is a third party organization that allows you to hire employees in the islands by acting as the legal employer. Meaning you do not need a local legal entity to hire local employees.

A standard Antiguan employment contract should contain the following information:

ID and address of the employer and employee

City and date

The location where the service will be provided.

Type of tasks to be carried out

Remuneration and bonifications/commissions (if applicable)

Method payment frequency

Duration of the contract.

Probation period

Work hours

Additional benefits (if applicable)

The mandatory employment benefits in Antigua and Barbuda are the following:

Working Hours: The standard workweek spans 48 hours, but most people work 40 hours, with overtime compensated at one and a half times the regular rate.

Holidays: Antigua and Barbuda observe 10 national holidays, and employees are entitled to 12 days of annual leave after completing 150 days in a job.

Bonuses: It is customary for employees to receive a Christmas bonus.

Sick Leave: Employees are entitled to 12 days of sick leave per year.

Maternity/Paternity Pay: By law, there is a maximum paid 13-week maternity leave period.

Tax: Antigua and Barbuda do not levy income tax on individuals.

Value Added Tax (VAT): Taxable activities for purposes of the Antigua and Barbuda sales tax are sales of goods or supplies of services within Antigua and Barbuda and the import of goods.

The standard rate is 15%, with a reduced rate of 12.5% applying to hotels. Certain goods and services may be zero-rated or exempt

Social Security: Effective 1st January 2021, the contribution rate increased to 14% of insurable earnings for private-sector workers; of which the employee pays 6% and the employer pays 8%.

Contracts: Written contracts must be provided to employees and submitted to the government.

Termination of Contracts: Upon contract termination, employers must settle any outstanding salary and proportional bonuses. If termination lacks just cause, severance pay might be offered.

This will depend on the type of business and person you are hiring. Use our payroll calculator for more information.

The best decision depends on the needs of your company. Forming a legal entity has the following characteristics:

Slower to establish.

Permanent presence in the country.

All costs deductible through a local entity.

Ability to sign contracts and agreements locally.

Ability to invoice through local entity.

Legal entity compliance support required.

Hire employees directly.

A PEO works with your company as a co-employer, while a EOR is the legal employer of your employees. An EOR can provide more services than a PEO.

Biz Latin Hub Can Help You With a PEO in Antigua and Barbuda

At Biz Latin Hub, we offer an extensive range of market entry and back-office solutions in Latin America and the Caribbean.

We have expertise in being a PEO in Antigua and Barbuda, legal services, accounting and taxation, company incorporation, and visa processing.

Our presence extends across major cities in the region, bolstered by robust partnerships in numerous other markets. This extensive network equips us with a wealth of resources ideally tailored to facilitate cross-border initiatives and market entry strategies in diverse countries.

Contact us today to learn more about our services and how we can help you achieve your business goals in Latin America and the Caribbean.