With a GDP of $1.92 trillion USD in 2022, Brazil is the largest economy in Latin America and the 11th largest in the world. The state of Sao Paulo is the country’s economic center with 45 million inhabitants and makes up 33% of the nation’s GDP.

In terms of foreign direct investment in Brazil, the largest country in South America has consistently been an attractive destination – due to its richness in raw materials and large domestic consumer market. It’s no surprise then, that many entrepreneurs are starting a business in Brazil.

Foreign direct investment in Brazil

Brazil is and has been a hot-spot for foreign direct investment (FDI). According to a report by the Organization for Economic Cooperation and Development (OECD), in the first half of 2023, the US is the principal recipient of FDI, followed by Brazil, and then Canada and Mexico both taking third position.

Foreign direct investment in Brazil reached its highest levels after the pandemic ended, seeing FDI soar to $51.06 billion USD, an increase of 102.7% compared to the same period of 2021, and it totaled $82 billion as of April 2023. In addition, the balance of foreign investments received by Brazil in 2021 was the highest as a proportion of GDP when considering the 15 largest economies in the World Bank ranking – yet another sign of structural a recovery in the Brazilian economy.

According to Statista Research Department, in 2022, the main sources of foreign direct investment in Brazil were the Netherlands (25%), the United States (24%), France (8%) and Spain (6%).

The main drivers for foreign direct investment in Brazil

- Natural resources – Brazil is a world-leading producer of sugar, coffee, soybean, orange juice, tin and the mineral phosphate

- Advantageous geographic location – Located in the center of Latin America, Brazil borders 10 countries and enjoys a large Atlantic coastline

- A large domestic consumer market – Brazil has a substantial domestic consumer market of 214 million people, 70% of whom are considered middle class, and account for just over half of the country’s total consumer spending.

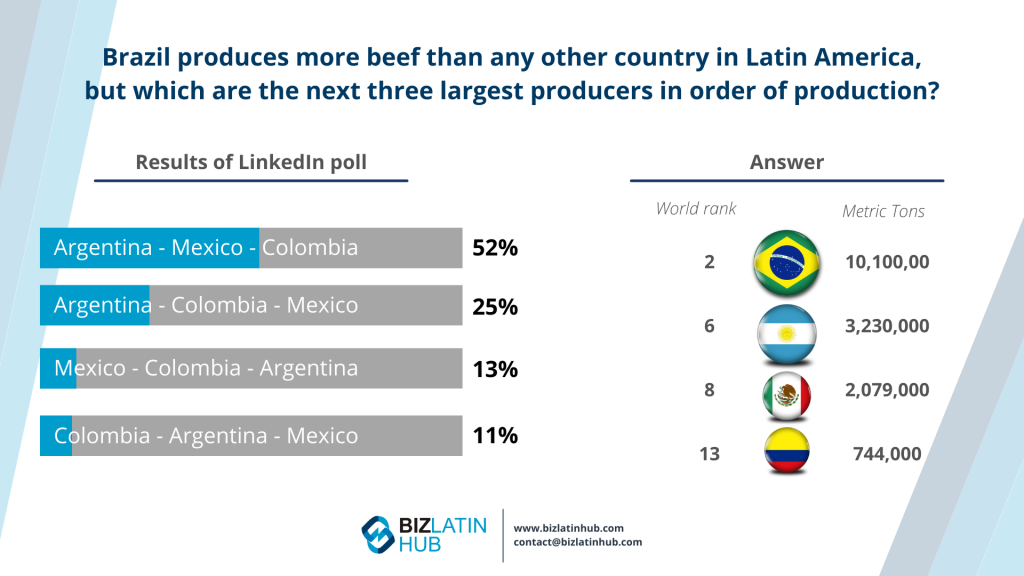

- Strong international trade – Brazil is a strong exporter; the country is a large exporter of beef, poultry meat, tobacco, wood, ethanol, iron ore and has advanced industries in automotive, oil, food and beverage, chemical production and cement. China is the largest consumer of Brazilian exports, accounting for 26.8% in 2022, followed by the US at 11.4% and Argentina at 4.6%.

Brazilian programs designed to attract foreign investors

- Inovar-Auto Programa aims to improve the technological development of the automotive industry and to create conditions for increased competitiveness in this sector

- Renai is the National Investment Information Network (Rede Nacional de Informações sobre o Investimento) and provides information to potential investors on business opportunities in Brazil. In addition, Brazil’s national government offers investment support through financing and double taxation agreements

- Startup Outreach Brasil is a government program that connects Brazilian startups with foreign investors. This initiative, led by ApexBrasil (the Brazilian Trade and Investment Promotion Agency), has succeeded in securing foreign investments from Canada, Chile, France, the United States and Germany, among others.

Foreign direct investment in Brazil: Key trends

Brazil’s highly diversified economy means that foreign investors can see healthy returns from a range of different industries. But the lion’s share of foreign direct investment in Brazil is mainly directed towards financial services, oil and gas, the automotive industry, trade, electricity and the chemical industry.

With about 700 startup companies, Brazil is also the largest exporter of fintech in Latin America, and ranks fourth in the world. In 2022, (the latest for which figures are available), investment in Brazilian fintech companies totaled $4.5 billion USD.

There are many opportunities for fintech foreign companies to collaborate with Brazilian counterparts in different areas, such as:

- Payment and remittances

- Enterprises or personal financial management

- Cryptocurrency and Blockchain

- Digital banking and technologies for financial institutions

- E-commerce

Although oil and gas will continue to play a key role in the economy (Latin America’s top producer), the renewable energy industry is on the rise in Brazil, according to the Brazilian Energy Planning Agency (EPE). The country has one of the cleanest electricity grids in the world, and has the capacity to generate electricity using 84% renewable energy.

Brazil also has a promising nuclear energy market and plans to more than quadruple its nuclear power generation by 2050 according to the Brazilian Nuclear Power Association.

Here are some great business opportunities in the renewable energy industry for foreign investors:

- Control and automation systems

- Remotely operated electric vehicles

- Nuclear power plants

- Other renewable energies (engineering, energy efficiency, smartgrids, photovoltaic, onshore wind, biomass)

Biz Latin Hub can help you with foreign direct investment in Brazil

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Sao Paulo, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge about foreign direct investment in Brazil, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you with investing in Brazil, or otherwise do business in the region.

If this article on foreign direct investment in Brazil was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.