Over the last decades, numerous international companies have successfully undertaken the challenge of setting up a company in Chile, a country that is known for having the best business expansion opportunities in Latin America. Although Chile’s dynamic and developed market has been in the scope for multiple US companies, executives should be aware of the challenges they may face to prosper in the country. In this article, we review the principal challenges for US companies doing business in Chile and how to overcome them.

Key takeaways on doing business in Chile

| Is foreign ownership allowed in Chile? | Chile allows 100% foreign ownership and has no monetary controls on the movement of capital |

| Most important sectors in Chile | The Chilean economy has long been based on primary resource extraction, with copper functioning as the bedrock. Tech is also important, while Chilean agriculture is world famous. |

| Are there Free Trade Zones in Chile? | Yes. Iquique, Arica and Punto Arenas have FTZs that offer full exemption from corporation tax and customs as well as location-specific benefits. |

| Are there incentives for Foreign Direct Investment in Chile? | The government does offer incentives when businesses help remote regions. There are programs such as StartUp Chile, in which entrepreneurs receive grants and a work visa to accelerate or develop their start-ups. |

| What international links does the country have? | Chile is a member of the Pacific Alliance, the Rio Group, Mercosur, APEC, and UNASUR and has a plethora of FTAs with countries around the globe. |

Why do business in Chile?

The country continues to employ policies that promote international trade and is a member of the Pacific Alliance, the Rio Group, Mercosur, APEC, and UNASUR. With a business environment that promotes foreign investment in practically every sector and a growing start up ecosystem, it is no wonder that Chile is a favorite destination for entrepreneurs.

Chile is routinely considered the most developed, best performing and most transparent business environments within the Latin American region. Underpinning this success is favorable investment conditions; the Chilean government is focused on maintaining an open market and competitive economy through the implementation of various business-friendly policies. According to the Doing Business study published by the World Bank, Chile is the 59th easiest country to do business in.

A notable event was the creation of the new form of legal entity known as the ‘Company by Shares’ or ‘Simplified Corporation’. This has streamlined the company incorporation process, has allowed a legal entity to be created with only a single shareholder (either a natural or legal person) and has reduced the required minimum share capital to zero.

Additionally, Chile allows 100% foreign ownership and has no monetary controls on the movement of capital. These reasons make the registration of a Chilean company both attractive and accessible for foreign individuals or companies.

Incentives for foreign investors in Chile

Another reason to incorporate a company in Chile is the incentives offered for both local and foreign investors. The government does not subsidize foreign investment, but it does offer incentives when businesses help remote regions such as Tarapacá, Aysen, Arica and Pariancota, Magallanes, Palena and Chiloé.

They also offer incentives for micro or small and medium sized enterprises involved in technology. For instance, Chile conceived StartUp Chile, a USD$40 million program in which entrepreneurs receive grants of USD$14,000, USD$30,000 or USD$80,000 depending on the size of their business – and a work visa to accelerate or develop their start-ups in Chile.

Foreign investors in Chile may access all productive activities freely, especially in the food, infrastructure, tourism, energy, and mining industries; there are some restrictions in certain sectors such as in the maritime, media, and air transportation sectors.

The mining sector in Chile for instance, is full of opportunities for foreign investment. According to the Invest Chile website, these are the best areas within the mining industry for international investment:

- Scale-up of technology in continuous-operation consumables.

- Transition from open-pit to underground operation.

- Integrated autonomous operations.

- Solutions to minimize energy consumption in milling and hydrometallurgical processes.

- Technologies to control impurities in concentrate.

- Technologies for efficient treatment of tailings.

- Modernization of smelters and refineries.

- Exploitation of rare earth elements.

- Exploration projects.

However, someone investing in the mining sector in Chile will need to secure a diversity of permits and official authorizations. Therefore, it is always better to consult with a lawyer familiarized with the mining sector in Chile before deciding to invest.

What sectors are important in the Chilean economy?

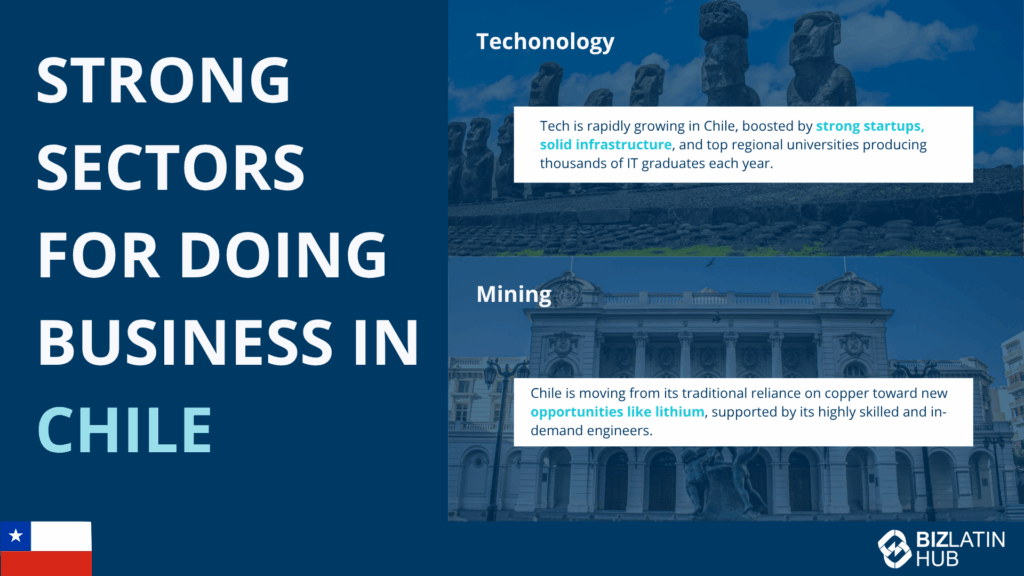

The Chilean economy has long been based on primary resource extraction, with copper functioning as the bedrock. However, the country is looking to diversify and move away from dependence on a single resource, with lithium targeted as a particularly interesting opportunity. The years of development in the field means that Chilean engineers are particularly highly skilled, experienced and thus sought after.

Tech, too, is an area of intensive growth in Chile, with a strong startup culture and rapid investment in the infrastructure necessary to grow the sector. All that copper means that fibre optic cables are easy to install, after all. A strong university system that leads the region helps produce thousands of IT graduates yearly, as well as a support network of administrators, lawyers and others.

This means there are literally thousands of highly qualified and skilled IT professionals in the country, resulting in a competitive market for positions. While the local tech scene is growing fast, it simply can’t provide as many jobs as there are workers, making it an employer’s market. Cybersecurity in particular is projected to grow rapidly up to the end of the decade.

5 Challenges for US companies doing business in Chile

1. Language

US executives must not assume that everybody in Chile speaks English. Even though English is increasingly common and is taught in most schools to a large percentage of the population, US companies doing business in Chile will find to their surprise that aside from most lawyers, fully fluent English speaking professionals are not easy to find.

It is difficult to find fully bilingual English-speaking accountants. Most non-executive staff at public entities like banks, notaries, and some private establishments such as insurance companies, will not speak English fluently.

The best way to overcome this challenge for US companies doing business in Chile is to partner with local and trusted specialists able to engage on your behalf with the different key players in the Chilean business and financial world.

2. Understanding the framework in place

US companies doing business in Chile need to grasp and understand as best as possible the legal and compliance framework in place.

Even though the Chilean Economy shares significant similarities with those found in the American economy, as many of our institutions and legislations have mirrored those of the US, there are still several particularities and complexities that aim to be navigated and understood to ensure complete local compliance and ultimately commercial success.

Any successful company doing business in Chile must be fully compliant in terms of the local laws and statutory regulations. Thus, all market entry strategies need to embrace them through a partnership with professional experienced firms able to provide bilingual consultancy and guidance in tax, legal affairs, migration, and other important areas.

3. Understanding the local way of conducting business

Chile excels in comparison with other neighboring countries in aspects regarding anti-corruption, transparency, economic strength, and social stability. These factors play a part in influencing Chileans’ approach to conducting business locally.

One of the most important aspects to note regards timing and overall compliance; US companies doing business in Chile will immediately notice that people in this country have acquired the habit of leaving things for the last minute.

Corporate governance also plays a key role in business activity. Apart from public institutions that offer their shares in the stock market, corporate governance has seen limited development within the “private realm”, composed by medium and small companies. A direct consequence of the latter, is usually a complete lack of internal structure concerning powers of representation, administration, etc.

A reasonable approach would involve US companies doing business in Chile adapting and customizing their offshore business model to the Chilean idiosyncrasy. As mentioned before, an adequate way to procure this is by engaging with a trusted and professional partner so that the odds for commercial success are significantly increased.

4. Navigating the payroll system

Human capital is at the core of any business plan and strategy. However, US companies doing business in Chile may underestimate the complexities that arise when employing people in the country. Whether the newly incorporated company has one or thirty employees, payroll calculations need to be considered to comply with all Chilean labor regulations. This is achieved by a teamwork of professional services provided by lawyers, accountants, and administrative executives, whose mission is to ensure the company is in good standing with local labor and tax authorities.

There are a series of preliminary steps and calculations that US companies doing business in Chile need to consider when interacting with organizations such as insurance companies, health providers, or pension funds. It is vital to count on local experts, as any incompliance on these delicate areas will trigger investigations and eventual fines by local authorities.

5. Opening a bank account

US companies doing business in Chile will inevitably conclude that it is almost impossible to operate without a local bank account. Future investors should negotiate with Chilean banks to ensure an account is swiftly open.

While multinational companies will not face problems when opening a bank account through a bank’s “international desks”, small organizations might find this process challenging. The reason for this is simply because local banks see much risk involved.

Therefore, it is vital to understand that in most cases, all corporate bank accounts come by default with lines of credit, ensuring the existence of a shareholder or legal representative that might assume the possible risks.

US companies doing business in Chile should partner with local specialists who can provide a legal representative already recognized by local banks. In this way, the business operation would be not considered a potential risk.

FAQs on doing business in Chile

Answers to some of the most common questions we get asked by our clients.

1. Can a foreigner own a business in Chile?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. Are there Free Trade Zones in Chile?

| Yes. Iquique, Arica and Punto Arenas have FTZs that offer full exemption from corporation tax and customs as well as location-specific benefits. |

3. How long does it take to register a company in Chile?

It takes 6 to 8 weeks to register and set up an operating company in Chile, contingent upon the timely submission of all necessary documents.

4. Which sectors are important in Chile?

The Chilean economy has long been based on primary resource extraction, with copper functioning as the bedrock. Tech is also important, while Chilean agriculture is world famous.

5. Does Chile have trade agreements with other countries?

Chile is a member of the Pacific Alliance, the Rio Group, Mercosur, APEC, and UNASUR and has a plethora of FTAs with countries around the globe.

6. What entity types offer Limited Liability in Chile?

The Sociedad por Acciones (SpA) and Sociedad de Responsabilidad Limitada (SRL) both provide limited liability protections to their owners in Chile.

Get help doing business in Chile with Biz Latin Hub

Although Chile is a very favorable business destination, there may arise some complexities when doing business abroad due to legal and cultural hurdles. This includes understanding a company’s corporate compliance requirements.

Avoid unnecessary setbacks and protect yourself and your company by seeking an entity health check in Chile from experienced and trusted experts. At Biz Latin Hub, our group of local and expatriate professionals offers a full suite of market entry and back-office services that can support your company operations and ensure you operate in full compliance with local regulations.

Contact us now, or visit our website at bizlatinhub.com to receive personalized guidance on legal, accounting, tax, payroll, employment, trade, due diligence, and other matters.

Or learn more about our team and expert authors.