When we talk about payroll processing in Ecuador, what we are really talking about is the costs and expenses associated with opening a business there. For foreign and local investors alike, here are some key facts about the country and its laws that you’ll need to familiarize yourself with before domiciling in the South American country:

What are the Steps for Payroll Processing in Ecuador?

- Payroll costs: Between 8 and 12 percent

- Payroll cycle: Monthly or bimonthly

- ‘13th salary’ for many permanent or ‘indefinite’ employees

- Employer Social Security contribution: 12.15 percent

- Employee Social Security contribution: 9.45 percent

- Corporate income tax rate: up to 25 percent

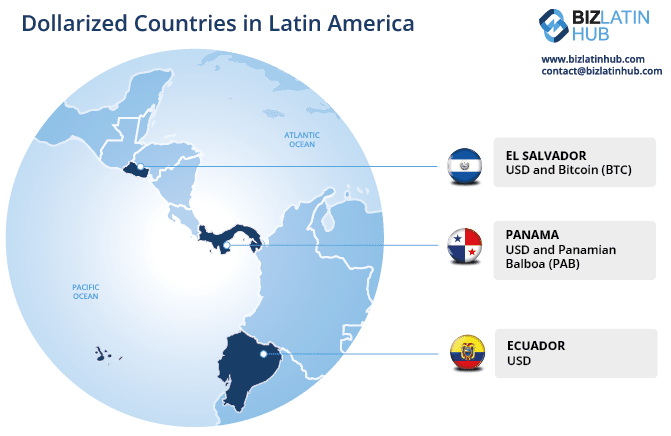

- Monthly Minimum Wage: $425 USD

- Termination/Severance Pay: Depends on contract type

SEE ALSO: Steps to Create/Register a Foreign Branch Office in Ecuador

What follows is a more detailed assessment of the 7 essential rules and regulations of domiciling in Ecuador, as well as some tips for the payroll processing in Ecuador once you’re in-country.

1. Payroll costs – Labor costs vary from industry to industry, but in general terms they are a small part of total costs. On average, total payroll processing in Ecuador – including fringe benefits for a semi-skilled labor force – range from 8 to 12 percent of a business’s total costs.

2. Payroll cycle – The payroll cycle in Ecuador is generally monthly or bi-monthly, and employers must make salary payments on the same day of each month. In some cases, Ecuador businesses pay their employees twice a month, receiving 40 percent of their salary around the 15th, and the remaining 60 percent at the end of the month.

3. 13th and 14th salary – For payroll processing in Ecuador, the law requires that firms pay a 13th-month salary for all permanent or ‘indefinite’ contract workers, and even a 14th-month salary payment in a 12-month period in some cases. The 13th-month salary is to be paid in December and the 14th-month salary in March or August.

4. Employer and employee social security contributions – Employers in Ecuador must pay 12.15 percent of an employee’s earnings to the Ecuadorian social security system, while employees themselves pay an average of 9.45 percent (though they can pay more into the system if they choose to do so).

5. Corporate income tax rate – Though it’s not directly related to payroll processing in Ecuador, it’s important for potential investors to know that companies located in non-tax-haven jurisdictions (be they owned by locals or foreigners) are subject to an income tax rate of 22 to 25 percent. Companies that carry out economic activities with a net equity equal to or greater than $5 million USD as of December 31, 2020, will pay a temporary contribution of 0.8 percent on their net 2020 equity for fiscal year 2022 and 2023, according to PwC Ecuador.

6. Minimum wage – Companies wanting to save on the costs associated with payroll processing in Ecuador should know that they must pay their employees no less than $425 USD a month. This is an extremely competitive wage rate when compared to other Latin American countries.

7. Termination and severance pay – The termination process varies according to the employment contract, and whether workers in a particular industry are unionized. The reason for termination will affect how much severance the dismissed employee is legally entitled to. Severance pay is equivalent to a one-month salary payment for each year of employment at the company. The minimum financial compensation is three monthly payments (at the regular salary rate).

What Documents Do Businesses Need to Add Employees to Payroll Processing in Ecuador?

Here are a few important documents that employers will need to obtain when hiring a new employee. Make copies, because the documentation will need to go to Ecuador’s Social Security authorities, as well as the Ministry of Labor:

- A utility bill and/or invoice containing the employee’s address

- The employee’s personal identification card, known as a cedula in Ecuador

- All the correct visas and work permits for all foreign employees

- Employment contract, signed by a legal representative and the employee

- Employee disability certificate, if applicable

Remember, this is just a general list of documents needed when hiring employees in Ecuador. Depending on the industry your business operates in, additional documentation may be required.

Beyond Payroll Processing in Ecuador: Tax Advantages and Disadvantages

While the robust set of benefits that workers are legally entitled to in Ecuador may make other places more attractive to domicile in, investors should keep in mind that the small Andean nation offers a host of tax advantages and rebates – and in some locations – tax-free economic activity zones.

However, in order to make up for its fiscal deficit, Ecuador’s business-friendly President Guillermo Lasso in 2021 levied a tax on equity for both individuals and companies. That tax rate is set at 1.5 percent of an individual’s net equity, while for businesses, that rate stands the 0.8 percent. The tax will be paid by companies over the 2022 and 2023 period. Individuals are required to pay the tax only in 2022, but the tax is not deductible for income tax purposes.

Biz Latin Hub can help you with payroll processing in Ecuador

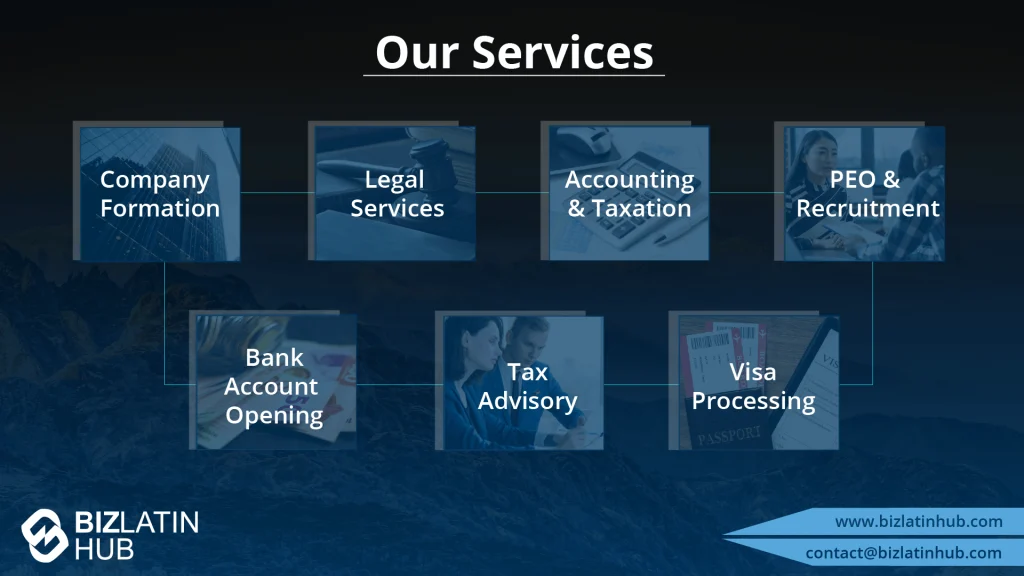

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivalled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as keeping track of payroll processing in Ecuador, our portfolio of services includes accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you finding top talent or otherwise doing business in Latin America and the Caribbean.

If this article on payroll processing in Ecuador was of interest to you, check out the rest of our coverage of this South American country. Or read about our team and expert authors.